The market continued its uptrend for the third consecutive session and registered fresh record closing on November 17 following further progress on the vaccine front.

Banking and financials, auto and metals stocks helped the BSE Sensex rise 314.73 points to end at a record closing high of 43,952.71, while the Nifty50 climbed 93.90 points to 12,874.20, but formed a small-bodied bearish candle (as closing was lower than opening levels) which resembles a Hanging Man kind of pattern on the daily scale.

"We observe smaller degree of higher tops and bottoms on the daily chart and recent dips in the market on November 13 could be considered as a new higher bottom of the sequence. Hence, the present upmove could continue for another 1-2 sessions before showing another higher top at the new highs," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"Nifty has reached the long term resistance of significant uptrend line (trend line connected the rising tops of the last two year-as per weekly/monthly chart). Presently, Nifty is making an attempt of breaking above this crucial overhead resistance at 12,850 levels. Any slowing down of upside momentum around this area could bring some profit booking from the highs and a decisive/ sustainable move could open the next upside target of 13,500 levels,"

The market breadth was slightly positive and broad market indices like Midcap 100 and Smallcap 100 have ended higher by 1.11 percent and 0.26 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 12,802.87, followed by 12,731.53. If the index moves up, the key resistance levels to watch out for are 12,939.77 and 13,005.33.

Nifty Bank

The Bank Nifty outperformed the benchmark Nifty50, climbing 587 points or 2.05 percent to 29,181.30 on November 17. The important pivot level, which will act as crucial support for the index, is placed at 28,856.41, followed by 28,531.5. On the upside, key resistance levels are placed at 29,372.71 and 29,564.1.

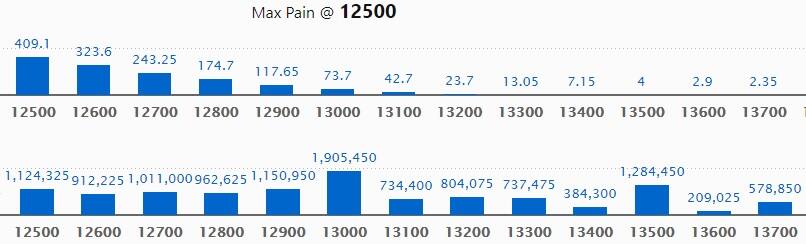

Call option data

Maximum Call open interest of 19.05 lakh contracts was seen at 13,000 strike, which will act as a crucial resistance level in the November series.

This is followed by 13,500 strike, which holds 12.84 lakh contracts, and 12,900 strike, which has accumulated 11.50 lakh contracts.

Call writing was seen at 13,100 strike, which added 1.58 lakh contracts, followed by 13,300 strike which added 1.18 lakh contracts and 13,800 strike which added 57,225 contracts.

Call unwinding was seen at 13,500 strike, which shed 2.51 lakh contracts, followed by 12,700 strike which shed 1.64 lakh contracts and 13,000 strike which shed 1.11 lakh contracts.

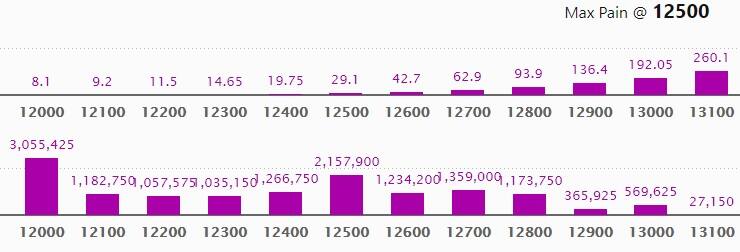

Put option data

Maximum Put open interest of 30.55 lakh contracts was seen at 12,000 strike, which will act as a crucial support in the November series.

This is followed by 12,500 strike, which holds 21.57 lakh contracts, and 12,700 strike, which has accumulated 13.59 lakh contracts.

Put writing was seen at 12,800 strike, which added 6.98 lakh contracts, followed by 12,700 strike, which added 3.55 lakh contracts and 12,500 strike which added 2.94 lakh contracts.

Put unwinding was seen at 12,000 strike, which shed 3.32 lakh contracts, followed by 12,200 strike, which shed 1.45 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

