Siemens gained the spotlight in December, winning a huge Rs 26,000-crore order from Indian Railways, and the contract for the same was signed on Monday, January 16.

The news took the company’s share 4 percent higher intraday on Monday but quickly came off its day’s high as some profit booking crept in. At 11:52 am on Tuesday, shares of the company were trading at Rs 2949.9, up 0.2 percent on the BSE.

In the past three months, the stock has risen 7 percent, and 85 percent in the past three years.

The railways order is for 1,200 locomotives of 9,000 horsepower (HP), marking the single largest locomotive order in the history of Siemens Mobility, the transport solutions arm, and the single largest order in the history of Siemens in India. The company will design, manufacture, commission and test the locomotives.

“The contract has a total value of Rs 26,000 crore (approximately), excluding taxes and price variation,” the company said in an exchange filing.

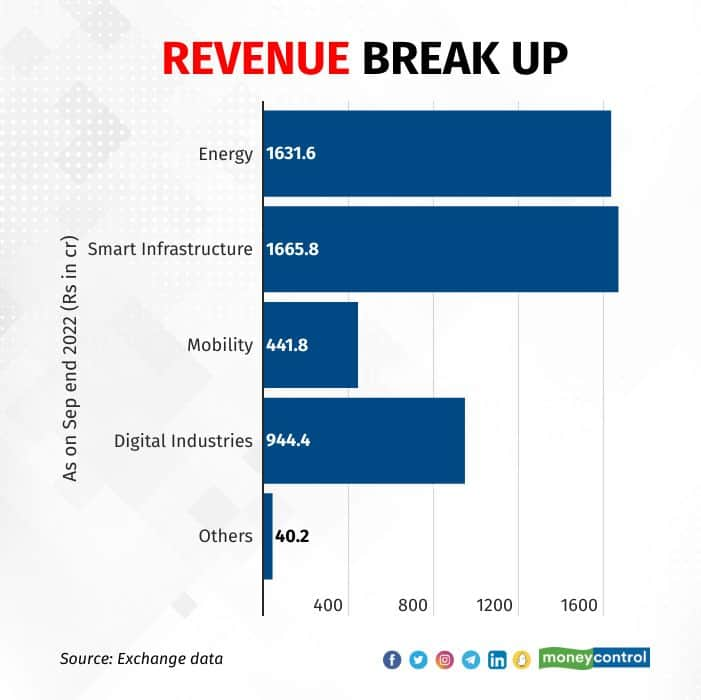

At the end of the September quarter, the company’s total order book stood at Rs 17,183 crore.

Deliveries are planned over an 11-year period, and the contract includes 35 years of full-service maintenance, Siemens said.

Read here | Large-caps rule near-term strategy, but long-term belongs to mid-caps, small-caps

The locomotives will be assembled in the Indian Railways factory in Dahod, Gujarat, and maintenance will be performed in four Indian Railways depots in Visakhapatnam, Raipur, Kharagpur and Pune.

“A ballpark calculation assuming 50 percent revenue from manufacturing and 50 from O&M keeping in mind a delivery period of 7-8 years shows that this order win could add an incremental revenue of 10-15 percent every year after FY25,” said Amit Anwani, research analyst at Prabhudas Lilladher.

Most sector experts believe that this order win will only help the company’s revenue from FY26 onwards. Moreover, sales figures will definitely get a leg up but more importantly, what this order win gives is revenue visibility over the long run.

“Even as this order is quite large, it will be executed over a period of 10-11 years, which means the annual impact of revenue will be fairly low but what this order win gives is revenue visibility and keeps the factories busy,” said an analyst from a foreign brokerage firm, who did not want to be identified.

This could also open a whole new range of opportunities for the company, including exports, potentially, but it’s early days yet and a lot depends on the execution of the order, said analysts.

Read here | Budget Snapshots | How does the Union Budget influence stock market behaviour?

Besides, a big order win from Indian Railways also raises the possibility of Siemens getting more of such big orders. The market buzz is that while detailing the upcoming Union budget, the government will increase its capital expenditure for the railways.

In the last budget, Finance Minister Nirmala Sitharaman laid out the plan of introducing 400 Vande Bharat trains in three years. The government is likely to unveil plans for another 400 new Vande Bharat trains in this year's budget.

Moreover, the National Rail Plan Vision 2030 has laid the roadmap for the railways to increase its share of freight gradually to 40-45 percent from the current 27 percent.

“As the railways is improving the infrastructure, steam locomotives are being upgraded to electric locomotives. Hence, the opportunity is quite big for electric locomotives going forward, and will benefit companies like Siemens,” said ICICI Securities.

Analysts believe that Siemens, a subsidiary of Siemens AG, is well-placed to gain from the overall energy market transformation from electrification to automation and digitisation.

The company’s product portfolio includes building technology, energy, railway signalling equipment, drive technology, financing, industrial automation, mobility, software and consumer products.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.