The market failed to hold on to opening gains and lost momentum in late morning deals and traded lower for the rest of the session on January 16, making a disappointing start to the week. The benchmark indices lost a third of a percent, weighed by metal, private banks, financial services, and auto stocks.

The BSE Sensex fell 168 points to 60,093, while the Nifty50 dropped 62 points to 17,895 and formed a bearish candle which, to some extent, resembles a Dark Cloud cover kind of pattern on the daily charts, indicating a bearish reversal signal.

"Nifty failed to sustain above 18,000 and slipped lower before closing around 17,900. A "Dark Cloud Cover"-like pattern has formed on the daily chart, suggesting a near-term weakness," Rupak De, Senior Technical Analyst at LKP Securities said.

The analyst feels support on the lower end is visible at 17,850-17,750. Below 17,750, Nifty may witness a meaningful correction, De said.

On the higher end, the analyst added that resistance is visible at 18,000–18,100.

The broader markets also had a negative start to the week as the Nifty Midcap 100 was down 0.24 percent and Smallcap 100 index declined 0.07 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

Per the pivot charts, we have the key support level for the Nifty at 17,858, followed by 17,812, and 17,737. If the index moves up, the key resistance levels to watch out for are 18,008, followed by 18,054 and 18,129.

The Nifty Bank index fell 204 points to 42,168, forming a bearish candle on the daily charts but making a higher high higher low for the third straight session.

The important pivot level, which will act as crucial support for the index, is placed at 42,069, followed by 41,916, and 41,668. On the upside, key resistance levels are placed at 42,564, followed by 42,718, and 42,966.

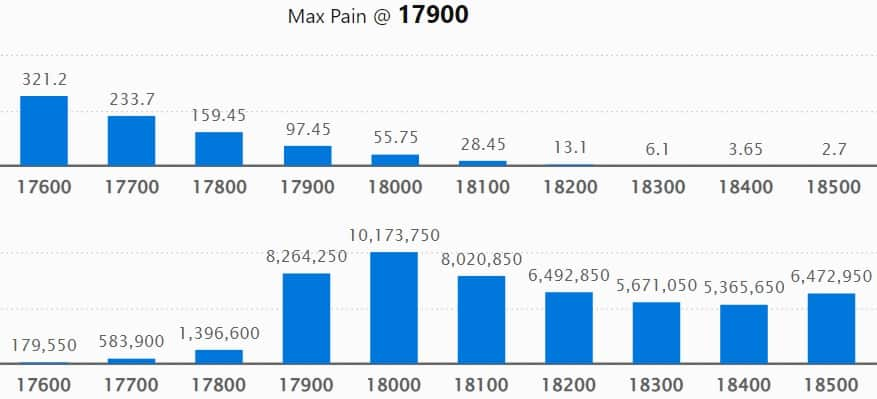

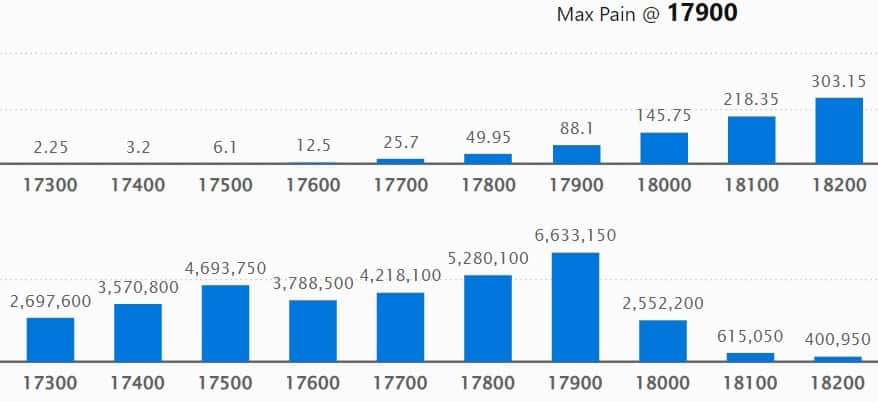

On the weekly basis, we have seen the maximum Call open interest (OI) at 18,000 strike, with 1.01 crore contracts, which can act as a resistance for the coming sessions of the January series.

This is followed by a 17,900 strike, comprising 82.64 lakh contracts, and an 18,100 strike, where we have more than 80.2 lakh contracts.

