The market on November 24 staged a strong performance with the benchmark indices registering fresh record highs and Nifty50 closing above 13,000 for the first time, backed by FII inflow and vaccine news.

The BSE Sensex surged 445.87 points or 1.01 percent to 44,523.02, while the Nifty50 climbed 128.70 points or 1 percent to 13,055.20 and formed a bullish candle on the daily charts.

"A reasonable positive candle formation and record closing high above 13,000 mark could be considered as an upside breakout of the minor consolidation at 12,970 levels. Hence, one may expect continuation of an upside momentum in the market. Now, one needs to follow-through the upmove in the market, post-breakout for the next upside targets for the index," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

The overall market breadth was positive as about four shares advanced for every share declining on the BSE. The broad market indices like Nifty Midcap 100 and Smallcap 100 indices have closed higher by 0.73 percent and 1.11 percent respectively.

"Further decisive upmove could have a sharp positive impact on the market and that could open the next upside targets of around 13,500-13,600 levels in the near term. Immediate support is now placed at 12,950," Shetti said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 12,995.77, followed by 12,936.33. If the index moves up, the key resistance levels to watch out for are 13,096.87 and 13,138.53.

Nifty Bank

The Bank Nifty rallied 713.10 points or 2.46 percent to close at 29,737.30 and outperformed Nifty50 on November 24. The important pivot level, which will act as crucial support for the index, is placed at 29,353.4, followed by 28,969.6. On the upside, key resistance levels are placed at 29,974.4 and 30,211.6.

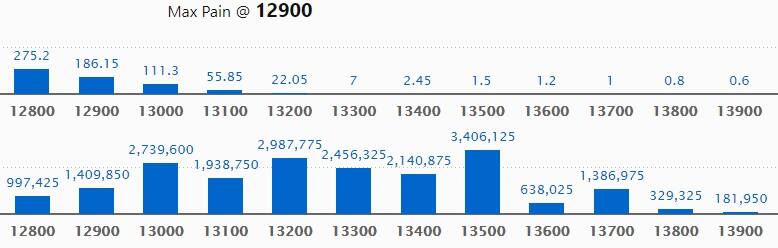

Call option data

Maximum Call open interest of 34.06 lakh contracts was seen at 13,500 strike, which will act as crucial resistance level in the November series.

This is followed by 13,200 strike, which holds 29.87 lakh contracts, and 13,000 strike, which has accumulated 27.39 lakh contracts.

Call writing was seen at 13,300 strike, which added 3.91 lakh contracts, followed by 13,400 strike which added 1.59 lakh contracts and 13,900 strike which added 24,150 contracts.

Call unwinding was seen at 12,900 strike, which shed 11.36 lakh contracts, followed by 13,000 strike which shed 9.3 lakh contracts and 13,500 strike which shed 7.26 lakh contracts.

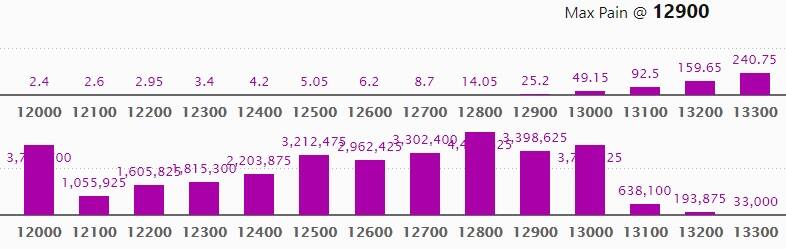

Put option data

Maximum Put open interest of 44.18 lakh contracts was seen at 12,800 strike, which will act as crucial support in the November series.

This is followed by 12,000 strike, which holds 37.61 lakh contracts, and 13,000 strike, which has accumulated 37.11 lakh contracts.

Put writing was seen at 13,000 strike, which added 26.62 lakh contracts, followed by 12,900 strike, which added 8.81 lakh contracts and 13,100 strike which added 5.34 lakh contracts.

