December 19, 2022 / 16:29 IST

Prashanth Tapse - Research Analyst, Senior VP (Research), Mehta Equities

An unexpected bullish day seen at Dalal Street where short covering+ value buying ruled the roost. Barring IT, all the other sectoral indices ended in green, with maximum gains seen in Auto & FMCG Indices.

All eyes will be on RBI MPC meeting minutes to trickle on Wednesday, 21st December. The street will look for clues with regards to inflation scenario and RBI's plan of action in the months to come. Technically, the biggest hurdle for Nifty is seen only at 18888.

December 19, 2022 / 16:25 IST

Kunal Shah, Senior Technical Analyst at LKP Securities:

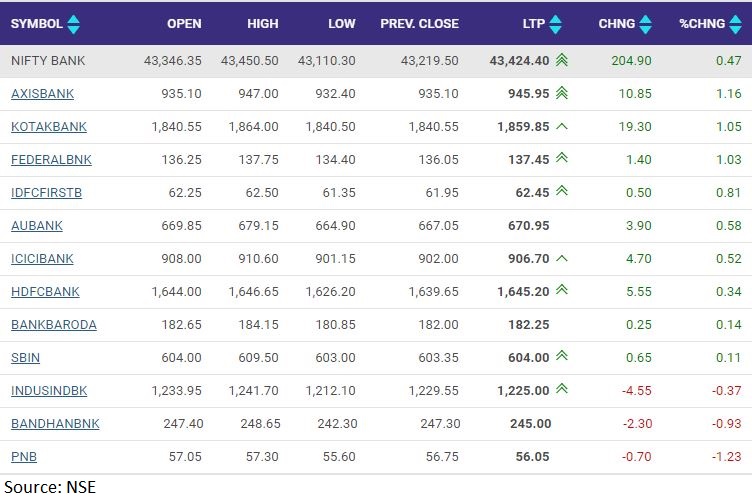

The Bank Nifty bulls managed to hold the support of 43,000 on the downside and the index witnessed buying momentum throughout the day.

The index is stuck in a broad range between the 43,000-44,000 zone and a break on either side will provide a trending move. The undertone within the range remains bullish and one should keep a buy-on dip approach around the mentioned support level.

December 19, 2022 / 16:04 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas:

Post a minor degree dip in the last week, the Nifty reached the junction of the 40 DEMA & the daily lower Bollinger Band. These two parameters together form a key support zone & the same is being witnessed this time as well.

Also, the channel study shows that the index touched lower end of the downward sloping channel that encompasses the recent decline from 18887.

From these multiple technical parameters, the Nifty took a leap on December 19. Going ahead, the Nifty is expected to test the upper channel line near 18600. On the downside, 18250-18200 will act as a key short term support zone.

December 19, 2022 / 16:00 IST

Vinod Nair, Head of Research at Geojit Financial Services

Stabilizing after the previous session, domestic indices edged towards gains owing to optimistic cues from western markets.

However, the IT sector stood out as an exception to the rally, as the growth guidance of the US IT sector signalled downgrades.

Fears of a worldwide recession and mounting local COVID cases weighed heavily on Asian stocks.

December 19, 2022 / 15:57 IST

Ajit Mishra, VP - Technical Research, Religare Broking

Markets started the week on a firm note and gained nearly a percent, taking a breather after the recent slide. After the flat opening, the Nifty index gradually inched higher, thanks to a recovery in select index majors from across sectors and finally settled at 18.420.45 levels.

Among the sectoral pack, auto, metal and FMCG posted decent gains while IT and pharma continue to trade subdued.

We’ve been seeing this trend that select heavyweights come to rescue the index during the corrective phase and it’s no different this time. A decisive close above 18,500 in Nifty could further fuel the rebound else profit taking may resume.

We recommend staying selective and preferring t

December 19, 2022 / 15:33 IST

Rupee Close:

Indian rupee closed 16 paise higher at 82.70 per dollar on Monday against Friday's close of 82.86.

December 19, 2022 / 15:30 IST

Market Close:

Benchmark indices ended higher on December 22 with Nifty above 18,400.

At Close, the Sensex was up 468.38 points or 0.76% at 61,806.19, and the Nifty was up 151.50 points or 0.83% at 18,420.50. About 2071 shares have advanced, 1436 shares declined, and 155 shares are unchanged.

Adani Ports, Eicher Motors, M&M, Power Grid Corporation and Adani Enterprises were among the biggest Nifty gainers, while losers were TCS, ONGC, Infosys, Sun Pharma and Tata Motors.

Except IT, all other sectoral indices ended in the green with Auto, Metal and FMCG indices up 1 percent each.

The BSE midcap index rose 0.6 percent and smallcap index up 0.3 percent.

December 19, 2022 / 15:28 IST

Oil prices bounce as China demand hopes offset recession fears

Oil prices rose on Monday after tumbling by more than $2 a barrel in the previous session as optimism over the Chinese economy outweighed concern over a global recession.

