Taking Stock: Market snaps 4-day run; Nifty around 18,550, Sensex falls 347 pts

Except, Information Technology, realty and healthcare, all other sectoral indices ended in the red.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 83,216.28 | -94.73 | -0.11% |

| Nifty 50 | 25,492.30 | -17.40 | -0.07% |

| Nifty Bank | 57,876.80 | 322.55 | +0.56% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Shriram Finance | 816.35 | 23.85 | +3.01% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Bharti Airtel | 2,001.20 | -93.70 | -4.47% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10426.80 | 144.90 | +1.41% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Infra | 9393.60 | -95.20 | -1.00% |

The Bank Nifty index experienced selling pressure from bears during the first half of the trading session. However, buying activity was witnessed in the last hour of trading, driven by MSCI index rebalancing.

The index has support at 43500, indicating a level where buyers have shown interest and the potential for a bounce-back. On the other hand, resistance is seen at 44500, which is a significant level where both put and call writing is visible. This suggests that there may be a considerable number of traders with bearish and bullish expectations around this price level

The Nifty index experienced a decline as selling pressure emerged at higher levels. At the lower end, there was a previous congestion high. The current trend is expected to remain sideways to positive unless the index falls below the 18500 level. On the higher end, there is resistance at 18650. However, if the index decisively falls below 18500, it may trigger additional selling pressure.

Nifty and Banknifty opened on a weak basis which increased as the day progressed. The anticipation of MSCI rebalancing kept the market participants apprehensive, which was evident in muted trading throughout the day. The last half hour brought some relief to the markets, especially Banknifty which gained about 300 points from the low point of the day. Banknifty’s move is important because it has bounced strongly from an important ichimoku support area of 43700-43800 which if sustained can result in a move towards 45000.

Nifty also attempted a retest of the previous swing break area of 18460 and witnessed a smart bounce above 18500 implying it can resume its uptrend towards 18700 levels till it doesn’t close below 18450.

Markets witnessed profit taking and shed over half a percent, tracking mixed cues. After the initial downtick, the Nifty index traded with a negative bias for most of the session however a marginal rebound in the final hours trimmed some losses and it finally settled at 18,534.40 levels. Pressure in the energy, banking and metal pack was weighing on the sentiment while pharma and realty showed resilience and ended higher. Amid all, the broader indices showed noticeable strength and gained in the range of 0.4%-1%.

Global headwinds, especially from the US markets, are causing intermediate volatility however the positional up trend is still intact. Considering the scenario, it is prudent to focus on position management while maintaining a positive bias.

Profit-taking was overdue for sometime and investors offloaded their holdings in metals, realty and energy stocks on the back of weak Asian and European market cues. Traders also decided to keep a low profile ahead of the likely decision on the US debt agreement over raising the debt ceiling, as the outcome would provide some hint to the markets over the near-term direction.

Technically, on daily charts the Nifty has formed a reversal formation which is largely negative. However, after an intraday sell off the index took support near 18480 and bounced back sharply. As long as the market is holding 18480, the positive sentiment is likely to continue and above the same, the market could move up till 18600-18650. On the flip side, a fresh sell off is likely only after the dismissal of 18480. Below which, the index could slip till 18400-18375.

The Nifty opened on a weak note and traded with a negative bias throughout the day ultimately closing the day down ~100 points. On the daily charts, we can observe that the Nifty has filled the gap area 18500 – 18580 formed on 29th May and held on to that support zone.

We believe that the Nifty is in the process of retesting the breakout it provided last week from the zone of 18000 – 18400. The hourly momentum indicator has reached the equilibrium line indicating that the consolidation may have matured, and it can start a new cycle on the upside.

Overall, we continue to maintain our positive outlook on the index for a target of 18800 from a short-term perspective. In terms of levels, 18460 – 18400 shall act as the crucial support zone while the hurdle zone is placed at 18660 – 18700.

As indicated by multiple economic data points, the Indian economy is presently experiencing a robust recovery, leading to an upward trend in domestic equity markets. However, the rally is being hindered at times due to negative signals from global peers, as observed today.

Concerns about a recession and potential interest rate hikes in western markets are impacting the domestic market but it is nevertheless maintaining the outperformance.

The Indian rupee gained following month-end dollar inflows amid MSCI rebalancing and lower crude oil prices. Rupee outperformed among the regional Asian currencies which were traded lower following soft Chinese economic data.

The short-term trend for USDINR remains bullish as long as it trades above 82.30 while on the higher side, 82.90 remains the biggest hurdle to cross.

Indian rupee closed flat 82.72 per dollar against previous close of 82.72.

Benchmark indices ended lower on May 31 with Nifty around 18,550.

At close, the Sensex was down 346.89 points or 0.55% at 62,622.24, and the Nifty was down 99.40 points or 0.53% at 18,534.40. About 1679 shares advanced, 1733 shares declined, and 133 shares unchanged.

ONGC, Reliance Industries, Axis Bank, SBI and HDFC were among biggest losers on the Nifty, while gainers included Bharti Airtel, Kotak Mahindra Bank, Britannia Industries, Sun Pharma and SBI Life Insurance.

Except, Information Technology, realty and healthcare, all other sectoral indices ended in the red.

The BSE midcap and smallcap indices rose 0.5 percent each.

Crude oil prices edged lower on Wednesday with NYMEX WTI crude oil trading down by 0.95percentat USD 68.84 per barrel. Crude oil price extended loss in today’s session after price declined more than 4.0percentin the previous session as trades were concerned about weakening demand from top oil importer China after the release of weaker-than-estimated economic data. Chinses official manufacturing purchasing managers' index was 48.8 from 49.2 in April, indicating economic activity is losing momentum and which could hurt crude oil demand.

We expect crude oil prices can correct further after the price broke an important support level in the previous session. For the day, NYMEX WTI Crude oil has resistance at $71.8/$74.0 levels and finds supports at $67.80/ $66.0 levels. MCX Crude Oil June Future has supports at Rs 5680/5575 and resistances at Rs 5820/5934.

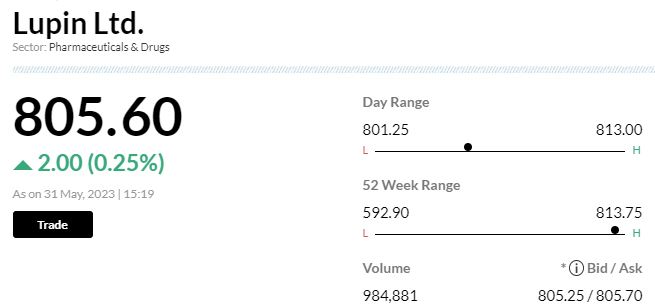

Lupin has received approval from the United States Food and Drug Administration (U.S. FDA) for its Abbreviated New Drug Application for Obeticholic Acid Tablets, 5 mg and 10 mg, a generic equivalent of Ocaliva Tablets, 5 mg and 10 mg, of Intercept Pharmaceuticals, Inc. This product will be manufactured at Lupin’s Nagpur facility in India.