The year gone by since the start of last Republic Day 2022 has been quite topsy-turvy for the market with the benchmark indices clocking about 4 percent gains.

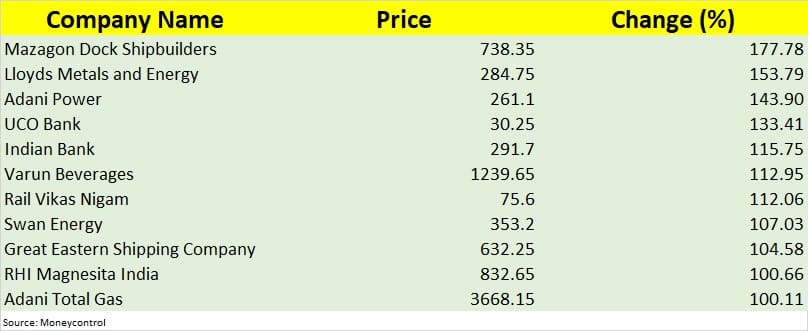

The broader market performance was mixed as the BSE Midcap rose 1.7 percent and Smallcap index lost 2.4 percent, but there were 11 stocks in the BSE500 index that gave outstanding returns in the last one year including Mazagon Dock Shipbuilders, Adani Power, Indian Bank, Varun Beverages, Swan Energy, RHI Magnesita India, and Adani Total Gas.

State-owned shipbuilding company Mazagon Dock Shipbuilders topped the list among gainers, rising 178 percent during the year amid the increasing focus of the government on the defence sector. The company is yet to release its quarterly earnings for the December FY23 quarter but in six-month period ended September FY23, it clocked a massive 85 percent year-on-year growth in consolidated profit at Rs 439 crore and a 41 percent rise in revenue from operations at Rs 3,933 crore.

In the current financial year (FY23), the government has allocated Rs 5.25 lakh crore for the defence sector, which is nearly 10 percent higher than the previous Budget estimates, with a focus on the modernisation of defence services and security infrastructure development.

Shipping company Great Eastern Shipping Company gave a similar performance, rising 105 percent since the last Republic Day. With a presence in the international maritime industry, its shipping business operates under two main businesses – dry bulk carriers and tankers. The company will announce its quarterly earnings on January 31, 2023, but in the last six-month period ended September, the consolidated profit surged 421 percent to Rs 1,226 crore and revenue grew 70 percent to Rs 2,813 crore compared to the corresponding period last fiscal.

Lloyds Metals and Energy, which is into steel, iron ore mining and DRI (direct reduced iron) manufacturing, surged 154 percent since the last Republic Day. This midcap company registered healthy growth in earnings for quarter ended December FY23 as consolidated profit came in at Rs 230 crore for the quarter against loss of Rs 26.2 crore in the corresponding period last year and the consolidated profit increased 61 percent on a sequential basis. Revenue from operations grew 494 percent on-year and 48 percent sequentially to Rs 1,000 crore in Q3FY23 on higher volumes of iron ore and sponge iron. "The company remains debt-free and shall continue to remain so, as we plan to undertake projects majorly from internal accruals," Mukesh Gupta, Chairman, said this month.

Two Adani group stocks – Adani Power and Adani Total Gas – also brought a big cheer to investors by reporting 144 percent and 100 percent rallies respectively in the past one year. City gas distribution company Adani Total Gas continued to report healthy earnings with revenue for the first half of FY23 rising 90 percent YoY to Rs 2,301 crore while in the September FY23 quarter the growth was 73 percent, though profit in the same period fell 7 percent and 12 percent, respectively largely due to higher input gas prices amid geopolitical factors as well as supply shortages across the globe.

Given the increased demand for power, following a focus on infrastructure and manufacturing segments by the government, power stocks have been in limelight. Among them, Adani Power caught investors' attention as it recorded an 87 percent YoY growth in consolidated revenues in the first half of FY23 due to higher tariff realisation and higher one-time revenue recognition. Its profit grew by 114 times to Rs 5,475 crore in the same period due to higher operating profit including one-time income.

Banks were also in focus with clean balance sheets and increased credit demand. In fact, experts are betting on the banking space for the year ahead as they feel the space is in a sweet spot. UCO Bank and Indian Bank were star performers since Republic Day 2022, rising 133 percent and 116 percent, respectively, outperforming BSE Bankex by a wide margin, which gained 10 percent in the same period.

Among others, Varun Beverages, Rail Vikas Nigam, Swan Energy, and RHI Magnesita India also gave a stellar performance, rising between 100 percent and 113 percent.

Overall, the year saw a lot of challenges with the start of Ukraine-Russia war, a surge in oil prices, policy tightening by global central banks to tame the elevated inflation, earnings and economic growth concerns, and FII selling but the domestic investors retained their strong faith by being net buyers in the same period.

The coming year also seems to be volatile at least in the coming few months given the slowdown fears in the western world after aggressive rate hikes and the continuity in rate hikes by US Federal Reserve. This could be followed by some kind of recovery in the second half as India has taken a lot of initiatives in the last several years to boost the economy, which has helped the equity markets to outperform others in the last couple of years. Even the economy has been performing well in the last one year, outperforming the global economy.

"In the first three to six months of CY23, we will see the economic impact of the interest rate increases as the way that several countries have done it. We will see the impact of the same with regards to the growth rates of companies and the economy," Trideep Bhattacharya, Chief Investment Officer-Equities at Edelweiss Asset Management, said.

Once we tide through that somewhere around the second quarter of the calendar year broadly global economies will probably bottom out and there can be a nice economic rebound, he said.

After two amazing years in the equity markets driven by the economic bounce-back, sharp earnings growth and high liquidity, Raghvendra Nath of Ladderup Wealth Management said there is a good probability that 2023 may also see good returns but it will be more stock-specific and not so much at a broader-market level.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.