Taking Stock | Nifty above 18,000; Sensex gains 562 points led by FMCG, power and capital goods

The BSE midcap and smallcap indices end flat... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 84,587.01 | -313.70 | -0.37% |

| Nifty 50 | 25,884.80 | -74.70 | -0.29% |

| Nifty Bank | 58,820.30 | -15.05 | -0.03% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Hindalco | 789.35 | 14.70 | +1.90% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Adani Enterpris | 2,332.90 | -66.30 | -2.76% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8486.50 | 120.75 | +1.44% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 36826.90 | -211.00 | -0.57% |

Nifty breaks the barrier of utter slothfulness and ends up the day with a net gain of 158 points. The market rallied strongly towards the latter part of the day with a healthy ratio of advances vs declines.

Nifty holds above the support at 17800 and a series of equal lows makes it a “tweezer bottom” pattern. The moot point is if a major low is in and Nifty is likely to see a rally from here.

Nifty has just closed above its 20-day moving average, which placed at 18034. The crossover of the average is with a long green candle which is a bullish sign. If Nifty manages to hold above this resistance we could see a rally towards 18500.

Nifty is at an important inflexion point where Nifty offers a big risk to reward ratio. With international markets moving higher bulls could very well see a grand Jan expiry.

Nifty remained volatile throughout the day before closing on a strong note. On the daily chart, the benchmark Nifty has given a falling wedge breakout, suggesting a rise in optimism.

The RSI momentum indicator has indicated a falling trendline breakout.

The current technical setup suggests near-term strength, which may take the Nifty towards 18,250–18,270. On the lower end, support is visible at 17,850.

The Bank Nifty index continued to witness volatile moves, and it ended on a flat note. The index is stuck in a broad range between 41,800 and 42,700, and a break on either side will lead to trending moves.

The second half of the session belonged to the bulls, and if the momentum has to be maintained, it has to surpass the level of 42,400, where the immediate resistance is visible.

The Nifty witnessed a late surge which helped it to close with gains of 158 points. More importantly it has managed to close above the 20-day moving average (18,035) which is a sign of strength.

The daily and hourly momentum indicator has a positive crossover which is a buy signal. Thus, all parameters are suggesting towards a sharp up move over the next few trading sessions.

In terms of levels 17,880 – 17,850 shall act as a crucial support zone while 18,280 – 18,300 shall act as an immediate hurdle zone for the Nifty.

The domestic market is attempting to gain, in comparison to its weak YTD performance, which was caused in anticipation of a soft Q3 result & union budget.

We started the third quarter results on a shaky note, but the latest set of financial announcements from IT and banking blue chips are encouraging.

Heavy weights are also pushing the counter, including the fact of the fall in windfall tax. Given the positive undercurrents, the trend should continue in the short term. However, a lot will depend on the second line of Q3 results, the budget outcome, and the Fed policy statement.

Markets were extremely lacklustre with a negative bias in the last few sessions and global indices were witnessing an upward bias due to hopes of demand revival following the reopening of China and cooling inflation data in the US.

Indian markets also rallied back sharply as we had missed the recent upsurge, although the undertone remains cautious to negative bias.

Even as the global economic scenario is seen bleak, investors are hoping the forthcoming Budget would announce some measures to boost the economy to overcome some of the challenges.

Technically, the market has formed bullish candle on daily charts and higher bottom formation on intraday charts, which is indicating further uptrend from the current levels.

For the trend following traders, 17,950 would act as a strong support zone, and above which the index could move up to 18,100-18,200 levels. On the other hand, below 17,950, uptrend would be vulnerable and the index could slip till 17,900-17,850.

Indian rupee ended 16 paise lower at 81.77 per dollar against previous close of 81.61.

: Indian benchmark indices ended higher on January 17 with Nifty above 18,000.

At Close, the Sensex was up 562.75 points or 0.94% at 60,655.72, and the Nifty was up 158.50 points or 0.89% at 18,053.30. About 1641 shares have advanced, 1764 shares declined, and 133 shares are unchanged.

L&T, HUL, HDFC, HCL Technologies and HDFC Bank were among the top gainers on the Nifty, while losers included SBI, IndusInd Bank, Bajaj Finserv, Wipro and Tata Steel.

On the sectoral front, realty, energy, infra, power, capital goods and FMCG gained 1 percent each, while PSU bank index shed nearly 2 percent.

The BSE midcap and smallcap indices ended flat.

Pharmaceutical companies Innova Captab and Blue Jet Healthcare have received approval from the capital markets regulator to go ahead with their IPO plans.

