The market continued its southward journey for the seventh consecutive session and closed at a two-month low on September 29, the expiry day for September futures & options contracts, tracking a negative trend in global peers.

The BSE Sensex declined 188 points to 56,410, while the Nifty50 fell 40 points to 16,818 and formed a bearish candle on the daily charts.

"On the daily timeframe, the Nifty closed below its 200 days SMA (16,990) consecutively for the second day with the formation of the lower top lower bottom pattern. Also, the Bollinger Band is expanding and the prices running consistently on the lower edge of the band for the 4th day indicating volatility has increased on the downside," Vidnyan Sawant, AVP - Technical Research at GEPL Capital said.

The momentum indicator RSI (relative strength index) is moving downwards and sustaining below 35 levels, indicating strong bearish momentum of the index for the short to medium term.

As per the overall chart pattern and indicator set-up, the market expert feels that the Nifty will continue its corrective move and if it breaches below 16,788 levels, then it will move down towards 16,653 in the coming future. "Our corrective view would be negated if we see prices sustaining above the level of 17,196 levels," the expert added.

The broader markets continued to outperform frontline indices, as the Nifty Midcap 100 index gained four-tenth of a percent, and Smallcap 100 index rose six-tenth of a percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,729, followed by 16,640. If the index moves up, the key resistance levels to watch out for are 16,967 and 17,115.

The Nifty Bank fell 112 points to close at 37,648 and witnessed a bearish candlestick formation on the daily charts on September 29. The important pivot level, which will act as crucial support for the index, is placed at 37,362, followed by 37,076. On the upside, key resistance levels are placed at 38,109 and 38,569 levels.

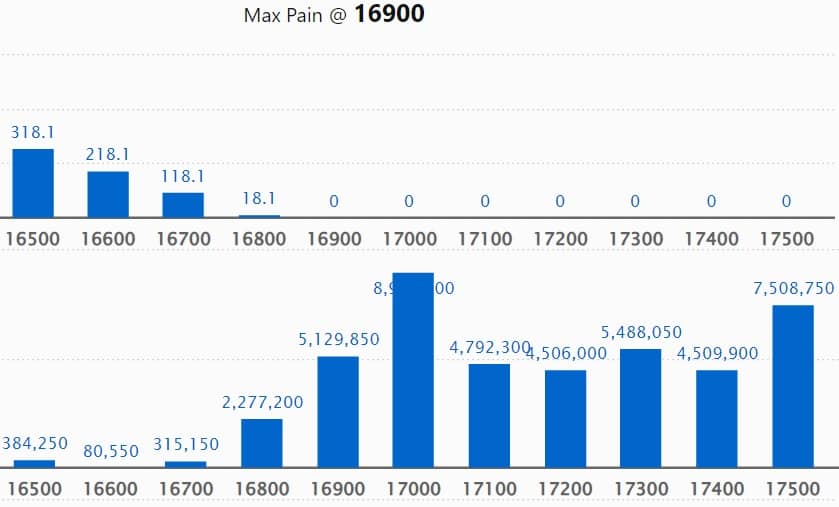

Maximum Call open interest of 89.97 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the October series.

This is followed by 17,500 strike, which holds 75.08 lakh contracts, and 17,300 strike, which has 54.88 lakh contracts.

Call writing was seen at 16,900 strike, which added 5.56 lakh contracts, followed by 16,800 strike which added 4.44 lakh contracts, and 16,700 strike which added 98,350 contracts.

Call unwinding was seen at 18,000 strike, which shed 26.46 lakh contracts, followed by 17,700 & 17,800 strikes which shed 17.58 lakh contracts each.

