March 24, 2022 / 16:35 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets traded dull and ended marginally lower citing mixed global cues. After the initial dip, the benchmark oscillated in a narrow range however mixed moves on the sectoral front kept the participants busy. Among the sectors, financials was the top loser followed by consumer durable however buying in IT, energy, pharma and metal capped the downside. The broader indices outperformed as both Midcap and Smallcap ended in the green.

All eyes are on the outcome of the NATO summit as it could provide the direction to the lingering Russia-Ukraine tension. Indications are in the favour of further consolidation in the index however the prevailing underperformance from the banking pack is denting sentiment. Among the sectors, IT, metal and pharma look strong to us, so participants should align their positions accordingly.

March 24, 2022 / 16:34 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas:

The Nifty witnessed swinging action on March 24 & ultimately posted a negative daily close. For the last few sessions, it is stuck in between the hourly Bollinger Bands, which are in contraction mode.

The Fibonacci retracement shows that the Nifty is finding it difficult to extend beyond the 61.8% retracement of Jan – March decline, which is near 17330.

On the downside, the junction of 40 DEMA & the 200 DMA, which is near 17000, is offering support to the index. Structurally, the Nifty is expected to witness sideways action near these parameters before starting the next leg up. Thus dips towards 17000 will continue to offer buying opportunities to the short term traders.

March 24, 2022 / 16:10 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Markets lingered in negative territory for major part of the trading session but trimmed losses at the end, as positive European markets opening aided partial recovery.

Global markets trend will continue to dictate sentiment as investors would not want to take bullish bets given the fragile situation globally.

The intraday formation indicates continuation of a range bound activity in the near term. For the bulls, 17325 could be the immediate hurdle and below the same a correction wave could continue up to 17100-17060. Above 17325, Nifty could go up to 17375-17425 levels. Contra traders can take a long bet near 17060 with a strict 17030 support stop loss.

March 24, 2022 / 16:10 IST

Shishir Baijal, Chairman & Managing Director, Knight Frank India:

The direct result for stamp duty waiver will be increased investor participation as this move provides greater flexibility to the investors for an elongated period.

The extension of sops of stamp duty on resale from 1 year to 3 years will allow investors longer hold period and realise better returns on their home investments. This will keep the secondary sales market buoyant and maintain the registration momentum.

March 24, 2022 / 15:36 IST

Narendra Solanki, Head- Equity Research (Fundamental), Anand Rathi Shares & Stock Brokers:

Indian markets opened mixed following mixed Asian market cues as investors took note of easing COVID measures which could help in economic recovery and also eye today's NATO summit focused on Ukraine.

During the afternoon session markets traded in red terrain as concerns about rising inflation and slower economic growth weighed traders’ mood.

The mood of the markets turned soured as concerns over the country’s bilateral trade emerging due to the ongoing Russia-Ukraine war which could lead to some kind of disruption in trade.

March 24, 2022 / 15:34 IST

Market Close:

Benchmark indices ended marginally lower in the volatile session on March 24.

At close, the Sensex was down 89.14 points or 0.15% at 57,595.68, and the Nifty was down 22.90 points or 0.13% at 17,222.80. About 1426 shares have advanced, 1888 shares declined, and 100 shares are unchanged.

Dr Reddy's Laboratories, Coal India, Hindalco Industries, UltraTech Cement and Tech Mahindra were among the top Nifty gainers, while losers were Kotak Mahindra Bank, Titan Company, HDFC Bank, ICICI Bank and HDFC.

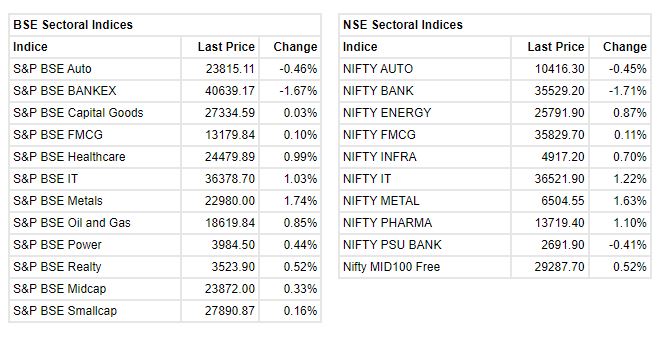

Among sectors, IT, oil & gas, metal and pharma indices rose 1 percent each, while bank index was down 1 percent. BSE midcap and smallcap indices ended marginally higher.

March 24, 2022 / 15:22 IST

Ruchi Soya FPO Updates:

The follow-on public offer of Patanjali Ayurved Group-controlled Ruchi Soya Industries was subscribed 9 percent, with investors putting in bids for 46.03 lakh equity shares against an offer size of 4.89 crore equity shares by noon on March 24, the first day of bidding.

The offer size was reduced from 6.6 crore shares to 4.89 crore as the FMCG company, backed by yoga guru Ramdev, mopped up Rs 1,290 crore from anchor investors a day earlier. The price band for the offer has been fixed at Rs 615-650 a share.

The portion set aside for retail investors was subscribed 17 percent and non-institutional investors portion subscribed 3 percent.

Qualified institutional buyers are yet to subscribe to the offer.

March 24, 2022 / 15:16 IST

BSE Information Technology index gained 1 percent supported by the Datamatics Global Services, Firstsource Solutions, NELCO

March 24, 2022 / 15:09 IST

CLSA view on Kotak Mahindra Bank:

Research house CLSA has maintained buy rating on Kotak Mahindra Bank with a target at Rs 2,200 per share.

The bank can deliver 4-5% higher growth versus peers and liability side will be the key focus, it added.

Kotak Mahindra Bank was quoting at Rs 1,716.75, down Rs 51.20, or 2.90 percent on the BSE.

March 24, 2022 / 15:05 IST

Market at 3 PM

Benchmark indices were trading flat in the final hour of the volatile session.

The Sensex was down 65.60 points or 0.11% at 57619.22, and the Nifty was down 17.20 points or 0.10% at 17228.50. About 1389 shares have advanced, 1796 shares declined, and 91 shares are unchanged.

March 24, 2022 / 14:50 IST

Dolat Capital view on One 97 Communications (Paytm)

At current EV of sub-$4Bn, Paytm is trading at a modest 3.6x on FY23E Revenues and offers traditional business kind valuations despite its hyper-growth and inclusion led scalable business opportunity for investors.

We firmly believe that Paytm will emerge as the best internet play in Indian market given its wide variety utilities that service both ‘Needs and Wants’ of consumers and maintain our buy rating on the stock with DCF based target price of Rs 1,620 implying 9x/7x on its EV/Rev in FY24/FY25E (TP revised to account for lowered revenue estimate and higher risk premium).

March 24, 2022 / 14:40 IST

Over 100 stocks hit 52-week high on the BSE:

March 24, 2022 / 14:33 IST

Choice Broking view on Ruchi Soya Industries FPO:

At higher price band of Rs 650, Ruchi Soya is demanding an TTM EV/S multiple of 1x, which is in-line to its only listed peer i.e. Adani Wilmar Ltd.

The edible oil business is likely to have a secular growth trend, but there is a huge untapped market for its Food & FMCG business segment. Thus, we assign a “SUBSCRIBE” rating for the issue.