The intense selling pressure in technology, and banking & financial services counters dragged the benchmark indices nearly 2 percent lower on April 18. The downtrend continued for the fourth consecutive session. A lower-than-expected Q4 results by Infosys and HDFC Bank hit the investor sentiment. Besides, Ukraine war, elevated oil prices, FII selling, and US dollar index above 100-mark, too, spooked market participants.

The BSE Sensex declined 1,172 points or 2 percent to 57,167, while the Nifty50 plunged 302 points or 1.73 percent to 17,174 and formed Doji kind of candle on the daily charts, indicating indecisiveness among bulls and bears.

"Nifty is now placed at the important valuation support of around 17,000-16,800 levels. This area was acted as a significant reversal in the past and resulted in a substantial moves in Nifty on either side. Hence, there is a more scope for short term upside bounce," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Shetti feels the short term trend of Nifty is negative. "The overall chart pattern indicates a possibility of upside bounce in the market from here or from near 17,000 mark. The confirmation of reversal pattern and the strength of upside bounce is likely to open a relief rally for the market," he said.

In the broader space, the Nifty Midcap 100 and Smallcap 100 indices fell more than 1 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,082, followed by 16,990. If the index moves up, the key resistance levels to watch out for are 17,252 and 17,330.

Bank Nifty plunged 734 points or 2 percent to close at 36,729 on April 18. The important pivot level, which will act as crucial support for the index, is placed at 36,458, followed by 36,188. On the upside, key resistance levels are placed at 36,983 and 37,237 levels.

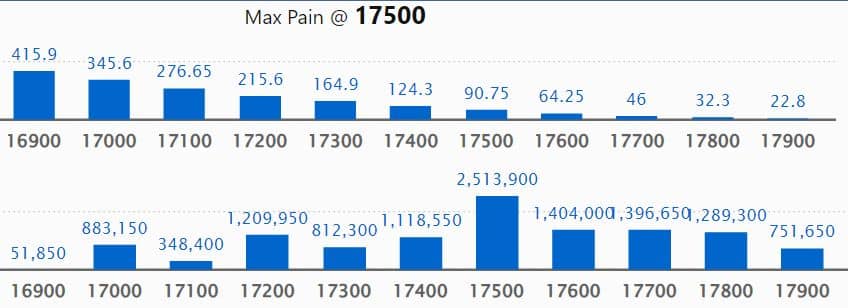

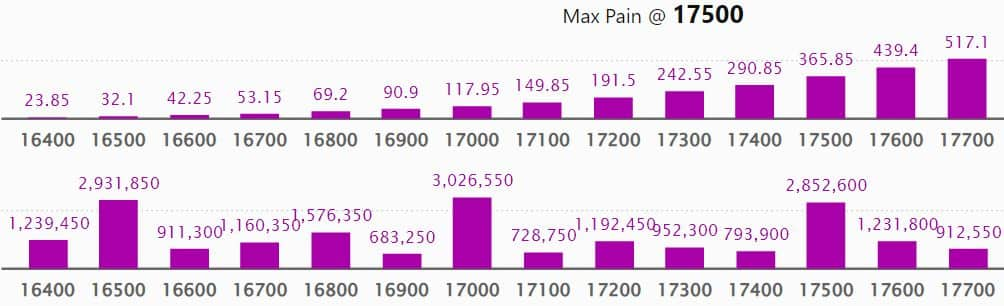

Maximum Call open interest of 30.78 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 17,500 strike, which holds 25.13 lakh contracts, and 19,000 strike, which has accumulated 19.96 lakh contracts.

Call writing was seen at 17,200 strike, which added 9.38 lakh contracts, followed by 17,400 strike which added 7.38 lakh contracts, and 17,300 strike which added 5.08 lakh contracts.

Call unwinding was seen at 18,400 strike, which shed 1.12 lakh contracts, followed by 17,800 strike which shed 91,500 contracts and 19,000 strike which shed 85,700 contracts.

Maximum Put open interest of 30.26 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the April series.

