With the consistent correction and the formation of lower highs and lower lows for yet another session, the 21,500 on the Nifty50 may be a make-or-break level in the coming sessions. If the index falls decisively below the same, then 21,300-21,500 may be the next levels to watch on the downside, whereas on the higher side, if the index manages to hold, then it may march towards 21,600-21,800 levels again, experts said.

On January 3, the BSE Sensex dropped 536 points to 71,357, while the Nifty50 declined 149 points to 21,517 and formed a long bullish candlestick pattern on the daily charts continuing a downtrend for the second straight session.

"On the way down, the Nifty has now reached the 38.2 percent Fibonacci retracement level (21,507), which is likely to act as a make-or-break level for the Nifty," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

He expects the Nifty to hold on to this support and prepare a base for the next leg of upmove. Overall, he believes that the fall is a retracement of the previous rise from 20,976 to 21,834 and not a trend reversal, and thus this dip should be used as a buying opportunity.

Ashwin Ramani, derivatives & technical analyst at SAMCO Securities also feels the option activity at the 21,500 strike will provide cues about Nifty’s Intraday direction on January 4.

The broader markets were mixed in trend and the market breadth was in favour of bulls. The Nifty Midcap 100 index was up 0.3 percent and Smallcap 100 index fell 0.01 percent.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

The pivot point calculator indicates that the Nifty is likely to see immediate resistance at 21,534 followed by 21,674 and 21,742 levels, while on the lower side, it can take support at 21,497 followed by 21,456 and 21,388 levels.

On January 3, the Bank Nifty recovered more than 200 points from the day's low to close with 57 points loss at 47,705 and formed a bearish candlestick pattern with a long lower shadow on the daily charts with above-average volumes.

The Bank Nifty experienced significant volatility on the day of the weekly expiry, maintaining a bearish trend as long as it stayed below the key level of 48,000.

"The index, however, managed to sustain above its 20-day moving average (20DMA) support at 47,688. It is crucial for the index to hold this level, as a decisive break below it could intensify the selling pressure in the market," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

Traders should closely monitor the movements around 48,000 and 47,688 for potential trend changes and trading opportunities, he advised.

As per the pivot point calculator, the Bank Nifty is expected to see resistance at the 47,734 level followed by 47,858 and 47,979 levels, while on the lower side, it may take support at 47,540 followed by 47,466 and 47,344 levels.

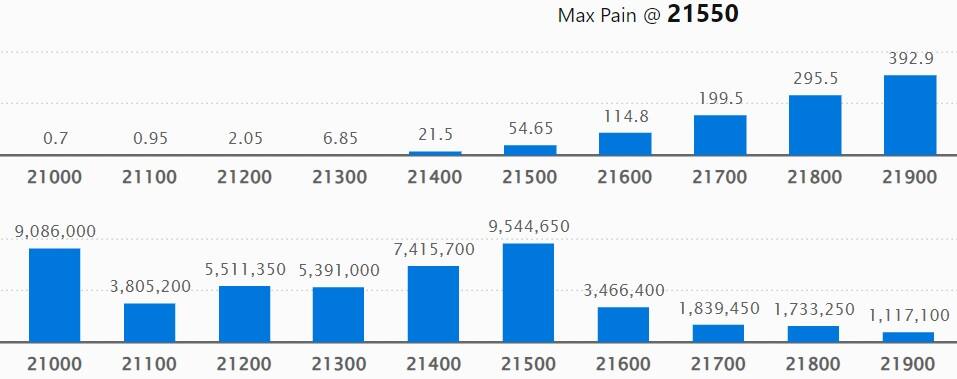

According to the weekly options data, the maximum Call open interest was seen at 22,000 strike with 1.41 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 21,700 strike, which had 1.38 crore contracts, while the 21,600 strike had 1.36 crore contracts.

Meaningful Call writing was seen at the 21,600 strike, which added 1.02 crore contracts followed by 22,000 and 21,700 strikes adding 50.56 lakh and 47.12 lakh contracts, respectively.

The maximum Call unwinding was at the 22,500 strike, which shed 17.06 lakh contracts followed by 22,700 and 22,200 strikes that shed 4.39 lakh and 2.55 lakh contracts.

On the Put front, the maximum open interest was seen at 21,500 strike, which can act as a key support area for the Nifty with 95.44 lakh contracts. It was followed by 21,000 strike comprising 90.86 lakh contracts and then 21,400 strike with 74.15 lakh contracts.

Meaningful Put writing was at 21,400 strike, which added 32.78 lakh contracts followed by 21,500 strike and 21,200 strike adding 31.4 lakh contracts and 26.22 lakh contracts, respectively.

The Put unwinding was seen at 21,700 strike, which shed 29.59 lakh contracts followed by 21,600 strike, which shed 24.75 lakh contracts and then at 20,500 strike, which shed 4.89 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Godrej Consumer Products, Maruti Suzuki India, Infosys, Bharti Airtel and ICICI Lombard General Insurance Company saw the highest delivery among the F&O stocks.

