The market closed the volatile session on a negative note on February 21, continuing the downtrend for the third day in a row, weighed down by selling in most of the sectors barring FMCG.

The BSE Sensex fell 19 points to 60,673. The Nifty50 declined 18 points to 17,827 and formed a bearish candlestick pattern on the daily charts making lower highs and lower lows for the third consecutive session while taking support at the 17,800 level.

"A reasonable negative candle was formed on the daily chart with a minor lower shadow. We observe the formation of overlapping candles during present weakness and the sharp decline from the swing highs on February 16 is missing. This pattern indicates the possibility of an upside bounce which is expected to emerge from the lows," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

He says the positive chart pattern like higher tops and bottoms is intact and the present weakness could be in line with the formation of the new higher bottom of the sequence. But still, there is no confirmation of any higher bottom reversal at the lows, he said.

According to him, there is a possibility of an upside bounce in the market from near the support of 17,700-17,750 levels. Immediate resistance is placed at 17,950-18,000 levels, the market expert said.

The broader markets were also down in trade on Tuesday as the Nifty Midcap 100 and Smallcap 100 indices declined 0.36 percent each. The breadth was in favour of declines.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the Nifty has support at 17,803, followed by 17,774 and then 17,726. If the index moves up, the key resistance levels to watch out for are 17,898, followed by 17,928 and 17,975.

The Nifty Bank was also under pressure amid volatility, for the fourth day in a row, falling 28 points to 40,674. The index has seen the formation of a bearish candlestick pattern on the daily charts, with making lower highs lower lows for the third straight session.

"The index is now trading at a critical support zone of 40,500 and if it manages to stay above this level can witness a pullback rally towards 41,000-41,300 levels," Kunal Shah, Senior Technical Analyst at LKP Securities said.

He feels the mentioned support if breaches will lead to further sell-off towards 40,000 where a significant amount of Put writing is visible.

The important pivot level, which will act as a support, is at 40,542, followed by 40,439 and 40,271. On the upside, key resistance levels are 40,877, followed by 40,980, and 41,147.

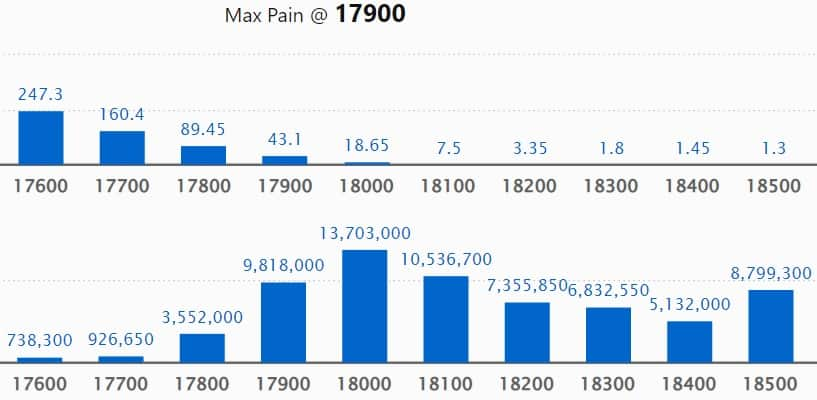

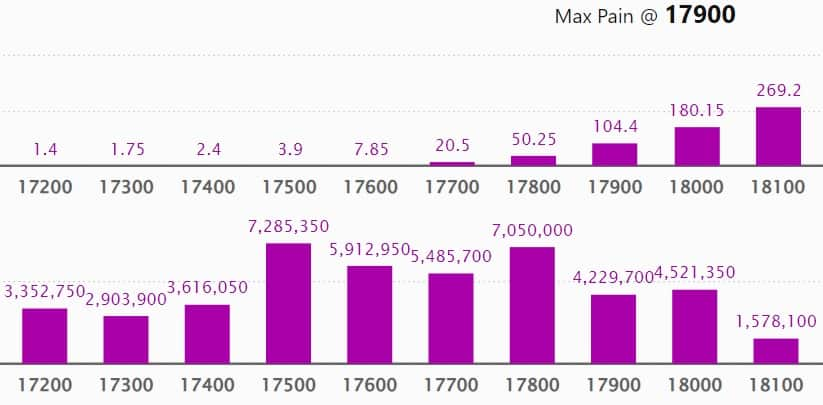

On a monthly basis, we have seen the maximum Call open interest (OI) at 18,000 strike, with 1.37 crore contracts, which may be a crucial resistance level for the Nifty in coming sessions.

This is followed by an 18,100 strike, comprising 1.05 crore contracts, and an 17,900 strike, where there are more than 98.18 lakh contracts.

Call writing was seen at 17,800 strike, which added 8.48 lakh contracts, followed by 17,700 strike which added 37,900 contracts and 17,600 strike which added 24,350 contracts.

