March 16, 2022 / 16:38 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets started on a buoyant note and gained nearly 2%, after taking a breather in yesterday’s session. Supportive global cues led to gap-up opening however caution ahead of the US Fed meeting outcome capped the movement as the day progressed. Meanwhile, strong participation from the broader markets kept the participants busy. Among the benchmark indices, the Nifty index inched closer to the 17,000 mark and finally settled at 16,975 levels.

Markets will first react to the US Fed meeting outcome in early trade on Thursday. Besides global updates, the scheduled weekly expiry would further add to the volatility.

We recommend booking some profits on the rise, citing immediate hurdles around the 17,150 zone and focusing on identifying opportunities in sectors that are trading in sync with the benchmark.

March 16, 2022 / 16:37 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas:

The Nifty had formed a bearish outside bar on the daily chart on March 15. However, the bulls hit back on March 16 thus crossing the high point of the bearish pattern. Also, it has marginally crossed a falling trendline as well as the 40 DEMA. However, it will be crucial to monitor whether the index sustains above these parameters.

On the higher side, the Nifty is staring at the key barrier of 17000, which is the make or break level from short term perspective. If the index manages to surpass 17000 mark on a closing basis then it will be poised for a leap towards 17500. On the flip side, failure near 17000 would drag the index back to 16500.

March 16, 2022 / 16:28 IST

Rupak De, Senior Technical Analyst at LKP Securities:

The market ended with a decent gain after a bearish closing in the previous session. However, the recovery has taken the Nifty towards the 200 days moving average.

Now, as long as the Nifty remains below 200DMA we may expect choppiness in the market. On the lower end, support is seen at 16600 whereas on the higher end, 17000 is likely to act as resistance on closing basis.

March 16, 2022 / 16:27 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Ease in FII selling & crude prices is adding strength to the domestic trend. Positive global cues & strong bounce back by the Chinese market in anticipation of stimulus supported the trend.

The world equity market has stabilized factoring in a 25bps hike in US FED, an in-line policy outlook, will be a relief to the market and we may see a drop in volatility.

March 16, 2022 / 16:12 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Market seems to have come off from the turbulent phase of the last few weeks. While the conflict between Russia and Ukraine continues, other events such as cooling oil prices and US Federal Reserve's decision on the rate front and commentary about the pace of future rate hikes are being eyed by the investors.

The trend reversal in recent sessions is also due to the market being in an oversold territory in the past few weeks. Technically, on intraday charts, the Nifty maintains a higher high and higher low formation and now is heading towards 17000 and 17200.

We are of the view that the current texture is likely to continue unless the index slips below 16750-16700 levels. Above this level, the Nifty could rise up to 17100-17200 levels.

On the flip side, traders may prefer to take a caution stance if the index slips below 16750 and below the same, chances of hitting 16700-16600 would be brighter.

March 16, 2022 / 16:00 IST

Palak Kothari, Research Associate at Choice Broking:

The market has recouped all its previous day's losses and gained 1.87 percent on March 16, tracking rally in global counterparts ahead of the outcome of the Federal Reserve policy meeting. After a gap up opening, index showed strength throughout the session & managed to close on a higher note at 16975.35 level with a gain of 312.35 points while Bank nifty has increased by 2.07% to settle at 35748.25 levels.

Technically, index has given breakout of prior swing high & given closing above the same which suggest northward direction in the counter. Moreover, the index has given closing above 21 & 50 HMA which adds strength to the price.

Momentum indicator MACD is trading with a positive crossover which adds strength for the next day. At present, the index has support at 16700 levels while resistance comes at 17000 levels, crossing above the same can show 17200-17300 levels. On the other hand, Bank Nifty has support at 34800 levels while resistance at 36500 levels.

March 16, 2022 / 15:45 IST

Rahul Sharma - Equity 99:

After yesterday`s fall markets today made a good comeback with Sensex gaining almost 1.86% due to falling crude oil price. Tomorrow, we will witness a volatile session due to weakly expiry and also fed's meeting today where likely rate hike is expected after COVID-19.

