The top-performing Alternative Investment Funds (AIFs) for the month of April saw CCV Investment Managers LLP’s Emerging Opportunities Fund-I leading the pack, at 8.61% returns for the month. Aarth AIF’s Growth Fund and Finideas Growth Fund Scheme-1 followed with returns of 7.86% and 7.36% respectively.

Top 10 AIF Performers for the month of April

Top 10 AIF Performers for the month of April

Note: The historical returns timeline in each chart is different because of the variation in inception timelines of all funds. The top 10 data is based on calculations uptill April 30.

CCV Investment Managers LLP: Emerging Opportunities Fund-I: The fund has a sector-agnostic approach but primarily focuses on investing in small and medium-sized enterprises (SMEs) across India. It actively participates as an anchor investor in SME IPOs (invested in 8 such IPOs so far). Managed by Sahil Garg, the fund follows a bottom-up strategy.

CCV Investment Managers LLP: Emerging Opportunities Fund-I: The fund has a sector-agnostic approach but primarily focuses on investing in small and medium-sized enterprises (SMEs) across India. It actively participates as an anchor investor in SME IPOs (invested in 8 such IPOs so far). Managed by Sahil Garg, the fund follows a bottom-up strategy.

Aarth AIF Growth Fund: Managed by Rishi Agarwal, the fund targets superior risk-adjusted returns by investing in listed equities, late-stage unlisted companies, IPOs, QIB placements, and private placements, with up to 40% of assets in unlisted securities and a 10% cap per company.

Aarth AIF Growth Fund: Managed by Rishi Agarwal, the fund targets superior risk-adjusted returns by investing in listed equities, late-stage unlisted companies, IPOs, QIB placements, and private placements, with up to 40% of assets in unlisted securities and a 10% cap per company.

Finideas Growth Fund Scheme-1: It deploys systematic strategies across index, stock, and currency derivatives, while also hedging naked positions when necessary. The fund actively invests in Indian listed derivatives such as Nifty and Bank Nifty options and futures, stock futures and options, as well as other approved equity derivative products. In addition, it can allocate capital to equity shares, debt securities, ETFs, and other SEBI-permitted instruments.

Finideas Growth Fund Scheme-1: It deploys systematic strategies across index, stock, and currency derivatives, while also hedging naked positions when necessary. The fund actively invests in Indian listed derivatives such as Nifty and Bank Nifty options and futures, stock futures and options, as well as other approved equity derivative products. In addition, it can allocate capital to equity shares, debt securities, ETFs, and other SEBI-permitted instruments.

Alchemy Capital Management: Leaders of Tomorrow - 2

Managed by Hiren Ved, the fund required minimum of 65% allocation to mid and small-cap stocks alongside select large-cap opportunities. The fund also targets around 10% allocation to IPOs or other instruments permitted under applicable laws.

Negen Undiscovered Value Fund: Managed by Jigar Dinesh Shah, the Fund focuses on overlooked mid-cap and small-cap stocks. Its approach emphasizes sectoral weightage in industrials (25%) and materials (20%), targeting undervalued assets with catalysts for re-rating.

Negen Undiscovered Value Fund: Managed by Jigar Dinesh Shah, the Fund focuses on overlooked mid-cap and small-cap stocks. Its approach emphasizes sectoral weightage in industrials (25%) and materials (20%), targeting undervalued assets with catalysts for re-rating.

