The market hit a fresh record high in the morning on February 16; however, a correction in the afternoon dragged the benchmark indices to close lower, thanks to selling in private banks, FMCG and IT stocks.

The BSE Sensex declined 49.96 points to 52,104.17, while the Nifty50 fell 1.20 points to 15,313.50 and formed a Spinning Top kind of pattern on the daily charts.

"It is an overextended market and traders need to be careful when adding long positions at high levels. We must be optimistic but cautiously," Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities, told Moneycontrol.

"The market has fallen to the lowest level of the previous day but due to the unusual strength in the market, it has turned into a buying opportunity for short-term traders," he said, adding on February 17, the Nifty could show gains up to the 15,400 level and further bullishness above the 15,450 levels.

On the downside, the 15,240 level would provide major support, and dismissing it would lead to short-term weakness in the market, he feels.

The broader markets like Nifty Midcap 100 index and Smallcap 100 index gained 0.44 percent and 0.14 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,226.53, followed by 15,139.57. If the index moves up, the key resistance levels to watch out for are 15,416.13 and 15,518.77.

Nifty Bank

The Nifty Bank fell 207.85 points to 37,098.40 on February 16. The important pivot level, which will act as crucial support for the index, is placed at 36,671.2, followed by 36,244. On the upside, key resistance levels are placed at 37,617.2 and 38,136.

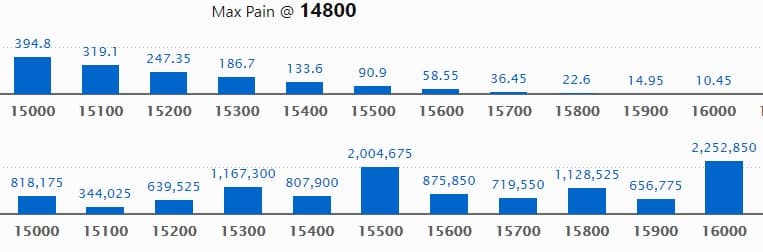

Call option data

Maximum Call open interest of 22.52 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the February series.

This is followed by 15,500 strike, which holds 20.04 lakh contracts, and 15,300 strike, which has accumulated 11.67 lakh contracts.

Call writing was seen at 15,400 strike, which added 2.85 lakh contracts, followed by 16,000 strike which added 1.84 lakh contracts and 15,900 strike which added 1.2 lakh contracts.

Call unwinding was seen at 15,200 strike, which shed 1.6 lakh contracts, followed by 15,000 strike which shed 88,950 contracts and 14,700 strike which shed 25,125 contracts.

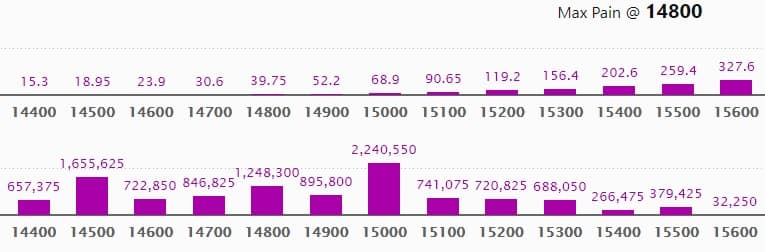

Put option data

Maximum Put open interest of 22.4 lakh contracts was seen at 15,000 strike, which will act as crucial support level in the February series.

This is followed by 14,500 strike, which holds 16.55 lakh contracts, and 14,800 strike, which has accumulated 12.48 lakh contracts.

Put writing was seen at 15,000 strike, which added 2.21 lakh contracts, followed by 14,800 strike, which added 1.91 lakh contracts and 15,100 strike which added 1.86 lakh contracts.

Put unwinding was seen at 14,600 strike, which shed 76,350 contracts, followed by 14,500 strike which shed 70,350 contracts.

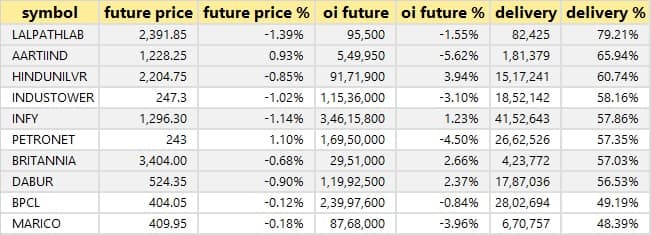

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

34 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

34 stocks saw long unwinding

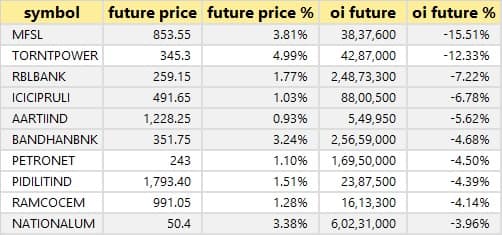

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

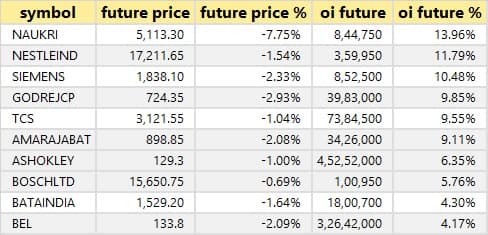

36 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

35 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

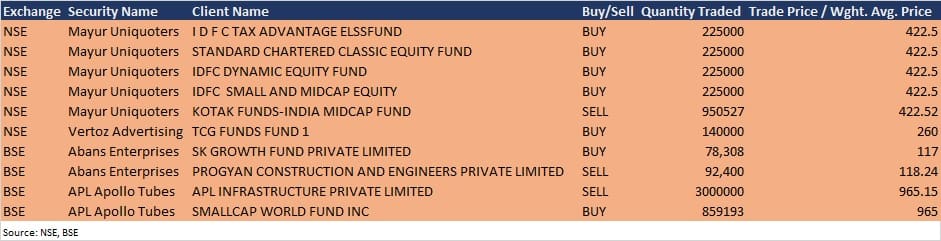

Bulk deals

(For more bulk deals, click here)

Pasupati Spinning, Sanghvi Forging and Engineering, SR Industries, Uniply Decor and Uniply Industries will announce their quarterly earnings on February 17.

Stocks in the news

Adani Ports: The company earmarked Rs 10,000 crore to build a new gateway into Maharashtra, and acquired Dighi Ports for Rs 705 crore.

L&T Finance Holdings: The company closed a rights issue of Rs 2,998.61 crore, which was oversubscribed by 15 percent.

TVS Srichakra: The company signed a Memorandum of Understanding with the Tamil Nadu government to facilitate the investment programme of Rs 1,000 crore.

Nestle India: The company reported higher profit at Rs 483.3 crore in Q4CY20 against Rs 472.6 crore Q4CY19; revenue rose to Rs 3,432.6 crore from Rs 3,149.3 crore YoY.

Heritage Foods: Heritage Novandie Foods, a 50:50 joint venture company between Heritage Foods and Novandie, France started commercial production.

Infosys: The US subsidiary completed acquisition of automated new business and underwriting platform from STEP Solutions.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,144.09 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,559.53 crore in the Indian equity market on February 16, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - SAIL - is under the F&O ban for February 17. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!