The market is expected to maintain its bullish run given the significant consolidation breakout ahead of the monthly expiry of December derivative contracts on December 28. The Nifty 50 is likely to face immediate resistance at 21,700-21,800 levels, followed by the 22,000 mark, considering the higher highs, higher lows formation and positive momentum indicators, while the 21,500, which acted as a resistance, is expected to be support for the index, experts said.

On December 27, the benchmark indices ended at fresh record closing highs. The BSE Sensex climbed above the 72,000 mark for the first time, rising 702 points to 72,038, while the Nifty 50 surged 214 points to 21,655 and formed a long bullish candlestick pattern on the daily timeframe.

Technically, this pattern indicates an upside breakout of the previous swing high at 21,593 levels.

"Positive chart patterns like higher tops and bottoms are intact as per the daily chart and currently, the Nifty is moving towards the new higher top formation. Still, there is no confirmation of any higher top reversal at the highs," Nagaraj Shetti, senior technical research analyst at HDFC Securities said.

Having breached above the immediate resistance of 21,550-21,600 levels, there is a possibility of more upside in the short term, he feels. "The next upside targets to be watched around 22,000-22,200 levels in the next week. Immediate support is placed at 21,300 levels," Shetti said.

Given the upcoming session is a monthly expiry and holds significant importance from the calendar year-end point, Rajesh Bhosale, technical analyst at Angel One expects potential price settlements and increased volatility. Traders can view this as an opportunity and explore trending trading opportunities, he advised.

Meanwhile, the volatility jumped to the highest level since March 20 this year, which experts feel may make the trend unfavourable for bulls. The India VIX rose 6 percent to 15.56 levels.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

The pivot point calculator indicates that the Nifty is likely to see immediate resistance at 21,722, followed by 21,789 and 21,969 levels, while on the lower side, it can take support at 21,542, followed by 21,429 and 21,249 levels.

On December 27, the Bank Nifty outperformed the benchmark Nifty 50, climbing 557 points or 1.2 percent to end at a record closing high of 48,282 while forming a long bullish candlestick pattern on the daily charts.

Heavy Put writing with short covering was observed at the 48,000 strike in Bank Nifty. "The resistance for Bank Nifty shifts to 48,500 Strike. The options activity at the 48,500 strike will provide cues about Bank Nifty’s direction ahead of the monthly expiry on December 28," Ashwin Ramani, derivatives & technical analyst at SAMCO Securities said.

As per the pivot point calculator, the Bank Nifty is expected to see resistance at 48,484 followed by 48,686 and 49,227 levels, while on the lower side, it may take support at 47,943 followed by 47,604 and 47,064 levels.

As per the monthly options data, the maximum Call open interest remained at 22,000 strike with 1.46 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 21,800 strike, which had 87.5 lakh contracts, while the 21,700 strike had 78.29 lakh contracts.

Meaningful Call writing was at the 21,700 strike, which added 25.72 lakh contracts followed by 21,800 and 22,000 strikes, which added 23.97 lakh and 20.55 lakh contracts, respectively.

The maximum Call unwinding was at the 21,500 strike, which shed 42.28 lakh contracts followed by 21,400 and 21,600 strikes, which shed 21.05 lakh and 19.62 lakh contracts.

On the Put front, the 21,500 strike reported the maximum open interest, which can act as a key support area for the Nifty with 1.36 crore contracts. It was followed by 21,000 strike comprising 1.25 crore contracts and 21,600 strike with 1 crore contracts.

Meaningful Put writing was at 21,600 strike, which added 83.57 lakh contracts followed by 21,500 strike and 21,000 strike, which added 75.62 lakh contracts and 34.13 lakh contracts, respectively.

Put unwinding was at 21,300 strike, which shed 20.85 lakh contracts, followed by 20,600 strike and 20,700 strike, which shed 20.35 lakh contracts and 19.19 lakh contracts, respectively.

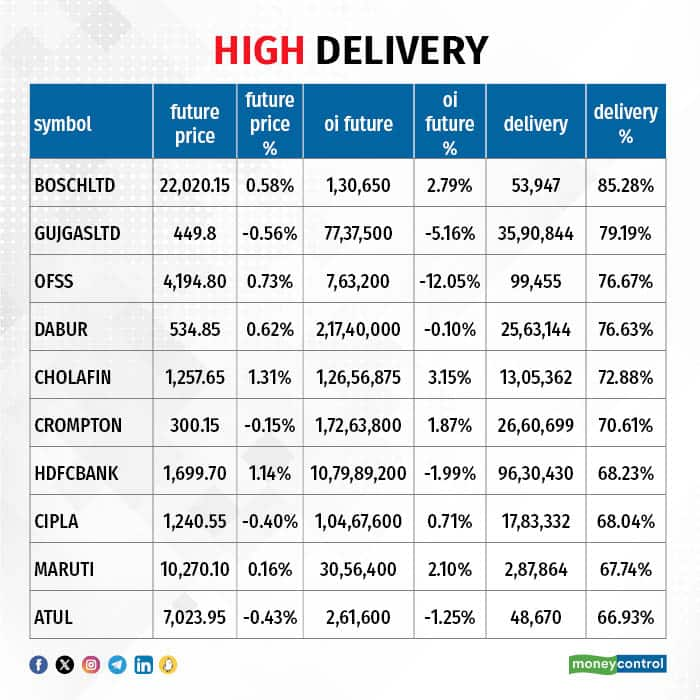

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Bosch, Gujarat Gas, Oracle Financial, Dabur India and Cholamandalam Investment & Finance saw the highest delivery among the F&O stocks.