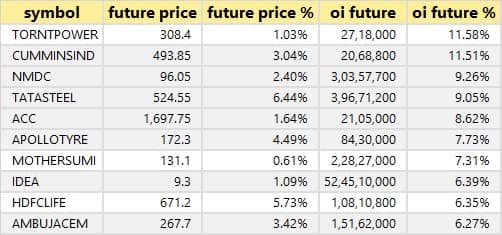

51 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

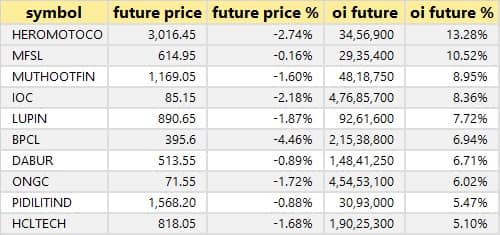

17 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

26 stocks saw short build-up

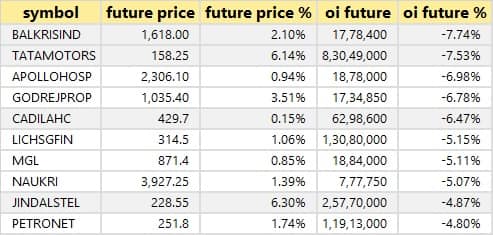

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

45 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

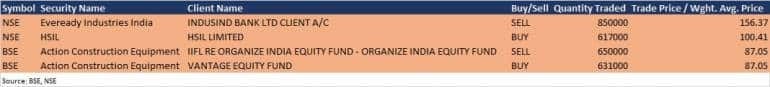

Bulk deals

(For more bulk deals, click here)

Analysts Meets/Board Meetings

HeidelbergCement India: The company's representatives Jamshed Naval Cooper, Managing Director; Anil Sharma, CFO and Amit Angra, VP - Finance will have online meetings on November 20 with the representatives of various institutional investors/fund houses, being organised by Centrum Broking Ltd.

Hindustan Aeronautics: Management team of the company will be participating in the Q2FY21 post-results conference call scheduled on November 18.

PNC Infratech: Officials of the company will be attending the investor conference organised by Centrum Broking on November 18.

Jamna Auto Industries: Officials of the company will hold a conference call with analysts/ institutional investors on November 19.

Supreme Industries: Officials of the company will meet analysts / institutional investors on November 18 and 19.

Indraprastha Gas: The company's officials will attend an Investor Conference organised by CLSA India on November 20.

Computer Age Management Services: The company's officials will meet Warburg Pincus via conference call on November 18.

Oriental Aromatics: The company will hold the conference call with the institutional investors/analysts on November 18, 19, 20 and 25.

Lemon Tree Hotels: The company's management will be participating online in the 23rd Annual CITIC CLSA India Forum 2020 organised by CLSA with analysts/institutional investors on November 18.

Bajaj Consumer Care: The company will be participating in institutional investors meet organised by Kotak Securities on November 25.

Advanced Enzyme Technologies: The company's officials will meet Eternity Capital LLP via video conference on November 19.

Sterlite Technologies: The company's management will be participating online in the 23rd Annual CITIC CLSA India Forum 2020 organised by CLSA with analysts/institutional investors on November 18.

Rossari Biotech: The company's officials will attend Rising Stars Conference organised by Axis Capital on November 18.

Ashoka Buildcon: The company will be attending the Investor Video Conference organised by Centrum Broking on November 18.

Mindspace Business Parks REIT: The company's management will attend the 23rd Annual CITIC CLSA India Forum 2020 organised by CLSA with analysts/institutional investors on November 18.

IIFL Securities: The company on November 20 will consider the proposal for buy-back of fully paid-up equity shares.

Stocks in the news

Lakshmi Vilas Bank: The RBI announced a draft scheme of amalgamation for Lakshmi Vilas Bank with DBS Bank.

Tata Steel: HDFC AMC reduced its shareholding in the company to 2.96 percent from 5.02 percent earlier.

DLF: The company recognised as an index component of the Dow Jones Sustainability Indices (DJSI) in Emerging markets category.

Ajanta Pharma: Promoter Ravi P Agrawal, trustee Ravi Agrawal Trust released 7.75 lakh pledged shares.

Ganesh Benzoplast: Stolt Nielsen Singapore Pte Ltd acquired 61,11,048 equity shares of the company.

Nel Holdings South: The company exited from another prime project - Caesar's Palace - by entering into a settlement agreement with landowners and Caesar's Palace Buyers Welfare Association.

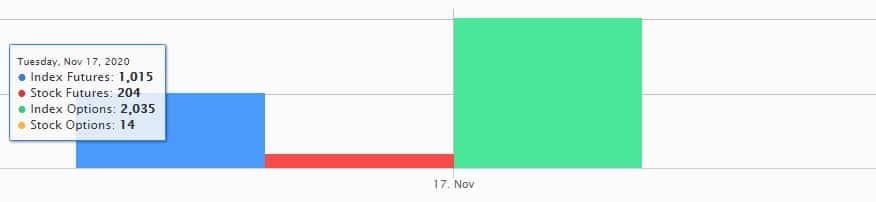

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 4,905.35 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 3,829.16 crore in the Indian equity market on November 17, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Eight stocks - BHEL, Canara Bank, Indiabulls Housing Finance, Jindal Steel & Power, LIC Housing Finance, SAIL, Sun TV Network and Tata Steel - are under the F&O ban for November 18. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!