Call writing was seen at 18,000 strike, which added 49.83 lakh contracts, followed by 18,100 strike, which added 41.6 lakh contracts, and 18,500 strike, which added 24.55 lakh contracts.

Call unwinding was seen at 18,700 strike, which shed 7.51 lakh contracts, followed by 18,800 strike, which shed 2.59 lakh contracts, and 17,600 strike, which shed 70,800 contracts.

On a weekly basis, the maximum Put OI was seen at 17,900 strike, with 66.33 lakh contracts, which can act as crucial support for the Nifty50 in the coming sessions of the January series.

This is followed by a 17,800 strike, comprising 52.8 lakh contracts, and a 17,500 strike, where we have 46.93 lakh contracts.

Put writing was seen at 17,600 strike, which added 9.39 lakh contracts, followed by 17,500 strike, which added 8.79 lakh contracts, and 17,400 strike which added 8.11 lakh contracts.

Put unwinding was seen at 17,200 strike, which shed 15.95 lakh contracts, followed by 17,900 strike, which shed 9.75 lakh contracts, and 17,800 strike, which shed 5.68 lakh contracts.

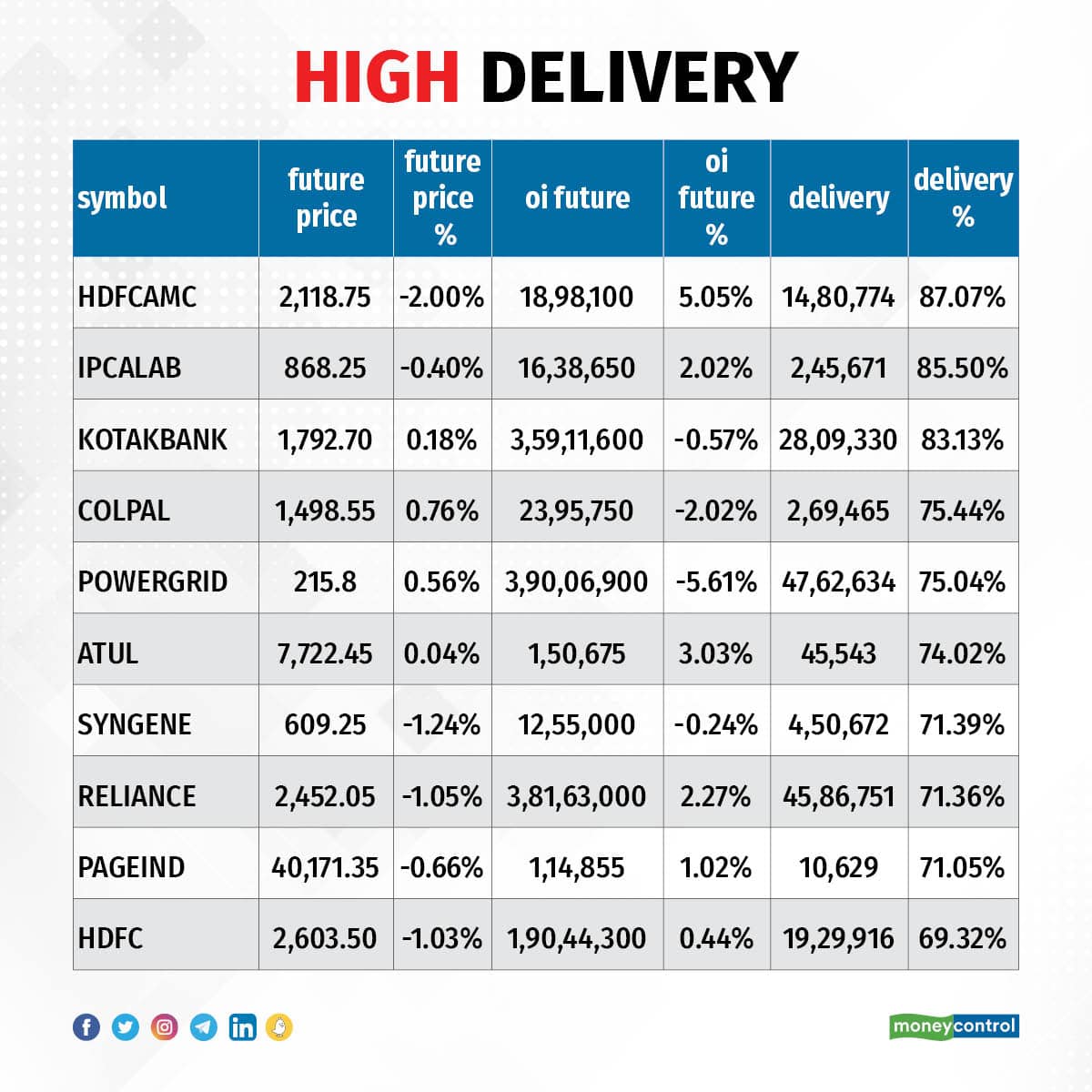

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. We have seen the highest delivery in HDFC AMC, Ipca Laboratories, Kotak Mahindra Bank, Colgate Palmolive, and Power Grid Corporation of India, among others.

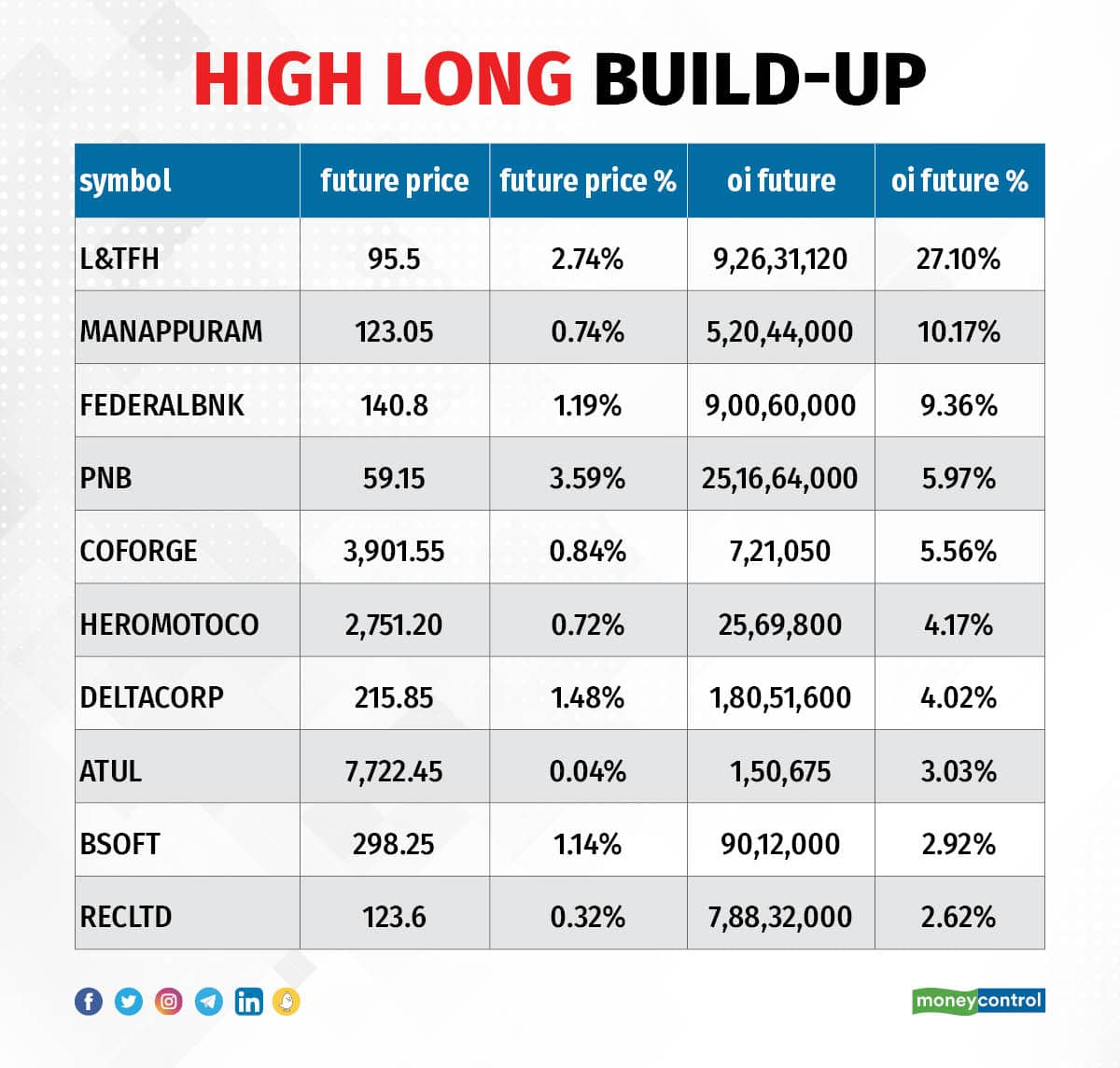

An increase in OI, along with an increase in price, mostly indicates a build-up of long positions. Based on the OI percentage, a long build-up was seen in 22 stocks on Monday, including L&T Finance Holdings, Manappuram Finance, Federal Bank, Punjab National Bank, and Coforge.

