Taking Stock: Nifty Ends Below 15,700 Amid Volatility; Auto Stocks Outperform

While indeices ended lower, more than 400 stocks, including Titan, Infosys and Oil India, hit a fresh 52-week high on the BSE.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,712.37 | 447.05 | +0.52% |

| Nifty 50 | 26,186.45 | 152.70 | +0.59% |

| Nifty Bank | 59,777.20 | 488.50 | +0.82% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Shriram Finance | 854.90 | 26.75 | +3.23% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 5,370.50 | -66.00 | -1.21% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8381.75 | 125.05 | +1.51% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Pharma | 22947.20 | -11.80 | -0.05% |

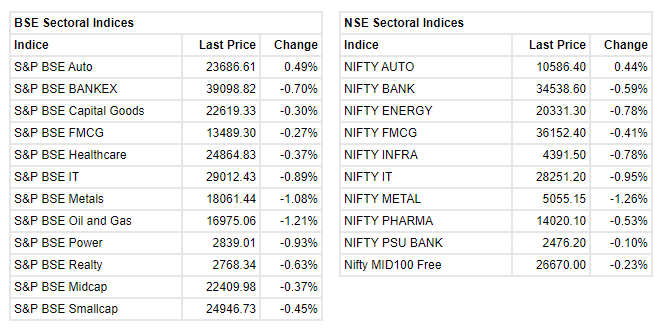

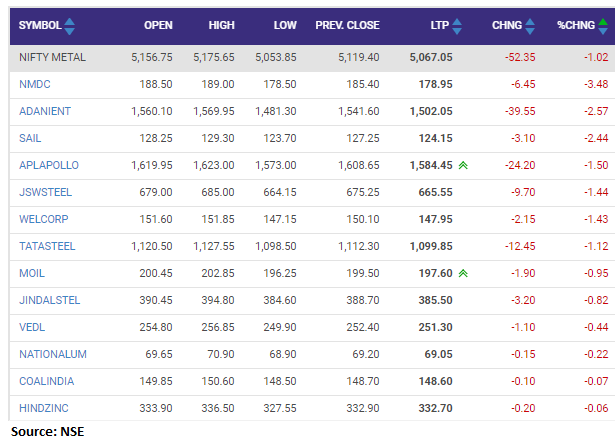

Markets traded lacklustre and lost nearly half a percent, in absence of any major trigger. Firm global cues triggered an upbeat start but it couldn’t hold for long and gradually drifted lower as the day progressed. Among the sectors, profit taking in metal and IT majors combined with the prevailing underperformance of the banking pack led to the decline. Consequently, the Nifty ended lower by 0.5% at 15,687 levels. The broader markets too ended in the red in the range of 0.2-0.4%.

We’re currently seeing a time-wise correction in the market and it’s likely to end soon. The scheduled monthly expiry of the June month contracts combined with AGM of index heavyweight, Reliance, will keep the participants busy on Thursday i.e. June 24. We reiterate our advice to continue with the “buy on dips” approach until we see some sign of exhaustion or trend reversal.

Nifty failed to maintain its upward thrust; along with this the broader market health has also weakened. The larger setup suggests a possible short term correction up to 15300 odd levels in the next few weeks. We suggest reducing long aggression and buying on aggressive corrections.

The USDINR spot is following the trend in dollar. Fed Powell downplaying the threat of tapering is not weighing on the spot, rather Fed rate hike worries has kept all the dollar bulls active. So until the spot tries above 73.75-73.80, it will remain afloat with immediate resistance around 74.50 and then 74.75 zone. While the major supports lies around 73.75-73.50-73.45.

The market witnessed a very volatile movement in the range of 15700-15850. It is suggested, trading above 15700 is positive from a short-term perspective. If the market closes below 15700, market expects a correction till the level of 15500. The technical indicator suggests, a volatile movement in the market in the range of 15500-15900. As such the traders are advised to refrain from building a fresh buying position until further decisive movement is seen in the market.

Indian rupee ended marginally higher at 74.28 per dollar, amid volatile trade saw in the domestic equity market.

Rupee opened 10 paise higher at 74.26 per dollar versus previous close of 74.36 and traded in the range of 74.16-74-39.

In the volatile session on June 23, the benchmark indices ended near the day's low with Nifty below 15700.

At close, the Sensex was down 282.63 points or 0.54% at 52306.08, and the Nifty was down 85.80 points or 0.54% at 15687. About 1335 shares have advanced, 1629 shares declined, and 116 shares are unchanged.

Adani Ports, Wipro, JSW Steel, Divis Labs and L&T were among major losers, while Maruti Suzuki, Titan Company, Bajaj Finserv, ONGC and M&M were among major gainers.

Except auto, all other sectoral indices ended lower. BSE Midcap and Smallcap indices ended in th

e red.

I

The initial public offering (IPO) of India Pesticides has been subscribed 83 percent so far on June 23, the first day of bidding. The public issue of the agro-chemical manufacturer received bids for 1.6 crore equity shares against the IPO size of 1.93 crore equity shares.

The IPO size has been reduced by 81,08,107 equity shares to 1.93 crore equity shares after the company raised Rs 240 crore from anchor investors on June 22.

The portion set aside for retail investors has been subscribed 1.63 times and that of non-institutional investors 7 percent, the subscription data available on the exchanges showed. Qualified institutional investors have put in their bids yet.

Fuel demand optimism is supportive for energy prices; WTI crude oil prices are trading firm for the last several months following global recovery in energy consumption post covid. WTI crude oil is now trading at $73.53 which is sharply higher from last week low of $69.77

WTI Crude oil price is likely to trade firm while above the key support level of 20 days EMA at $69.78 and 50 days EMA of $67.08, while it may find stiff resistance near $73.17-$74.69

Indian rupee is trading marginally higher at 74.30 per dollar, amid volatile trade seen in the domestic equity market.

Rupee opened 10 paise higher at 74.26 per dollar versus previous close of 74.36.

Benchmark indices extended the losses and trading at day's low with Nifty below 15700.

The Sensex was down 290.30 points or 0.55% at 52298.41, and the Nifty was down 90.60 points or 0.57% at 15682.20. About 1389 shares have advanced, 1556 shares declined, and 116 shares are unchanged.