Tata Consumer Products on January 12 announced two big acquisitions — Capital Foods and Organic India — for Rs 7,000 crore but its pricey valuation indicates that the good news may already be in the price.

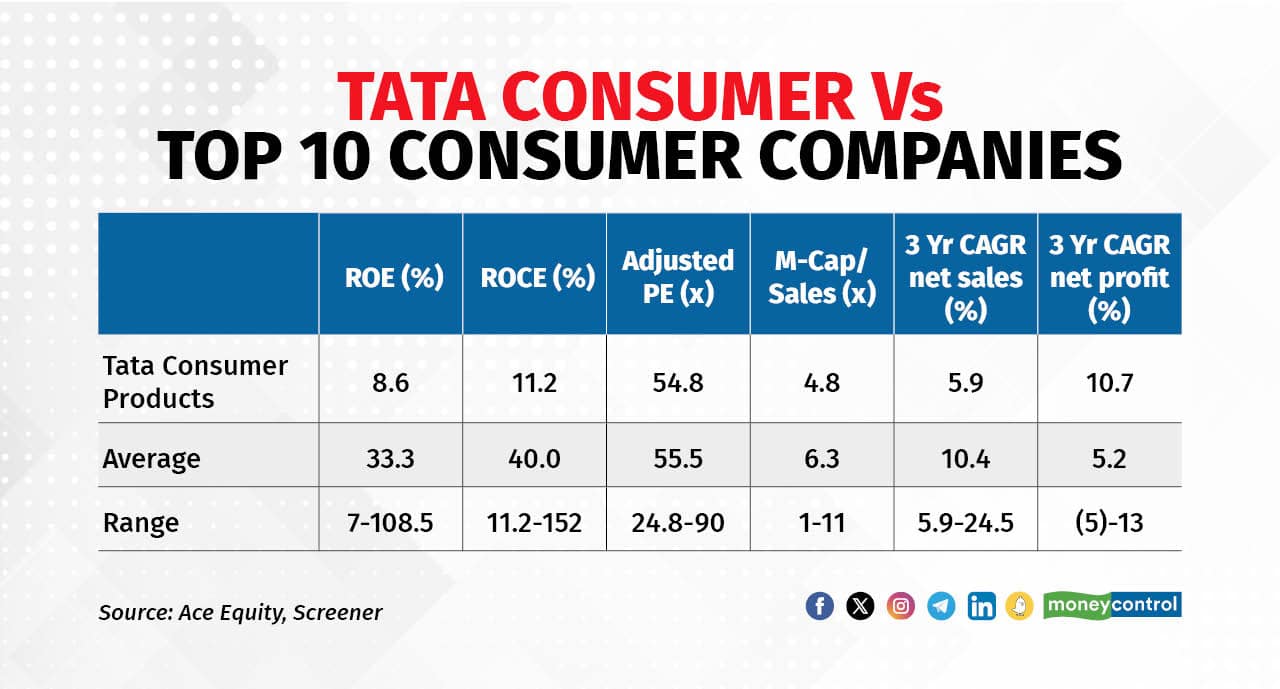

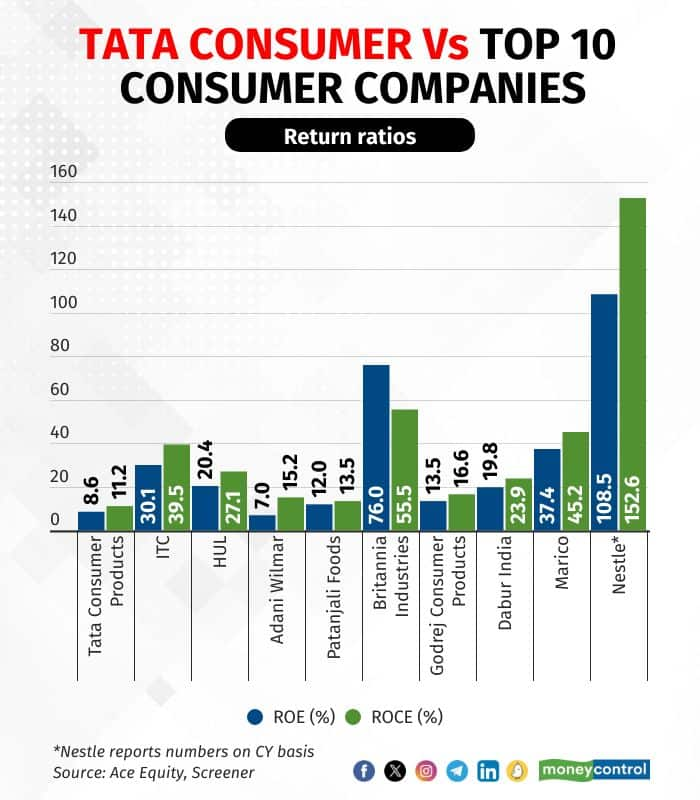

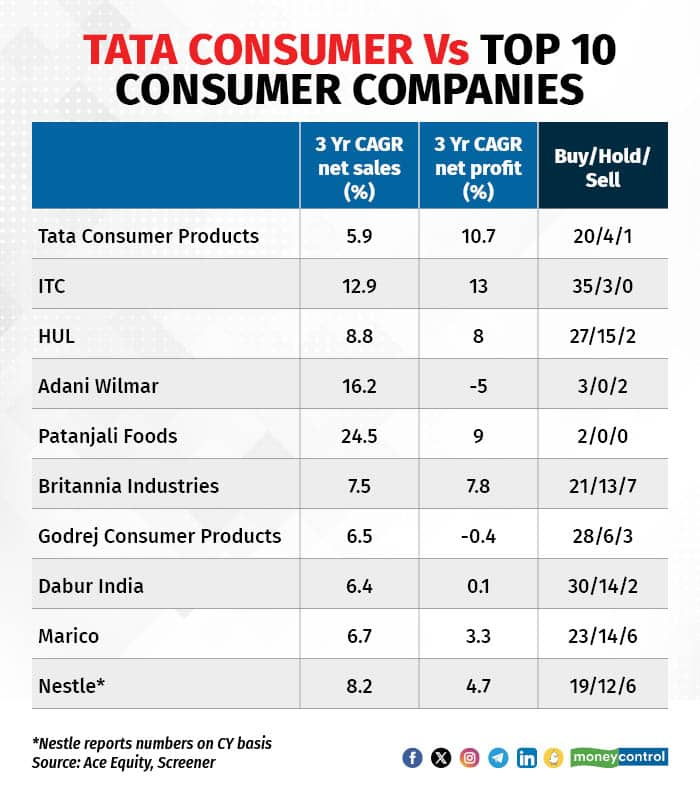

