September 02, 2021 / 16:14 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets regained momentum after a minor pause in yesterday’s session and closed higher by nearly a percent. The benchmark opened in the green and gradually inched higher as the day progressed led by a surge in FMCG, IT and realty stocks. Finally, the Nifty ended near day’s high at 17,234 levels, up by 0.9%. On the sector front, except for auto and PSU banks, all the other indices posted gains. The broader markets too traded in line with the benchmark.

We’re seeing buying on every dip across sectors which shows that the bulls are in control. Besides the supportive global cues, the recent positives from the domestic front viz. the pace of the vaccination drive and further reopening by the states are fuelling the momentum. We’re now eyeing 17,500 in Nifty. Amid all, we reiterate our positive yet cautious stance and suggest focusing on accumulating quality stocks on dips.

September 02, 2021 / 16:11 IST

Shrikant Chouhan, Executive Vice President, Equity Technical Research, Kotak Securities:

Markets were back in action after yesterday's small correction and benchmark Nifty found support near 17050 level. After a muted opening the index successfully cleared the intraday resistance of 17150 and is comfortably trading above the same which is largely positive.

The intraday rally indicates further uptrend from the current levels but the market has formed a double top kind of formation. For the trend following traders, 17150 would be the key support level, and above the same the uptrend structure could continue up to 17300-17350 levels. On the flip side, if the Nifty slips below 17150, it may trigger a quick intraday correction till 17100-17075 levels.

September 02, 2021 / 15:48 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Domestic indices nudged higher tracking cues from positive economic data, FII buying and mixed global markets ahead of the release of US job data. Economic data is nudging the performance of core sectors like capital goods & industrials while the recent high performance of the market is also tempting investors to shift to safer defensive sectors. All major sectors followed the market trend while the auto sector lost ground due to weak sales.

September 02, 2021 / 15:46 IST

Ashis Biswas, Head of Technical Research at CapitalVia Global Research:

The market witnessed the continuation of a positive trend, after sustaining above the level of 17100. If the market sustains above the level of 17200-17250, it is expected that the market to gain momentum, leading to an upside projection till 17400-17450 level.

The momentum indicators like RSI and MACD to stay positive and market breadth to improve, further strengthening a short-term bullish outlook.

September 02, 2021 / 15:42 IST

Rohit Singre, Senior Technical Analyst at LKP Securities:

Index again showed positive move and closed a day at 17233 with gains of nearly one percent forming a bullish candle on the daily chart. The index has shifted its support to 17,175-17,050 zone and if managed to hold above-said levels, we may see more northward moment in coming sessions. Also dips around said levels will be again fresh buying opportunity and if failed to hold then we may see good profit booking still make or break level is at 17k mark, on the higher side strong hurdle is coming near 17300-17350 zone.

September 02, 2021 / 15:39 IST

S Ranganathan, Head of Research at LKP securities:

Bulls took complete control today as indices rose by almost a percentage to hit record highs on the back of IT, Cement & FMCG biggies. The broader markets were buzzing as the formalisation of the economy is enabling organised branded players to gain share. High-Frequency indicators are pointing towards an uptick in rail freight, consumer durables and appliances ahead of the festive season.

September 02, 2021 / 15:37 IST

Market Close:

Benchmark indices ended higher with Nifty closing above 17200 led by IT and FMCG stocks.

At close, the Sensex was up 514.33 points or 0.90% at 57852.54, and the Nifty was up 157.90 points or 0.92% at 17234.20. About 1933 shares have advanced, 1187 shares declined, and 143 shares are unchanged.

Shree Cements, HDFC Life, Cipla, TCS and HUL were the top Nifty gainers. M&M, Coal India, Bajaj Auto, ONGC and Divis Labs were among the top losers.

Except auto and PSU Bank, all other sectoral indices ended in the green with IT and Pharma indices up 1 percent each. BSE midcap and smallcap indices gained over 0.5 percent each.

September 02, 2021 / 15:29 IST

Ami Organics IPO issue oversubscribed 3.27 times on Day 2

The public offer of Ami Organics, the specialty chemical company, witnessed a strong demand from investors as it was oversubscribed by 3.27 times on September 2, the second day of bidding.

