A sharp downswing erased all the weekly gains last Friday and, as a result, the market closed flat on the NIfty50 but still held on to the psychological 18,000 mark that, according to experts, would be crucial for the road ahead.

The index closed at 18,069 on May 5, falling over a percent, while the weekly gains were at 4 points. The 18,200-18,250 range could be crucial on the higher side which can take the index above 18,500-18,600 levels, but falling below 18,000 levels can drag the index up to 17,800, while 17,500 would be a critical hurdle going ahead, experts said.

On the weekly basis, the Nifty50 continued its higher highs formation for sixth consecutive week, though we have seen shooting star kind of pattern which is generally a bearish reversal patter but requires confirmation in following sessions.

"We are of the opinion that if there is no aberration globally, we may see buying resuming at key supports," Sameet Chavan, Head Research - Technical and Derivatives at Angel One, said.

As far as levels are concerned, he said 18,000, followed by 17,900 are to be seen as key supports, whereas on the flipside, the sturdy wall once again stands at 18,150–18,250.

Mitesh Karwa, research analyst at Bonanza Portfolio, feels the current week is of extreme importance as it will decide the trend for the next leg. "The 18,000 levels are expected to act as a strong support zone and if held in the current week, Nifty will start moving towards 18,500 levels."

On the indicator front, Karwa says the momentum indicator Relative Strength Index RSI (14) is showing a reading of 63 and Nifty is trading above its 200 EMA at 17,569 which indicates strength.

Sameet Chavan advised that traders should continue with a stock centric approach and should use declines to add longs with a near term perspective.

Let's take a look at the top 10 trading ideas by experts for the next three-four weeks. Returns are based on the May 5 closing prices:

Expert: Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities

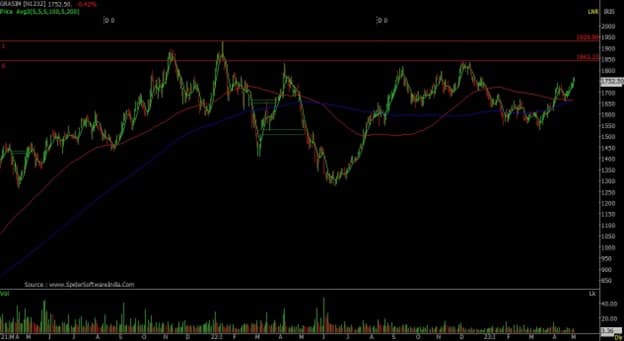

Grasim Industries: Buy | LTP: Rs 1,752.5 | Stop-Loss: Rs 1,680 | Target: Rs 1,840 | Return: 5 percent

On a daily and weekly basis, the stock is trending upward. On Friday, it closed above the level of Rs 1,740 which would send the stock into the higher trading zone, which is between Rs 1,700 and Rs 1,930.

Minor resistance exists at Rs 1,800 and Rs 1,840. The strategy should be to buy at Rs 1,750 and at Rs 1,710. Keep a stop-loss at Rs 1,680.

Hero MotoCorp: Buy | LTP: Rs 2,547 | Stop-Loss: Rs 2,350 | Target: Rs 2,850 | Return: 12 percent

Since, March 2022, technically, a lot of things changed for the stock Hero MotoCorp. In the month of August 2022, the stock has made a higher high at Rs 2,938, which is a sign of bulls' victory above bears after a period of 18 months.

Later, on we saw a gradual decline along with the trend of the market to Rs 2,296; however, it has made a higher bottom as compared to Rs 2,146.

On a weekly basis, the stock has left a bullish breakaway gap at Rs 2,372. Based on the broader formation, traders should be buyers at current levels and more on dips at Rs 2,450. Keep stop-loss at Rs 2,350. On the higher side, the stock could move to Rs 2,650 (200-day SMA) and Rs 2,850 levels.

Bharat Forge: Sell | LTP: Rs 760.25 | Stop-Loss: Rs 825 | Target: Rs 660 | Return: 13 percent

The stock is forming a series of lower top and lower bottom. It is against the trend of the Auto sector and also underperforming on a weekly basis. However, it is currently at crucial support of Rs 740 and till the stock is not breaking it, we can expect rangebound activity between Rs 800 and Rs 740.

It is advisable to sell the stock at Rs 800 or below the level of Rs 740 for the target of Rs 660. However, stop-loss at Rs 825 or at Rs 765 is a must respectively.

Expert: Nagaraj Shetti, Technical Research Analyst at HDFC Securities

Birla Corporation: Buy | LTP: Rs 980.15 | Stop-Loss: Rs 925 | Target: Rs 1,060 | Return: 8 percent

After showing rangebound action in the last few weeks, the stock price (Birla Corporation) has witnessed a sharp upside breakout this week amidst a volatile broader market. The stock price has moved above the crucial resistance of down sloping trend line at Rs 930 levels and closed higher. Hence, there is a higher possibility of further extension of upside momentum in the coming week.

Volume has started to expand during upside breakout in the stock price and weekly 14 period RSI shows positive indication. Hence, one may expect further strengthening of upside momentum in the stock price ahead.

