A bounceback in the afternoon helped the market snap the two-day losing streak and form a bullish candle on daily charts on July 31.

The BSE Sensex gained 83.88 points to 37,481.12 while the Nifty 50 strongly defended psychological 11,000-mark and rose 32.60 points to close at 11,118.

"A reasonable positive candle was formed at the new swing low of 10,999 levels. This pattern could be considered as a comeback attempt of bulls from the lows, but we need more confirmation to call this as an upside reversal," Nagaraj Shetti, Technical Research Analyst, HDFC Securities told Moneycontrol.

"The short term trend of Nifty is in the process of upside bounce. A sustainable follow-through up move could open an upside bounce in the market in the coming sessions," he said.

According to Rohit Singre, Senior Technical Analyst at LKP Securities, the index has immediate resistance near the 200-DMA at 11,150-zone. If it manages to sustain above the said level then there can be some smooth move towards 11,220-11,300 zone and support for the index coming near 11,060-11,000 zone.

The broader markets also rebounded to close higher with the Nifty Midcap index rising 1.38 percent and Smallcap index gaining 0.4 percent.

In July, the BSE Sensex lost nearly 5 percent and the Nifty 50 shed 5.7 percent and formed a bearish candle on the monthly charts. It was the worst July for Nifty in the last 17 years.

We have collated 10 data points to help you spot profitable trades:

Key support and resistance level for Nifty

The Nifty closed at 11,118.00 on July 31. According to the pivot charts, the key support level is placed at 11,029.83, followed by 10,941.67. If the index starts moving upward, the key resistance levels to watch for out are 11,175.73 and 11,233.47.

Nifty Bank

The Nifty Bank closed at 28,876.00, up by 84.40 points on July 31. The important pivot level, which will act as crucial support for the index, is placed at 28,610.6, followed by 28,345.2. On the upside, key resistance levels are placed at 29,060.6, and 29,245.2.

Call options data

Maximum Call open interest is at 11,500, which will act as a crucial resistance in August series. It is followed by 11,300 strike.

Call writing is at 11,100 followed by 11,500 strike.

Put options data

Maximum Put open interest is at 11,000, which will act as crucial support in August series. It is followed by 11,200 strike.

Put writing is at 11,000 followed by 11,100 strike.

Analyst or Board Meetings/Briefings

Satin Creditcare Network: Conference call is scheduled to be held on August 9.

Religare Enterprises: Company will announce its June quarter earnings on August 8.

Procter & Gamble Health: Company will announce its June quarter earnings on August 8.

ITD Cementation: Company will announce its June quarter earnings on August 9.

Punjab Alkalies & Chemicals: Company will announce its June quarter earnings on August 9.

Glenmark Pharma: Company will announce its June quarter earnings on August 13.

Zensar Technologies: Q1FY20 results earnings call is scheduled to be held on August 7.

Thyrocare Technologies: Annual General Meeting to be held on August 24.

Zicom Electronic Security Systems: Annual General Meeting to be held on September 30.

SRF: Company will participate in an investor and analyst conference call on August 6 hosted by B&K Securities.

Stocks in news

Eicher Motors Q1: Profit falls 21.6 percent to Rs 451.8 crore versus Rs 576.2 crore, revenue dips 6 percent to Rs 2,381.9 crore versus Rs 2,534.4 crore YoY.

UPL Q1: Consolidated profit at Rs 178 crore against Rs 510 crore, revenue at Rs 7,906 crore against Rs 4,134 crore YoY. (numbers are not comparable due to Arysta acquisition).

Jagran Prakashan Q1: Consolidated profit falls 25.6 percent to Rs 658 crore versus Rs 883.5 crore, revenue dips 3.2 percent to Rs 5,882 crore versus Rs 6,074.6 crore YoY.

Tata Global Beverages Q1: Consolidated profit increases 11.6 percent to Rs 149.1 crore versus Rs 133.6 crore, revenue rises 5.2 percent to Rs 1,897.1 crore versus Rs 1,802.6 crore YoY.

HCL Infosystems Q1: Consolidated loss at Rs 40 crore against loss of Rs 28.60 crore, revenue falls to Rs 680.87 crore versus Rs 1,128.52 crore YoY.