This is followed by 16,500 strike, which holds 29.31 lakh contracts, and 17,500 strike, which has accumulated 28.52 lakh contracts.

Put writing was seen at 17,000 strike, which added 6.86 lakh contracts, followed by 16,400 strike, which added 5.82 lakh contracts and 16,700 strike which added 5.24 lakh contracts.

Put unwinding was seen at 17,500 strike, which shed 8.61 lakh contracts, followed by 17,600 strike which shed 5.69 lakh contracts, and 17,800 strike which shed 3.71 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Gujarat State Petronet, TVS Motor Company, HDFC, HDFC Bank, and ICICI Bank, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Chambal Fertilisers, NTPC, Coromandel International, Torrent Power, and ICICI Prudential Life Insurance Company, in which a long build-up was seen.

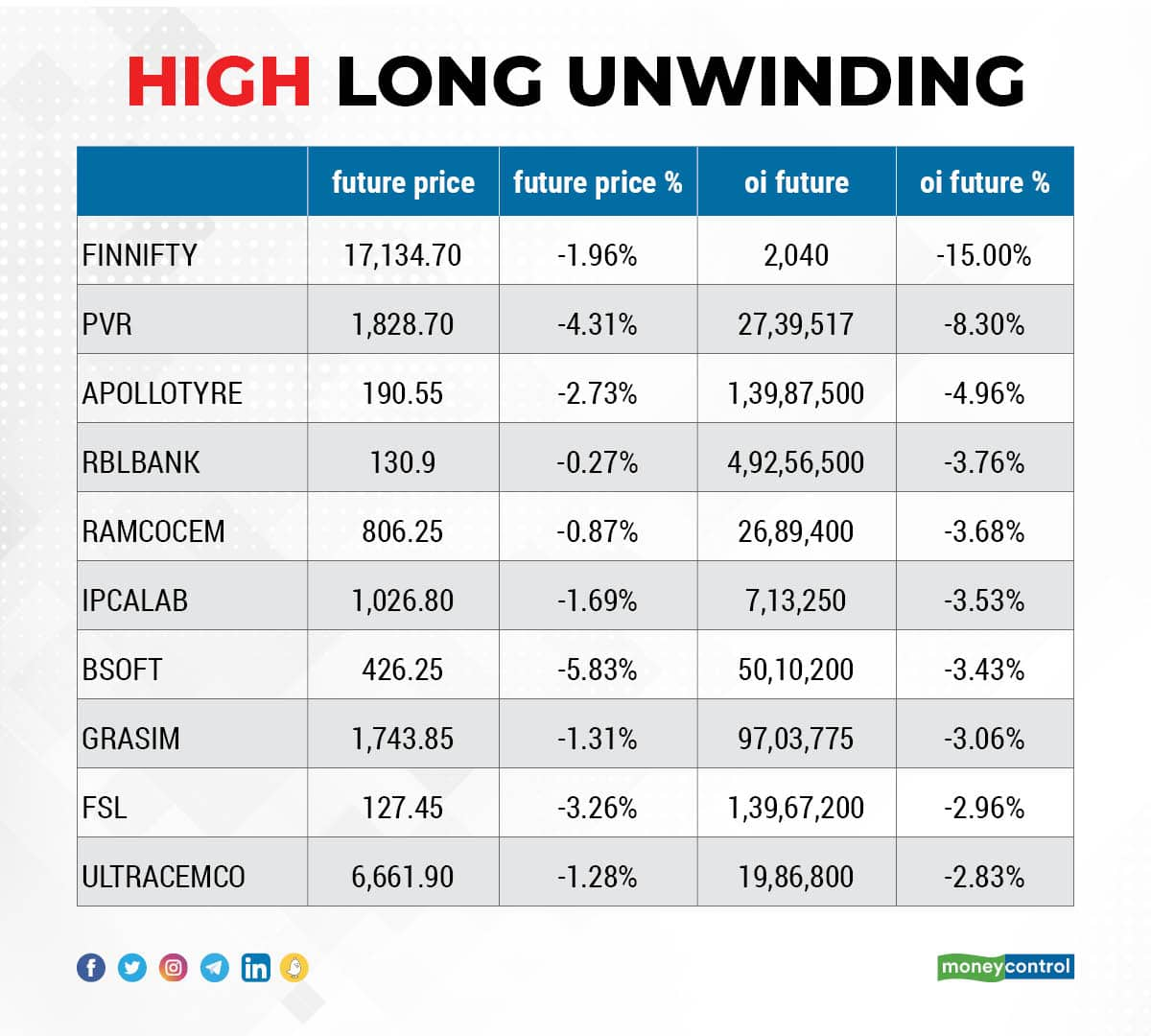

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, PVR, Apollo Tyres, RBL Bank, and The Ramco Cements, in which long unwinding was seen.