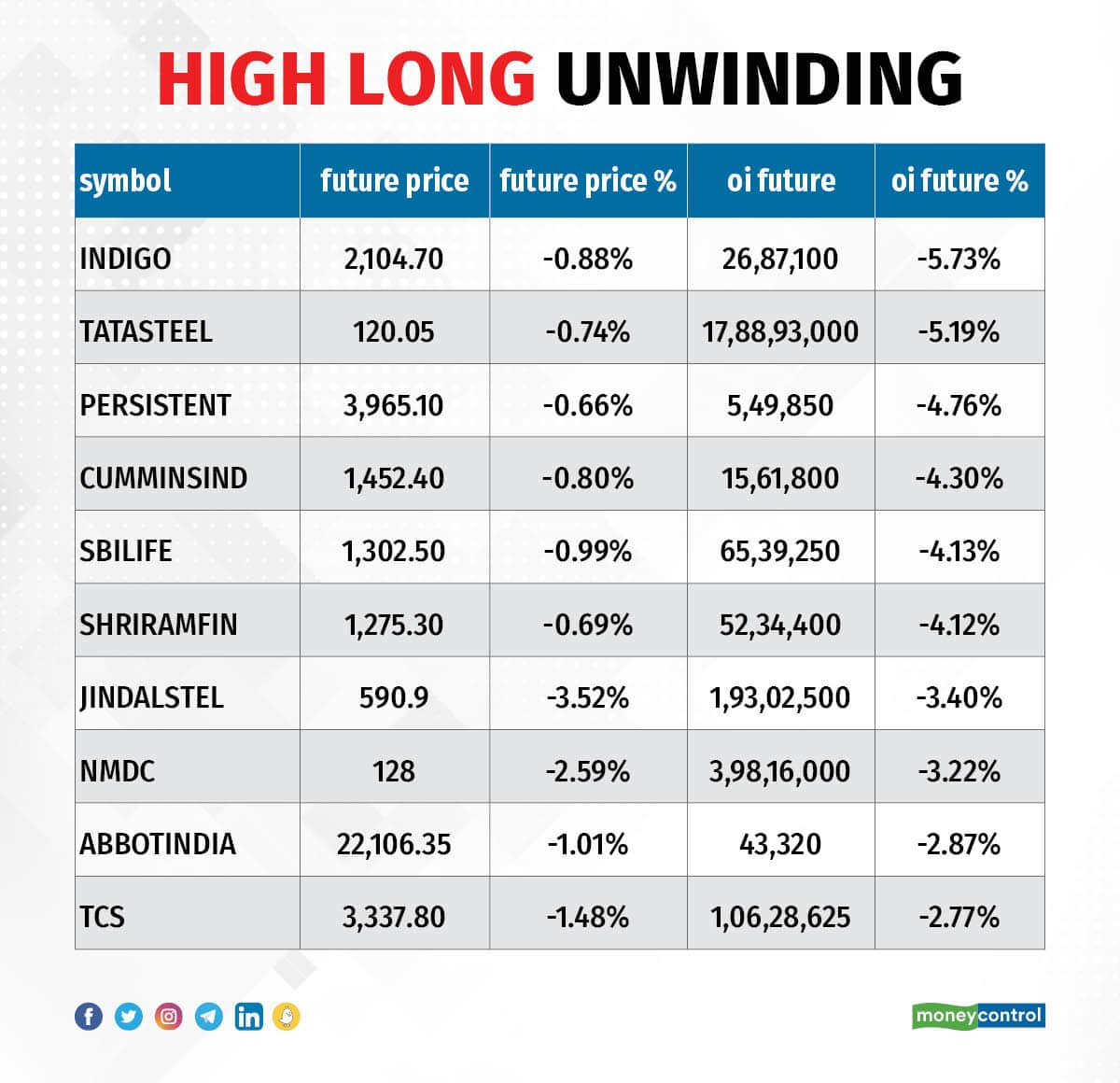

A decline in OI, along with a decrease in price, mostly indicates long unwinding. Based on the OI percentage, 52 stocks saw long unwinding on Monday, including InterGlobe Aviation, Tata Steel, Persistent Systems, Cummins India, and SBI Life Insurance Company.