The offer has received bids for 2.13 crore equity shares against the IPO size of 65.42 lakh equity shares, subscription data available on the exchanges showed.

The response from retail investors to the issue remained strong as they have put in bids 5.35 times their reserved portion. A part set aside for non-institutional investors was subscribed 90 percent and that of qualified institutional buyers saw 1.39 times subscription.

September 02, 2021 / 15:27 IST

Vijaya Diagnostic Centre IPO issue subscribed 42% on day 2:

The IPO of Vijaya Diagnostic Centre, one of the largest integrated diagnostic chain in South India, has so far received muted response from investors as it was subscribed 42 percent on September 2, the second day of bidding.

The public issue has received bids for 1.06 crore equity shares against offer size of 2.50 crore equity shares, the subscription data available on the exchanges showed.

Retail investors have put in bids for 68 percent of their reserved portion and that of employees 44 percent of their portion. A part set aside for qualified institutional buyers was subscribed 26 percent and that of non-institutional investors 4 percent

September 02, 2021 / 15:25 IST

Buzzing

Mahindra and Mahindra (M&M) share price slipped more than 2 percent intraday on September 2 amid ‘No Production Days’ in its automotive division plants in September 2021 due to shortages in the supply of

The company said that its automotive division continues to face supply shortages of semiconductors, which has got further accentuated due to Covid lockdowns in some parts of the world.

Consequently, the company will be observing ‘No Production Days’ for around 7 days which is estimated to result in a reduction in production volumes of the automotive division by 20-25 percent, the company said in its press release.

September 02, 2021 / 15:21 IST

click for more

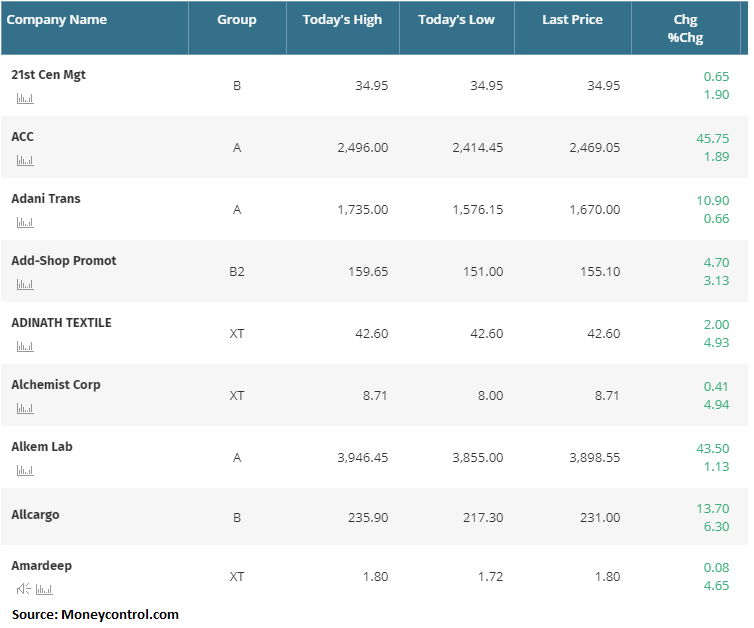

Here are the list stocks that have touched their 52 week highs during the day;

September 02, 2021 / 15:15 IST

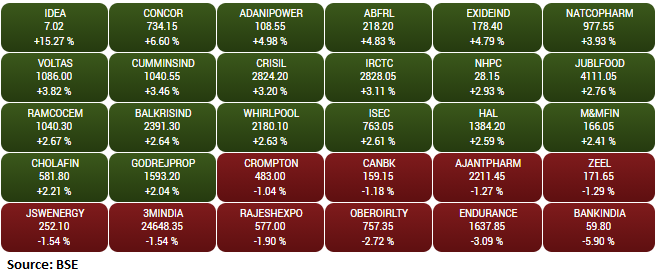

BSE Midcap index gained nearly 1 percent supported by the Vodafone Idea, CONCOR, Adani Power:

September 02, 2021 / 15:09 IST

Euro near 1-mth peak versus dollar

The euro held near a one-month high versus the dollar and a six-week peak to the pound, supported by hawkish comments from ECB policymakers after data showed inflation at a decade high and amid signs the Fed is not hurrying to tighten policy.