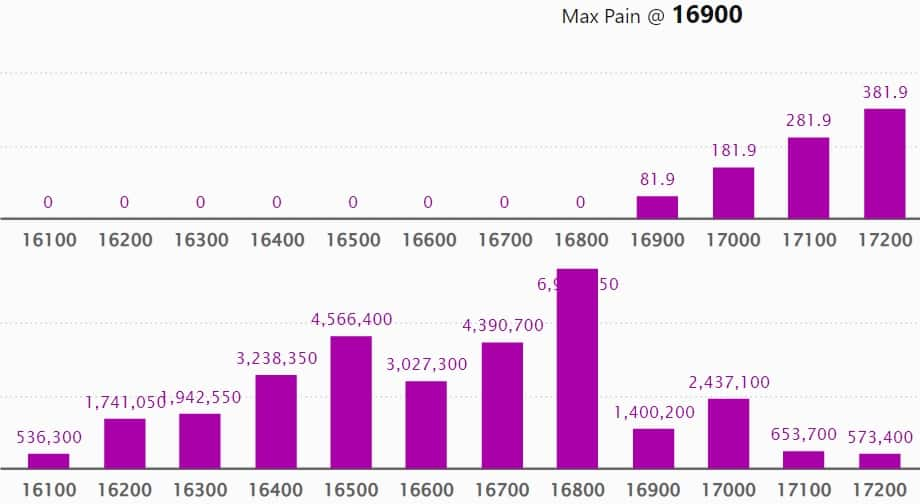

Maximum Put open interest of 69.1 lakh contracts was seen at 16,800 strike, which will act as a crucial support level in the October series.

This is followed by 16,500 strike, which holds 45.66 lakh contracts, and 16,700 strike, which has accumulated 43.9 lakh contracts.

Put writing was seen at 16,800 strike, which added 13.42 lakh contracts, followed by 15,700 strike, which added 97,250 contracts, and 15,600 strike which added 62,200 contracts.

Put unwinding was seen at 16,000 strike, which shed 14.97 lakh contracts, followed by 16,900 strike which shed 14.79 lakh contracts and 17,000 strike which shed 13.32 lakh contracts.

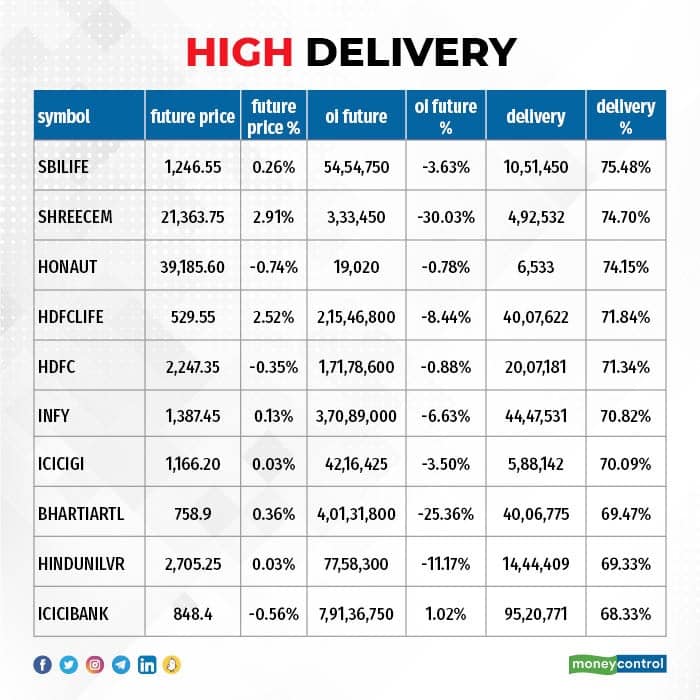

STOCKS WITH A HIGH DELIVERY PERCENTAGE

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in SBI Life Insurance Company, Shree Cements, Honeywell Automation, HDFC Life Insurance, and HDFC, among others.