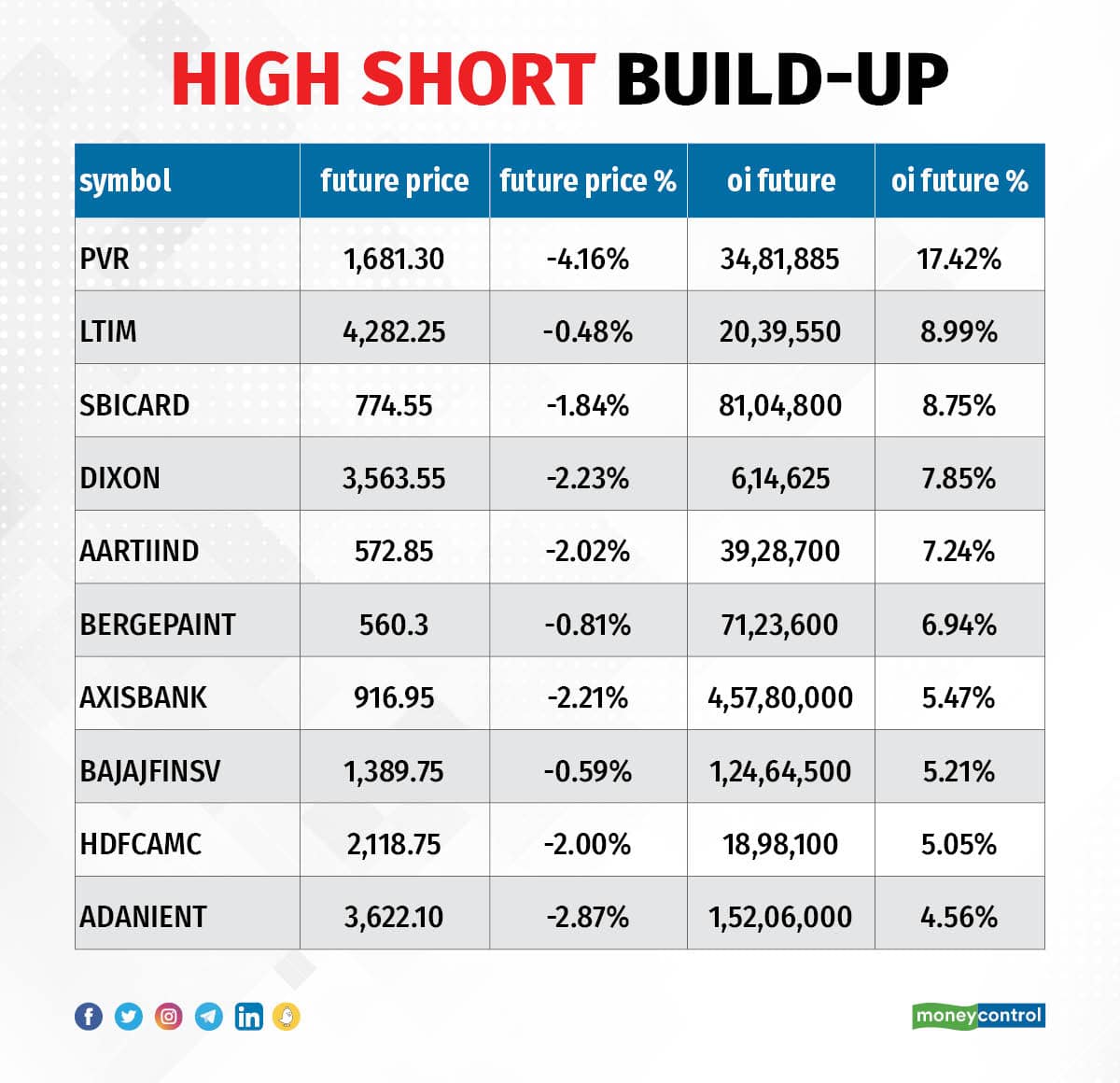

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI percentage, a short build-up was seen in 82 stocks on Monday, including PVR, LTIMindtree, SBI Card, Dixon Technologies, and Aarti Industries.

