US President Donald Trump announced that his administration will impose reciprocal tariffs on India, given that India levies higher tariffs compared to the US. “We are being reciprocal with India on tariffs; we will charge what they charge,” President Donald Trump said.

According to international brokerage Morgan Stanley, the direct impact of reciprocal tariff hikes will likely be manageable; however, the indirect impact through uncertainty weighing on business confidence is more worrisome.

Further, Morgan Stanley added that the indirect impact from uncertainty weighing on

business confidence is more worrisome. Furthermore, the uncertainty could lead to risk aversion and strength in US dollar which would weigh on central banks to effectively ease domestic financial conditions.

Also Read | 'Couldn't get any concessions during my first term': Trump hints no US tariff relief for India

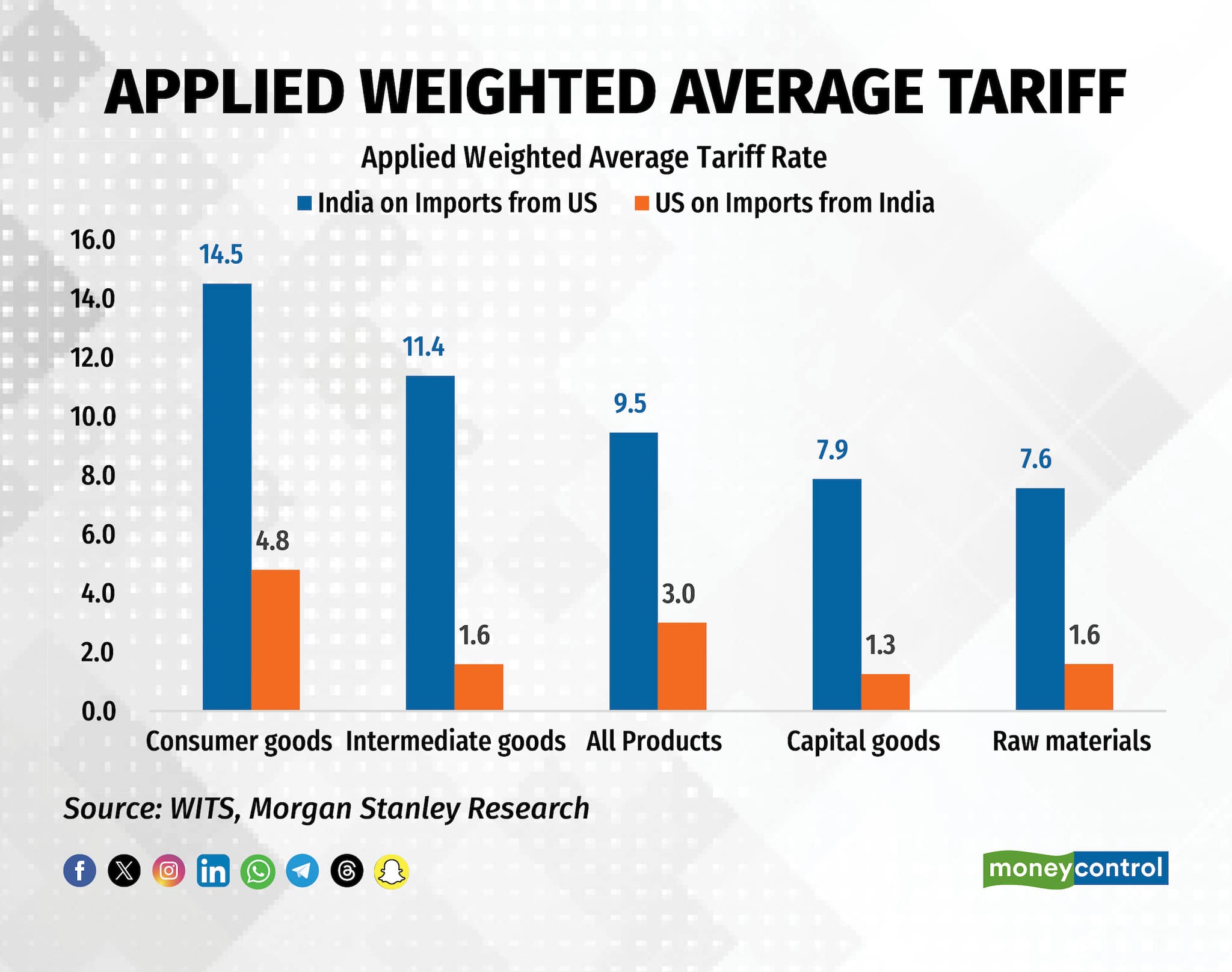

Exports are a significant contribution to India's GDP, with the total exports comprising 20.8 percent of India’s GDP, based on a five-year average. Currently, India's weighted average tariff rates imposed on US imports is at 8.5 precent, while the tariff levied by US on the import of Indian products is 3 percent.

The US is an important trading partner for India, with 17.7 percent of India's overall exports going to America in 2024. On the flip side, India's share of US overall imports was at 2.7 percent in 2024.

The US is also an important market for India's services exports, with a share of 54 percent in India's software service exports as of F2024, per RBI data.

"As such, India run's a trade surplus with the US, tracking at $45 billion in CY24, making it the seventh-largest trade surplus amongst nations that have a trade surplus with the US," noted Morgan Stanley.

The tariffs levied across different products is highly varied, and according to the research firm, key segments which could come under pressure due to reciprocal tariff hikes will be are electrical, industrial machinery, gems & jewellery, pharmaceuticals, fuels, textiles, iron & steel,

autos, and chemicals.

During President Trump’s first term, the US imposed additional tariffs of 25 percent on steel and 10 percent on aluminum globally in March 2018. That year, the US accounted for 3.3 percent of India’s total steel exports and 14.3 percent of its aluminum exports.

In retaliation, the Indian government introduced tariffs on 28 US products worth approximately $217 million, effective June 2019. Among the hardest-hit items were almonds, walnuts, lentils, and apples, with some tariffs reaching 20 percent and total levies exceeding 70 percent in certain cases.

So what happens when Trump's reciprocal tariffs are levied?

As per Morgan Stanley, if downside risks to growth materialize from trade policies through direct and indirect channel, the brokerage expects policy makers to respond through supportive policy measures.

The RBI could deepen its monetary policy easing cycle, potentially cutting the key benchmark lending rate by 100 basis points, instead of the 50 bps cut previously anticipated, along with easing liquidity by stealth.

"While fiscal policy remains on a consolidating path, the event of a deeper slowdown in global growth could prompt policy makers to provide support through higher capex spending," added Morgan Stanley.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.