A long build-up was seen in 54 stocks, which included Bajaj Auto, SAIL, JK Cement, Vodafone Idea and UltraTech Cement. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 38 stocks saw long unwinding, including Hero MotoCorp, Hindustan Petroleum Corporation, Chambal Fertilisers, Laurus Labs and GNFC (Gujarat Narmada Valley Fertilisers & Chemicals). A decline in OI and price indicates long unwinding.

22 stocks see a short build-up

A short build-up was seen in 22 stocks, which were India Cements, Jubilant Foodworks, SBI Cards and Payment Services, Shree Cement and Container Corporation of India. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 72 stocks were on the short-covering list. This included Indiabulls Housing Finance, MCX India, National Aluminium Company, Oracle Financial and Navin Fluorine International. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, spiked further to 1.43 (the highest since December 15) on December 27, from 1.23 levels in the previous session. The above 1 PCR indicates that the traders are buying more Puts options than Calls, which generally indicates an increase in bearish sentiment.

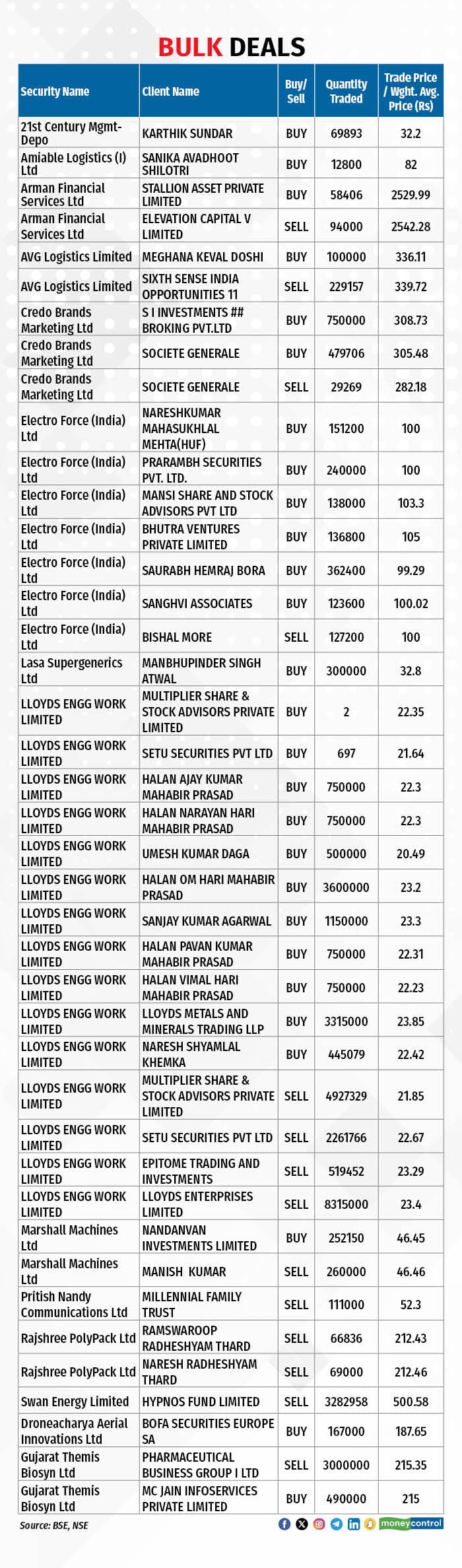

For more bulk deals, click here

Stocks in the news

Azad Engineering: The aerospace components and turbines manufacturing company will list its equity shares on the bourses on December 28. The final issue price has been fixed at Rs 524 per share.

Reliance Capital: The Competition Commission of India (CCI) has approved the acquisition of the stake in Reliance Capital by IndusInd International Holdings Limited, IIHL BFSI (India) Limited, and Aasia Enterprises LLP. Reliance Capital is undergoing insolvency resolution proceedings initiated under the Insolvency and Bankruptcy Code.

Coromandel International: The Tamil Nadu government had temporarily suspended the operation of the Coromandel International plant at Ennore near Chennai after an ammonia leak at its facility late at night on December 26. Tamil Nadu Pollution Control Board said no further leakage as found from the pipeline. The government has directed the company to identify and rectify damages before resuming ammonia transfer.

Canara Bank: The public sector lender has approved to initiate the process of listing its mutual fund subsidiary Canara Robeco Asset Management Company, in the Stock Exchanges via initial public offer (IPO). The modalities of listing will be decided in due course.

Tata Power Company: The Tata Group company has signed a Share Purchase Agreement and acquired 100 percent equity stake in Bikaner III Neemrana II Transmission, a project special purpose vehicle. The acquisition cost is Rs 18.6 crore. The special purpose vehicle formed in June 2023 will build, own, operate and transfer electrical power transmission system between Bikaner and Neemrana in Rajasthan.

Life Insurance Corporation of India: S Sunder Krishnan is appointed as Chief Risk Officer of the corporation with effect from December 27. Pratap Chandra Paikray has ceased as Chief Risk Officer of the LIC.

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) turned net buyers for the first time in the last seven consecutive sessions, buying shares worth Rs 2,926.05 crore, while domestic institutional investors (DIIs) turned net sellers after six-day of consistent buying, offloading Rs 192.01 crore worth of stocks on December 27, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has retained National Aluminium Company, and RBL Bank to its F&O ban list for December 28. Balrampur Chini Mills, Delta Corp and Hindustan Copper were removed from the list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.