November 28, 2022 / 16:32 IST

Shrikant chouhan, Head of equity research (retail), Kotak Securities:

The benchmark indices held the positive momentum, the nifty ends 50 points higher while the Sensex was up by 211 points. Among sectors, Oil and Gas and Energy indices rallied most whereas Metal stocks corrected sharply as a result Metal index shed over 1 percent.

On the backdrop of weak market conditions our market opened with a red but after early morning correction it bounce back sharply. Higher bottom formation on intraday charts indicating continuation of uptrend in the near future.

For the trend following traders now 18,400-18,350/62,200-62,000 would be the sacrosanct support zones. Above which the index may hit the fresh all time high or 18,605-18,650/62,750-63,000. On the flip side, below 18,350/62,000 uptrend would be vulnerable. Below the same, traders may prefer to exit out from the trading long positions.

November 28, 2022 / 16:27 IST

Ajit Mishra, VP - Technical Research, Religare Broking

Markets extended the prevailing trend and posted modest gains amid mixed cues. Weakness in the global markets triggered a weak start however the Nifty index recovered in no time and inched gradually higher as the session progressed. It finally made a new record high but profit taking in the last hour trimmed the gains. Consequently, it closed 18,562.70 levels; up by 0.3%. Meanwhile, the sectoral indices traded mixed wherein energy and auto were the top gainers while metal, IT and banking traded subdued.

We may see some consolidation in markets amid mixed global cues however the bias would remain on the positive side. Participants should utilise the phase to add quality names, especially from banking, IT and auto space. Besides, they may consider selective bets from the midcap and smallcap citing the recent participation.

November 28, 2022 / 16:21 IST

Mohit Nigam, Fund Manager & Head - PMS, Hem Securities:

Benchmark Indices ended on a positive note after Nifty 50 scaled an all-time high of 18,614.25 in spot markets. Nifty 50 closed +0.27% and Sensex closed +0.34% up today.

Good buying was witnessed in Tyres, Auto and Defence counters while the Bank Nifty saw some profit taking. Oil marketing companies showed gains on account of fall in crude prices. BPCL and Reliance were top gainers while Hindalco and JSW Steel were top losers in Nifty 50 today.

Overall domestic markets are moving from strength to strength amid global macro concerns and we believe that Indian markets can continue to outperform global indices backed by strong corporate earnings and healthy demand. Currently IT, Auto and banking sector look well poised to us.

On the technical front, immediate support and resistance in Nifty50 are 18,450 and 18,650 respectively. Immediate support and resistance in Bank Nifty are 42,500 and 43,350 respectively.

November 28, 2022 / 16:09 IST

Vinod Nair, Head of Research at Geojit Financial Services.

Despite unfavourable global cues, the domestic market reversed its early losses to trade at record highs. Following the decline in oil prices, oil & gas stocks led the rally in anticipation of margin gains, as ongoing protests in China fuelled demand concerns.

Going ahead, global markets will depend on Powell’s speech on Wednesday, which is crucial in maintaining the momentum, as the market seems to have factored in a moderation in the pace of rate hike.

November 28, 2022 / 16:02 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty opened gap down today, only to attract buying support at lower levels. The index opened right into the support zone of the key hourly moving averages from where the index recovered swiftly.

It went on to cross the all-time high of 18,604 & registered a new high of 18,614.

Structurally, the index is forming extension on the upside. Thus the zone of 18,400-18,360 will continue to act as a crucial support area.

As long as the index stays above this zone, it can stay on the upward trajectory from a short term perspective. Subsequent targets on the upside will be 18,700 & 19,000.

November 28, 2022 / 15:59 IST

Lakshmi Iyer, CEO- Investment Advisory, Kotak Investment Advisors

Sentiment and flows currently are acting as a strong catalyst for the markets which touched an all-time high. We are seeing domestic as also foreign investors being net buyers of equity aiding the momentum.

Here on one needs to be balanced as most of the positives are in the prices for now. Incremental allocations to equities could be done in a staggered manner as opposed to lump sum investments.

November 28, 2022 / 15:49 IST

Hemant Kanawala, Executive Vice President & Head Equity, Kotak Mahindra Life Insurance Company

Although markets have touched new highs, the valuations have normalized over past one year as earnings have rolled forward. The prospects for Indian markets remain bright over medium term as structural growth drivers for Indian economy are intact and India’s macroeconomic parameters remain resilient against challenges in the global economy.

Meanwhile, equity investors should remain invested and increase equity allocation on correction.

November 28, 2022 / 15:48 IST

Srikanth Subramanian, CEO, Kotak Cherry

Indian markets are defying global weakness and touching all-time high. This is on back of renewed interest from FIIs as Indian decoupling story continues to play out. However, one must also realize that as we continue to see better growth rates than world, our valuations too are priced at those premiums.