We have seen Call unwinding in 18,500 strike, which shed 23.34 lakh contracts, followed by 18,000 strike, which shed 20.20 lakh contracts, and 18,900 strike which shed 13.77 lakh contracts.

On a monthly basis, the maximum Put OI was seen at 17,500 strike, with 72.85 lakh contracts, which is expected to act as a crucial support zone for the Nifty50 in coming sessions.

This is followed by the 17,800 strike, comprising 70.5 lakh contracts, and the 17,600 strike, where we have 59.12 lakh contracts.

Put writing was seen at 17,800 strike, which added 17.54 lakh contracts, followed by 17,000 strike, which added 6.99 lakh contracts, and 17,700 strike which added 6.02 lakh contracts.

We have seen Put unwinding at 18,000 strike, which shed 18.62 lakh contracts, followed by 17,900 strike which shed 11.7 lakh contracts, and 18,200 strike which shed 1.84 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Dabur India, ICICI Lombard General Insurance Company, Honeywell Automation, GAIL India, and Crompton Greaves Consumer Electricals, among others.

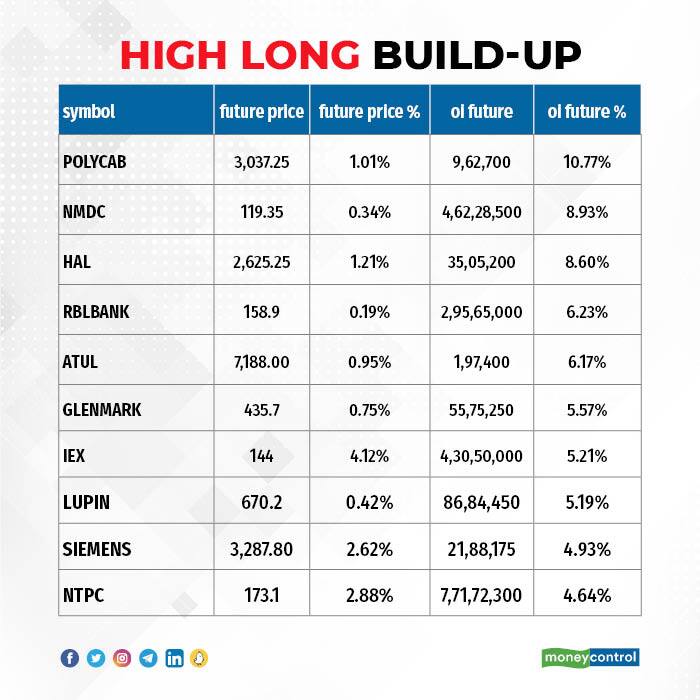

An increase in open interest (OI) and an increase in price mostly indicate a build-up of long positions. Based on the OI percentage, 25 stocks, including Polycab India, NMDC, Honeywell Automation, RBL Bank, and Atul, saw a long build-up.

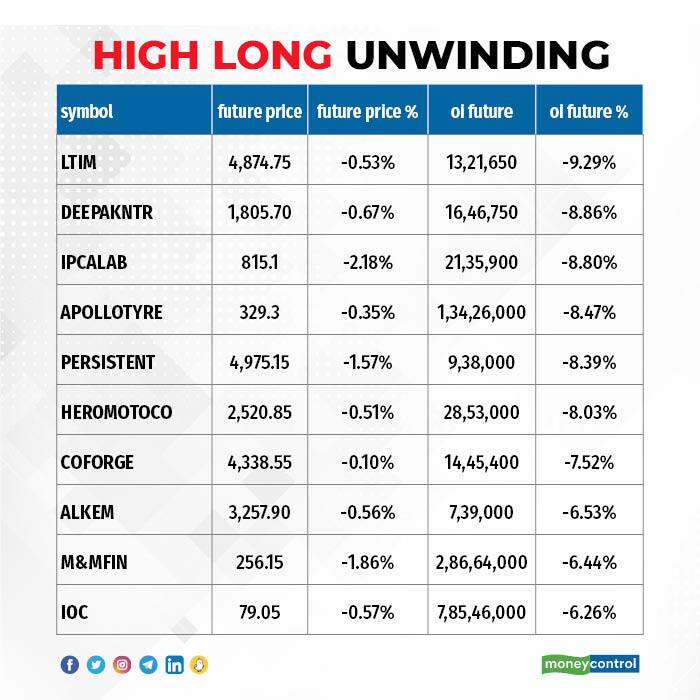

A decline in OI and a decrease in price, in most cases, indicate long unwinding. Based on the OI percentage, 71 stocks including LTIMindtree, Deepak Nitrite, Ipca Laboratories, Apollo Tyres, and Persistent Systems, witnessed long unwinding.

