The total shareholding of domestic institutional investors and foreign portfolio investors (DIIs/FPIs) declined in the March quarter from the previous three months, while promoter stakes rose, but the three categories of equity holders raised their holdings in top performing companies.

FPI holding fell to 22.6 percent from 22.74 percent despite net inflows of Rs 55,741 crore, while DII holding declined to a 10-quarter low of 13.03 percent after an inflow Rs 23,124 crore although in value terms their holdings rose to record levels in the quarter when Sensex and Nifty rose by 3.70 and 5.10 percent, respectively, said Pranav Haldea, Managing Director at PRIME Database Group.

Holding of the government (as promoter) in NSE-listed firms rose to 5.66 percent from 5.22 percent, while private promoters raised their stake to 44.85 percent from 44.32 percent, he said.

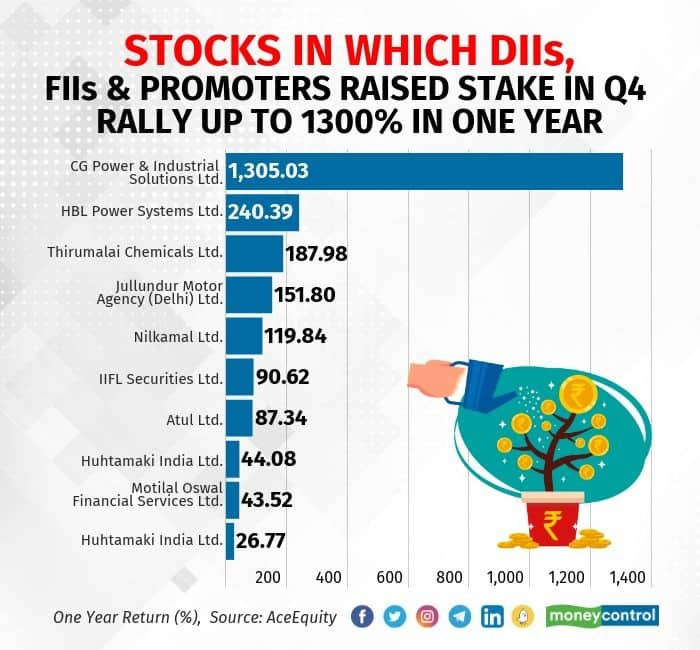

But all of them – FPIs, DIIs and promoters – raised their shareholding in top 10 stocks in the March quarter. These are: Atul, CG Power & Industrial solutions, Motilal Oswal Financial Services, Nilkamal, Huhtamaki, IIFL Securities, Thirumalai Chemicals, HBL Power Systems, Sreeleathers and Jullundur Motor Agency (Delhi).

These companies are in the chemical, stock broking, and power & engineering segments. If someone has a portfolio of these stocks in May 2020, he/she would have earned bumper returns by May 2021.

"From the last few quarters, we have consistently witnessed outperformance in chemical stocks especially where promoters, FPIs and DII (all three) have increased their stakes significantly. This includes include Atul, Thirumalai Chemicals etc," Gaurav Garg, Head of Research, at CapitalVia Global Research told Moneycontrol.

"Interesting to ponder on a few of the broking companies where we have seen traction in this quarter and stocks are close to their 52-week highs. Motilal Oswal Financial Services and IIFL Securities have given higher alpha compared to index, as their customer base has increased significantly during the lockdown period as many new retail investors have got attracted towards equity as an asset class," he said.

However, he had doubts about some companies. "In our opinion, some of power and engineering stocks like HBL Power Systems, CG Power & Industrial solutions are not very convincing and investors should avoid them."

"Nilkamal is one of our favourite stocks and it fares well on almost every parameter and investors should try to accumulate this at any healthy correction," he added.

Amongst them, CG Power & Industrial Solutions registered a stellar return (1,305 percent) in the last one year. HBL Power Systems, Thirumalai Chemicals, Jullundur Motor Agency (Delhi), and Nilkamal gained 120-240 percent during the same period.

Among others, IIFL Securities, Atul, Huhtamaki India, Motilal Oswal Financial Services, and Sreeleathers rallied 27-91 percent in the last one year.

Most of these stocks are from midcap and smallcap segments which outpaced benchmark indices in the last one year as well as in March 2021 quarter. The BSE Sensex, BSE Midcap and Smallcap indices gained 65 percent, 92 percent, and 121 percent respectively in the one year, while in the March quarter, these indices rose 3.68 percent, 12.4 percent and 14 percent respectively.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.