Even long term investors at this point should not betray discipline. One should ideally avoid any extreme movements and stick to the core asset allocation that one has defined for oneself.

November 28, 2022 / 15:40 IST

Pankaj Pandey, Head – Research, ICICIdirect:

Nifty at life time high is a function of multiple factors such as resilient corporate earnings in Q2FY23, robust GST numbers (at 6 months high in October, 2022) and retail inflation slowing to a three-month low in October, 2022 at 6.77%, led by softening food and commodity prices.

Globally, US has also found comfort in its recently released lower than expected inflation readings with growing expectations of a decline in pace of interest rate hikes by Fed, amid already existing growth concerns.

Furthermore, with ~20% decline in crude prices in the last fortnight, further relief is likely in inflation, going ahead. We continue to remain constructive on the Indian equities. Over FY22-24E, Nifty earnings are seen growing at a CAGR of ~15%. Our 12- month forward Nifty target is at 20,000 (i.e. 21x PE on FY24E) with corresponding Sensex target of 66,600.

As structural bets, we like the banking space, capex linked capital goods, domestic consumption plays including autos.

November 28, 2022 / 15:36 IST

Rupee Close:

Indian rupee closed flat at 81.66 per dollar against previous close of 81.68.

November 28, 2022 / 15:30 IST

Market Close:

Indian benchmark indices ended on positive note on November 28 with Sensex, Nifty finishing at record closing levels.

At Close, the Sensex was up 211.16 points or 0.34% at 62,504.80, and the Nifty was up 50 points or 0.27% at 18,562.80. About 2024 shares have advanced, 1458 shares declined, and 185 shares are unchanged.

BPCL, Reliance Industries, Hero MotoCorp, Tata Consumer Products and SBI Life Insurance were among the top Nifty gainers, while losers included Hindalco Industries, JSW Steel, Apollo Hospitals, Tata Steel and Bharti Airtel.

Except metal, all other sectoral indices ended in the green with oil & gas up 1.5 percent.

BSE Midcap and Smallcap indices added 0.7 percent each.

November 28, 2022 / 15:28 IST

Macquarie initiates with underperform rating on Container Corporation of India

-Initiate with underperform rating, target at Rs 620 per share

-Delayed completion of freight corridor to JNPT will impact volume growth

-Market share loss & pricing pressures would offset DFC gains in near term

-Divestment of government’s stake will be key catalyst

Container Corporation of India was quoting at Rs 764.85, up Rs 2.40, or 0.31 percent.

November 28, 2022 / 15:21 IST

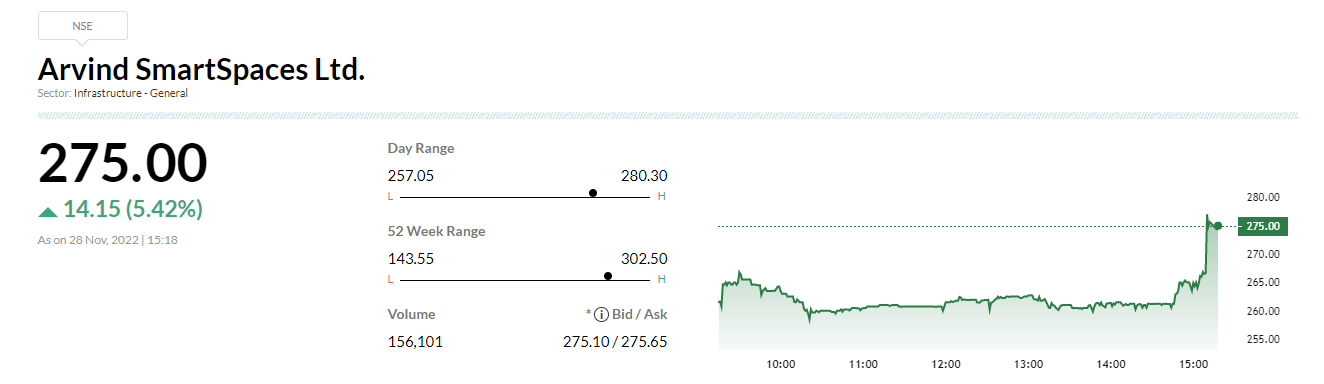

Arvind SmartSpaces sells entire 1st phase of Arvind Greatlands in 10 hours

Arvind SmartSpaces announced that it’s 100% wholly owned subsidiary Arvind Homes Pvt. Ltd. sold the entire 1st phase of its residential plotting project, Arvind Greatlands in Devanahalli, Bengaluru on November 26, 2022.

The first phase, comprising of 400 plots with a saleable area of ~0.57 million sq. ft. amounting to a booking value of more than Rs 200 crore, was sold out in 10 hours, it said.