Taking Stock: Market ends flat amid volatility; BSE marketcap crosses Rs 300 lakh crore

The BSE midcap and smallcap indices rose 0.7 percent each.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 83,938.71 | -465.75 | -0.55% |

| Nifty 50 | 25,722.10 | -155.75 | -0.60% |

| Nifty Bank | 57,776.35 | -254.75 | -0.44% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Bharat Elec | 426.10 | 16.20 | +3.95% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Eternal | 317.75 | -11.60 | -3.52% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8184.35 | 125.60 | +1.56% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10612.20 | -117.00 | -1.09% |

In today's trading session, the USDINR spot closed 20 paise higher at 82.22, reaching its highest levels since June 13th. This increase was primarily attributed to strong corporate dollar demand and suspected intervention by the Reserve Bank of India (RBI). Looking ahead, tonight's focus will be on the release of the US Federal Open Market Committee (FOMC) minutes. If the commentary from the FOMC minutes is hawkish, it could potentially push the USDINR pair towards the 82.30/40 levels. In the near term, it is expected that the USDINR exchange rate will range between 82.00 and 82.40 levels.

The Nifty witnessed a day of consolidation. It traded within the range of the previous trading session (19434 – 19300) and closed with marginal gains. On the daily charts it has formed an Inside Bar Pattern indicating consolidation. The hourly Bollinger bands are also contracting, indicating that rangebound price action.

We believe that the Nifty is in the process of consolidation after a sharp runup and this consolidation form a floor for the next leg of upmove. Over the next few trading sessions, we expect the Nifty to consolidate in the range 19500 – 19300 and a dip towards the 19300 should be used as a buying opportunity.

Overall, the uptrend is intact, and we expect levels of 19500 and 19300– 19270 shall act as a crucial support zone while 19450 – 19500 shall act as a crucial resistance zone.

As far as Bank Nifty is concerned, the Index also witnessed subdued price action on the back of weakness in HDFC Bank. Overall, the Bank Nifty is in a consolidation mode after a sharp run up. The hourly momentum indicator has a negative crossover and negative divergence which indicates loss of momentum on the upside. Overall, the range of consolidation is likely to be 45000 - 45600.

Investors traded with caution due to absence of any cues from US markets which were shut on Tuesday. Also, the market was already in an overbought zone due to the recent upsurge and hence selective profit-taking was on the cards.

Technically, as long as the index is trading between 19320 -19435 the narrow range activity is likely to continue. For bulls, 19435 would be the immediate breakout level. Above which, the market could rally till 19500-19525. However, below 19320 the selling pressure is likely to accelerate and could slip till 19250-19200. Contra traders can take a long bet near 19200 with a strict 35 points stop loss.

Global worries along with moderation in Service PMI data briefly impacted the domestic market’s rally. Heightened trade tensions between the US and China, coupled with uncertainties surrounding the upcoming release of FOMC minutes, tested the risk appetite of global investors. However, the market's last-minute broad based recovery serves as a reaffirmation of investors' confidence in the Indian economy.

Markets remained range bound and ended almost unchanged, in continuation to Tuesday’s move. After the flat start, the Nifty oscillated in a narrow band and finally settled around the day’s high at 19398.50 levels. Meanwhile, a mixed trend across sectors kept the participants busy wherein FMCG and auto majors were in the limelight. Besides, a modest up move in the midcap and smallcap space added to the trading opportunities.

The last two days of move in the index shows that bulls are not in the mood to loosen their grip and we have more legs to this up move. As we are seeing rotational buying across sectors, traders should continue with a “buy on dips” approach while maintaining focus on stock selection.

Indian rupee closed 20 paise lower at 82.22 per dollar versus previous close of 82.02.

Market Close: Indian benchmark indices ended flat in the volatile session on July 5.

At close, the Sensex was down 33.01 points or 0.05% at 65,446.04, and the Nifty was up 9.50 points or 0.05% at 19,398.50. About 1929 shares advanced, 1481 shares declined, and 119 shares unchanged.

Top losers on the Nifty included Eicher Motors, HDFC, HDFC Bank, Tata Consumer Products and UPL, while gainers were Bajaj Auto, Divis Laboratories, Hero MotoCorp, Maruti Suzuki and HDFC Life.

On the sectoral front, Auto, FMCG, PSU Bank and Oil & Gas up 1 percent each, while some selling is seen in the banking names.

The BSE midcap and smallcap indices rose 0.7 percent each.

-Sell call, target Rs 2,708 per share

-Attractive price point could help hero gain share in the 250cc+ segment

-X440 launched, base model offers compelling proposition

-X440 should help hero reach 9 percent share in the 250cc+ motorcycle segment in FY25

-Multiple new premium launches lined up to capture market share

-Company is losing share in its core segments

Competitive intensity is increasing in 2-wheeler segment as well

Indian Rupee depreciated on weak tone in domestic markets and disappointing macroeconomic data from India. India’s services and composite PMI were weaker than forecast in June. A positive US Dollar and surge in crude oil prices also put downside pressure on Rupee. US Dollar gained on safe haven demand amid risk aversion and rising expectations of a hawkish US Federal Reserve monetary policy in July.

We expect Rupee to trade with a negative bias on strong Dollar amid risk aversion in global markets and higher crude oil prices. However, steady FII inflows may support Rupee at lower levels. Market participants may remain cautious ahead of FOMC minutes today which may provide cues on the US Federal Reserve’s rate hike path. We expect USDINR spot to trade in between 81.80 to 82.80 in the near term.

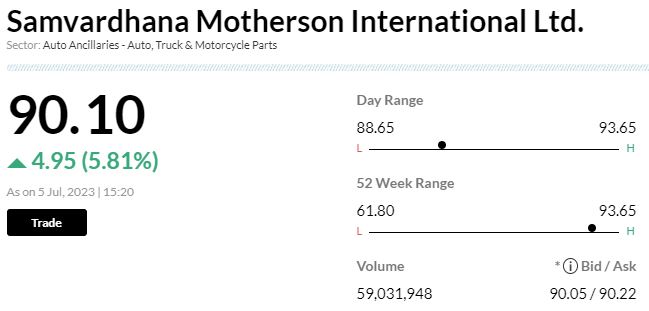

-Sell call, target Rs 65 per share

-Yachiyo acquisition is more significant compared with Prysm

-Yachiyo’s products complement company’s existing portfolio

-Yachiyo acquisition strengthen company’s customer base

-While acquisitions help in top line expansion, impact on returns is uncertain

-Cautious on SMRPBV’s margin trends going forward