Buying can be initiated in Birla Corporation at CMP (Rs 980.15), add more on dips down to Rs Rs 950. One can wait for the upside target of Rs 1,060 in the next 3-5 weeks, with a stop-loss of Rs 925.

RBL Bank: Buy | LTP: Rs 148.95 | Stop-Loss: Rs 159 | Tartget: Rs 136 | Return: 8.7 percent

After showing a sustainable upside bounce in the last five weeks, the stock price (RBL Bank) has witnessed sharp weakness in this week and closed lower.

Previous week’s swing high at Rs 163.30 levels could now be considered as a new lower top of bearish sequence. Hence, further weakness could be expected towards new lower bottom formation in the near term. Further weakness below Rs 144 is likely to be a downside breakout of crucial support of ascending trend line. Volume has started to expand during recent weakness and the weekly 14 period RSI shows negative indication.

One may look to go short in RBL Bank at CMP (Rs 148.95), add more on rise up to Rs 154 and wait for the downside target of Rs 136 in the next 3-5 weeks. Place a stoploss of Rs 159.

Expert: Ruchit Jain, Lead Research at 5paisa.com

UltraTech Cement: Buy | LTP: Rs 7,628.8 | Stop-Loss: Rs 7,420 | Target: Rs 7,900 | Return: 3.5 percent

The stock has been trading in a rising channel and is forming a ‘Higher Top Higher Bottom’ formation which is a sign of an uptrend. The stock prices have seen some correction in later part of the April month, but now seems to be resuming its uptrend.

The RSI oscillator has given a positive crossover and hence, we advise traders to look for buying opportunities in the stock from short to medium term perspective.

Traders can buy this stock in the range of Rs 7,620-7,600 for potential targets of Rs 7,900. The stop-loss for long positions should be placed below Rs 7,420.

Havells India: Buy | LTP: Rs 1,285.8 | Stop-Loss: Rs 1,210 | Target: Rs 1,400 | Return: 9 percent

The stock prices consolidated in a range in last few months and have now given a breakout from its resistance end. The volumes have picked up gradually and the short term momentum also seems to be bullish.

Hence, short term traders can look to buy the stock at current price of Rs. 1,285 and add on dips around Rs 1,250 for potential targets of Rs 1,355 and Rs 1,400. The stop-loss for long positions should be placed below Rs 1,210.

Expert: Mitesh Karwa, Research Analyst at Bonanza Portfolio

Gabriel India: Buy | LTP: Rs 165.95 | Stop-Loss: Rs 155 | Target: Rs 185 | Return: 11.5 percent

The stock has seen trading in an upwards sloping parallel channel pattern and closing with a big bullish candlestick after taking support from the support trendline on the weekly timeframe and is also trading above important EMA’s of 20/50/100/200 which can be used as a confluence towards the bullish view.

On the indicator front, the supertrend indicator is indicating a bullish continuation on the daily timeframe and the ichimoku cloud is also suggesting a bullish move as the price is trading above the conversion and base line.

Momentum oscillator RSI (relative strength index - 14) is at around 71 on the daily time frame indicating strength by sustaining above 50.

Observation of the above factors indicates that a bullish move in Gabriel is possible for targets upto Rs 185. One can initiate a buy trade in between the range of Rs 162-165, with a stop-loss of Rs 155 on daily closing basis.

Hitachi Energy India: Buy | LTP: Rs 3,729.8 | Stop-Loss: Rs 3,580 | Target: Rs 3,950 | Return: 6 percent

Hitachi Energy has seen breaking out of a descending triangle pattern on the weekly timeframe after 14 months with above average volumes and a bullish candlestick. On the indicator front, the stock is trading above important EMA’s of 20/50/100/200 which indicates bullishness.

The supertrend indicator is indicating a bullish continuation, while momentum oscillator RSI (14) is at around 73 on the daily time frame indicating strength by sustaining above 50.

And the ichimoku cloud is also suggesting a bullish move as the price is trading above the conversion and base line on the daily timeframe.

Observation of the above factors indicates that a bullish move in Hitachi Energy is possible for target upto Rs 3,950. One can initiate a buy trade in the range of Rs 3,720-3,729, with a stop-loss of Rs 3,580 on daily closing basis.

Ion Exchange (India): Buy | LTP: Rs 3,620.7 | Stop-Loss: Rs 3,410 | Target: Rs 4,000 | Return: 10.5 percent

Ion Exchange has seen breaking and sustaining above a rounding bottom pattern with a big bullish candlestick on the weekly timeframe and closing at all time high levels. The supertrend indicator is also indicating a bullish continuation which supports the bullish view.

Momentum oscillator RSI (14) is at around 65 on the daily time frame indicating strength by sustaining above 50 and the ichimoku cloud is also suggesting a bullish move as the price is trading above the conversion and base line.

Observation of the above factors indicates that a bullish move in Ion Exchange is possible for target upto Rs 4,000. One can initiate a buy trade in between the range of Rs 3,630-3,641, with a stop-loss of Rs 3,410 on daily closing basis.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.