The Innova Captab public issue comprises a fresh issue of Rs 400 crore and an offer-for-sale of 96 lakh equity shares by promoters.

Another CDMO business operator Blue Jet Healthcare is also now ready to launch its public issue that comprises only an offer for sale of 2.16 crore equity shares by promoters Akshay Bansarilal Arora, and Shiven Akshay Arora. It is 100 percent owned by promoters.

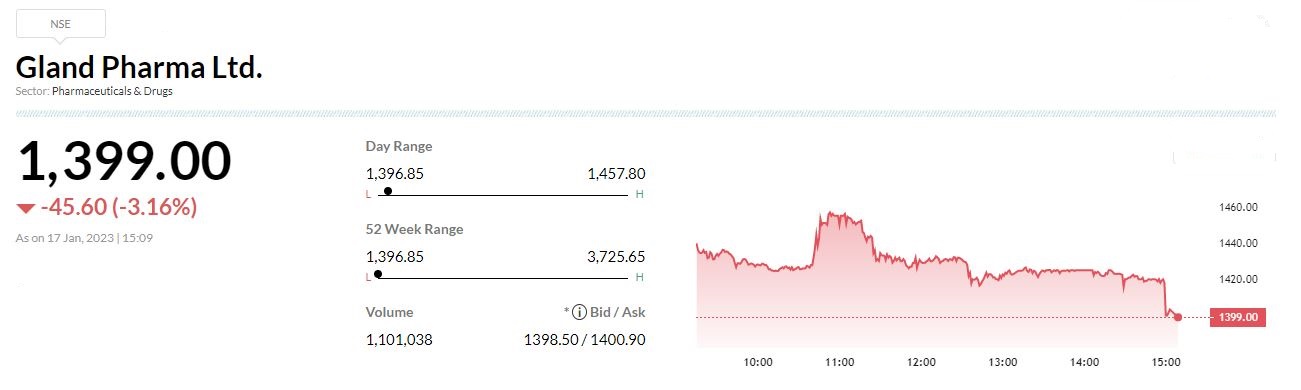

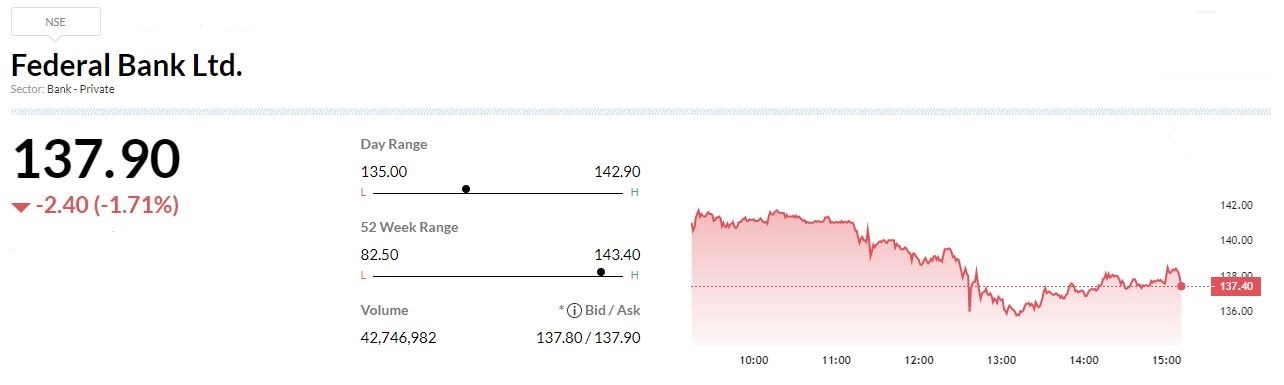

Maintains 'buy' rating on Federal Bank with a revised price target of Rs 170.

The broking firm believes the bank is well poised to sustain RoA of 1.2-1.3 percent over the medium term. It believes the bank has fewer levers to surprise positively from here on except on the operating leverage. However, a reversal in return ratios is unlikely and asset-quality outlook is stable for the sector.

Sharekhan believes now consistent steady performance could drive re-rating in the stock.

-Buy rating, target at Rs 3,100 per share

-Government approved the green hydrogen mission

-Phase 1 will focus on existing hydrogen users & electrolyser capacity creation

-Phase 2 will focus on new customer industries

-Initial incentives of Rs 19,740 crore is dwarfed by subsidies announced by the US & Europe

-Any meaningful cap subsidy to RIL should aid USD 8 billion valuation of its green H2 foray

Reliance Industries was quoting at Rs 2,479.10, up Rs 34.40, or 1.41 percent on the BSE.