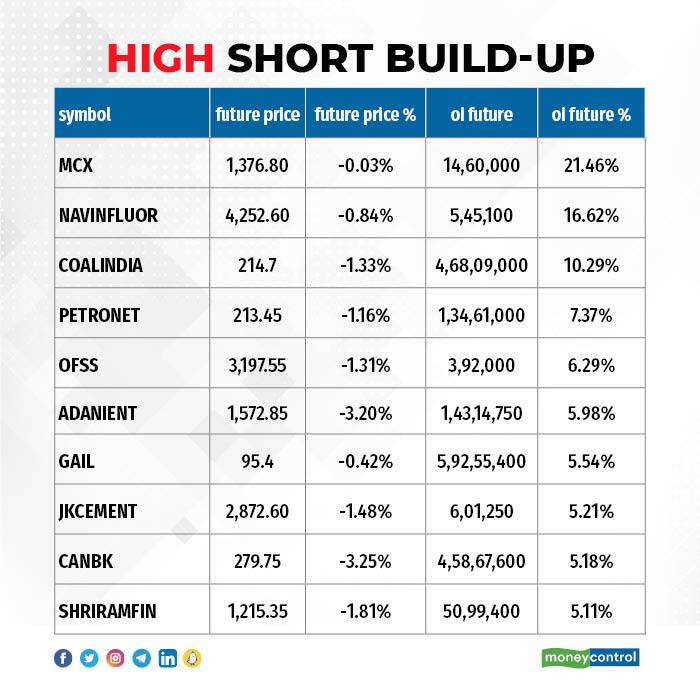

58 stocks see a short build-up

An increase in OI accompanied by a decrease in price mostly indicate a build-up of short positions. Based on the OI percentage, 58 stocks, including MCX India, Navin Fluorine International, Coal India, Petronet LNG, and Oracle Financial, saw a short build-up.

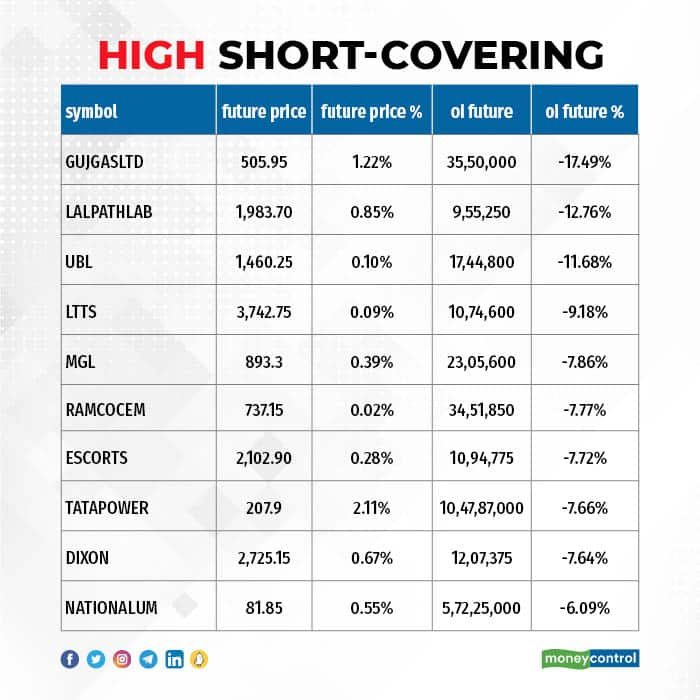

A decrease in OI along with an increase in price is an indication of short-covering. Based on the OI percentage, 40 stocks were on the short-covering list. These included Gujarat Gas, Dr Lal PathLabs, United Breweries, L&T Technology Services, and Mahanagar Gas.

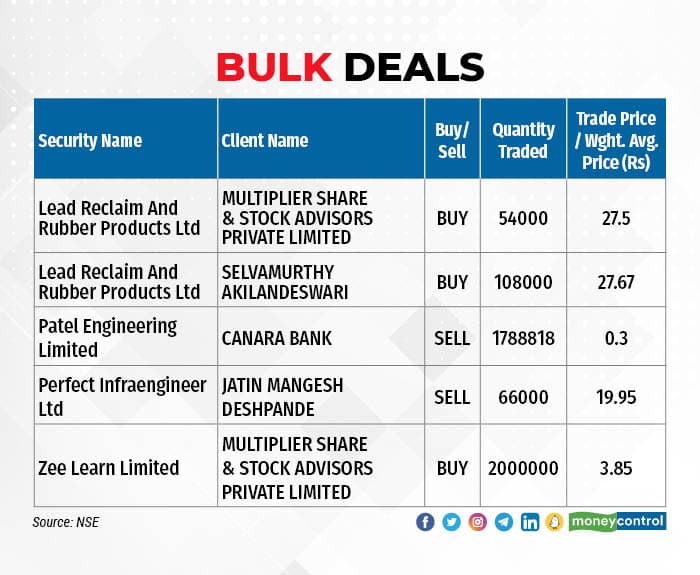

(For more bulk deals, click here)

Investors Meets on February 22

Crompton Greaves Consumer Electricals: Officials of the company will meet Franklin Templeton.

eMudhra: The company's officials will interact with Bay Capital.

