India’s stocks are trailing most of their global peers this year but one set of companies may be about to see a resurgence: those with links to China.

Decades of frosty relations between the world’s two most-populous nations are thawing as both countries consider themselves unfair targets of President Donald Trump’s “America First” trade wars. Fund managers are now scouring Indian industries such as pharmaceuticals and electronics for firms with Chinese supply lines or export channels that may be among key beneficiaries.

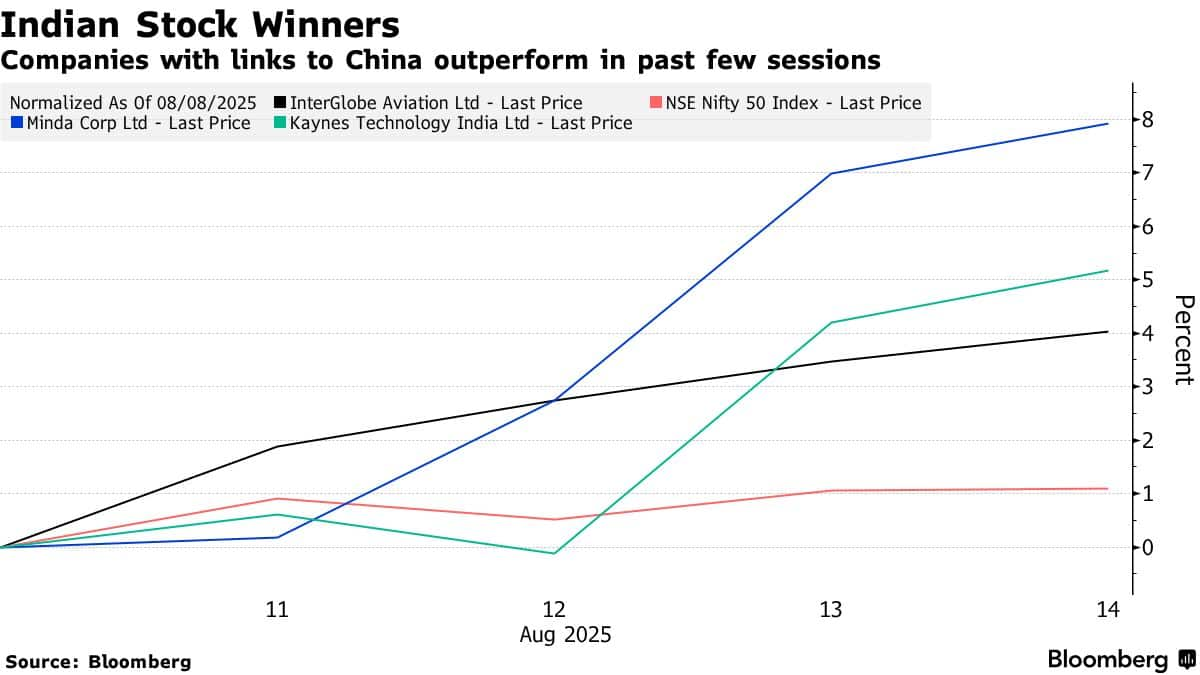

There have already been some winners. Shares of InterGlobe Aviation Ltd., which operates the India’s largest carrier IndiGo, jumped more than 4% last week on reports that direct flights between the country and China may resume as soon as next month. Car-part maker Minda Corp., which has a Chinese partner, and electronic-component manufacturer Kaynes Technology India Ltd., which imports key parts from China, both jumped more than 5%.

“Disputes will be over very soon and India will open the floodgates to Chinese investments,” said Ritesh Jain, founder of Pinetree Macro, a global asset-management company based in Calgary. “The scale and technology at which they operate will create new winners in India, and it’s important to be positioned accordingly.”

Relations between India and China have been plagued for years by a fractious border dispute and conflicting geopolitical aims. A new round of skirmishes broke out in 2020 that led to the deaths of soldiers from both nations and calls for Indian consumers to boycott Chinese goods. Chinese weaponry also helped Pakistan in a recent military escalation with India.

Relations between India and China have been plagued for years by a fractious border dispute and conflicting geopolitical aims. A new round of skirmishes broke out in 2020 that led to the deaths of soldiers from both nations and calls for Indian consumers to boycott Chinese goods. Chinese weaponry also helped Pakistan in a recent military escalation with India.

