Tejas Khoday

The coronavirus pandemic of 2020 is changing the outlook on physical and mental health, impacting everyone's survival quotient across the globe. Relegated to the confines of their homes, people from over 214 countries and thousands of cities have tried to find solace in other activities to avoid boredom.

As world governments continue to grapple with health and economic issues, a different scenario has been unfolding in the stock markets everywhere. After an astounding drop of around 40 percent across major global indices in March, within a span of 3-4 months, stock markets witnessed a dramatic recovery, some on the verge of reaching their lifetime highs, all made possible due to the indomitable resolve of the retail investor.

On the other hand, gold continued its outperformance from the previous year, with 17 percent returns YTD. According to the World Gold Council, gold-backed ETFs closed H1CY20 with a record $40 billion of net inflows. In June gold ETFs added 104 tonnes, taking global holdings to all-time highs of 3,621 tonnes.

With work from home restrictions in place, retail investors armed with ample time and decent sums, indulged in trading and investing. These retail investors, pumping in an average of around Rs 8,000 crore a month through mutual fund SIPs for the last 18 months, took interest in direct equity investing also. With stable and consistent incomes remaining doubtful, they shunned fixed income products and deep dived into equities. As per SEBI May 2020 bulletin, demat accounts increased from 3.62 crore in April 2019 to 4.15 crore by April 2020. Retail and high net worth investors (HNIs) participation as a percentage of total cash turnover has increased from 76.6 percent in January 2020 to 85.8 percent in July 2020. As per latest AMFI data, even across mutual funds, investors opted to invest in high risk- high return segments like smallcap and focused funds while liquidating large and midcap funds.

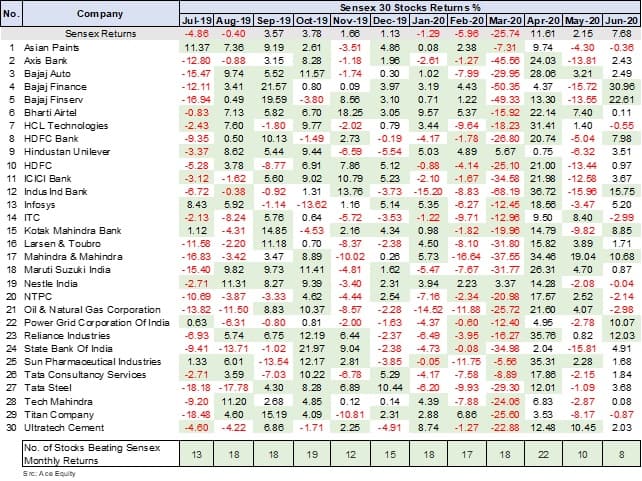

The returns from most indices are average at best, and a quick analysis of an index returns with respect to its constituent stocks will provide the necessary evidence. An analysis of Sensex 30 stocks’ last 12-month returns highlights the fact that, barring April - due to exceptional returns, only 50 percent of stocks on an average were able to surpass their index returns.

Over the last few years, many active investors shunned investing in index or value funds and opted for growth and thematic investments in search of higher returns. Thematic investments aren't novel and have been in existence for at least two decades. Under this philosophy, unlike generic portfolios, managers seek strong, healthy and a narrow set of companies with excellent prospects for growth, and offering tremendous opportunities for returns. These companies are grouped into various themes and offered to investors of all categories.

As per Morningstar Manager Research Report on "Global Thematic Funds Landscape – February 2020",

• Over the three years ending December 31, 2019, collective assets under management in thematic funds grew nearly threefold, from $75 billion to around $195 billion worldwide.

• This represented around 1 percent of total global equity-fund assets, up from 0.1 percent 10 years ago.

• A total of 154 new thematic funds debuted globally in 2019, falling just short of the record 169 new funds launched in 2018.

• By end of December 2019, there were 923 thematic funds in Morningstar's global database.

• Europe is the largest market for thematic funds, accounting for 54 percent of global thematic fund assets.

• With over $27 billion in assets, Robotics and Automation is the most popular theme globally.

• Just 45 percent of all thematic funds launched prior to 2010 survived to 2020. Of those that survived, just one in four outperformed the MSCI World Index over that 10-year span.