PVR, Mahindra & Mahindra, Grasim Industries, Tata Steel, Blue Star, Zomato, Mahindra Logistics: Officials of these companies will meet investors at KIE Chasing Growth 2023 Conference.

Tata Motors: The company's officials will interact with several analysts and institutional investors.

Multi Commodity Exchange of India: Officials of the company will interact with Ward Ferry (WF Asian Smaller Companies Fund Limited).

Persistent Systems: The company's officials will meet India Avenue.

FSN E-Commerce Ventures: Officials of the company will interact with Soros Capital.

Eicher Motors: The company's officials will interact with Fidelity International, and CI Global Asset Management.

Sapphire Foods India: Officials of the company will interact with Bellwether Capital.

Max Financial Services: Amrit Singh – CFO of the company will interact with Ashmore Management, Wellington Management, Citadel Asia, Millennium Capital, Oxbow Capital Management, Trikon Asset Management, East Bridge Capital, JP Morgan Asset Management, and Nippon Life India Asset Management.

UltraTech Cement: The company's officials will meet JP Morgan Asset Management.

Stocks in the news

Sapphire Foods India: The quick service restaurant company's wholly owned subsidiary Gamma Pizzakraft (Overseas) has increased stake in its subsidiary Gamma Island Food to 75 percent, from 51 percent earlier after the acquisition of 81,914 equity shares. The acquisition cost of those shares is MVR 1,88,40,220. Gamma Island Food is incorporated in the Republic of Maldives, to operate Pizza Hut and KFC restaurants in Maldives under franchisee agreements.

Zensar Technologies: Nippon Life India Trustee has acquired an additional 1.7529 percent stake in the IT services management company via open market transactions. With this, its stake in the company increased to 5.2275 percent, up from 3.4745 percent earlier.

Bharat Electronics: The state-owned defence company has signed MoU with Aeronautical Development Agency (ADA), DRDO for the advanced medium combat aircraft (AMCA) programme. The Advanced Medium Combat Aircraft is a 5th generation, multi-role, all-weather fighter aircraft designed with high survivability and stealth capability.

Rashtriya Chemicals & Fertilizers: Sanjay Rastogi is appointed as government nominee director on the board of RCF with effect from February 21, 2023. He is currently working as an additional secretary and financial adviser in the Ministry of Chemicals and Fertilizers, Government of India.

LIC Housing Finance: ICICI Prudential Mutual Fund has acquired an additional 2.03 percent stake in the housing finance company via open market transactions. With this, the mutual fund house shareholding in the company increased to 7.07 percent, up from 5.04 percent earlier.

Petronet LNG: The company has received approval from board members for the extension of Vinod Kumar Mishra's tenure as Director (Finance), the whole-time Key Managerial Personnel and Chief Financial Officer, for another two years. The extension of two years will be effective from April 18, 2023, on the existing terms and conditions.

Biocon: The biopharmaceutical company has raised Rs 1,070 crore by issuing 1.07 lakh non-convertible debentures of the face value of Rs 1 lakh each on a private placement basis in 3 Series. The tenure of the NCDs is five years from the deemed date of allotment.

ITI: The government has appointed Rajesh Rai as the Chairman and Managing Director of ITI for a period of five years with effect from February 21, till the date of his superannuation, or until further orders, whichever is the earliest. Rai was General Manager at Mahanagar Telephone Nigam.

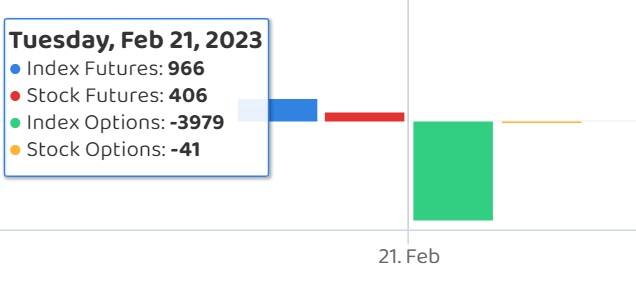

Fund Flow

Foreign institutional investors (FII) bought shares worth Rs 525.80 crore, whereas domestic institutional investors (DII) sold shares worth Rs 235.23 crore on February 21, NSE's provisional data showed.

Stocks under F&O ban on NSE

The National Stock Exchange has added Vodafone India to its F&O ban list for February 22. Securities banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.