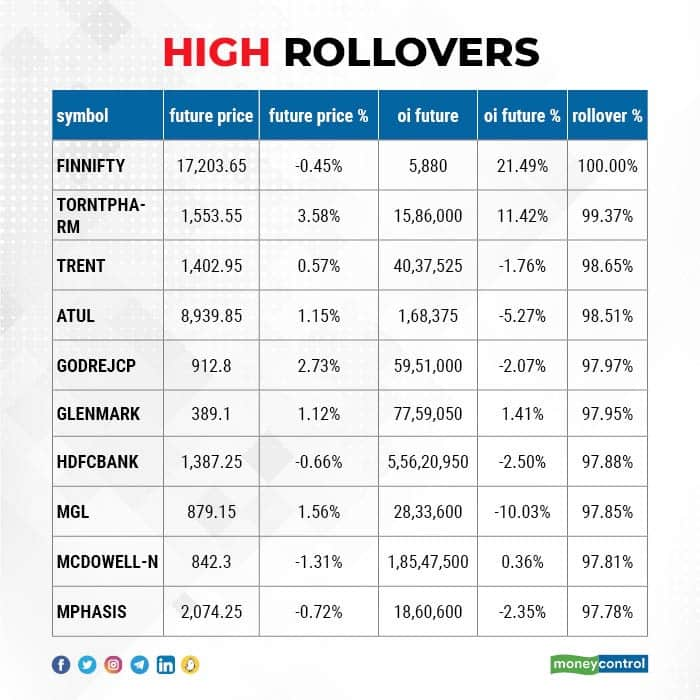

Here are the top 10 stocks which saw the highest rollovers on expiry day including Nifty Financial that witnessed 100 percent rollover, followed by Torrent Pharma, Trent, Atul, and Godrej Consumer Products with 98-99 percent rollovers.

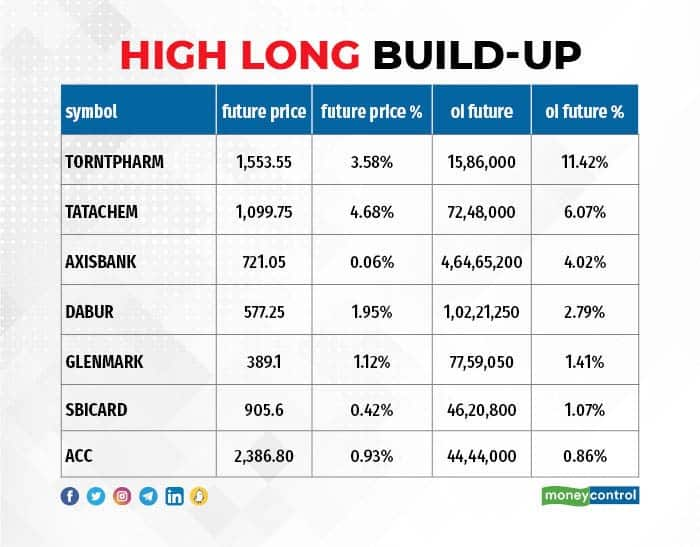

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the seven stocks in which a long build-up was seen. The list included Torrent Pharma, Tata Chemicals, Axis Bank, Dabur India, and Glenmark Pharma.

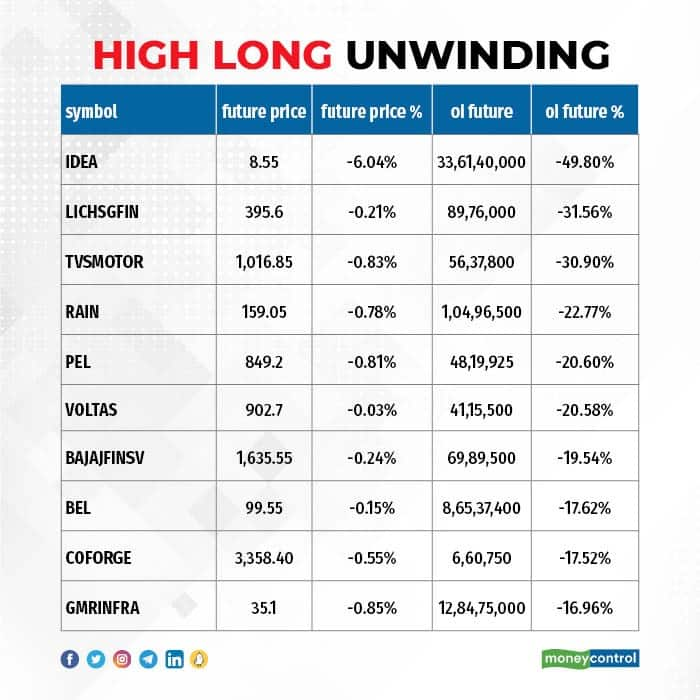

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Vodafone Idea, LIC Housing Finance, TVS Motor Company, Rain Industries, and Piramal Enterprises, in which long unwinding was seen.

