September 29, 2021 / 16:04 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Markets witnessed a highly volatile trading session, which was marked by weak global cues but benchmark Nifty once again took support near the 10 days SMA or 17600 and reversed sharply. After yesterday's sharp intraday fall, the index has formed an inside candle pattern which indicates indecisiveness between bulls and bears.

In the run-up to monthly F&O expiry, the market may continue with the narrow range activity. For day traders, 17800 -17850 would be the key resistance level, while 17625-17590 could act as strong support.

September 29, 2021 / 16:00 IST

Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities

Nifty continues to remain in a medium-term uptrend for targets of 18500 and above; expect positive activity to continue for the initial part of the October series.

Immediate support is seen at 17400 with buying on dips advisable. Select stocks in the Auto and BFSI space are showing positive buildup, while Metal stocks are expected to consolidate before any positive reversal.

September 29, 2021 / 15:56 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Domestic market started on a very negative trend due to global sell-off on Tuesday & high crude prices. Spiking US treasury yields and slowing economy were impacting growth stocks. During the day, European & Asian markets recovered and crude prices stabilized. Indian growth-oriented sectors like Energy, Metals and Pharma also recovered strongly but selling continued on other sectors like private sector banks & consumption.

September 29, 2021 / 15:51 IST

Sachin Gupta, AVP, Research at Choice Broking:

After a negative opening, the benchmark index recovered the maximum loss and settled above 17700 levels with a marginal loss of 0.2%, while Bank Nifty ended at 37743 levels with a loss of 202 points.

Technically, the index is hovering above the Middle Bollinger Band formation and also moving above 50-SMA, which indicates a bullish presence in the counter. Moreover, the index witnessed a positive crossover in Stochastic. At present, the Nifty has immediate support at 17500 while resistance lies at 17900/17950 levels.

September 29, 2021 / 15:46 IST

Ashis Biswas, Head of Technical Research at CapitalVia Global Research:

The market witnessed some positive movements after able to sustain the Nifty 50 Index level of 17600. It is going to be crucial for the short-term market scenario to sustain above the 17550-17600 support zone.

If the market is able to sustain the level of 17550-17600, market can witness higher levels of 18000. The technical indicator suggests, a volatile movement in the market in a small range between 17600-18000.

September 29, 2021 / 15:42 IST

S Ranganathan, Head of Research at LKP securities:

Markets were volatile for the second consecutive day with the street wary of inflation on the back of supply side disruptions and higher commodity prices. As China pulls back on the back of power shortages, export opportunities are seen opening up for several Indian companies with the PLI schemes providing the catalyst.

PSE index rose for the second consecutive day with power stocks hogging the limelight. As the gap between growth and value stocks widen, we are witnessing sector rotation in several pockets. Metals & PSU banks helped stage a recovery in afternoon trade.

September 29, 2021 / 15:35 IST

Market Close:

Benchmark indices ended lower for the second consecutive session on September 29 amid volatility.

At close, the Sensex was down 254.33 points or 0.43% at 59,413.27, and the Nifty was down 37.30 points or 0.21% at 17,711.30. About 1830 shares have advanced, 1371 shares declined, and 151 shares are unchanged.

HDFC, Kotak Mahindra Bank, Asian Paints, UltraTech Cement and HUL were among the major losers on the Nifty. Coal India, NTPC, Power Grid Corporation, Sun Pharma and IOC were among the gainers.

On the sectoral front, the power, metal, pharma and realty indices added 1-3.5 percent, while selling was seen in the auto, bank, capital goods, FMCG names. The BSE midcap and smallcap indices ended in the green.

September 29, 2021 / 15:26 IST

Mahesh Kumar, EVP & Head Capital & Commodities Market at Abans Group:

WTI Crude oil prices have retraced from yesterday's high of $76.67 and are now hanging around $74.66. Crude oil prices have risen dramatically from a low of $61.74 last month, owing to increased demand in the United States and Europe, as well as a tight supply situation in the Gulf of Mexico following a series of hurricanes.

Crude oil prices are expected to remain stable as long as they remain above important support levels of $71.78 per barrel and $70.55 per barrel on the 20-day and 50-day exponential moving averages, respectively. In the meanwhile, $76.56 and $77.83 are considered as imminent resistance levels.

September 29, 2021 / 15:24 IST

Piramal acquires DHFL by paying creditors Rs 38,000 crore

Piramal Enterprises on September 29 announced that it has acquired Dewan Housing Finance Corporation (DHFL) by paying the latter's creditors Rs 38,000 crore.

This includes Rs 34,250 crore to be paid by Piramal Capital and Housing Finance (PCHFL) in cash and non-convertible debentures, and Rs 3,800 crore from the cash balance of DHFL.

Piramal Enterprises was quoting at Rs 2,643.35, down Rs 36.85, or 1.37 percent on the BSE.

September 29, 2021 / 15:17 IST

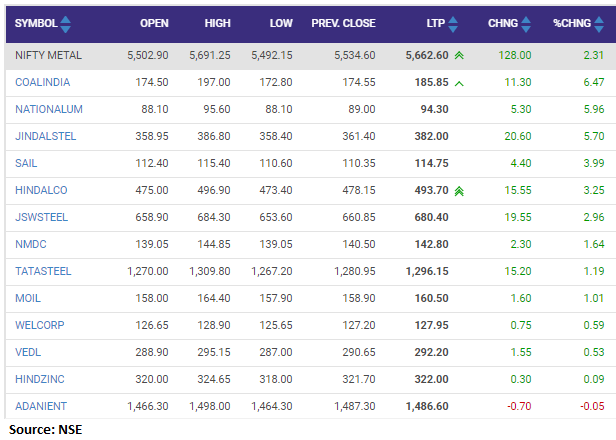

Nifty Metal index added over 2 percent supported by the Coal India, NALCO, Jindal Steel

September 29, 2021 / 15:02 IST

Market at 3 PM

Benchmark indices were trading with marginal losses with Nifty above 17700.

The Sensex was down 198.23 points or 0.33% at 59469.37, and the Nifty was down 25.40 points or 0.14% at 17723.20. About 1806 shares have advanced, 1222 shares declined, and 115 shares are unchanged.

September 29, 2021 / 14:53 IST

Click to View more

Around 200 stocks touched their 52 week highs during the day on the BSE including Coal India, Titan, Godrej Properties, Sun Pharma, NTPC, Power Grid.

September 29, 2021 / 14:41 IST

Aditya Birla Sun Life AMC IPO subscribed 34% on first day of bidding

The public issue of Aditya Birla Sun Life AMC, ranked as the largest non-bank affiliated AMC in India by QAAUM, is subscribed 34 percent on September 29, the first day of bidding. The bidding for the issue will continue for three days till October 1.

Retail investors have put in bids for 70 percent of their reserved portion and shareholders of Aditya Birla Capital have bought 21 percent shares of total portion reserved for them. Of the issue size, 19.44 lakh shares are reserved for shareholders. Click to Read More