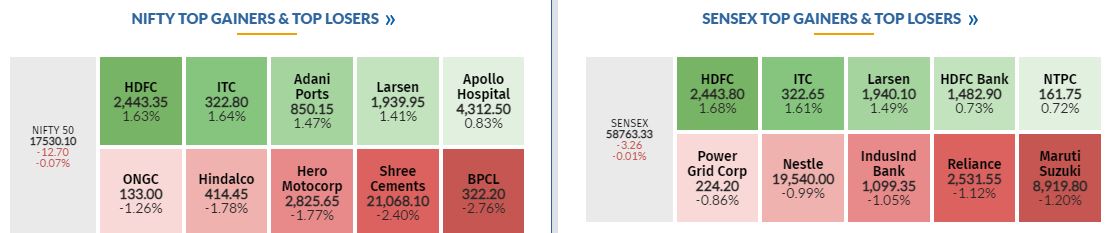

After a volatile action for the week gone by, the Nifty posted a negative close on the weekly chart. The price action for the last 2-3 weeks shows that the index is in a short term consolidation phase. It is witnessing sideways action below a crucial falling trendline. The daily Bollinger Bands have started contraction, which suggests that the consolidation is likely to continue going ahead.

In terms of the price patterns, the Nifty has formed a Double Inside bar on the daily chart. Developments on the lower time frame indicate that the Nifty is gearing up for a down move within this short term consolidation. With the next move down, the index can test 17200 on the downside. On the higher side, 17700-17780 is acting as a key resistance zone