After a six-day rally, the market seems to be losing its fizz as indices neared the key resistance levels, stoking caution ahead of the June quarter results. As of 11am, the Nifty traded down 10 points or 0.05 percent to 19,379.40. The Bank Nifty also fell 0.24 percent.

Analysts have noted that given the recent strong surge, indicators are entering an overbought territory, and prices are deviating significantly from the five-day exponential moving average (EMA), indicating the possibility of occasional dips or sideways consolidation in the short term.

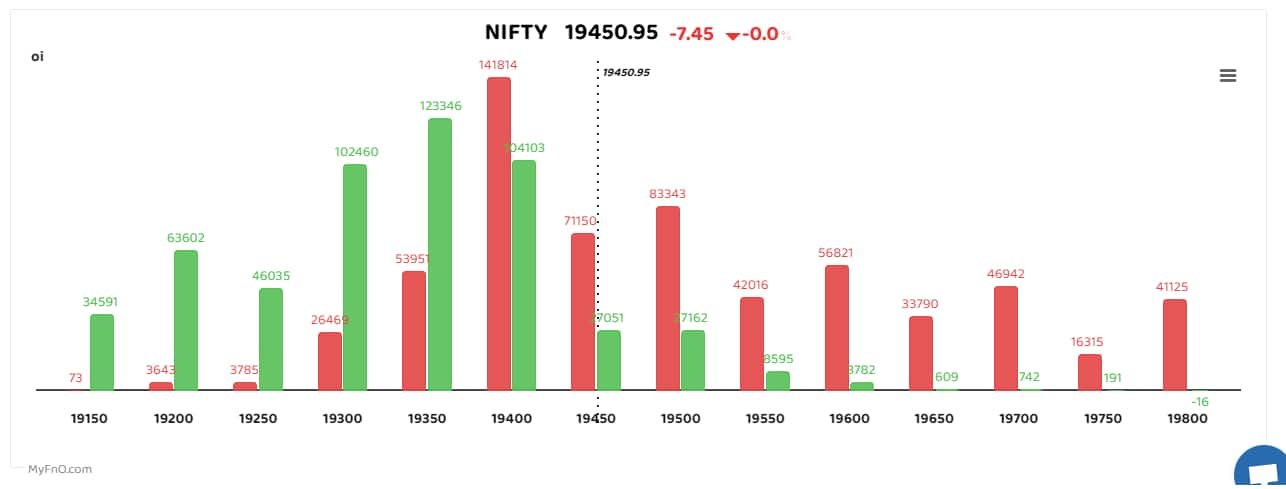

Option data also shows consolidation around 19,400, while 19,500 remains a key resistance for the Nifty. On the monthly option chain, 19,700 has also seen an accumulation of calls as this will become a resistance if 19,500 is taken out.

Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.

Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.

“It is advisable for traders to secure some profits and consider any dip as a buying opportunity. The support levels to watch are the bullish gap left on Monday around 19,200–19,250, followed by strong support at the psychological level of 19,000,” said Sameet Chavan, Head of Research for Technical and Derivatives at Angel One.

“On the upside, the immediate resistance is at 19,500–19,540 in the uncharted zone. As we anticipate a consolidation phase in the key indices, it would be prudent to shift focus towards thematic approaches and specific stocks that offer better performance opportunities.”

Among individual stocks, long trades were seen in Samvardhana Motherson, RBL Bank and Colgate Palmolive. Bandhan Bank, Dixon Tech and Godrej Consumer Properties saw short buildup.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.