Brent crude gained 82 cents, or 1%, to $79.86 a barrel by 0925 GMT while U.S. West Texas Intermediate crude advanced by 60 cents, or 0.8%, to $74.89.

December 19, 2022 / 15:26 IST

Gold holds firm as dollar dip offsets pressure from rate hikes

Gold prices inched higher on Monday as a softer dollar countered pressure on the non-yielding bullion from expectations of higher interest rates in the United States for longer than earlier expected.

Spot gold rose 0.2% to $1,797.17 per ounce by 0915 GMT. U.S. gold futures gained 0.4% to $1,807.20.

December 19, 2022 / 15:23 IST

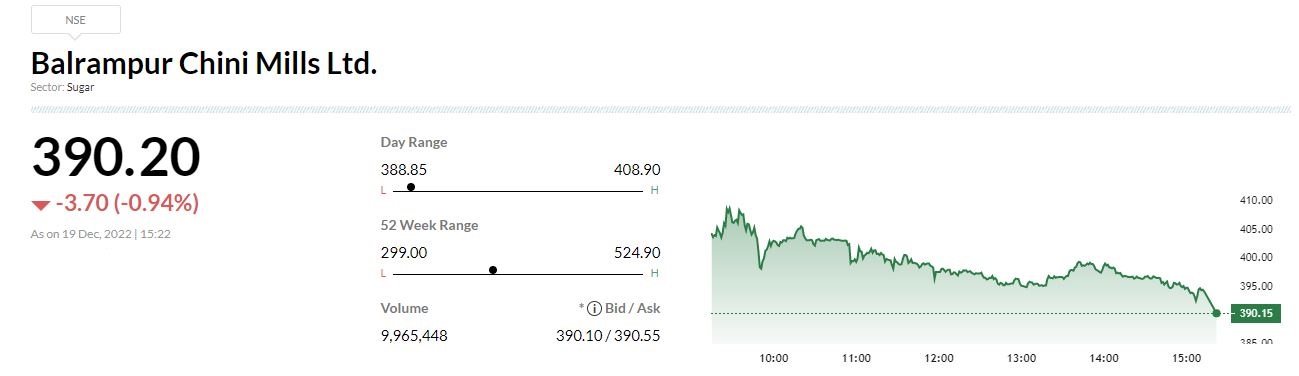

Balrampur Chini Mills has commenced commercial production of Rectified Spirit / Industrial Alcohol for the additional capacity of 170 KLPD at Balrmapur Unit. With the said addition, the total distillation capacity of the company now stands at 1050 KLPD.

December 19, 2022 / 15:21 IST

CLSA view on IT sector

-Accenture’s Q1 ahead of guidance/consensus

-Healthy managed services revenues/bookings by Accenture is positive read-through

-Consulting to remain weak on macro headwinds; managed services strong

-Accenture’s Q1 is a positive read through for Indian IT companies

-Infosys, TCS, HCL & LTIMindtree are top bets in the sector

December 19, 2022 / 15:18 IST

Nifty Bank index up 0.5 percent supported by the Axis Bank, Kotak Mahindra Bank, Federal Bank

December 19, 2022 / 15:13 IST

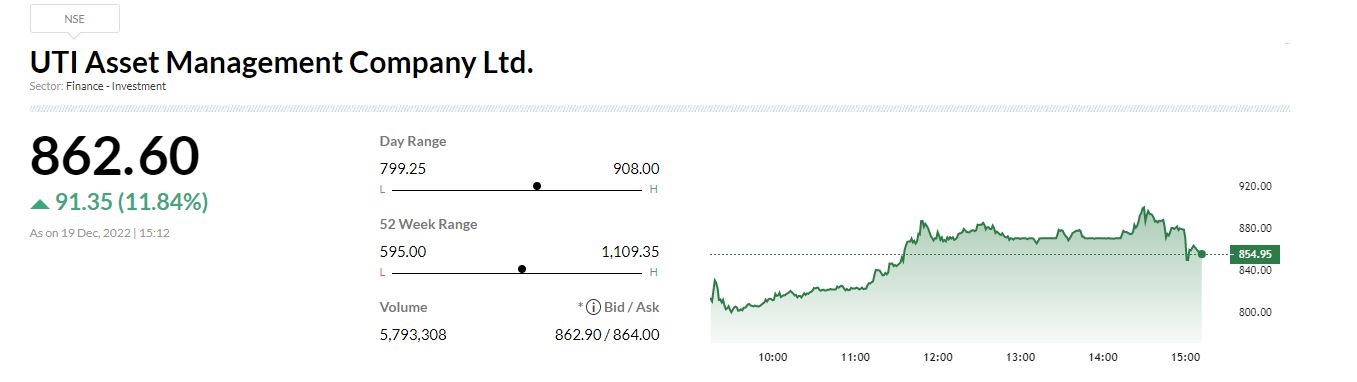

Tata Investment Corporation clarified that the company is not aware of any information about news item 'Tata in final talks to buy majority stake in UTI AMC from PSU fin cos” and hence unable to comment on the same.