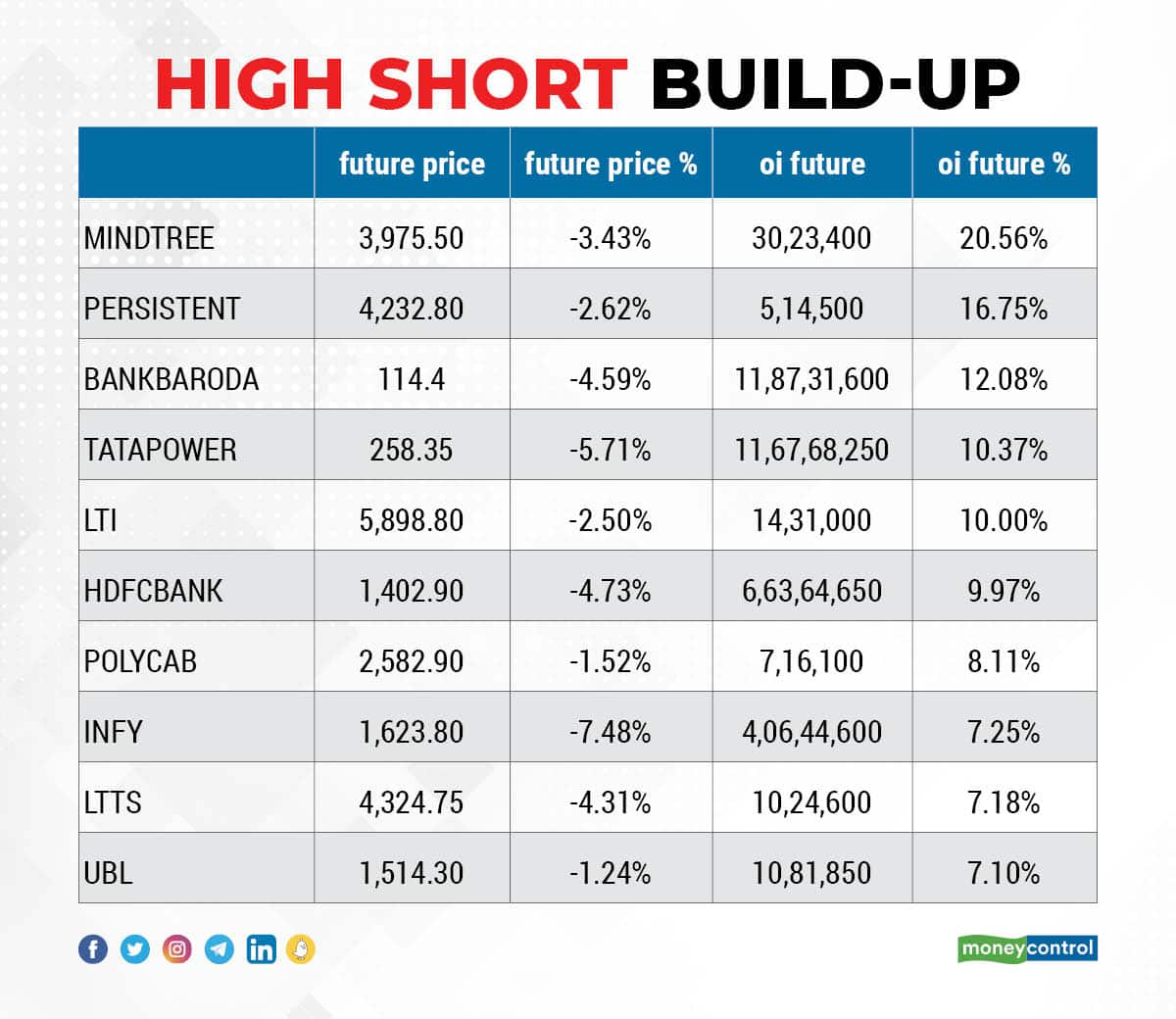

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Mindtree, Persistent Systems, Bank of Baroda, Tata Power, and L&T Infotech, in which a short build-up was seen.

34 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Honeywell Automation, Escorts, Bharat Electronics, Indus Towers, and Syngene International, in which short-covering was seen.

TVS Motor Company: Jwalamukhi Investment Holdings sold 32,62,840 equity shares in the company via open market transactions. These shares were sold at an average price of Rs 650 per share on the NSE.

(For more bulk deals, click here)

ACC, Larsen & Toubro Infotech, Mastek, Tata Steel Long Products, PCBL, Benares Hotels, Godavari Drugs, and Longview Tea Company will release quarterly earnings on April 19.

Stocks In News

Mindtree: The midcap IT company recorded an 8.1 percent QoQ growth in profit at Rs 473 crore with revenue rising 5.4 percent to Rs 2,897.4 crore. Revenue in dollar terms grew by 4.8 percent QoQ to $383.8 million and the growth in constant currency terms was 5.2 percent for Q4FY22, but EBIT margin contracted to 18.9 percent, down from 19.2 percent in previous quarter. The company has recommended a final dividend of Rs 27 per equity share for full year.

INEOS Styrolution India: Promoter INEOS Styrolution APAC Pte Ltd has proposed to sell 25,32,330 equity shares (14.4 percent stake) of the company via offer for sale issue. It has also kept an option open, to additionally sell 16,88,220 equity shares (9.6 percent stake) vis OFS. The OFS will open for two days - April 19 and April 20.

