Benchmark indices ended marginally lower after rangebound trade on November 21 with Nifty failing to hold above 12,000 level.

At close, the Sensex was down 76.47 points at 40,575.17, while Nifty was down 30.70 points at 11,968.40.

"We strongly feel that markets are set for profit taking or consolidation prior to further rise. Traders should limit their naked leveraged trades in the index and book profits on every rise," said Ajit Mishra Vice President, Research, Religare Broking.

"In case of decline, 11,800-11,850 zone would act as a cushion in the Nifty. Stocks, on the other hand, would continue to see movement on both sides thus maintain extra caution in the stock selection," he added.

We have collated 13 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level for Nifty is placed at 11,940.8, followed by 11,913.2. If the index continues moving up, key resistance levels to watch out for are 12,012.1 and 12,055.8.

Nifty Bank

Nifty Bank closed flat at 31,349.9. The important pivot level, which will act as crucial support for the index, is placed at 31,240.87, followed by 31,131.83. On the upside, key resistance levels are placed at 31,461.07 and 31,572.23.

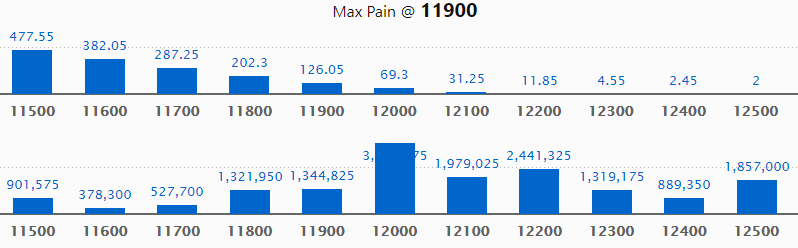

Call options data

Maximum call open interest (OI) of 37.91 lakh contracts was seen at the 12,000 strike price. It will act as a crucial resistance level in November series.

This is followed by 12,200 strike price, which holds 24.41 lakh contracts in open interest, and 12,500, which has accumulated 18.57 lakh contracts in open interest.

Significant call writing was seen at the 12,000 strike price, which added 13.37 lakh contracts, followed by 12,500 strike price that added 6.47 lakh contracts and 12,100 strike which added 5.58 lakh contracts.

No major Call unwinding was seen.

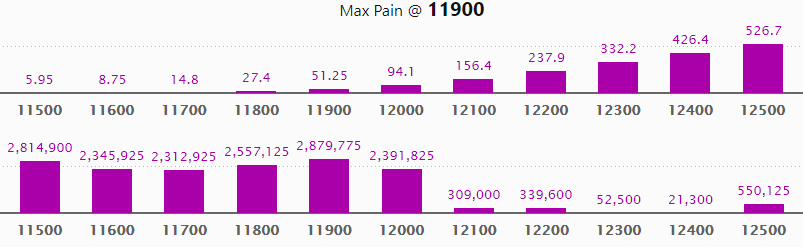

Put options data

Maximum put open interest of 28.79 lakh contracts was seen at 11,900 strike price, which will act as crucial support in November series.

This is followed by 11,500 strike price, which holds 28.14 lakh contracts in open interest, and 11,800 strike price, which has accumulated 25.57 lakh contracts in open interest.

Put writing was seen at the 12,000 strike price, which added nearly 4.76 lakh contracts, followed by 11,900 strike, which added 4.35 lakh contracts and 11,500 strike, which added 4.25 lakh contracts.

No major Put unwinding was seen.

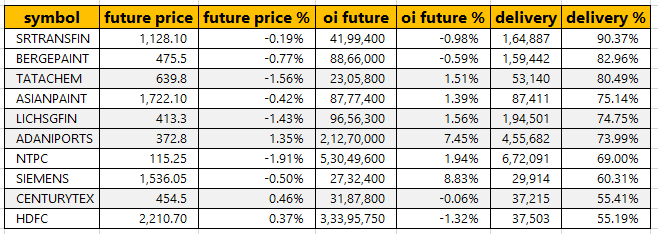

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

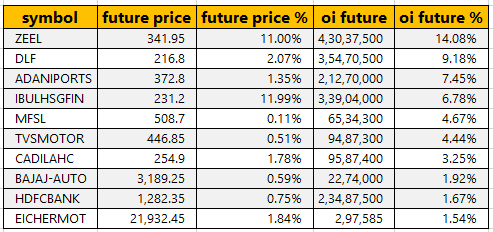

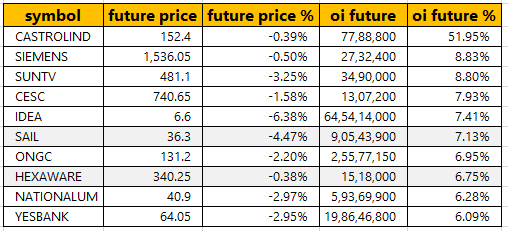

16 stocks saw long buildup

Overall, 16 stocks witnessed long buildup on November 21. Based on open interest (OI) future percentage, here are the top 10 stocks in which long buildup was seen.

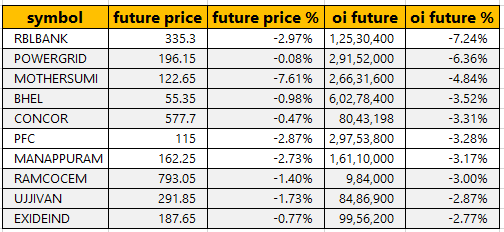

45 stocks saw long unwinding

76 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 10 stocks in which short build-up was seen.

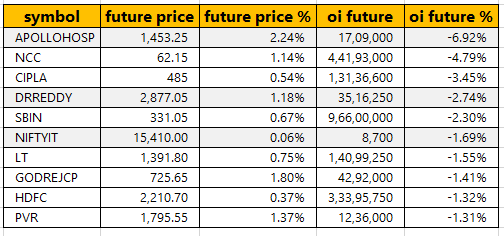

13 stocks witnessed short-covering

As per available data, 13 stocks witnessed short-covering. A decrease in open interest, along with an increase in price, mostly indicates a short covering.

Upcoming analyst or board meetings/briefings

Gammon Infrastructure - board meeting on November 27 to consider and approve the financial results for the period ended September 30, 2019

Khaitan India - board meeting on December 05 to consider and approve the financial results for the period ended September 30, 2019 and other business matters

Sandhar Technologies - board meeting on February 10 to consider and approve the financial results for the period ended December 31, 2019

Stocks in news

BHEL - CRISIL downgraded the rating on the long-term bank facilities of to ‘CRISIL AA’ from ‘CRISIL AA+’; revises outlook from ‘Negative’ to ‘Stable’.

Finolex Cables launches electrical accessories range to fortify its product offering

Cholamandalam Financial Holdings' independent director Shubhalakshmi Panse resigns

Tarmat - Dilip Varghese resigns as chief executive officer and Jerry E. Varghese resigns as a chief operating officer of the company

Tata Power raises Rs 1,500 crore via NCDs

Laurus Lab - USFDA issues 3 observations for Units 1 and 3 at Vizag

FII & DII data

Foreign institutional investors (FIIs) bought shares worth Rs 5,023.54 crore, while domestic institutional investors (DIIs) sold shares of worth Rs 247.74 crore in the Indian equity market on November 21, provisional data available on the NSE showed.

No stock under F&O ban on NSE

There is no stock under F&O ban for November 22. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!