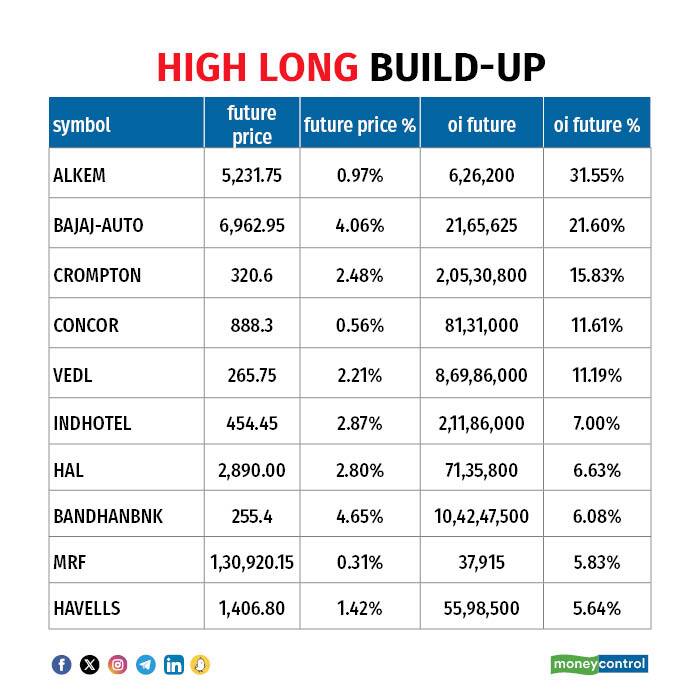

A long build-up was seen in 48 stocks, which included Alkem Laboratories, Bajaj Auto, Crompton Greaves Consumer Electricals, Container Corporation of India and Vedanta. An increase in open interest (OI) and price indicates a build-up of long positions.

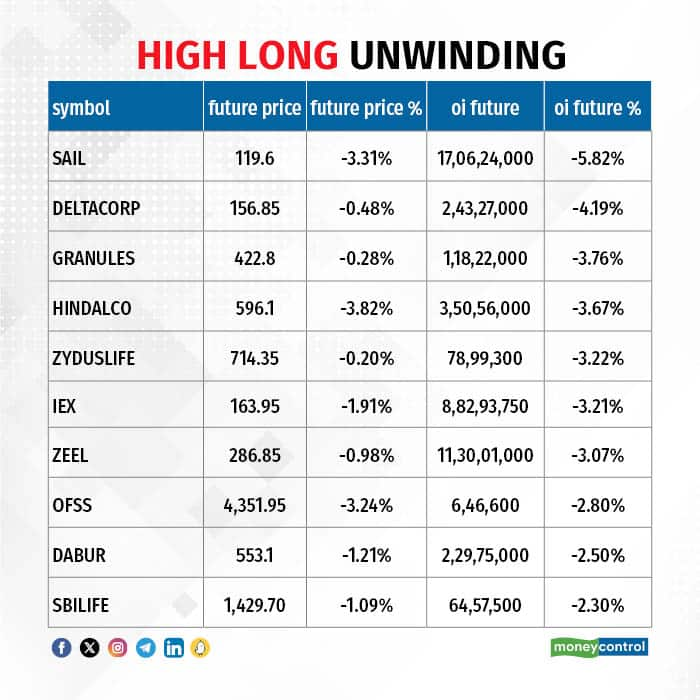

Based on the OI percentage, 44 stocks saw long unwinding, including SAIL, Delta Corp, Granules India, Hindalco Industries and Zydus Lifesciences. A decline in OI and price indicates long unwinding.

53 stocks see a short build-up

A short build-up was seen in 53 stocks including National Aluminium Company, LTIMindtree, Escorts Kubota, Infosys and Coforge. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 42 stocks were on the short-covering list. This included Coromandel International, PVR INOX, ITC, ONGC and Siemens India. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, remained below the 1 mark, falling further to 0.77 on January 3, from 0.92 levels in the previous session. The below 1 PCR indicates that the traders are buying more Calls options than Puts, which generally indicates an increase in bullish sentiment.

For more bulk deals, click here

Stocks in the news

Induslnd Bank: The private sector lender has registered a 13 percent on-year growth in deposits (up 3 percent QoQ) at Rs 3.69 lakh crore for quarter ended December FY24, while advances grew by 4 percent sequentially and 20 percent year-on-year to Rs 3.27 lakh crore during the said quarter.

Ujjivan Small Finance Bank: The small finance bank has recorded a strong 29 percent on-year growth in total deposits at Rs 29,869 crore for the quarter ended December FY24, while gross loan book grew by 27 percent YoY to Rs 27,791 crore during the quarter.

Adani Ports and Special Economic Zone: The Adani Group company said the board members have approved the raising of funds up to Rs 5,000 crore through non-convertible debentures (NCDs) in one or more tranches.

Mphasis: The information technology solutions provider announced a strategic reallocation of leadership responsibilities to accelerate growth across multiple vectors. Ashish Devalekar has joined the company as Head of Europe with effect from January 3, while Anurag Bhatia, the current Head of Europe, will lead Mphasis' Global Business Process Services business (BPS).

Chambal Fertilisers and Chemicals: The fertilisers company said the Board of Directors will be meeting on January 8 to consider a proposal to buyback equity shares of the company.

BGR Energy Systems: State Bank of India has classified the credit exposure of the company with them as Sub-Standard with effect from February 2, 2023, and Central Bank of India downgraded the asset classification of the company’s accounts with it to the non-performing asset on December 26, 2023, due to divergence observed by RBI.

Vedanta: More than 97 percent of bondholders of Vedanta Resources (VRL) approved the restructuring of $3.2 billion worth of bonds due to mature in the next three years. With this, the mining conglomerate has secured the required approval from at least two-thirds of the bondholders to proceed with the restructuring plan.

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) sold shares worth Rs 666.34 crore, while domestic institutional investors (DIIs) offloaded Rs 862.98 crore worth of stocks on January 3, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has added National Aluminium Company to its F&O ban list for January 4, while retaining Balrampur Chini Mills, Delta Corp, Hindustan Copper, Indian Energy Exchange, SAIL and Zee Entertainment Enterprises to the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.