That ill-feeling is now being offset by Trump’s chaotic tariff policies that have encouraged Beijing and New Delhi to find common ground. These tariffs currently include a charge of 50% on Indian goods, and the threat of levies on China of at least 54%. In addition to the expected resumption of direct flights, the two countries are in talks to revive border trade, and Prime Minister Narendra Modi is expected to visit China later this month, where he will meet Premier Xi Jinping.

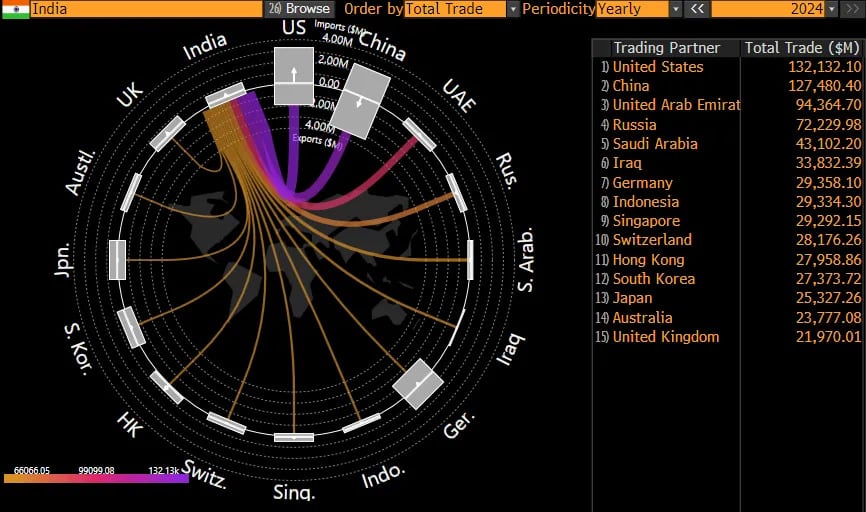

Even as India hardened its position against its neighbor following the latest border conflicts, China has remained its second-largest trading partner. India’s imports from China climbed to $113.5 billion in the fiscal year ending March 2025, from $101.7 billion a year earlier. That compares with India’s exports to its neighbor of $14.2 billion.

One likely beneficiary of the improving relations between the two countries is the travel and tourism sector.

The resumption of direct flights would be “a symbolic yet practical step towards thawing ties, enabling smoother business and tourism,” said Sonam Srivastava, founder of Wright Research in Mumbai. “We see selective opportunities in aviation, travel, and supply chain-linked manufacturing, but would pair these with overweight positions in domestic import-substitution related companies.”

In addition to InterGlobe Aviation, other travel-industry shares to gain last week were budget carrier SpiceJet Ltd. and Thomas Cook India Ltd., which sells travel packages.

Pharma, Chemicals

A better trading relationship may make it easier for Indian pharmaceutical companies, such as Lupin Ltd., to import critical ingredients from China. Rashtriya Chemicals & Fertilizers Ltd. also stands to gain from any loosening of Chinese restrictions on the export of urea.

Electronics manufacturer Dixon Technologies India Ltd., which partners with Chinese electric-vehicle manufacturers such as Xiaomi Corp., may be in a better position to scale up. JSW Group could benefit as its operates a joint venture with China’s SAIC Motor Corp.

“Any increased economic co-operation between India and China, if that can happen, would present more opportunities,” said Kok Hoong Wong, head of institutional equities sales trading at Maybank Securities Pte in Singapore. “We should be looking at companies that can benefit from cheaper, more cost-effective imports such as Indian pharma and some electronics makers.”

The potential boost for stocks such as these would be welcome for Indian investors who have seen the nation’s equities underperform in recent months. Fears about the negative impact of Trump’s tariffs have limited gains in the benchmark Nifty 50 to just 4.2% this year, versus an advance of 13% for the MSCI World Index.

Ironically, Trump — the person who inadvertently brought India and China closer together with his trade policies — had no intention of creating that outcome.

India and China “are facing the same pressure from Trump with regards to purchasing of oil and dealing with Russia so it makes sense to strengthen ties in the face of this increased scrutiny and interference,” said Matthew Haupt, a fund manager at Wilson Asset Management in Sydney.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.