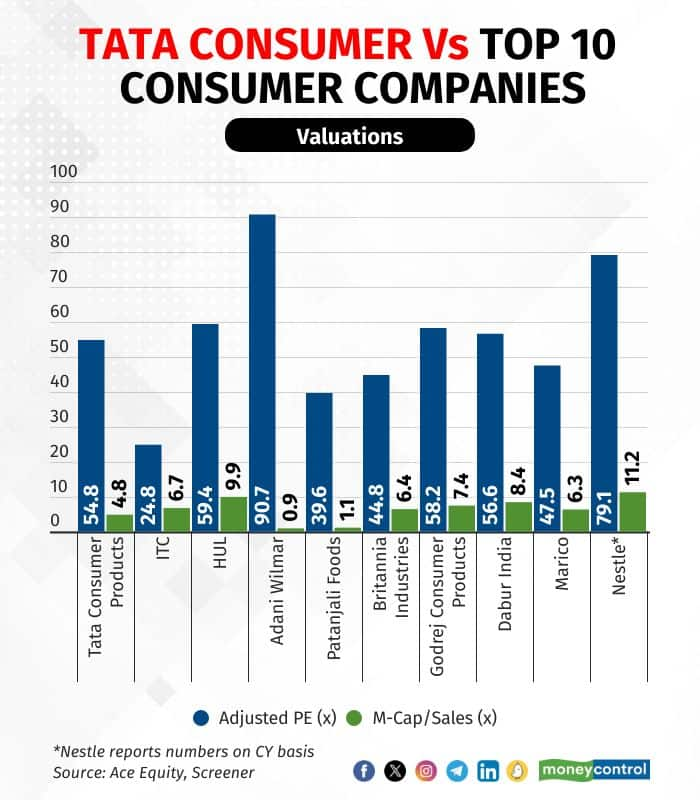

Tata Consumer's trailing-12-month price-to-earnings ratio of 54x is in-line with its peers despite a lower pace of sales and profit growth as well as single-digit return on equity (RoE). Its return on capital employed (RoCE) is also significantly lower than peers.

