The market extended selling pressure for the second consecutive session and closed at a five-month low on July 30, dragged by banks, auto, metals and pharma stocks.

The BSE Sensex was down 289.13 points at 37,397.24 while the Nifty50 fell 103.80 points to close below the 200-day moving average, at 11,085.40 and formed a large bearish candle on the daily charts.

"The index managed to breach the strong support of 11,140 and closed below it. This means some more pressure can be seen in coming session if continues to trade below 11,140. Immediate support for Nifty is coming near 11,000 mark and resistance is coming near the 11,140-11,220 zone," Rohit Singre, Senior Technical Analyst, LKP Securities told Moneycontrol.

Nagaraj Shetti, Technical Research Analyst at HDFC Securities, said that the Nifty moving below the 11,100 support level could open up more weakness in the coming sessions.

"The next downside levels to be watched is around 10,980-10,950 (upper area of previous larger consolidation, as per the concept of change in polarity-weekly timeframe chart) in the next few sessions," he added.

Selling pressure in broader markets was quite high compared to benchmark indices, especially after a sharp correction in Coffee Day Enterprises and Sical Logistics stocks after owner VG Siddhartha was reported missing on July 29. The Nifty Midcap index lost nearly 2 percent and Smallcap index was down 2.6 percent.

We have collated 13 data points to help you spot profitable trades:

Key support and resistance level for Nifty

The Nifty closed at 11,085.40 on July 30. According to the pivot charts, the key support level is placed at 11,016.23, followed by 10,947.07. If the index starts moving upward, the key resistance levels to watch for out are 11,211.03 and 11,336.67.

Nifty Bank

The Nifty Bank closed at 28,791.60, down by 504.30 points on July 30. The important pivot level, which will act as crucial support for the index, is placed at 28,509.5, followed by 28,227.4. On the upside, key resistance levels are placed at 29,302.0, and 29,812.4.

Call options data

Maximum Call open interest is at 11,500 strike, which will act as a crucial resistance in August series. It is followed by 11,300 strike.

Significant Call writing is at 11,300 strike, followed by 11,200 strike.

Put options data

Maximum Put open interest (OI) is at 11,000 strike, which will act as a crucial support in August series. It is followed by 11,200 strike.

Marginal Put writing is at 11,000 strike, followed by 10,800 strike.

Analyst or Board Meetings/Briefings

Edelweiss Financial Services: Company will announce its June quarter earnings on August 14.

Archies: Company will announce its June quarter earnings on August 10.

IOL Chemicals: Company will announce its June quarter earnings on August 12.

SAIL: Company will announce its June quarter earnings on August 9.

KEC International: Company will hold an analyst/ investors' conference call on August 7 on its Unaudited Financial Results for the quarter ended June 2019.

Jet Airways: Committee of creditors to meet on August 1.

Oberoi Realty: AGM to be held on August 23.

JK Lakshmi Cement: Annual General Meeting to be held on August 31.

Oracle Financial Services Software: Company will announce its June quarter earnings on August 7.

Wabco India: Company will have meetings with various institutional investors/fund houses organized by Batlivala & Karani Securities India Private Limited on August 2.

Stocks in the news

Hero MotoCorp Q1: Profit jumps 38.3 percent to Rs 1,256.7 crore versus Rs 909.2 crore led by exceptional gain of Rs 737.5 crore on reversal of calamity fund provision; revenue falls 8.8 percent to Rs 8,030.3 crore versus Rs 8,809.8 crore YoY.

Axis Bank Q1: Profit jumps 95 percent to Rs 1,370 crore versus Rs 701 crore, NII rises 13 percent to Rs 5,843.6 crore versus Rs 5,167 crore YoY. Gross NPA falls to 5.25 percent versus 5.26 percent and net NPA dips to 2.04 percent versus 2.06 percent QoQ.

Tech Mahindra Q1: Profit falls 15.3 percent to Rs 959 crore versus Rs 1,132.5 crore, revenue dips 2.7 percent to Rs 8,653 crore versus Rs 8,892.3 crore; dollar revenue declines 1.6 percent to $1,247.1 million versus $1,267.5 million QoQ.

Dish TV Q1: Consolidated loss at Rs 32 crore against profit of Rs 37.9 crore, revenue falls 44.1 percent to Rs 926.3 crore versus Rs 1,655.6 crore YoY.

Vaibhav Global Q1: Consolidated profit jumps 20 percent to Rs 36 crore versus Rs 30 crore, revenue rises 12.8 percent to Rs 440 crore versus Rs 390.1 crore YoY.

