The market ended the week on a strong note after three straight day of losses as the benchmark indices rose 1.3 percent each on November 12, driven by buying across sectors. IT, FMCG, and financial services were the top gainers among sectors, rising 1-2 percent.

The Sensex gained 767 points to close at 60,686.69, while the Nifty jumped 229.20 points to 18,102.80 and formed a bullish candle on the daily chart. The index gained a percent for the week as well, forming a small bullish candle on the weekly scale.

"A long bull candle was formed on the daily chart with minor lower shadow. Technically, this pattern signals chances of upside breakout of the overhead resistance at 18,115 levels. A sustainable move above this area could open a sharp upmove towards the next hurdle of 18,350 levels," said Nagaraj Shetti, Technical Research Analyst, HDFC Securities.

He said the sharp upmove on November 12 seemed to have nullified the short-term negative pattern on the daily chart. "Further upmove from here could be considered as an upside breakout of important resistance and that could pull the Nifty towards 18,350 levels in the short term. Immediate support is placed at 18,000 levels," Shetti said.

The broader markets also closed in the green but underperformed the benchmarks. The Nifty midcap 100 index was up 0.45 percent and the smallcap index gained 0.29 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not the current month only.

Key support, resistance levels for Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,964.8, followed by 17,826.8. If the index moves up, the key resistance levels to watch out for are 18,181.9 and 18,261.

Nifty Bank

The Nifty Bank gained 173.15 points to close at Rs 38,733.35 on November 12. The important pivot level, which will act as crucial support for the index, is placed at 38,526.5 followed by 38,319.6. On the upside, key resistance levels are 38,881.6 and 39,029.8.

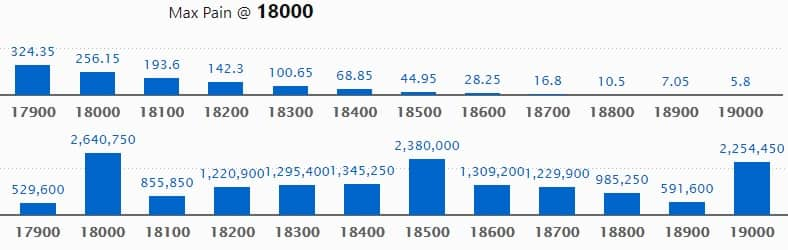

Call option data

Maximum Call open interest of 26.40 lakh contracts was seen at 18,000 strike. This is followed by 18,500 strike, which holds 23.80 lakh contracts, and 19,000 strike that accumulated 22.54 lakh contracts.

Call writing was seen at 18,400 strike, which added 2.44 lakh contracts followed by 18,300 strike, which added 1.53 lakh contracts, and 18,700 strike that added 1.53 lakh contracts.

Call unwinding was seen at 17900 strike which shed 2.1 lakh contracts followed by 17800 strike that shed 1.44 lakh contracts and 18,100 strike that shed 1.35 lakh contracts.

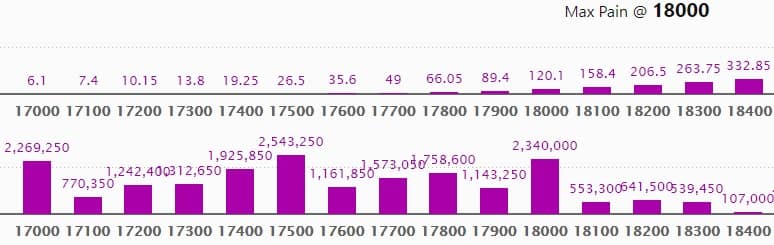

Put option data

Maximum Put open interest of 25.43 lakh contracts was seen at 17,500 strike, which will act as a crucial support level in the November series.

This is followed by 18,000 strike, which holds 23.40 lakh contracts, and 17,000 strike, which has accumulated 22.69 lakh contracts.

Put writing was seen at 18,000 strike, which added 6.07 lakh contracts, followed by 17900 strike that added 2.6 lakh contracts and 1,7800 strike that added 2.59 lakh contracts.

Put unwinding was seen at 17000 strike which shed 2.51 lakh contracts, followed by 17500 strike that shed 1.88 lakh contracts and 17,200 strike that shed 1.81 lakh contracts.

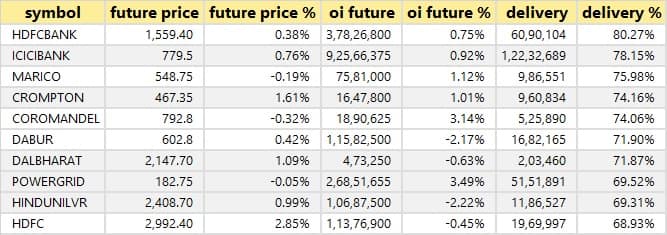

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

53 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

21 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 10 stocks in which long unwinding was seen.