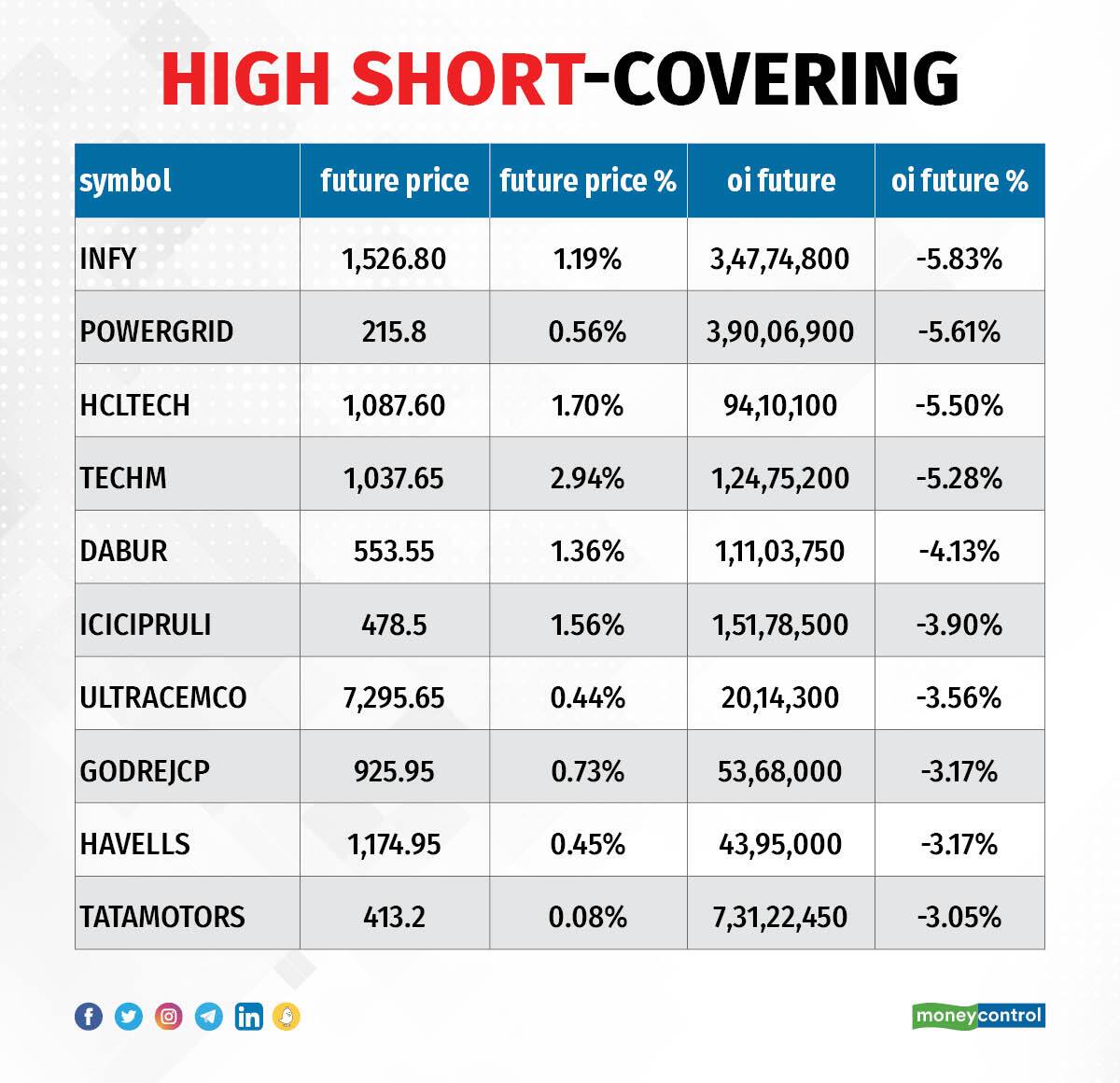

38 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI percentage, we have a total of 38 stocks in the short-covering list on Monday, including Infosys, Power Grid Corporation of India, HCL Technologies, Tech Mahindra, and Dabur India.