Put unwinding was seen at 12,000 strike, which shed 3.44 lakh contracts, followed by 12,500 strike, which shed 1.94 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

47 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

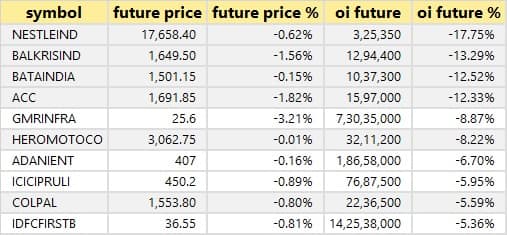

29 stocks saw long unwinding

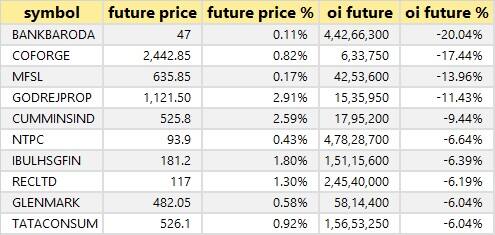

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

26 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

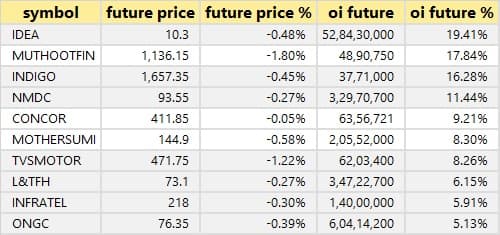

35 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are top 10 stocks in which short-covering was seen.

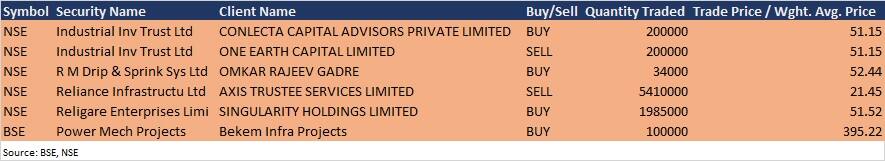

Bulk deals

(For more bulk deals, click here)

Analysts Meets/Board Meetings

Dixon Technologies: The company's officials will meet KGI Funds on November 26 and Enam AMC on November 27.

Brigade Enterprises: The company's officials will meet Spark Capital on November 25.

Ramco Cements: Online investors' meet is scheduled on December 2, organised by Citi Group Global Markets India.

Mahindra Logistics: A one-on-one call with Yes Securities is scheduled to be held on November 27.

VST Tillers: The company's officials will meet Dhanki Securities on November 25.

Tech Mahindra: Investor Day 2020 to be held by the company on November 30.

Stocks in the news

Muthoot Finance: The RBI rejects Muthoot Finance's proposal to acquire IDBI AMC.

TRF: The company sought approval of the shareholders for sale of the entire stake held by subsidiary Dutch Lanka Trailer Manufacturers, in Tata International DLT, a 50:50 joint venture company of Tata International Limited and Dutch Lanka Trailer Manufacturers.

IRB Infrastructure Developers: Agra Etawah BOT Project implemented by AE Tollway (SPV) which is now part of IRB Infrastructure Trust - Private InvIT, has been issued a completion certificate by the competent authority. Consequently, toll rates for the SPV would be increased by 70 percent and the SPV will collect toll at revised toll rates on this project.

Lasa Supergenerics: The company received further injunction from the Bombay High Court, restraining its competitor from manufacturing albendazole in addition to other reliefs which is subject matter of patent infringement case.

Max Financial Services: The company reported a profit of Rs 81 crore in Q2FY21 compared to Rs 64.4 crore, and revenue increased to Rs 7,020 crore from Rs 4,686 crore YoY.

JSW Steel: The company acquired balance 26.45 percent of the issued and paid-up share capital of JSW Vallabh Tinplate.

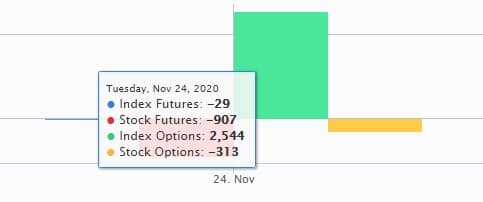

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 4,563.18 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 2,522.11 crore in the Indian equity market on November 24, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Five stocks - Adani Enterprises, Federal Bank, NALCO, SAIL and Tata Motors- are under the F&O ban for November 25. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!