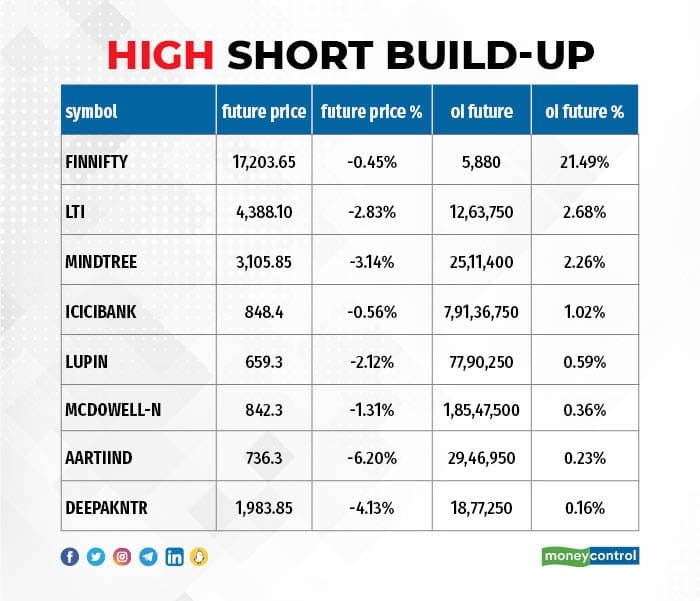

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 8 stocks in which a short build-up was seen. The list included Nifty Financial, L&T Infotech, Mindtree, ICICI Bank, and Lupin.

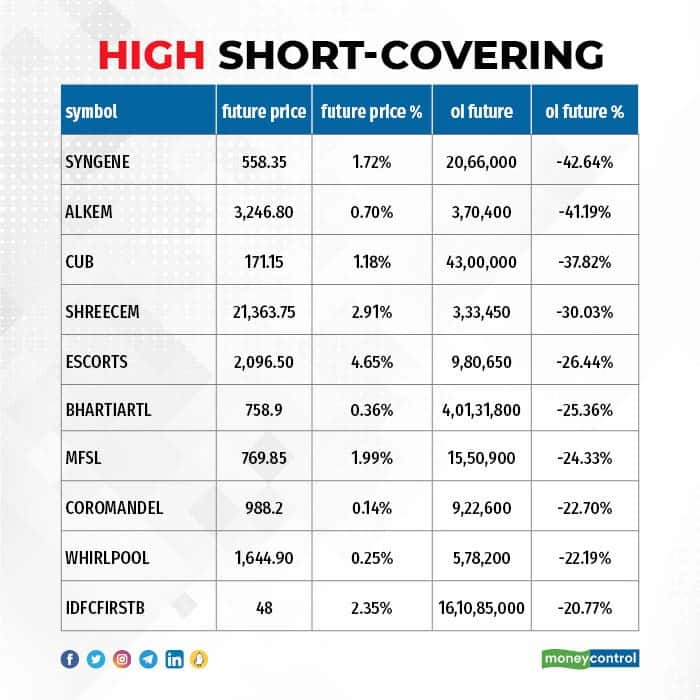

108 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks, in which short-covering was seen, including Syngene International, Alkem Laboratories, City Union Bank, Shree Cement, and Escorts.

