The market fell sharply after consolidating on September 3, with the Nifty falling nearly 200 points, tracking correction in global peers on September 4. Uncertainty over loan recovery after the latest Supreme Court directions also dented sentiment. As a result, banking and financial stocks were caught in a bear trap.

In the week gone by, bulls took a breather, with the Nifty losing 2.7 percent after rising 4.2 percent in the previous two weeks.

On September 4, the Sensex declined 633.76 points, or 1.63 percent, to 38,357.18, while the Nifty corrected 193.60 points, or 1.68 percent, to close at 11,333.90. It formed a small bearish candle, which resembles a Doji kind of pattern on the daily charts, and witnessed a Bearish Engulfing formation on the weekly charts.

The formation of a reversal pattern like Bearish Engulfing is an important pattern on the weekly chart and is a negative indication.

"The crucial multiple lower supports of around 11,350-11,380 (previous swing low, minor uptrend line and 20 day EMA) has been broken on September 4 and the Nifty closed just below that area towards the end. Hence, a decisive decline below this area could open more weakness in the near term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

Nirali Shah, Senior Research Analyst at Samco Securities, advises traders to lighten their long positions in the market and maintain a negative outlook with a sell on rally strategy.

"Once the immediate support of 11,100 is broken on the downside, the Nifty might test the lower end of the channel, which is placed at 10,700 levels. Immediate resistance is now placed at 11,600," she said.

On the broader markets front, the Nifty Midcap and Smallcap indices ended 1.67 percent and 1.16 percent lower on September 4, respectively. They ended the week 2.55 percent and 3.21 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,274.33, followed by 11,214.87. If the index moves up, the key resistance levels to watch out for are 11,422.63 and 11,511.47.

Nifty Bank

The Bank Nifty underperformed Nifty again, declining 519.30 points, or 2.21 percent, to 23,011.50 on September 4. The important pivot level, which will act as crucial support for the index, is placed at 22,794, followed by 22,576.5. On the upside, key resistance levels are placed at 23,311.9 and 23,612.3.

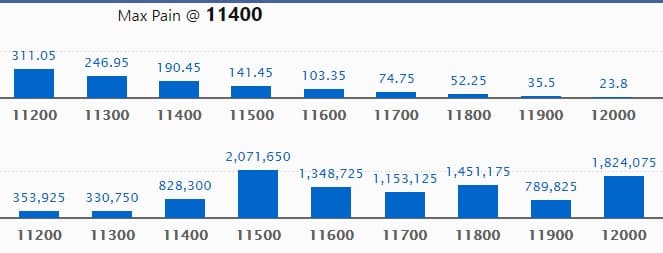

Call option data

Maximum Call OI of 20.71 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the September series.

This is followed by 12,000, which holds 18.24 lakh contracts, and 11,800 strikes, which has accumulated 14.51 lakh contracts.

Call writing was seen at 11,500, which added 3.23 lakh contracts, followed by 11,400, which added 2.14 lakh contracts, and 11,600 strikes, which added 1.68 lakh contracts.

Call unwinding was seen at 12,000, which shed 1.39 lakh contracts, followed by 11,900 strikes, which shed 50,025 contracts.

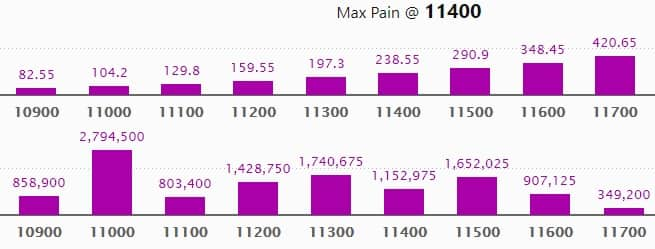

Put option data

Maximum Put OI of 27.94 lakh contracts was seen at 11,000 strike, which will act as crucial support in the September series.

This is followed by 11,300, which holds 17.4 lakh contracts, and 11,500 strikes, which has accumulated 16.52 lakh contracts.

Put writing was seen at 11,300, which added 2.04 lakh contracts, followed by 10,800 strikes, which added 84,675 contracts.

Put unwinding was witnessed at 11,500, which shed 2.63 lakh contracts, followed by 11,400 strikes, which shed 87,825 contracts.

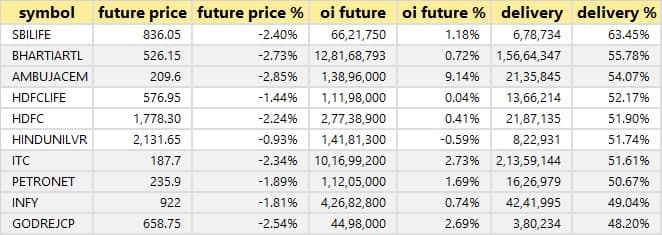

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

4 stocks saw long build-up

Based on the OI future percentage, here are those four stocks in which long build-up was seen.