Ajanta Pharma Q1: Consolidated profit rises to Rs 114.63 crore versus Rs 105.79 crore, revenue jumps to Rs 611.94 crore versus Rs 510.99 crore YoY, but standalone profit falls to Rs 123.60 crore versus Rs 150.82 crore, revenue rises to Rs 545.74 crore versus Rs 442 crore YoY.

MAS Financial Services Q1: Consolidated profit rises to Rs 41.8 crore versus Rs 31.33 crore, revenue rises to Rs 168.89 crore versus Rs 126.63 crore YoY. Assets under management increased by 29.22 percent to Rs Rs 5,578.21 crore against Rs 4,317 crore YoY.

Star Cement Q1: Consolidated profit falls to Rs 83.88 crore versus Rs 90.3 crore, revenue dips to Rs 460.85 crore versus Rs 517.9 crore YoY.

Indiabulls Ventures Q1: Profit jumps to Rs 109.78 crore versus Rs 87.72 crore, revenue climbs to Rs 710.3 crore versus Rs 349.2 crore YoY.

Munjal Showa Q1: Profit falls to Rs 15.7 crore versus Rs 17.35 crore, revenue dips to Rs 388 crore versus Rs 442.4 crore YoY.

Zee Media Corporation Q1: Profit falls 52.9 percent to Rs 26.1 crore versus Rs 55.4 crore, revenue rises 29.7 percent to Rs 200.6 crore versus Rs 154.7 crore YoY.

IndiaMart InterMesh Q1: Consolidated profit at Rs 32.4 crore against loss at Rs 56.4 crore, revenue jumps to Rs 147.3 crore versus Rs 113.3 crore YoY.

Trent Q1: Consolidated profit rises to Rs 37.57 crore versus Rs 35.87 crore, revenue jumps to Rs 799.88 crore versus Rs 614.82 crore YoY.

CreditAccess Grameen Q1: Profit increases to Rs 95.83 crore versus Rs 72.22 crore, revenue rises to Rs 375.80 crore versus Rs 285.76 crore YoY.

Unichem Labs: US FDA issued 4 observations to company's Goa formulation unit but there was no repeat observations.

GMR Infrastructure: Company will consider raising up to Rs 27,300 crore via equity, debt.

Mindtree: Company joined Hyperledger to accelerate blockchain development.

Results To Watch Out For

Results on August 1: Bharti Airtel, Tata Power Company, Marico, Godrej Consumer Products, Elgi Rubber Company, Ginni Filaments, JK Tyre & Industries, Ceat, JSW Holdings, Cera Sanitaryware, International Paper APPM, Ganesha Ecosphere, Prestige Estates Projects, Varun Beverages, KRBL, Adlabs Entertainment, Aavas Financiers, Dynemic Products, 21st Century Management Services, Hindustan Construction Company, Dalmia Bharat, OnMobile Global, Mahindra Logistics, Welspun Enterprises, Orient Paper & Industries, PTC India Financial Services, Hikal, Thangamayil Jewellery, LGB Forge, Magma Fincorp, GlaxoSmithKline Consumer Healthcare, ICRA, AXISCADES Engineering, Raymond

Zee Entertainment in Action

"Invesco Oppenheimer Developing Markets Fund has agreed to make an additional investment in Zee Entertainment Enterprises. The fund has agreed to buy up to an 11 percent stake in ZEE from its promoters, for a total consideration value of up to Rs 4,224 crore," company said in its filing.

Essel Group aims to repay all the lenders by September 2019, it added.

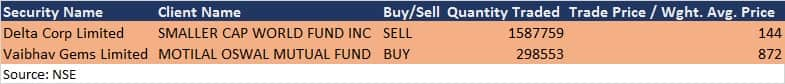

Bulk deals

(For more bulk deals, click here)

FII & DII data

Foreign Institutional Investors (FIIs) sold shares worth Rs 1,497.07 crore, but Domestic Institutional Investors (DIIs) bought Rs 2,479.38 crore worth of shares in the Indian equity market on July 31, as per provisional data available on the NSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.