November 30, 2022 / 16:29 IST

Ajit Mishra, VP - Technical Research, Religare Broking

Markets managed to inch higher and gained nearly a percent, in continuation of the prevailing trend. After the initial uptick, the Nifty index oscillated in a narrow band for most of the session however a sharp surge in the index majors in the last half an hour helped the index to surpass the hurdle at 18,700 and close around the day’s high at 18,758.35 levels.

Meanwhile, a mixed trend on the sectoral front kept the participants busy wherein metal, realty, and auto traded upbeat while banking and IT consolidated further. The broader indices too participated in the move and gained in the range of 0.7-1.3%.

The rotational buying across sectors is fuelling the recent surge while the global markets are not offering any clear signal. We’re now eyeing a new milestone of the 19,000 mark in Nifty. Participants should keep a close watch on themes/sectors which are gaining traction and place their bets accordingly.

November 30, 2022 / 16:22 IST

Mohit Nigam, Fund Manager & Head - PMS, Hem Securities:

Benchmark Indices ended in the green today after Nifty 50 scaled an all-time high of 18,816 in spot markets. Nifty50 closed +0.75% and Sensex closed +0.67% up today.

Good buying was witnessed in Metals and Mid cap IT stocks. The street cheered real estate stocks today.

M&M and Hindalco were top gainers today while IndusInd Bank and SBI were top losers in Nifty 50 today. Among the Nifty 50 stocks, 42 advanced while 8 declined.

The market is showing strength and has more legs as the mid-cap space might play catch up rally. The market is well positioned ahead of Jereme Powell's speech today and is expecting some softness in his stance.

On the technical front, immediate support and resistance in Nifty50 are 18,500 and 18,850, respectively. Immediate support and resistance in Bank Nifty are 42,750 and 43,450 respectively.

November 30, 2022 / 16:19 IST

Kunal Shah, Senior Technical Analyst at LKP Securities:

The Bank Nifty index continued to trade in a narrow range between 43,000-43,500 where both the bulls and the bears are sitting on the lines.

The undertone remains bullish and one should keep a buy-on-dip approach as long as it maintains the support of 42,800 on the downside.

The index on the upside to resume the momentum must surpass the hurdle of 43,500 on a closing basis.

November 30, 2022 / 16:18 IST

Shrikant chouhan, Head of Equity Research (Retail), Kotak Securities

Sentiment turned extremely bullish towards the closing stages, as renewed foreign institutional buying propelled both the benchmark indices to scale fresh highs. Also, strong European markets opening further bolstered investors' sentiment ahead of the Q2 GDP data announcement.

India is currently seen as a green shoot in an otherwise weak global economic scenario because of its strong macroeconomic performance in recent months. Technically, the Nifty holds the uptrend continuation formation and has also formed a long bullish candle on daily charts which is broadly positive.

However, intraday texture is mildly overbought hence we could expect some profit booking at higher levels.

For the trend following traders, 18,650 would be the trend decider level, above which the index could move up to 18,900-18,950. However, traders may prefer to exit from their long positions if the index trades below 18,650 and could slip till 18,600-18,550.

November 30, 2022 / 16:12 IST

Rupee Close:

Indian rupee closed 30 paise higher at 81.42 per dollar against previous close of 81. 72.

November 30, 2022 / 15:54 IST

Santosh Meena, Head of Research, Swastika Investmart

Indian equity markets are cheering at their all-time highs, snubbing the volatility of global markets. The broader market is also trying to catch up momentum as Nifty midcap and smallcap indices are still well below this all-time highs.

The beauty of the current rally is that the market is finding support from new sectors every day. In the second half of 2022, there is a clear trend of outperformance of Indian equity markets. This trend is likely to continue despite the fact that we are trading at expensive valuations compared to most of our global peers, as our fundamentals are strong and we have strong support from domestic money.

The market will react to Jerome Powell's speech tomorrow, and auto sales figures will cause stock-specific movements. The market's attention will then shift to the Gujarat election and RBI policy.

Globally, news flow from China may continue to cause volatility, while the movement of the dollar index, US bond yields, and crude oil prices will be other important factors. The only concern is that the market is overbought, which may lead to some pullback or consolidation at higher levels, but there are no major signs of weakness. Technically, Nifty has immediate targets of 18,888 and 19,000, while on the downside, 18,700 and 18,500 will act as strong support levels.

November 30, 2022 / 15:54 IST

Ajit Mishra, VP - Technical Research, Religare Broking

Markets managed to inch higher and gained nearly a percent, in continuation of the prevailing trend. After the initial uptick, the Nifty index oscillated in a narrow band for most of the session however a sharp surge in the index majors in the last half an hour helped the index to surpass the hurdle at 18,700 and close around the day’s high at 18,758.35 levels.Meanwhile, a mixed trend on the sectoral front kept the participants busy wherein metal, realty,and auto traded upbeat while banking and IT consolidated further. The broader indices too participated in the move and gained in the range of 0.7-1.3%.

The rotational buying across sectors is fuelling the recent surge while the global markets are not offering any clear signal. We’re now eyeing a new milestone of the 19,000 mark in Nifty. Participants should keep a close watch on themes/sectors which are gaining traction and place their bets accordingly.

