Benchmark indices erased all gains and ended lower on October 24. Nifty slipped below 11,600 due to selling in the banking and telecom sectors.

Telecom stocks suffered massive selloff after the Supreme Court rejected the telecom companies' definition of Adjusted Gross Revenue (AGR). This means telecom companies will have to pay up as much as Rs 92,642 crore to the government. Bank stocks also fell on concerns about their exposure to the beleaguered telecom companies.

Also, no landslide victory for BJP in Maharashtra and Haryana dented sentiment.

Except for the Nifty Infra, all sectoral indices ended in the red led by the bank, metal, FMCG, pharma and auto.

Market breadth was in favour of declines, with just 1,069 shares advancing against 1,367 that declined. 161 shares stayed unchanged.

At close, the Sensex was down 38.44 points at 39,020.39, while Nifty was down 21.50 points at 11,582.60.

Technically, the short term uptrend of the Nifty still remains intact. Traders will need to watch if the index can now hold above the immediate support of 11,551; else a further correction is likely, said Deepak Jasani, Head Retail Research, HDFC securities.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level for the Nifty is placed at 11,518.33, followed by 11,454.07. If the index starts moving up, key resistance levels to watch out for are 11,663.23 and 11,743.87.

Nifty Bank

Nifty Bank ended lower by 357.85 points at 29,101.75 on October 24. The important pivot level, which will act as crucial support for the index, is placed at 28,837, followed by 28,566.1. On the upside, key resistance levels are placed at 29,536 and 29,964.1.

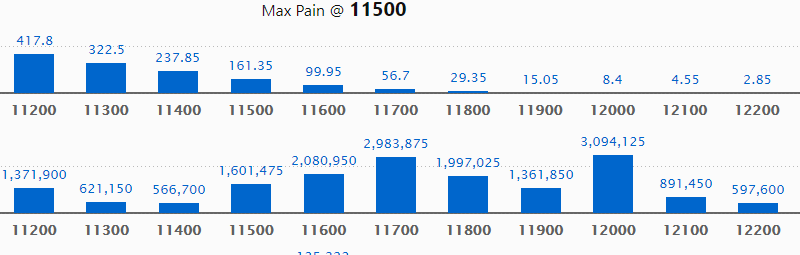

Call options data

Maximum call open interest (OI) of 30.94 lakh contracts was seen at 12,000 strike price. It will act as a crucial resistance level in the October series.

This is followed by 11,700 strike price, which holds 29.83 lakh contracts in open interest; and 11,600, which has accumulated 20.80 lakh contracts in open interest.

Call writing was seen at the 11,600 strike price, which added 4.92 lakh contracts, followed by 11,700 strike that added 4.79 lakh contracts and 12,000 strike that added 4.70 lakh contracts.

No major Call unwinding seen.

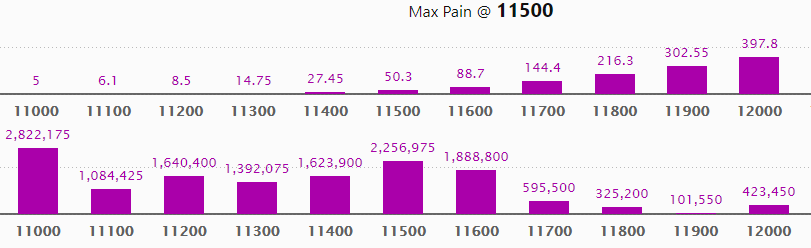

Put options data

Maximum put OI of 28.22 lakh contracts was seen at 11,000 strike price, which will act as crucial support in October series.

This is followed by 11,500 strike price, which holds 22.56 lakh contracts in open interest; and 11,600 strike price, which has accumulated 18.88 lakh contracts in OI.

Put writing was seen at the 11,600 strike price, which added 2.54 lakh contracts, followed by 11,100 strike price, which added 2.17 lakh contracts and 11,200 which added 1.98 lakh contracts.

No major Put unwinding seen.

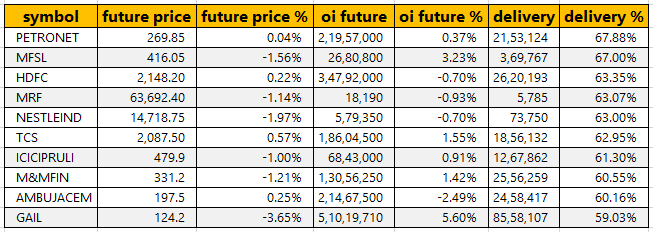

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

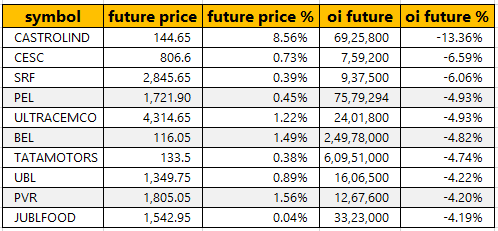

30 stocks saw long buildup

31 stocks witnessed short-covering

As per available data, 31 stocks witnessed short-covering. A decrease in open interest, along with an increase in price, mostly indicates a short covering. Based on the lowest open interest (OI) future percentage point, here are the top 10 stocks in which short-covering was seen.