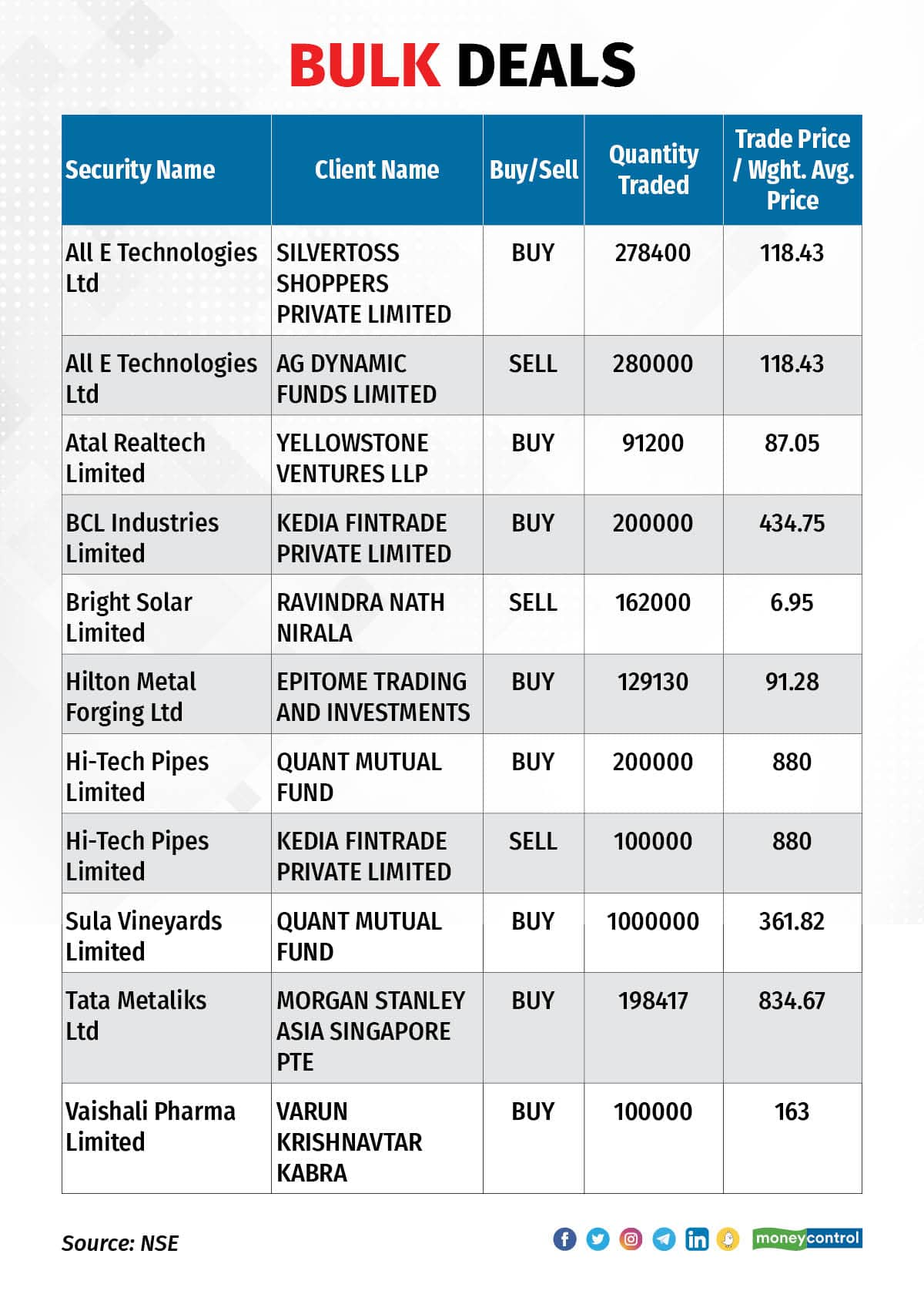

Hi-Tech Pipes: Quant Mutual Fund bought 2 lakh shares in the company via open market transactions. Shares are acquired at an average price of Rs 880 per share.

Sula Vineyards: Quant Mutual Fund purchased 10 lakh shares in the wine maker via open market transactions. The average buying price for these shares is Rs 361.82 per share.

Tata Metaliks: Morgan Stanley Asia Singapore Pte bought 1.98 lakh shares in the Tata Steel subsidiary via open market transactions. These shares are acquired at an average price of Rs 834.67 per share.