November 30, 2022 / 15:50 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty, after a brief consolidation near 18600-18700 in the last couple of sessions, surpassed the barrier of 18700 towards the end of the session today. The index witnessed fresh momentum build up as it crossed that hurdle of 18700. The hourly & the daily upper Bollinger Bands expanded along with the price action, which assisted the bulls today. Thus, the Nifty is set to test 19000 on the upside. On the downside, 18700-18600 has now become a short term base for the Nifty. Reversal for the short term bullish stance can be trailed below this support zone.

November 30, 2022 / 15:49 IST

Vinod Nair, Head of Research, Geojit Financial Services

Domestic market continued its quest for gains, boosted by FII inflows. However, markets will be sensitive to the Fed Chair’s remarks later in the day, as investors are expecting a moderation in the pace of rate hikes. An in-line comment will help to sustain the rally while loosening COVID-19 restrictions in China is providing relief to global markets.

November 30, 2022 / 15:30 IST

Market Close

: Indian benchmark indices ended higher for the seventh consecutive session on November 30.

At Close, the Sensex was up 417.81 points or 0.67% at 63,099.65, and the Nifty was up 140.30 points or 0.75% at 18,758.30. About 1992 shares have advanced, 1395 shares declined, and 104 shares are unchanged.

M&M, Hindalco Industries, Grasim Industries, Bajaj Auto and UltraTech Cement were among the top Nifty gainers. The losers included IndusInd Bank, SBI, HCL Technologies, ITC and Sun Pharma.

Except PSU bank, all other sectoral indices ended in the green.

BSE midcap index rose 1 percent and smallcap index added 0.6 percent.

November 30, 2022 / 15:21 IST

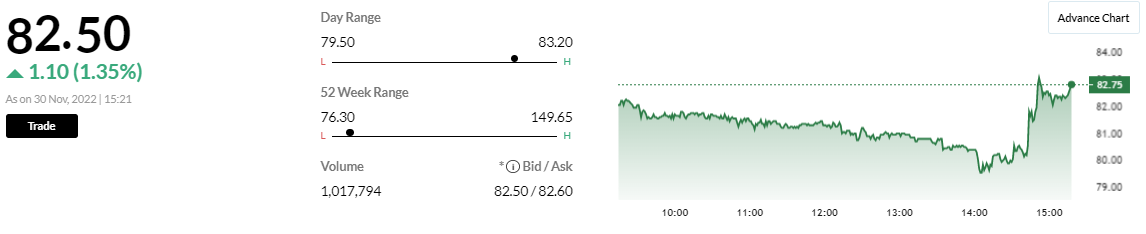

Manali Petrochem buys European co Penn Globe at GBP 21 million EV to expand product line and strengthen R&D

Penn-White Limited is a manufacturer of foam control agents and similar chemical products including lubricants, surface coatings, release agents and silicone emulsions. Pennwhite Print Solutions is a manufacturer of a range of high performance silicone emulsions, anti-statics and consumables developed specifically for the needs of commercial printers.

November 30, 2022 / 15:19 IST

Sensex, Nifty at new highs: How different is this uptrend from the last peak?

November 30, 2022 / 15:17 IST

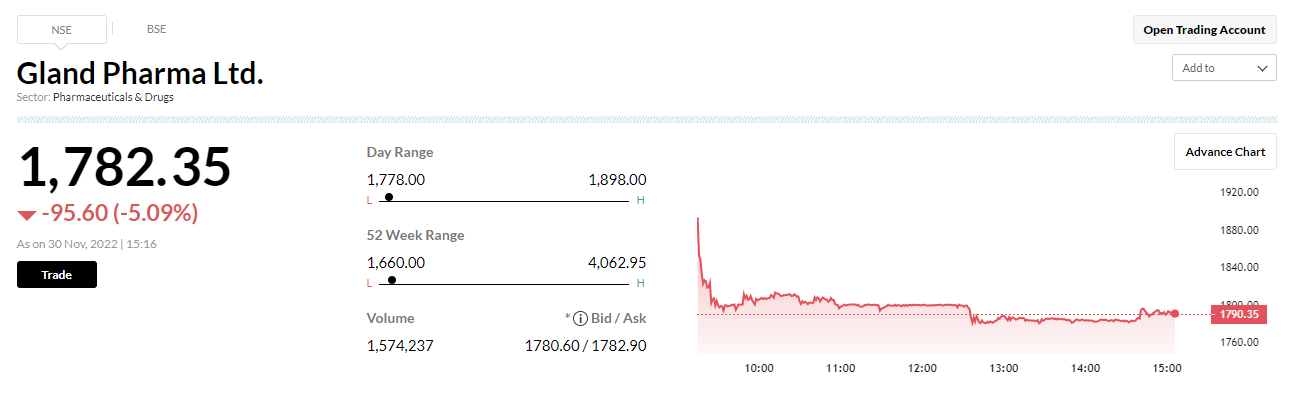

Goldman Sachs keeps buy on Gland Pharma, target at Rs 2,530

-Buy call, target at Rs 2,530 per share

-Pick-up in RoW & India sales as supply constraints ease off

-See an improvement in us/core markets to double-digit growth

-Increasing production capacities/utilisations at its key facilities