Investor confidence in Indian equities stays undeterred despite raging volatility in the market, shows the recent spike in systematic investment plans (SIP) and demat account additions.

Factors such as robust economic fundamentals, strong earnings, political stability, and lower inflation have contributed to this confidence. Analysts believe this positive sentiment will sustain despite short-term fluctuations, with promising long-term prospects and continued support from foreign portfolio investments (FPI).

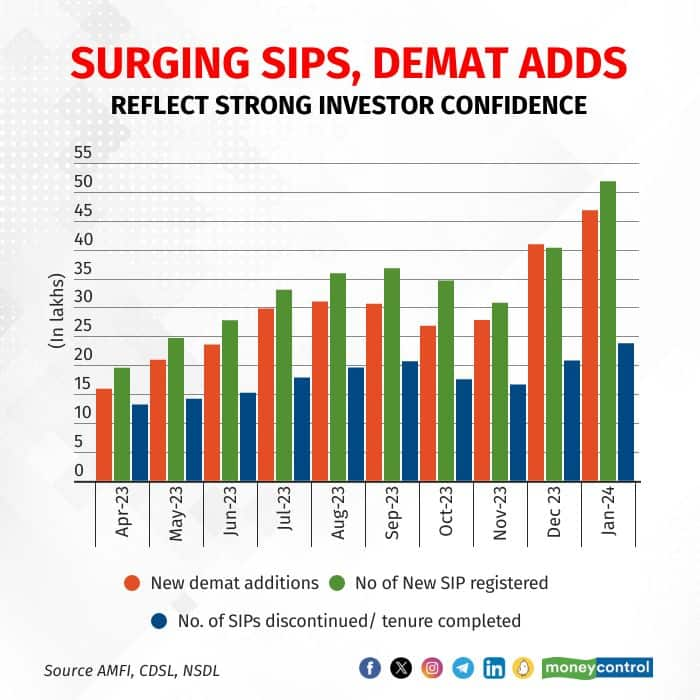

A record over 51.84 lakh people registered for SIPs in January compared to 40.33 lakh a month ago, clocking a 28.5 percent spike over December and a 128.9 percent surge over the last year. The number of SIP accounts stood at the highest ever 7.92 crore in January as against 7.64 crore in December. In the nine months of FY24, SIP registrations reached 3.36 crore, surpassing 2.51 crore and 2.66 crore registered for the entire FY23 and FY22.

sip demat

sip demat

On the flip side, discontinued SIP accounts or completed tenures increased in January 2024, with 23.79 lakh investors withdrawing funds. So far in FY24, some 1.80 crore investors terminated their SIPs, compared to 1.43 crore in entire FY23 and 1.11 crore in entire FY22. Few investors are partially removing their investment after a surge in local equity markets, according to analysts.

In step with the rise in SIP accounts, more and more investors have turned to the equity markets over the last few months with demat account additions making substantial growth in January 2024 and December 2023.

According to data from the Central Depository Service and National Securities Depository, the number of demat accounts opened in January totalled over 46.84 lakh, compared to 40.94 lakh a month back. The total demat tally crossed 14.39 crore in January, up from 13.92 crore a month ago and 11.05 crore a year back.

The average daily turnover in both cash and derivative segments also reached a record high, with the cash segment exceeding Rs 1.2 trillion for the second consecutive month in January.

Increasing demat, SIP additions and rising cash volume signal growing confidence in the Indian economy, with even those previously on the sidelines now participating after a record-breaking equity market surge, said Rajesh Palvia, analyst with Axis Securities. Interest is also fuelled by the strong performance of many PSU stocks.

The surge in new SIP accounts indicates increased involvement from small investors, contributing to the overall growth. The broader message is that more people are entering the market. A part of the surge in SIPs may also be attributed to investors opening multiple accounts, while others, unfamiliar with the equity market, are choosing the SIP route amid rising concern of an overheated market and overvaluation of stocks.

In 2023, the Sensex and the Nifty jumped 19 percent and 20 percent, while BSE MidCap and BSE SmallCap advanced 45.5 percent and 47.5 percent. So far in 2024, the benchmarks lost 1.1 percent and 0.06 percent, while the broader indices gains over 8.4 percent each.

Sunil Shah, group CEO of Khambatta Securities, pointed out that the growing SIP accounts indicating an spurt in equity market participation was a positive trend. More and more individuals are opting for investments through mutual funds, recognising SIP's historical success in wealth creation for the long-term and retirement goals. As awareness spreads, the number of SIP accounts is expected to rise consistently.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.