Shoppers Stop Q1: Consolidated loss at Rs 0.1 crore versus Rs 4.7 crore, revenue rises 0.4 percent to Rs 854 crore versus Rs 850 crore YoY.

Gulf Oil Lubricants Q1: Profit rises to Rs 48.72 crore versus Rs 40.13 crore, revenue climbs to Rs 440.68 crore versus Rs 390.36 crore YoY.

Vinati Organics Q1: Profit jumps to Rs 82.36 crore versus Rs 64.25 crore, revenue increases to Rs 290.74 crore versus Rs 259.74 crore YoY.

Gujarat Gas Q1: Consolidated profit surges 100 percent to Rs 234 crore versus Rs 116.6 crore, revenue rises 36 percent to Rs 2,670.8 crore versus Rs 1,963.3 crore QoQ.

Chemfab Alkalis Q1: Profit rises to Rs 9.04 crore versus Rs 8.35 crore, revenue increases to Rs 56.05 crore versus Rs 49.4 crore YoY.

PNB Housing Finance Q1: Consolidated net profit rises to Rs 284.5 crore versus Rs 255.8 crore, revenue jumps to Rs 2,231 crore versus Rs 1,648 crore YoY.

Music Broadcast: CRISIL reaffirmed its AA/Stable rating to the long term facilities of the company and A1+ rating to the short term facilities.

Alkem Labs: US FDA closes inspection at Baddi Unit after company's response. US FDA had issued 4 observations to Baddi unit in May.

Pfizer: Parent Pfizer Inc, USA and Mylan NV announced a definitive agreement to combine Mylan with Upjohn, company's off-patent branded and generic established medicines business, creating a new global pharmaceutical company.

JSW Steel: Company declared as the preferred bidder for another 3 iron ore mines (Narayanpura Manganese & Iron Ore Mine, Dharmapura Iron Ore Mine & BBH Mines) in the auctions held by the Government of Karnataka in July 2019. The estimated resources of these mines are around 92.97 MMT.

Tech Mahindra: Company to acquire majority stake in Mad*Pow Media Solutions, LLC through its wholly-owned subsidiary Tech Mahindra (Americas), Inc.

Sobha: Subsidiary Sobha Developers (Pune) Limited acquired entire equity shares of Kuthavakkam Builders Private Limited and Kuthavakkam Realtors Private Limited.

Union Bank of India: Bank cuts MCLR by 5-20 bps across tenures.

Lakshmi Vilas Bank: Bank to cut MCLR by 5 bps across tenures from Thursday.

Mahindra & Mahindra: After the issue of compulsorily convertible cumulative preference shares to the company, the shareholding of the company in SmartShift Logistics Solutions Private Limited (Porter) will get enhanced from 30.73 percent to approximately 34 percent.

Orient Green Power Company: State Bank of India's stressed Asset Management Branch, Chennai affixed e-auction sale notice for sale of factory, land and building of the company situated at Sookri Village, MP.

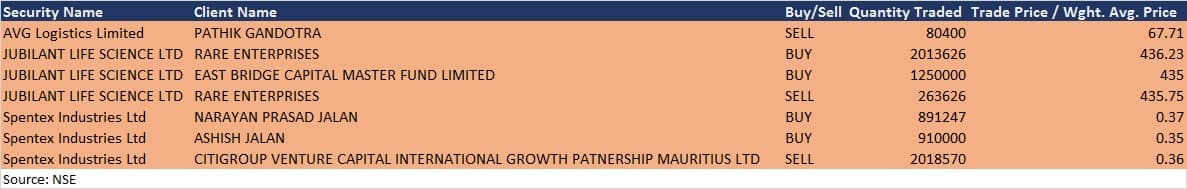

Bulk deals

(For more bulk deals, click here)

FII & DII data

Foreign Institutional Investors (FIIs) sold shares worth Rs 644.59 crore, but Domestic Institutional Investors (DIIs) bought Rs 1,079.72 crore worth of shares in the Indian equity market on July 30, as per provisional data available on the NSE.