(For more bulk deals, click here)

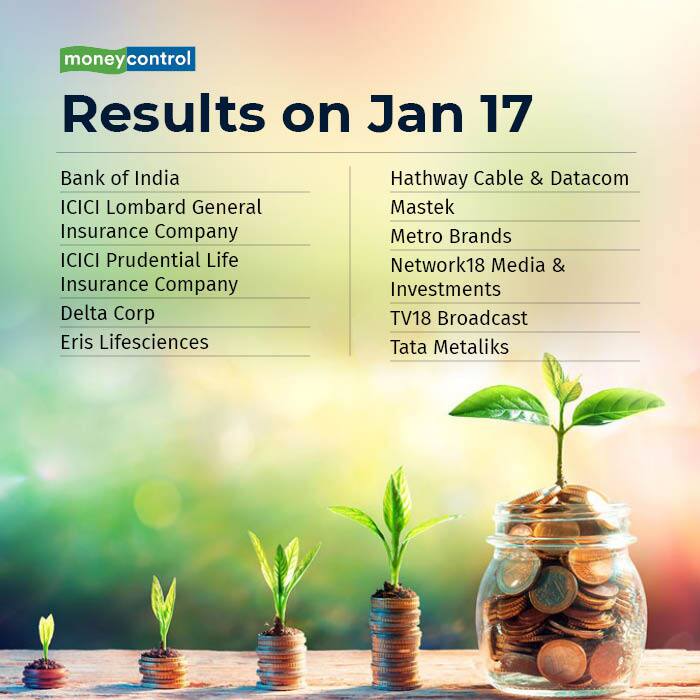

Bank of India, ICICI Lombard General Insurance Company, ICICI Prudential Life Insurance Company, Delta Corp, Eris Lifesciences, Hathway Cable & Datacom, Mastek, Metro Brands, Network18 Media & Investments, TV18 Broadcast, Newgen Software Technologies, Shalby, Tata Investment Corporation, and Tata Metaliks will be in focus ahead of quarterly earnings on January 17.

Stocks in the news

Siemens: The company has received an order for 1,200 locomotives of 9,000 horsepower (HP) from Indian Railways, marking the single largest order in the history of Siemens in India. It will design, manufacture, commission and test the locomotives. Deliveries are planned over an eleven-year period, and the contract includes 35 years of full service maintenance. The locomotives will be assembled in the Indian Railways factory in Dahod, Gujarat. The contract has a total value of Rs 26,000 crore.

NTPC: Government of Tripura has signed Memorandum of Understanding with NTPC Renewable Energy. The company in collaboration will develop large sized renewable energy projects in Tripura.

IRB InvIT Fund: The company has recommenced toll collection at toll plazas of IRB Pathankot Amritsar Toll Road, one of its project SPVs (special purpose vehicle). The toll collection by the said SPV temporarily suspended last month. The project SPV is eligible for compensation against the revenue loss under Force Majeure provisions of the Concession Agreement.

Kesoram Industries: The company has posted consolidated loss of Rs 48 crore for quarter ended December FY23, widening from loss of Rs 32 crore in same period last year, impacted by higher input cost, power & fuel expenses and exceptional loss. But consolidated revenue from operations increased 12.6 percent YoY to Rs 986 crore for the quarter. Its majority of business comes from cement segment.

Ashoka Buildcon: Ashoka Kandi Ramsanpalle Road, the special purpose vehicle (SPV) of the company, has received a provisional certificate for completion of 37.92 KMs out of total project highway length of 39.980 KMs in Telangana. Also the company informed the declaration of Novemer 19, 2022 as the commercial operational date for the said HAM project of NHAI under Bharatmala Pariyojna on hybrid annuity mode. After the declaration of commercial operational date, the SPV is eligible for receipt of annuity payments from NHAI for the operation period of 15 years at the interval of every 6 months from the date of achievement of commercial operational date.

Tinplate Company of India: The tinplate manufacturer and Tata Steel subsidiary has recorded a 62 percent year-on-year decline in profit at Rs 36.4 crore for quarter ended December FY23, impacted by lower top line and operating income. Revenue from operations for the quarter at Rs 959.9 crore fell by nearly 19 percent compared to year-ago period.

Fund Flow

Foreign institutional investors (FIIs) sold shares worth Rs 750.59 crore, continuing selling for the 17th consecutive session, but domestic institutional investors (DIIs) managed to offset the FII outflow, to a major extent, by net buying shares worth Rs 685.96 crore on January 16, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has added L&T Finance Holdings and retained Indiabulls Housing Finance and GNFC under its F&O ban list for January 17. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!