The market rebounded sharply on October 7 following strong global cues, a fall in oil prices, and ahead of the RBI monetary policy meeting scheduled to be held on October 8. All sectoral indices participated in the run with Auto, Realty, IT and Private Banks being the leading gainers.

The BSE Sensex rallied 488.10 points to close at 59,677.83, while the Nifty50 jumped 144.30 points to 17,790.30 and formed a Doji kind of pattern on the daily charts as the closing was near opening levels.

"Nifty opened with an upward gap and traded with positive bias throughout the session. The daily price action has formed a Doji candlestick pattern and remained restricted within the previous session's high-low range, indicating the absence of strength on either side," said Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

He further said that the next higher levels to be watched are around 17,900. "Any sustainable move above 17,900 levels may cause momentum towards 18,000-18,200 levels," he pointed out.

On the downside, any violation of an intraday support zone of 17,750 levels may cause profit booking towards 17,700-17,600 levels, he said.

The Nifty Midcap 100 and Smallcap 100 indices with gains of 1.88 percent and 1.22 percent respectively outperformed benchmark indices.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,750.2, followed by 17,710.1. If the index moves up, the key resistance levels to watch out for are 17,844 and 17,897.7.

Nifty Bank

The Nifty Bank rose 231.60 points to 37,753.20 on October 7. The important pivot level, which will act as crucial support for the index, is placed at 37,627.73, followed by 37,502.27. On the upside, key resistance levels are placed at 37,901.14 and 38,049.07 levels.

Call option data

Maximum Call open interest of 21.09 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the October series.

This is followed by 17800 strike, which holds 17.56 lakh contracts, and 18500 strike, which has accumulated 15.17 lakh contracts.

Call writing was seen at 17800 strike, which added 1.16 lakh contracts, followed by 18300 strike, which added 70,250 contracts and 17900 strike which added 49,100 contracts.

Call unwinding was seen at 17700 strike, which shed 2.62 lakh contracts, followed by 17600 strike, which shed 1.81 lakh contracts, and 18200 strike which shed 80,500 contracts.

Put option data

Maximum Put open interest of 33.58 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the October series.

This is followed by 17500 strike, which holds 28.72 lakh contracts, and 17800 strike, which has accumulated 18.29 lakh contracts.

Put writing was seen at 17800 strike, which added 5.26 lakh contracts, followed by 18500 strike which added 1.99 lakh contracts and 17600 strike which added 1.14 lakh contracts.

Put unwinding was seen at 17300 strike, which shed 2.23 lakh contracts, followed by 18000 strike which shed 1 lakh contracts, and 17200 strike which shed 47,200 contracts.

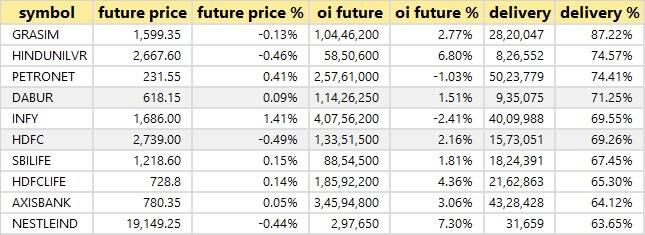

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

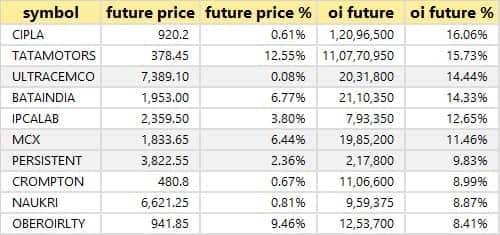

85 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

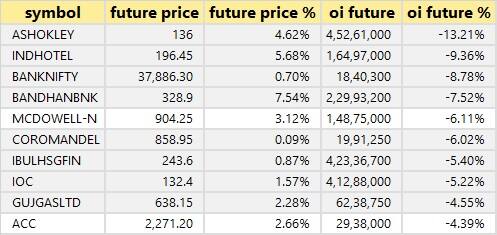

Eight stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the eight stocks in which long unwinding was seen.

23 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 10 stocks in which a short build-up was seen.

67 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

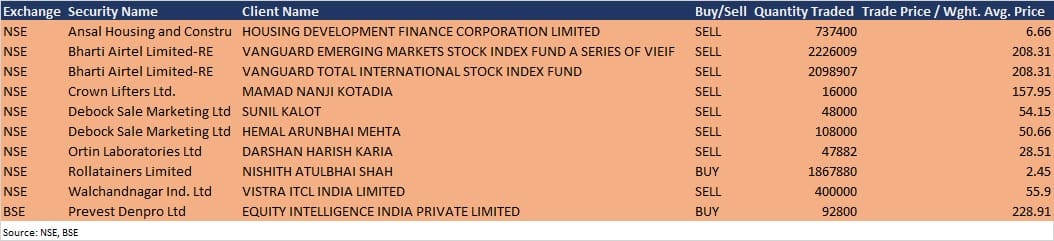

Bulk deals

Ansal Housing and Construction: Housing Development Finance Corporation sold 7,37,400 equity shares in the company at Rs 6.66 per share on the NSE, the bulk deals data showed.

Bharti Airtel (Rights Entitlement): Vanguard Emerging Markets Stock Index Fund A Series of VIEIF sold 22,26,009 equity shares in the company and Vanguard Total International Stock Index Fund offloaded 20,98,907 shares at Rs 208.31 per share on the NSE, the bulk deals data showed.

Prevest Denpro: Ace investor Porinju Veliyath-owned Equity Intelligence India Private Limited acquired 92,800 equity shares in the company at Rs 228.91 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Jindal Stainless: The company's officials will meet investors on October 8.

Navin Fluorine International: The company's officials will meet analysts and investors on October 20 to discuss operational and financial performance.

L&T Finance Holdings: The company's officials will meet institutional investors and analysts on October 21 to discuss Q2FY22 financial performance.

Dr Reddy's Labs: The company's officials will meet analysts and investors on October 29 to discuss financial performance.

Stocks in News

Tata Consultancy Services: The company will announce September 2021 quarter earnings on October 8.

KPI Global Infrastructure: The company has signed a new long-term Power Purchase Agreement (PPA) with GHCL Limited, Bhilad for the sale of 1.25 MW solar power for a period of 20 years under the Independent Power Producer (IPP) business vertical.

Ratnamani Metals & Tubes: The company has received a new order of Rs 98 crore for the supply of carbon steel pipes from the domestic oil and gas sector, to be executed in 5 to 12 months.

Great Eastern Shipping Company: SBI Funds Management sold 8.4 lakh equity shares in the company via an open market transaction on October 6, reducing shareholding to 2.85 percent from 3.43 percent earlier.

The Mandhana Retail Ventures: Rakesh Jhunjhunwala sold 8.52 lakh shares in the company via open market transactions during October 5-7, reducing shareholding to 2.40 percent from 6.26 percent earlier.

JSW Energy: The company has signed a contract with GE Renewable Energy, a leading manufacturer of wind turbines, for procurement of 810 MW of onshore wind turbines for under-construction pipeline of renewable energy projects.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,764.25 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 2,528.64 crore in the Indian equity market on October 7, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Five stocks - Canara Bank, Indiabulls Housing Finance, NALCO, Punjab National Bank, and SAIL - are under the F&O ban for October 8. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!