Also brutal FII's selling is a factor to consider before taking any positions. Tomorrow, considering the volatility, traders are advised to trade only after keeping strict stop losses.

For Nifty50 16900 will act as very strong support post which next support is at 16800 levels post which 16750 is also possible. On the upper side 17050 will act as very strong resistance, post which 17110 will be next hurdle rate. Once this level is broken than next resistance will be around 17200 levels.

March 16, 2022 / 15:43 IST

Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities:

Nifty has staged a strong recover with a combination of value and momentum. We expect the uptrend to sustain for the medium term.

The March series expect limited downside with resistance placed at 17200-17300 levels; on the downside support is seen at 16500-16600 levels.

Buying on dips is advisable with focus on cement, NBFC and consumption space. Metals are expected to consolidate with high volatility.

March 16, 2022 / 15:35 IST

Neeraj Chadawar, Head - Quantitative Equity Research, Axis Securities:

The Indian market rebounded from the losses after taking positive cues from Wall Street. Sentiments were further supported by the cool-off in the oil prices, and the progress on the peace talk between Russia and Ukraine conflict.

Now the market is waiting for the outcome of the FED meeting as the current geopolitical developments are adding further inflationary pressure in the global market, and it is important to see the view of central banks.

The wider view is that central banks first focus more on controlling the inflationary effects rather than growth effects. Volatility will continue to be on a higher side before we conclude concrete market direction.

It is likely to go down to settle below the long-term average as soon as we enter into a rate hike cycle, and the trajectory for the actual number of rate hikes projected for 2022 will be known to the market. The second half of 2022 is likely to be more stable compared to the first half.

March 16, 2022 / 15:34 IST

Market Close:

Benchmark indices ended higher on March 16 with Nifty above 16900 led by buying seen across the sectors.

At close, the Sensex was up 1,039.80 points or 1.86% at 56,816.65, and the Nifty was up 312.30 points or 1.87% at 16,975.30. About 2241 shares have advanced, 1105 shares declined, and 96 shares are unchanged.

UltraTech Cement, Axis Bank, Shree Cements, IndusInd Bank and Bajaj Auto were among the top Nifty gainers, while losers were Cipla, Sun Pharma, Tata Consumer Products and Power Grid Corporation.

All the sectoral indices ended in the green with IT, oil & gas, auto, bank, metal and realty indices rose 2-3 percent, while capital goods, FMCG, and power indices up 1 percent each. BSE midcap and smallcap indices added over 1 percent each.

March 16, 2022 / 15:24 IST

Jefferies view on Ambuja Cements:

Brokerage firm Jefferies has maintained buy rating on Ambuja Cements with a target at Rs 360 per share.

The current demand trend is sluggish but medium-term outlook is strong. The costs are rallying, however, price trend is not matching cost trend.

The start of 55 MW WHR capacity will reduce power & fuel costs, it added.

Ambuja Cements was quoting at Rs 309.90, up Rs 14.90, or 5.05 percent on the BSE.

March 16, 2022 / 15:19 IST

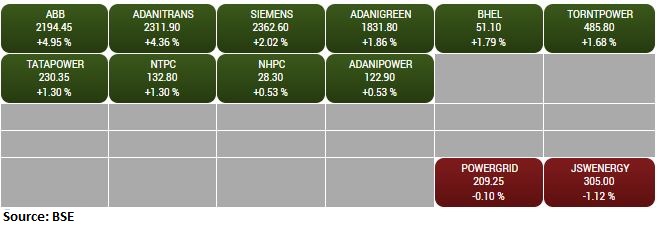

BSE Power index rose 1 percent led by the ABB, Adani Transmission, Adani Green

March 16, 2022 / 15:15 IST

NLC India signs power purchase agreemnet with TANGEDCO

A Power Purchase agreement for procuring 1500 MW power from Thermal Power Project at TALABIRA, Jharsuguda District in Odisha was signed between TANGEDCO and NLCIL in the presence of the Hon'ble Chief Minister of Tamil Nadu Thiru M.K Stalin.

NLC India was quoting at Rs 62.70, up Rs 0.15, or 0.24 percent on the BSE.