Results to Watch Out For

Results on July 31: Eicher Motors, Indian Oil Corporation, UPL, Ashok Leyland, Apollo Tyres, NR Agarwal Industries, Star Cement, Symphony, Zee Media Corporation, Allahabad Bank, Future Supply Chain Solutions, JBF Industries, SKM Egg Products, Tanla Solutions, Trent, Digicontent, Uttam Value Steels, MAS Financial Services, Gandhi Special Tubes, Tamilnadu PetroProducts, Shyam Century Ferrous, Maithan Alloys, BF Investment, Indian Energy Exchange, Ajanta Pharma, Kabra Extrusion Technik, Vardhman Special Steels, Indiabulls Ventures, Carborundum Universal, Container Corporation of India, Genus Paper & Boards, Heritage Foods, Blue Dart Express, Motilal Oswal Financial Services, Mahindra Holidays & Resorts India, Creditaccess Grameen, LG Balakrishnan & Bros, Sanwaria Consumer, HCL Infosystems, IndiaMart InterMesh, Sequent Scientific, Expleo Solutions, BF Utilities, Munjal Showa, Nelcast, Future Retail, Petronet LNG, CARE Ratings, Zydus Wellness, Tata Global Beverages, Hester Biosciences, Jagran Prakashan

Eicher Motors is expected to report double digit decline in June quarter profit with sharp contraction in EBITDA margin on subdued volume growth, according to brokerages.

"We expect standalone revenues to decline by 5 percent YoY, led by increase in prices as the company has introduced ABS in all its models to comply with the new safety norms. We expect EBITDA margin of Royal Enfield to decline by 660 bps YoY due to negative operating leverage (-270 bps YoY) and decline in gross margin (-390 bps YoY)," said Kotak which expects consolidated adjusted net profit to decline by 15 percent YoY led by weak performance of both Royal Enfield and VECV.

Royal Enfield volumes declined by 19 percent YoY in Q1FY20 due to weak demand and high ownership cost.

Prabhudas Lilladher expects consolidated EBITDA margin to slip to 27 percent, lower 480bps YoY/ 40bps QoQ.

State-owned oil marketing company IOC is likely to show more than 50 percent sequential as well as year-on-year fall in June quarter profit due to lower inventory gains.

According to ICICI direct, profit is expected to decline 72.1 percent QoQ as Q4FY19 results had huge inventory gains as well as marketing margins.

"Crude throughput is expected at 17.3 MMT, flattish QoQ. Marketing margins are expected to decline QoQ as companies had reported super-normal profits in Q4FY19. Core GRMs are expected to remain subdued near multi-year lows due to weak product spreads," said the brokerage which sees gross refining margin at $3.2 a barrel in Q1FY20 against $4.1 a barrel in Q4FY19.

Kotak Institutional Equities feels profit fall could be 80 percent QoQ and 82.3 percent YoY and revenue may decline 1 percent QoQ and 3.5 percent YoY.

"We expect IOCL to report weak results impacted by (1) adventitious loss and (2) muted refining margins, which will be partially offset by higher-than-normal blended marketing margins on auto fuels.

Agrochemical company UPL is expected to report sharp jump in revenue and EBITDA year-on-year but in actual sense, numbers are not comparable due to incorporation of Arysta's financials.

Company completed acquisition of New York-based Arysta LifeScience for $4.2 billion in February 2019.

Kotak said excluding Arysta, it expects a healthy 11 percent YoY growth in revenues amid sustained growth in Latin American markets. Including Arysta, revenue growth could be 84 percent and EBITDA may jump 89 percent YoY with 0.3 percent degrowth in profit.

The brokerage further expects overall EBITDA margin, including Arysta, to revert to 21 percent assuming sharply lower write-off on Arysta's inventories as compared to Q4FY19.

Prabhudas Lilladher also said including Arysta, UPL's topline could be growing 84 percent and EBITDA may increase by 93 percent with 4 percent bottomline degrowth YoY.

Most brokerages expect around 5-7 percent year-on-year decline in revenue and double digit fall in profit & EBITDA for the quarter ended June 2019, dented by weak volumes.

In Q1FY20, Ashok Leyland's volume decline was limited to 6 percent against around 9-18 percent degrowth for its competitors.

Total volumes of the quarter were at 39,608 units.

"Net sales in Q1FY20 is expected to fall 7.5 percent YoY. EBITDA is likely to slip 19 percent and PAT may fall 28 percent YoY," said ICICI direct which said the product mix worsened with light commercial vehicle (LCV) to medium & heavy commerical vehicle (M&HCV) ratio in Q1FY20 at 33:67 against 26:74 in Q4FY19 and 27:73 in Q1FY19.

But Kotak expects the maximum decline in profit at 62 percent YoY and EBITDA at 40 percent YoY. "We expect EBITDA margin to decline by 390 bps YoY, led by 240 bps YoY decline in gross margin and negative operating leverage," it said.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!