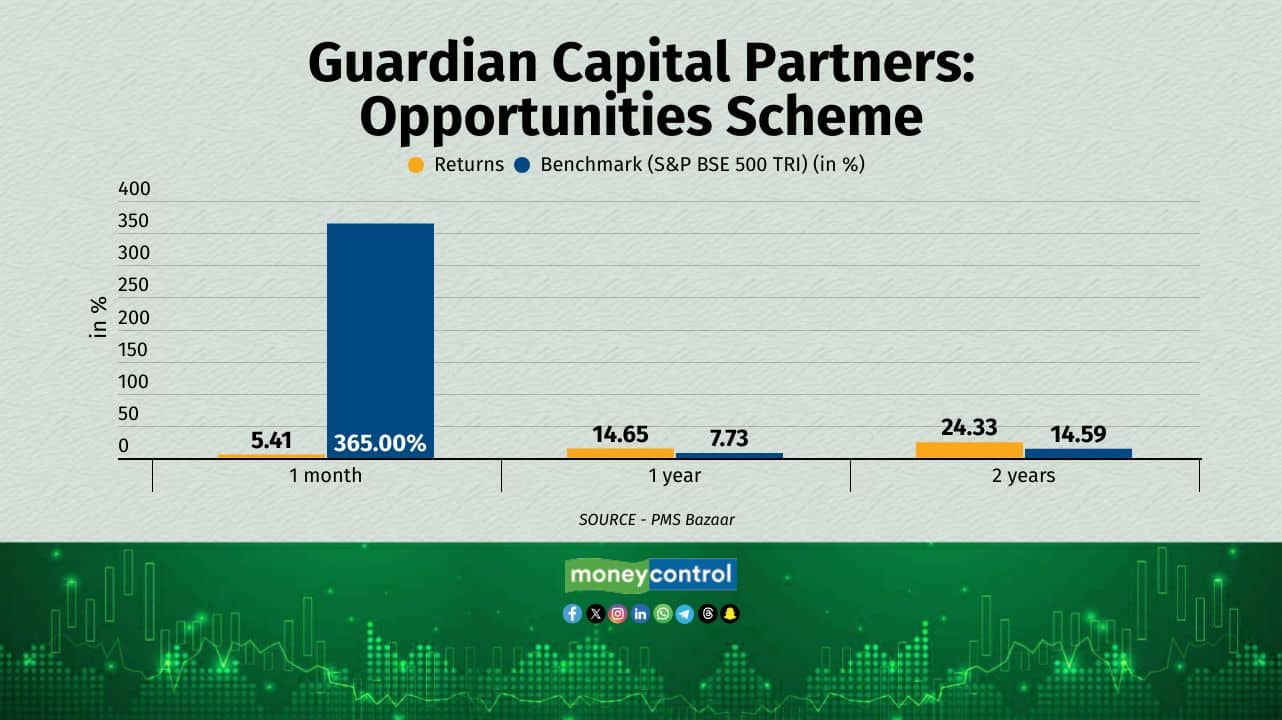

Guardian Capital Partners Opportunities Scheme: Managed by Manav Saraf, the fund’s strategy is to buy fundamentally strong companies only when they are trading at significant discounts to their long-term average valuations, with a particular emphasis on large caps. Otherwise, the fund remains in cash rather than compromising on valuation discipline. Exits are made once stocks move above their historical average valuations, without waiting for peak prices.

Guardian Capital Partners Opportunities Scheme: Managed by Manav Saraf, the fund’s strategy is to buy fundamentally strong companies only when they are trading at significant discounts to their long-term average valuations, with a particular emphasis on large caps. Otherwise, the fund remains in cash rather than compromising on valuation discipline. Exits are made once stocks move above their historical average valuations, without waiting for peak prices.

