Foreign Institutional Investors (FII) have been fleeing the Indian markets in the wake of rising interest rates as global central banks look to tame stubborn inflation and India’s elevated valuation premium.

The FII exodus has only gathered momentum after the reopening of the Chinese economy. Even though FIIs sold stocks worth over Rs 1.2 lakh crore in the last calendar year, they were net buyers in the last two months of 2022.

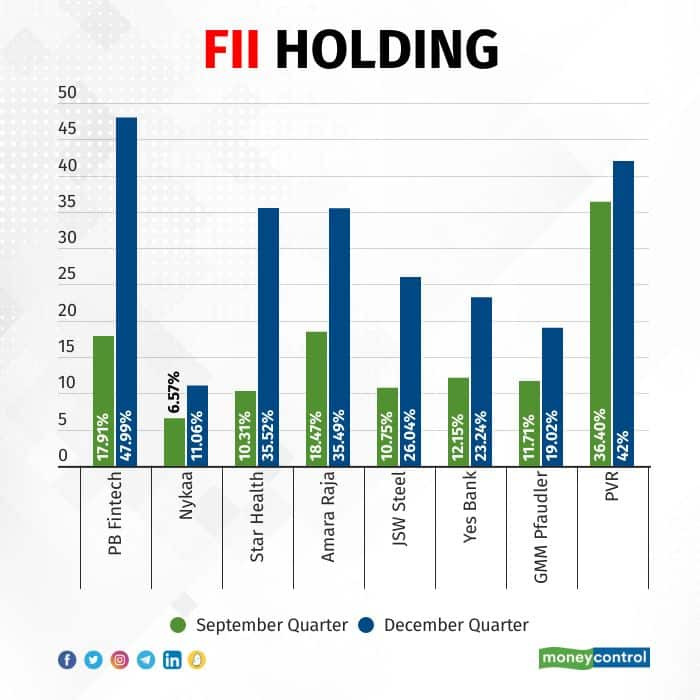

Let’s take a look at the stocks that emerged as FII darlings in the quarter gone by

New-age firms featured high on the FII buy list in the December quarter. PB Fintech, the parent firm of Policybazaar, saw foreign investors increase stake from nearly 18 percent in the September quarter to 48 percent. Pre-IPO investors like Softbank and Tiger Global sold a sizeable stake in the firm in December. However, marquee names like Morgan Stanley, Goldman Sachs, and Citigroup among others lapped up shares of the insurance aggregator.

The company narrowed its losses significantly in the third quarter and has set FY24 as the target year to turn profitable. It has a market cap of nearly Rs 24,000 crore and if you look at the stock performance in the last quarter, it has lost nearly 5 percent while the Nifty gained nearly 6 percent. Analysts remain super optimistic on the stock, thanks to a slew of target upgrades post its strong third quarter show.

FIIs added Nykaa to their shopping cart last quarter, increasing their holding in the beauty tech startup to 11 percent versus 6.5 percent in the September quarter. The company’s third-quarter earnings failed to enthuse, but brokerage views suggest the stock could still clock in a rally of over 75 percent going forward. Besides, analysts believe that after the recent bout of selloffs, the stock is emerging as a compelling buy and offers a good entry point at current levels. But, remember, the same isn’t true for all the new-age tech firms. The stake hike in PB Fintech and Nykaa comes even though FIIs reduced their holding in Zomato and Paytm in the same quarter.

Also Read: Nykaa logs in 71% decline in Q3 net profit: Check out what brokerages are saying

Rekha Jhunjhunwala-backed Star Health also found favour with the FII fraternity as they increased their holdings from 10 percent in the September quarter to 35 percent in the December quarter. The health insurer reported a profit of over Rs 200 crore in the third quarter versus a loss of Rs 500 crore compared to the corresponding period last year. If you look at the stock performance for the last quarter, it shaved off nearly 20 percent. Analysts are optimistic about its overall prospects given its leadership in the retail health segment and industry-beating growth.

Battery maker Amara Raja Batteries saw its FII holding nearly double from 18 percent to 36 percent sequentially. The company saw a 50 percent jump in its third-quarter profit powered by buoyant demand from automakers and telecom companies. In the last quarter, the stock has had a stellar run as it gave returns of nearly 17 percent.

Metal shares saw some buying by foreign investors in the December quarter. JSW Steel saw FIIs increase their stake in the counter to 26 percent vis-à-vis 10 percent in the previous quarter. However, when it comes to earnings, the company saw its Q3 profit melt by 90 percent missing analyst estimates. However, some brokerages believe that the firm’s margins may stabilise in FY24.

Also Read: Daily Voice | What makes this finance veteran expect record SIP inflow in coming years?

During the December quarter, FIIs doubled their bet on Yes Bank increasing their holding from 12 percent in the previous quarter to nearly 24 percent. Remember, this lender is seen as a retail favourite and has come off quite a bit from its 52-week high. So, there could be room for upside as some brokerages believe that a turnaround could be in the offing with improvement in the stability of the franchise boosting investor confidence.

Next on the FII buy list was GMM Pfaudler, where they increased their stake from a little over 11 percent in the September quarter to an all-time high of 19 percent. Axis Securities believes that this stock is a play on the manufacturing shift of chemicals and pharma from China and developed markets to India. Remember, China plus one is pegged to be a strong theme for the next decade.

Multiplex stocks were hammered out of shape during the Covid-19 pandemic but hopes of a picture-perfect recovery attracted FIIs to PVR as they upped their stake from 36 percent to 42 percent in the December quarter. PVR reported a blockbuster quarterly show as it swung to profits after logging losses in 10 out of the 11 previous quarters. Global brokerage CLSA has maintained a buy call on the stock and sees a 45 percent upside on the back of a resurgence in box office collections and a strong content lineup for this year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.