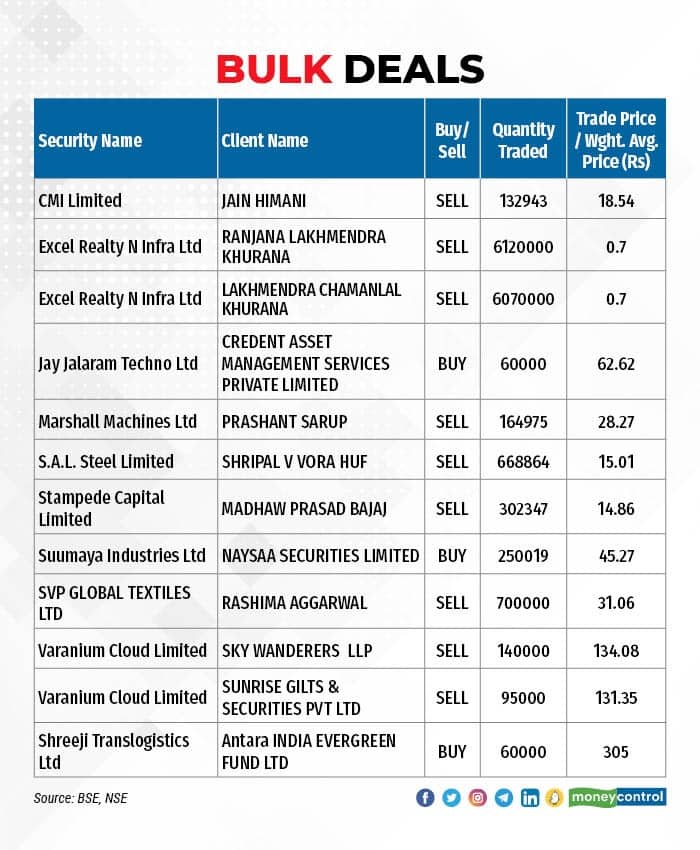

Varanium Cloud: Sky Wanderers LLP sold 1.4 lakh shares in the company at an average price of Rs 134.08 per share, and Sunrise Gilts & Securities sold 95,000 shares at an average price of Rs 131.35 per share.

Shreeji Translogistics: Antara India Evergreen Fund acquired 60,000 shares in the company at an average price of Rs 305 per share.

(For more bulk deals, click here)

Investors Meetings on September 30

Rossari Biotech: Officials of the company will attend Equirus Virtual Annual Conference.

Bharat Forge: Officials of the company will meet ICICI Prudential AMC.

Safari Industries (India): Officials of the company will meet IDFC Mutual Fund, and Mirae Asset Mutual Fund.

Gati: Officials of the company will meet Ambika Fincap, and Habrok Capital Management LLP.

Phoenix Mills: Officials of the company will interact with Mondrian Investment Partners.

Indian Energy Exchange: Officials of the company will interact with Ethos Investment Management.

Escorts Kubota: Officials of the company will interact with Toona Tree Capital.

Polycab India: Officials of the company will meet BlackRock Asia, Kotak Offshore, Nippon Offshore, and Wellington Management in Singapore.

Prudent Corporate Advisory Services: Officials of the company will meet Marcellus Investment Managers, and B&K Securities.

Meghmani Organics: Officials of the company will meet DAM Capital.

Stocks in News

Lupin: The pharma company has received approval from the United States Food and Drug Administration (FDA) for its abbreviated new drug application (ANDA), Mirabegron extended-release tablets, to market in the US. Mirabegron is a generic equivalent of Myrbetriq extended-release tablets of Astellas Pharma Global Development, Inc. The product will be manufactured at Lupin's facility in Nagpur, India. The drug had estimated annual sales of $2403 million in the US as per IQVIA MAT data by June 2022. The drug is used for treatment of certain bladder problem.

Arvind SmartSpaces: The company said the board of directors have approved the consolidation of the partnership interest of the company in Ahmedabad East Infrastructure LLP (AEI LLP) from 51.43% to 55.24% and profit sharing in AEI LLP from 94.25% to 98.00% upon acquisition of entire partnership interest of Arvind Infrabuild LLP (AILLP) in AILLP.

Ircon International: The public sector enterprise has completed commissioning of doubling work of Hajipur- Bachhwara of 72 route Km including electrification. IRCON was appointed by East Central Railways for this work.

Bhageria Industries: The company said it has entered in a Share Purchase Agreement for sale of 100% equity shares held in subsidiary Bhageria Exim Private Limited, for Rs 1 lakh. After the stake sale, Bhageria Exim will cease to be the wholly owned subsidiary of the company.

Punjab National Bank: The public sector bank has decided to sell its entire stake in Asset Reconstruction Company (ARCIL) at an agreed price. Its shareholding in ARCIL is 10.01% as of now.

Rail Vikas Nigam: The company has received contract for construction of 4 lane highway from Samarlakota to Achampeta Junction, from National Highways Authority of India (NHAI). The contract is a part of Kakinada port to NH - 16 connectivity in Andhra Pradesh under Bharatmala Pariyojana on EPC mode at a cost of Rs 408 crore.

Hero MotoCorp: The company is finalising a collaboration agreement with Zero Motorcycles, the California (USA)-based manufacturer of premium electric motorcycles and powertrains. The collaboration will focus on co-developing electric motorcycles. The company’s board also approved an equity investment up to $60 million in Zero Motorcycles.

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 3,599.42 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 3,161.73 crore on September 29, as per provisional data available on the NSE.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.