Low RoE indicates that a company generates relatively little return on shareholder's equity. A low RoCE indicates that a company is not using its capital efficiently. Both are keenly monitored by investors.

The recent acquisitions of Capital Foods and Organic India come as further bad news for RoE and RoCE, said Alok Shah of Ambit Capital. He assumes borrowing worth Rs 5,000 crore against immediate acquisition cost of Rs 5,725 crore and cash balance of Rs 1,500 crore.

In a note to investors, he said, "This (borrowing) will be arranged via rights issue too which would lead to higher equity base, impacting return ratios." This could lead to net profit cut of 10 percent in FY26 and RoCE dip of 350-400 basis points, he added.

One basis point is one-hundredth of a percentage point.

Tata Consumer's sub-par performance

When it comes to topline growth, Tata Consumer has struggled to keep pace with its peers as it has not been able to create strong enough brands. It has also been losing market share in tea and salt businesses. So, its strategy has been to acquire brands, which burns cash, analysts said.

"They haven't created many consumer brands like other FMCG biggies, so the new acquisitions will help in rapid growth of its portfolio of brands," said Sreedhar Prasad, former partner and head of consumer business at KPMG in India.

Tata Consumer has been scouring for new acquisitions for quite some time now. Over the past year, it had been in talks to acquire Bisleri and Haldiram's as well.

Also Read: MC India Inc CEO Survey: Executives strap in for unchanged inflation, interest rates

Tata Consumer’s growth push started in 2020 when as part of a restructuring it acquired brand and sales and distribution network of consumer food business of Tata Chemicals, which included primarily Tata Salt and Tata Sampann. It then acquired PepsiCo's stake in NourishCo and 100 percent stake in Soulfull Cereals.

The company has also been spending significant time in streamlining its business and simplifying its corporate structure. It recently merged Tata Coffee and TCPL Beverages into it. Most of these businesses do not offer margin accretive opportunities, analysts say.

Tata Consumer's operating margins have remained in 10-13 percent band over the past 10 years.

Also Read: HCL Tech Q3 beats estimates, all eyes on WPI inflation & more | Market Minutes

Will Capital Foods and Organic India help?

According to Ambit's Shah, the company had no choice but to expand its total addressable market via the inorganic route.

"Organically, except for water, there were no revenue/margin/RoCE accretive scalable opportunities in its current portfolio. Acquisitions of Capital Foods and Organic India optically fits well as it fills whitespaces in Tata Consumer's food and beverages portfolio," he said.

According to Prasad, the game will now intensify in omnichannel distribution. That is how the company can propel growth.

"OI is a niche brand with good acceptance among premium customers, while Capital Food's Ching's has had a clear positioning in the Indo-Chinese space. It now depends on how aggressive will TCPL be in scaling these using their pan India distribution," he said.

Also Read: India Inc CEO Survey: 53% believe India will soon become a competitive manufacturing hub

Tata Consumer has total reach of 3.8 million outlets, with 1.5 million being direct reach. It has over 10,000 channel partners including distributors and sub-distributors.

Capital Foods is expected to clock Rs 936 crore gross revenue in FY24, with around 50 percent gross margin and 20 percent EBITDA margin. On the other hand, Organic India grosses Rs 350 crore annually with high quality products focused on sustainable living and 55 percent gross margin.

While Tata Consumer now has a good bouquet of products in its portfolio, its high valuation seems to have factored in all the good news. Till the synergies and execution efficiencies are clearly visible, further multiple rerating seems unlikely, said analysts.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.