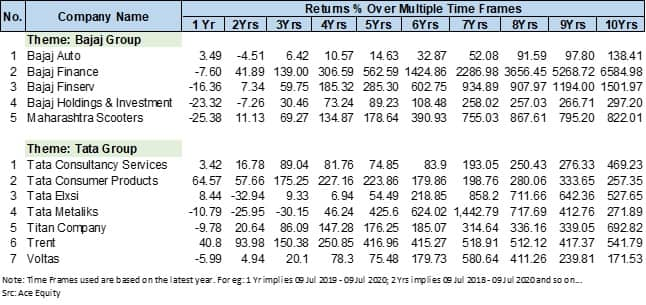

Thematic investments in India are still in their infancy and yet to gain mainstream awareness. Themes can vary widely, from a simple market leaders theme comprising top leaders from each sector, to a more futuristic theme with firms operating in sectors like artificial intelligence, smart cities, fintech, new age manufacturing and automation or from environmentally conscious businesses contributing towards social impact issues like health and safety, climate change etc. Depending on their preference, investors can choose from a wide variety of themes or even formulate their own theme. For eg: Many investors give importance to corporate governance, ethics and management's capabilities to drive businesses successfully. Business groups in India like Bajaj Group, Tata Group and many others, having established credibility and trust among stock market participants with diversified companies under their belt, can be selected as themes.

In recent years, chemicals – agro, basic, specialty, dyes & pigments – have seen remarkable demand and continued to enjoy higher price realisations for almost a decade. A theme related to chemicals would have ensured extraordinary returns to investors.

In recent years, chemicals – agro, basic, specialty, dyes & pigments – have seen remarkable demand and continued to enjoy higher price realisations for almost a decade. A theme related to chemicals would have ensured extraordinary returns to investors.

Identifying companies across sectors exhibiting the right markers for exponential growth is a humongous task, but if done right, would ensure returns beyond comparison of any index, mutual fund or PMS. Though easier to comment in hindsight on the performance of a specific set of companies, investment managers continue to do enormous research to zero in on the right firms, that can encash on the fiery growth, to deliver superlative returns.

Identifying companies across sectors exhibiting the right markers for exponential growth is a humongous task, but if done right, would ensure returns beyond comparison of any index, mutual fund or PMS. Though easier to comment in hindsight on the performance of a specific set of companies, investment managers continue to do enormous research to zero in on the right firms, that can encash on the fiery growth, to deliver superlative returns.

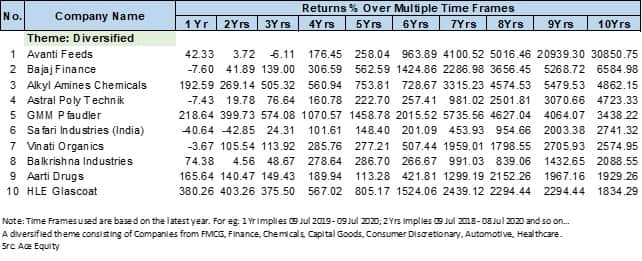

At times, a diversified theme spread across many sectors can form the perfect portfolio and yield the best of returns. Would it have been possible for any investment manager or an individual investor to pick 10 stocks across FMCG, Finance, Chemicals, Capital Goods, Automotive, Healthcare, Discretionary consumption to form a perfect portfolio?

It is near impossible to select these 10 stocks which have delivered the best of returns over multiple time frames. But, as investors look to shun low yielding products and seek investment avenues for higher returns, thematic investing could emerge as the way of the future and be the next generation choice for investments in India. However, it is imperative to hold the thought that, identifying and investing in the right stocks or theme will accomplish only half the task. Patience and long term holding, while continuing to retain a strong conviction, still remain the key attributes to mitigate investment risk while seeking unmatched returns.

It is near impossible to select these 10 stocks which have delivered the best of returns over multiple time frames. But, as investors look to shun low yielding products and seek investment avenues for higher returns, thematic investing could emerge as the way of the future and be the next generation choice for investments in India. However, it is imperative to hold the thought that, identifying and investing in the right stocks or theme will accomplish only half the task. Patience and long term holding, while continuing to retain a strong conviction, still remain the key attributes to mitigate investment risk while seeking unmatched returns.

The author is Co-Founder & CEO at FYERS.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.