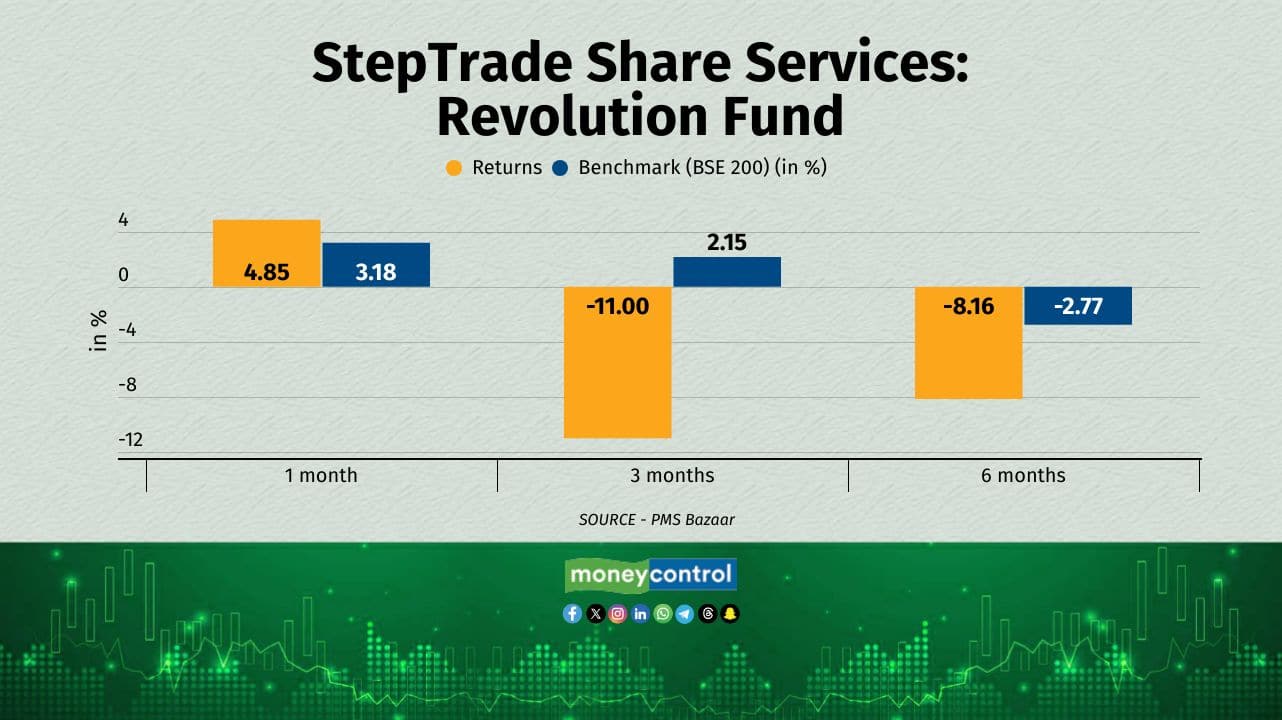

StepTrade Revolution Fund: Managed by Kresha Gupta, the Revolution Fund focuses on mid-cap growth stocks with a momentum-based strategy, emphasizing sectoral weightage in healthcare (30%) and industrials (20%).

StepTrade Revolution Fund: Managed by Kresha Gupta, the Revolution Fund focuses on mid-cap growth stocks with a momentum-based strategy, emphasizing sectoral weightage in healthcare (30%) and industrials (20%).

360 ONE Turnaround Opportunities Fund: Managed by Mehul Jani, the fund the fund invests in equities and related securities of companies especially those where short-term cycles have temporarily impacted profitability and growth.

360 ONE Turnaround Opportunities Fund: Managed by Mehul Jani, the fund the fund invests in equities and related securities of companies especially those where short-term cycles have temporarily impacted profitability and growth.

Edelweiss Asset Management Consumer Trends Fund: Managed by Nalin Moni, Edelweiss Consumption Fund invests 99.97% of its assets in domestic equities, with a portfolio allocation of 54.84% to large-cap stocks, 15.07% to mid-cap stocks, and 5.97% to small-cap stocks. This sectoral/thematic fund is suitable for investors who are willing to take higher-risk bets for the potential of higher returns compared to broader equity funds.

Edelweiss Asset Management Consumer Trends Fund: Managed by Nalin Moni, Edelweiss Consumption Fund invests 99.97% of its assets in domestic equities, with a portfolio allocation of 54.84% to large-cap stocks, 15.07% to mid-cap stocks, and 5.97% to small-cap stocks. This sectoral/thematic fund is suitable for investors who are willing to take higher-risk bets for the potential of higher returns compared to broader equity funds.

Singularity Equity Fund I: Managed by V Ramanan, follows bottom-up stock selection, focusing on a concentrated portfolio of listed and pre-IPO opportunities. It utilizes a proprietary PE DNA model with a cross-over focus, ensuring depth and rigor in investment decisions, and aims to deliver superior returns by integrating both macro themes and detailed company analysis.

Singularity Equity Fund I: Managed by V Ramanan, follows bottom-up stock selection, focusing on a concentrated portfolio of listed and pre-IPO opportunities. It utilizes a proprietary PE DNA model with a cross-over focus, ensuring depth and rigor in investment decisions, and aims to deliver superior returns by integrating both macro themes and detailed company analysis.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.