Taking Stock: Market Snaps 3-day Losing Streak; Sensex Gains 831 Points, Nifty Ends Above 17,900

More than 150 stocks, including Arvind, Sun TV Network and Escorts, hit a 52-week high on the BSE... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 84,587.01 | -313.70 | -0.37% |

| Nifty 50 | 25,884.80 | -74.70 | -0.29% |

| Nifty Bank | 58,820.30 | -15.05 | -0.03% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Hindalco | 789.35 | 14.70 | +1.90% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Adani Enterpris | 2,332.90 | -66.30 | -2.76% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8486.50 | 120.75 | +1.44% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 36826.90 | -211.00 | -0.57% |

Markets witnessed a rebound and gained nearly one and a half percent, taking a breather after the recent fall. Upbeat global cues triggered a firm start however profit taking at the higher levels capped the upside. However, the news of GST collection reaching closer to record high fueled fresh momentum in the latter half, which further strengthened with recovery in select index majors.

Finally, Nifty closed around the day’s high to settle at 17,929 levels. Mostly sectoral indices participated in the move wherein metal, realty and IT were among the top gains.

In line with the move, the market breadth was also inclined towards the advancing side.

We feel it’s a rebound and the bias would change if Nifty manages to cross and hold above 18,100. Meanwhile, participants should continue with the cautious approach and do not jump into a trade. The upcoming US Fed meet and earnings will dictate the trend ahead.

The USDINR spot closed flat at 74.86 as heavy FPI flows into the IPOs was offset by rising US Dollar Index and suspected RBI intervention.

USDINR is expected to remain rangebound in a holiday-shortened week. However, bias will be down due to the rise in equity markets and primary market inflows. We expect a range of 74.70-75.20 on spot over the near term.

The Nifty witnessed a sharp bounce today post a short term decline in the last couple of weeks. The hourly chart shows that the index had formed a base triangle on October 29. The pattern broke out on the upside today & the Nifty witnessed follow through on the upside.

The hourly momentum indicators that were pushed into the oversold zone assisted the pullback. Consequently, the Nifty is now heading towards the 18000 mark, which is a key level to watch out for.

If the bulls manage to cross that level on a closing basis then the short term range will again shift higher.

Beyond 18000, a falling trendline near 18180 will be the subsequent level to watch out for. On the downside, 17850-17800 will act as an immediate support zone.

Today's rally came as a major relief as bears had been gaining strength over the past few sessions. The recovery was also aided by favorable global market sentiment, which triggered frenzied buying here.

Benchmark Nifty opened with a gap up and in the late afternoon cleared the intraday resistance of 17800. Technically, the index has completed one leg of a pullback rally, and now 18000 and 18050 would act as a crucial resistance level. The index has formed a strong bullish candle but the key concern is it is still trading below 20 days SMA.

We are of the view that the intraday texture of the market is bullish but traders may prefer to take a cautious stance between 17975-18020 levels. As long as the index is trading above the level of 17800, the uptrend texture is intact. For bulls, the 17850-17800 level could be the strong support zone and below the same, the uptrend would be vulnerable.

Domestic indices bounced back on a positive footing from the recent sell-off, due to strong momentum in global markets, favourable domestic economic data and good Q2 results announcement.

India’s manufacturing PMI increased to 55.9 in October from 53.7 in September as output and new orders improved amid easing Covid restrictions.

The sustenance of the trend will depend on the views provided by Fed regarding the current easy money policy to be announced on Wednesday.

The Nifty has risen smartly to get past the 17900 level. If we can keep above this level for a couple of trading sessions, the uptrend should resume and take the index higher.

On the downside, 17550-17600 has become a good support for the markets and until that does not break on a closing basis, it is safe to assume that the trend continues to remain on the upside.

The market witnessed some swift recovery from the support levels of 17600. Our research suggests, a significant breakout above the levels of 18000 could result in improvement of market breadth and market can rally till the levels of 18250.

We retain our cautious stance and advise the traders to refrain from building a fresh buying position, until we see further improvement and market sustain above 18000.

The month began on a volatile note till the bulls wrested the initiative on the back of buoyant PMI data & GST collections for last month.

Despite the trends in e-way bills pointing towards higher GST collections in October ahead of festive demand, supply constraints in the automotive sector kept the street cautious.

: Benchmark indices ended higher with Nifty closing above 17900 supported by the rally in the metal, IT, realty stocks.

At close, the Sensex was up 831.53 points or 1.40% at 60,138.46, and the Nifty was up 258 points or 1.46% at 17,929.70. About 2099 shares have advanced, 1129 shares declined, and 186 shares are unchanged.

IndusInd Bank, Hindalco Industries, HCL Technologies, Bharti Airtel and Grasim Industries were among the major Nifty gainers. Losers included UPL, Bajaj Finserv, M&M and Nestle India.

All the sectoral indices ended in the green with metal, IT and realty indices up 2-3. BSE midcap and smallcap indices rose over 1 percent each.

Tata Motors said its total wholesales increased by 30 percent to 67,829 units in October as compared with the same period last year.

The company’s total dispatches in October 2020 stood at 52,132 units.

The company’s domestic sales increased by 31 percent to 65,151 units in October as compared to the same month last year.

The company had dispatched 49,669 units in October 2020.

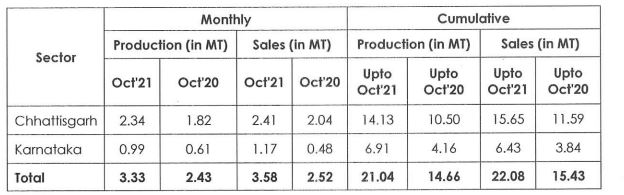

NMDC in the month of October reported total production at 3.33 mt versus 2.43 mt, a growth of 37%, YoY.

October sales were up 42% at 3.58 mt versus 2.52 mt, YoY.

NMDC was quoting at Rs 145.85, up Rs 2.80, or 1.96 percent.

NCC has received one new order for Rs 442 crore (exclusive of GST) in the month of October, 2021. This order pertains to Mining Division and is received from a State Government agency and does not include any internal order.

NCC was quoting at Rs 72.35, up Rs 1.10, or 1.54 percent.