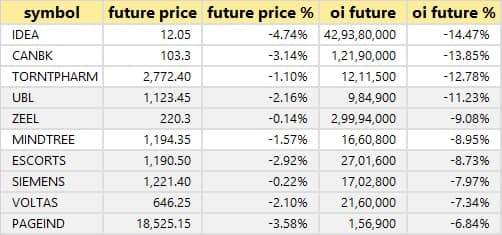

76 stocks saw long unwinding

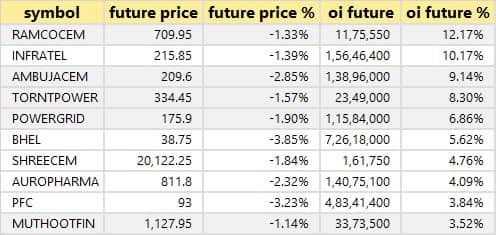

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

57 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

1 stock witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates short-covering. Based on OI future percentage, short-covering was seen in one stock.

![]()

Bulk deals

APL Apollo Tubes: Rahul Gupta acquired 3,00,200 shares in the company at Rs 2,375 per share. However, Kitara PIIN 1001 sold 5,94,049 shares at Rs 2,375.14 per share on the NSE.

Globus Spirits: Perpetuity Health to Wealth Fund sold 1.5 lakh shares in the company at Rs 204.14 per share on the NSE.

Shilpa Medicare: Nippon India Mutual Fund acquired 11.25 lakh shares in the company at Rs 514.94 per share on the NSE and 10 lakh shares at Rs 515 per share on the BSE. Baring India Private Equity Fund III sold 23.20 lakh shares in the company at Rs 512.97 per share on the NSE and 36.80 lakh shares on the BSE at Rs 509.04 per share. Barclays Merchant Bank Singapore also sold 4.5 lakh shares at Rs 513.36 per share and Tano Mauritius India FVCI II offloaded 8.5 lakh shares at Rs 514.29 per share.

Tata Motors DVR 'A' Ordinary: Promoter Tata Sons acquired 53,02,681 shares in the company at Rs 56.02 per share on the NSE.

(For more bulk deals, click here)

Earnings on September 7

CG Power and Industrial Solutions, Future Lifestyle Fashions, Future Market Networks, General Insurance Corporation of India, Aurionpro Solutions, Hindustan Oil Exploration, McNally Bharat Engineering, Info Edge India, Orchid Pharma, RPP Infra Projects, Tera Software, among 50 companies which will declare their June quarter earnings on September 7.

Stocks in the news

REC: Subsidiary received a 10 MW solar power project order in Rajasthan.

National Aluminium Company: Q1 profit at Rs 16.7 crore versus Rs 98 crore, revenue at Rs 1,380.6 crore versus Rs 2,084.1 crore YoY.

IDFC First Bank: Rajiv Lall resigned as non-executive chairman of the bank.

PSU banks: Moody's cuts deposit ratings of Bank of Baroda, Bank of India, Canara Bank and Union Bank of India to Ba1 and revised PNB's rating outlook to 'Negative' from 'Stable'.

Endurance Technologies: Based on an eligibility certificate from the Maharashtra government, the company is entitled to a cumulative incentive of Rs 466.39 crore under the package scheme of incentives. Of the eligible incentive, the company already accounted for Rs 128.93 crore until the June 30.

Jubilant Industries approved sale of land and building of manufacturing unit at Nimbut, Pune for Rs 12.35 crore, and plant and machinery for Rs 0.95 crore to Jubilant Life Sciences.

Repco Home Finance: Q1 profit at Rs 69.50 crore versus Rs 67.44 crore, revenue at Rs 337.71 crore versus Rs 328.15 crore YoY.

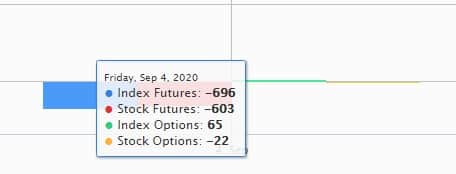

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,888.78 crore, while domestic institutional investors (DIIs) offloaded shares worth Rs 456.88 crore in the Indian equity market on September 4, as per provisional data available on the NSE.

Stock under F&O ban on NSESix stocks -- Bharat Heavy Electricals (BHEL), Canara Bank, Indiabulls Housing Finance, Vodafone Idea, Jindal Steel & Power and Punjab National Bank -- are under the F&O ban for September 7. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!