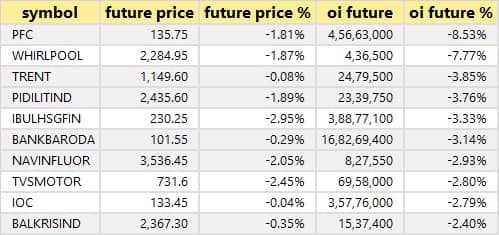

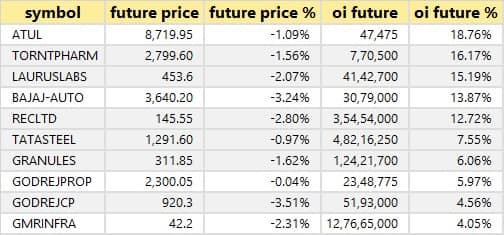

36 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

81 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

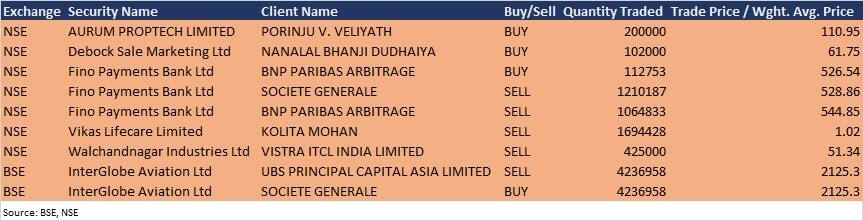

Bulk deals

Aurum Proptech: Ace investor Porinju V Veliyath acquired 2 lakh shares in the company at Rs 110.95 a share on the NSE, the bulk deals data shows.

Fino Payments Bank: Societe Generale sold 12,10,187 equity shares in the company at Rs 528.86 a share and BNP Paribas Arbitrage net sold 9,52,080 shares in the company at Rs 544.85 a share on the NSE, the bulk deals data shows.

InterGlobe Aviation: UBS Principal Capital Asia sold 42,36,958 equity shares in the company at Rs 2,125.3 a share, while Societe Generale acquired those shares at the same price on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/investors and results calendar

Results on November 15: Advance Syntex, Binani Industries, Containerway International, East India Securities, Esaar (India), GCCL Construction, Gold Line International, GV Films, Hemadri Cements, Integra Capital Management, Jai Balaji Industries, Kotia Enterprises, KSS, MSP Steel & Power, Newtime Infrastructure, Parle Industries, PB Films, PG Foils, Rajesh Exports, Ravi Kumar Distilleries, Rollatainers, Samtel India, Silver Oak (India), Tinplate Company of India and Simmonds Marshall are among 83 companies that will release their September quarter earnings on November 15.

Investors meeting schedule

Aimco Pesticides: The company's officials will meet analysts and investors on November 15 to discuss Q2FY22 results.

Apex Frozen Foods: The company's officials will meet analysts and investors on November 16 to discuss financial performance.

Kiri Industries: The company's officials will meet investors and analysts on November 15 to discuss financial performance.

Craftsman Automation: The company's officials will participate in Spark Capital Annual Conference Meeting and meet Capital Group on November 15.

Emami: The company's officials will participate in Centrum- 'Orion 2021 - Annual Conclave' on November 15, and B&K Securities-Periscope Conference' on November 16.

IOL Chemicals & Pharmaceuticals: The company's officials will meet analysts and investors on November 16 to discuss financial performance.

Aptech: The company's officials will meet investors and analysts on November 17 to discuss quarterly earnings performance.

Anupam Rasayan India: The company's officials will interact with investors on November 17 in Centrum Annual Investor Conclave 'Orion 2021'.

IRIS Business Services: The company's officials will meet analysts and investors on November 17 post earnings.

Tatva Chintan Pharma Chem: The company's officials will meet Dolat Capital on November 17, and participate in B&K Securities–Periscope India, 2021: Institutional Investor Conference on November 17-18.

Stocks in News

PB Fintech: The operator of Policybazaar will make its debut on the BSE and NSE on November 15. The final issue price has been fixed at Rs 980 a share.

Sigachi Industries: The microcrystalline cellulose (MCC) manufacturer will list its shares on the bourses on November 15. The final issue price has been fixed at Rs 163 a share.

SJS Enterprises: The decorative aesthetics products manufacturer will debut on the BSE and NSE on November 15. The final issue price has been fixed at Rs 542 a share.

Maruti Suzuki: The Haryana government has approved the allotment of 900 acres of land for Maruti Suzuki's new manufacturing plant in Kharkhoda, Sonepat district.

Coal India: The company reported a lower profit at Rs 2,932.7 crore from Rs 2,951.6 crore in Q2FY21. Its revenue rose to Rs 23,291 crore from Rs 21,153.1 crore YoY.

ONGC: The company reported higher profit at Rs 18,347.7 crore in Q2FY22 against Rs 4,334.7 crore in Q1FY22. The company's revenue was at Rs 24,353.6 crore, up from Rs 23,021.6 crore QoQ.

Hero MotoCorp: The company reported lower profit at Rs 794.4 crore in Q2FY22 against Rs 953.4 crore in Q2FY21. Revenue,too, fell to Rs 8,453.4 crore from Rs 9,637.3 crore YoY.

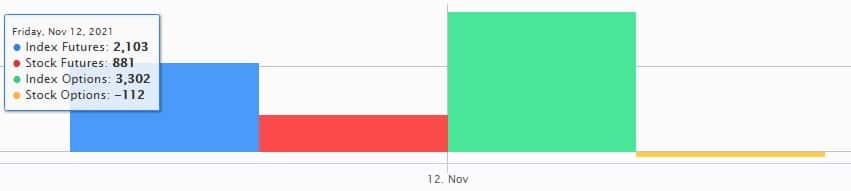

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 511.10 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 851.41 crore in the Indian equity market on November 12, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Eight stocks—Bank of Baroda, BHEL, Escorts, Indiabulls Housing Finance, NALCO, Punjab National Bank, SAIL and Sun TV Network—are under the F&O ban for November 15. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!