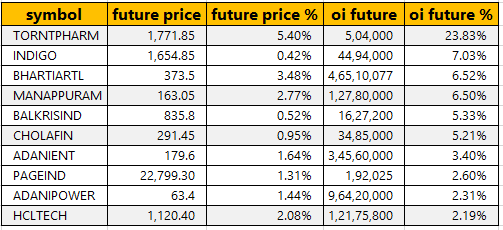

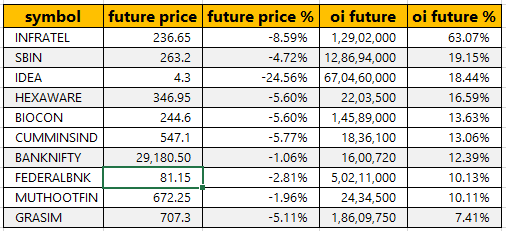

59 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 10 stocks in which short build-up was seen.

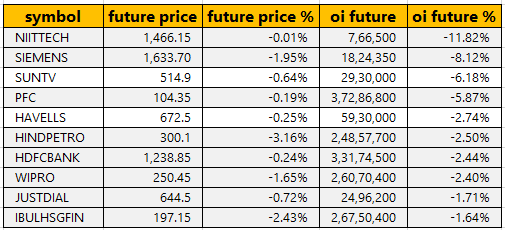

29 stocks saw long unwinding

Based on the lowest open interest (OI) future percentage point, here are the top 10 stocks in which long unwinding was seen.

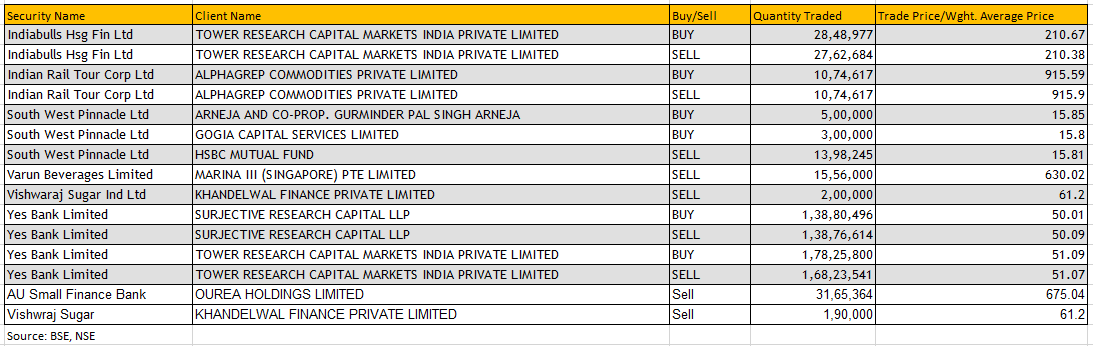

Bulk Deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings

Tarmat - board meeting on October 31 to consider allotment of shares

UPL - board meeting on November 7 to consider and approve the financial results for the period ended September 30, 2019

Eris Lifesciences - board meeting on November 7 to consider and approve the financial results for the period ended September 30, 2019

REC - board meeting on November 5 to consider and approve the financial results for the period ended September 30, 2019

Bharat Forge - board meeting on November 8 to consider and approve unaudited Standalone & Consolidated Financial Results for the quarter and half year ended on September 30, 2019.

JSW Energy - board meeting on November 1 to consider and approve the financial results for the period ended September 30, 2019, and other business matters

Amber Enterprises - board meeting on November 7 to consider and approve the financial results for the period ended September 30, 2019, and dividend

Stocks in news

Results on October 25: Tata Motors, SBI, Marico, HDFC Asset Management Company, Arvind, Hikal, Infibeam Avenues, Jubilant Life Sciences, Reliance Capital, Ratnamani Metals, Strides Pharma Science, Supreme Industries, Tata Coffee, Tata Motors DVR, V2 Retail, Zuari Agro Chemicals

Results on October 26: ICICI Bank, Pfizer and Triveni Glass

Alembic Pharma Q2: Consolidated net profit up 23.1% at Rs 246.3 crore versus Rs 200.1 crore, revenue up 10.1% at Rs 1,241 crore against Rs 1,127 crore, YoY

HDFC Life Insurance Company - Jamshed J Irani resigns as an independent director of the company w.e.f. October 23, 2019

Interglobe Aviation Q2: Net loss at Rs 1,062 crore versus loss of Rs 651.5 crore, revenue up 31% at Rs 8,105.2 crore versus Rs 6,185.3 crore, YoY

PNB Housing Q2: Net profit up 45% at Rs 366.8 crore versus Rs 253 crore, NII up 36% at Rs 628.4 crore versus Rs 462.8 crore, YoY

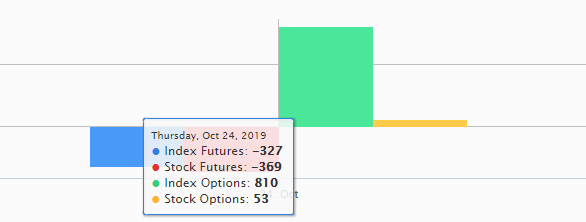

FII & DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 72.87 crore, while domestic institutional investors (DIIs) sold shares of worth Rs 738.75 crore in the Indian equity market on October 24, as per provisional data available on the NSE.

Fund Flow

No stock under ban period on NSE

For October 25, no stock is under F&O ban.

In the F&O segment, companies in which the security has crossed 95 percent of the market-wide position limit are put under a ban for a certain period.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!