Asahi Songwon Colors: The company acquired 78 percent stake in Atlas Life Sciences, a manufacturer of bulk pharmaceutical ingredients (APIs). The acquisition, which has taken place in cash deal for Rs 48 crore, includes a fully operational WHO GMP certified manufacturing facility in Odhav, Ahmedabad, R&D facility, corporate office, and land parcel in Chhatral. Asahi Songwon will acquire an additional 11 percent stake in Atlas each year for the next two years based on performance metrics, taking total equity stake to 100 percent by the end of FY25.

Eveready Industries India: Puran Associates Pvt Ltd & Others acquired 76,534 equity shares in the company via open market transactions on April 18. With this, their stake in the company stands increased to 20.07 percent, up from 19.96 percent earlier.

Ujjivan Financial Services: The company in its BSE filing said the board has appointed Radhakrishnan Ravi, as Chief Executive Officer (CEO) & Chief Financial Officer (CFO) of the company.

Rail Vikas Nigam: The company has entered into an memorandum of understanding (MoU) with Mahanadi Coalfields (MCL), a subsidiary of Coal India. MCL has given project management consultancy contract for rail infrastructure works to Rail Vikas from concept to commissioning.

SJVN: The company has achieved financial closure by signing of loan agreement of Rs 494 crore with Himachal Pradesh State Co-Operative Bank for development of 66 MW Dhaulasidh HEP (DSHEP), in Himachal Pradesh. The project has already commenced its construction activities since May 2021 and moving fast forward to generate 304 million unit in a 90 percent dependable year of clean hydro power from FY 2025-26 with levelised tariff of Rs 4.46/Kwh. The total project cost of Rs 688 crore of DSHEP has to be financed through a debt equity ratio of 80:20.

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 6,387.45 crore, while domestic institutional investors (DIIs) have net bought shares worth Rs 3,341.96 crore on April 18, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Tata Power - is under the F&O ban for April 19. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!