Taking Stock: Market Falls Nearly 1%, Bank, Pharma And Metal Stocks Worst Hit

On the BSE, except power, all other sectoral indices ended in the red, with metal, auto and bank indices down 1-2.4 percent.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 83,379.03 | 68.02 | +0.08% |

| Nifty 50 | 25,545.60 | 35.90 | +0.14% |

| Nifty Bank | 57,980.75 | 426.50 | +0.74% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Shriram Finance | 818.50 | 26.00 | +3.28% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Bharti Airtel | 2,010.60 | -84.30 | -4.02% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10461.00 | 179.10 | +1.74% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Infra | 9421.70 | -67.10 | -0.71% |

Technically, on intraday charts the index has formed lower top formation which indicates further weakness from the current level. For the next few trading sessions, 15780/ 52750 could act as important resistance levels for the traders and below the same, correction wave could continue up to 15635-15600/52200-52000 levels. On the other hand, the immediate hurdle would be 15780/ 52750, and trading above the same we can expect continuation of uptrend up to 15830-15860/ 53000-53150 levels.

Markets would first react to TCS numbers in early trade on Friday and that might set the tone for the result of the session as well. Further, demand scenario and management commentary will be crucial factors to watch in Q1FY22 results. We suggest keeping a check on naked leveraged positions and wait for clarity. Investors, on the other hand, should not read much into the intermediate correction and continue with the “buy on dips” approach in fundamentally sound counters with a long term view.

Indian rupee ended 10 paise lower at 74.71 per dollar, amid selling saw in the domestic equity market.It opened 20 paise lower at 74.81 per dollar against previous close of 74.61 and traded between 74.65-74.84.

June month saw flattish net sales in Fixed income - it being a month end and quarter end too. FMP a category continued to net sales negative as investors seem to adopt a wait and watch approach before locking in funds. Gold ETFs continued to add net positive AUMs month on month and witnessed a steady rise in folios too. Hybrid funds saw the highest net sales in June at over Rs 12,000 crore compared to April and May for Q1 of FY 22.

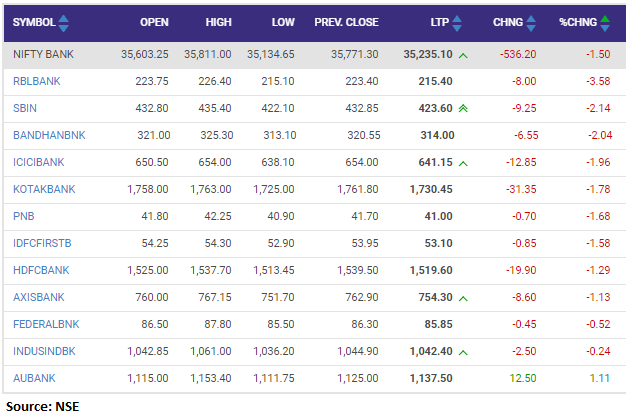

Benchmark indices erased previous session gains and ended nearly a percent lower dragged by the bank, metal and pharma names.

At close, the Sensex was down 485.82 points or 0.92% at 52568.94, and the Nifty was down 151.80 points or 0.96% at 15727.90. About 1277 shares have advanced, 1648 shares declined, and 112 shares are unchanged.

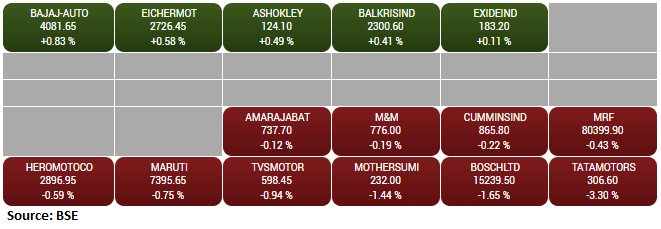

Tata Motors, JSW Steel, Bajaj Auto, Hindalco Industries and ONGC were among the top lower on the Nifty. Top gainers were Tech Mahindra, SBI Life Insurance, Eicher Motors, IndusInd Bank and Shree Cements.

All the sectoral indices ended in the red. BSE midcap index fell 0.3 percent, while smallcap ended flat.

Gold prices reversed course to trade higher on Thursday as the U.S. dollar eased and yields extended their downward momentum, making non-yielding bullion more appealing to investors.

Real-estate stock gaining momentum on the back of better than expected pre-sales for Q1FY22.

Today, S&P BSE REALTY hits a high of 2890 and now is trading near the 52 weeks high of 2909.9 which was made in March 2021. We have seen some good numbers from Sobha Limited yesterday which were better than the market expectation. The company reported pre-sales growth of 40%.

We have seen a very good 2nd half of FY21 after the sector was adversely hit by the pandemic in 2020. Several companies reported their all-time high results in Q4FY21 on the back of some effects of pent-up demand. It was expected that the demand for 2022 will strengthen this year whereas the ready to move inventory levels have hit 7 years low in Q1FY22, as customer preference has been changed to the ready property rather than the under-construction properties. We expect Residential real-estate to do well in the financial year 2022 as some early signs of the organized sector gaining the market share are encouraging. We have a buy call on Godrej property with a target price of 1700.

The market witnessed a correction after a failed attempt to hold the support level around the Nifty 50 Index level of 15800. Market suggests, 15650 will be an important support level from a short-term perspective. Sustaining above 15650-15670 levels, the market expects to bounce back, and trade in the range of 15650-15900. Technical indicator suggests, a volatile movement in the market in the range of 15650-15900.

Investors continue to invest in pure equity schemes resulting in positive net sales of almost Rs 6000 crore, this is slightly lower than last month due to higher redemptions. For now, the trend surely is in favour of Indian Equities by domestic investors. It is particularly very encouraging to witness good amount of interest in dynamic / asset allocations funds with higher gross sales of Rs 4300 crore and net sales of Rs 2300 crore.

The prime objective of the funds in this category is to use valuation models and then dynamically rebalance portfolio between equities and fixed income ensuring better risk-adjusted returns for investors. In current environment, dynamic / asset allocations funds are good option for investors certainly.

The public offer of Clean Science, a technology-driven specialty chemical manufacturing company, has seen a strong demand from investors as it got subscribed 2.87 times so far on the second day of bidding, July 8.

Investors have put in bids for 3.52 crore equity shares against the offer size of 1.23 crore equity shares, the subscription data available on the exchanges showed.