August 18, 2021 / 16:32 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets traded highly volatile on account of weekly F&O expiry session and ended in the red. After opening in positive, the benchmark continued to trade on an optimistic note and touched new highs in the first half. However, as the day progressed markets pared all its gains and turned negative as investors’ choose to book profit in metals, financials and realty stocks. Consequently, the Nifty closed at 16,569 levels, down by 0.3%. The broader markets trend remained mixed wherein small cap ended in-line with benchmark while midcap ended with gains of 0.3%.

We remain cautious on the markets as there is no clear direction over the next move. High volatility and profit taking in broader markets are adding to the participants’ worries. We suggest investors to remain selective and prefer investing in defensive sectors such as FMCG, IT and Pharma.

August 18, 2021 / 16:28 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Succumbing to profit-booking, Indian market gave away its gains. Bleeding banking, realty and metal stocks dragged while midcaps provided some relief but the broad trend was weak. European markets traded cautiously as Eurozone inflation accelerated to 2.2% in July, beating ECB estimates of 2% owing to a spike in energy prices.

The market are awaiting the US Fed meeting minutes to provide some direction on future policy, which is expected to showcase its current accommodative policy in-line with the latest policy statement.

August 18, 2021 / 16:23 IST

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments:

The index faced some selling pressure and gave up its gains. However, the trend continues to remain positive and traders should use corrections like these to accumulate long positions. The Nifty has a good support at 16400 and until we do not close below this level, the momentum continues to be strong and bullish.

August 18, 2021 / 16:09 IST

Rahul Sharma, Co-Founder, Equity99:

Going ahead for Friday, Nifty will have immediate support at 16,500 levels followed with 16,450-16,375 levels & on the upside 16,700 will act as resistance.

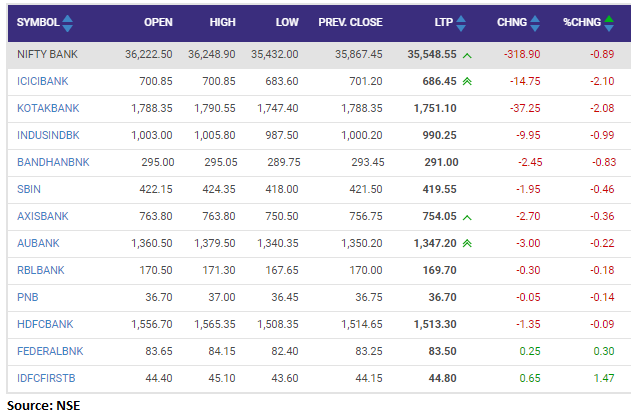

Nifty Bank which underperformed Nifty50 which lost more than 400 points and closed at 35554.50, has immediate support at 35300 & if it breaks this level then 35000- 34850 will be the next support level. On the upside 35,800 will be the hurdle above which 36,000-36,200 will act as a resistance level.

August 18, 2021 / 15:57 IST

Vinod Nair, Head of Research at Geojit Financial Services on metal sector:

The current uptrend is mainly due to pent-up demand post-reopening of the economy. While the high margins for the last several quarters helped the companies to deleverage their balance sheet. We expect the efforts from China to impose restrictions on domestic production will provide impetus to sustain the current cycle.

August 18, 2021 / 15:49 IST

Rohit Singre, Senior Technical Analyst at LKP Securities:

Index opened a day with a strong gap but profit booking from higher-end led index closed in negative territory at 16569 with loss of nearly half percent and formed a bearish candle after forming bullish candles for four consecutive sessions. The index has formed dark cloud cover candle pattern on the daily chart which is bearish reversal candle pattern by nature, the index still has good support zone at 16500 if broke then we may see more profit booking comes in & we may see index dragging towards 16400 zone and now resistance is coming near 16630-16700 zone

August 18, 2021 / 15:45 IST

Ashis Biswas, Head of Technical Research at CapitalVia Global Research:

The market have witnessed some correction from the higher levels of 16700. It is going to be crucial for the short-term market scenario to sustain above the 16500 level. Early signs of reversal in the market with deviation occurring in Nifty 50, Nifty mid cap, and Nifty small cap, hence traders are advised the traders to refrain from building a new buying position until we see further improvement in the market breadth.

August 18, 2021 / 15:36 IST

Market Close:

Benchmark indices erased all the intraday gains and ended lower with Nifty closing below 16,600.

At close, the Sensex was down 162.78 points or 0.29% at 55629.49, and the Nifty was down 45.80 points or 0.28% at 16568.80. About 1037 shares have advanced, 2067 shares declined, and 110 shares are unchanged.

Hindalco Industries, Kotak Mahindra Bank, ICICI Bank, Tata Motors and SBI Life Insurance were the top Nifty gainers. Eicher Motors, UltraTech Cement, Bajaj Finance, Adani Ports and Bajaj Finserv were among the top losers.

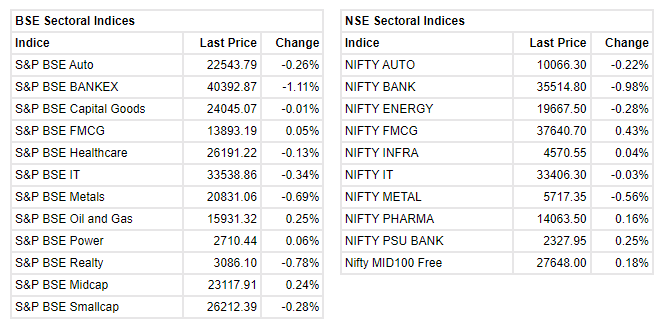

Among sectors, the Nifty metal and bank indices fall 0.8 percent each, while buying was seen in the FMCG, pharma and PSU Bank names. BSE midcap rose 0.26 percent and smallcap indices was down 0.18 percent.

August 18, 2021 / 15:24 IST

Dollar Updates:

The dollar held at a nine-month high versus the euro on Wednesday as major currencies marked time before the release of the Fed’s July minutes, with the kiwi the big mover overnight after its central bank kept interest rates unexpectedly on hold.

August 18, 2021 / 15:18 IST

Nifty Bank index shed nearly 1 percent dragged by the ICICI Bank, Kotak Mahindra Bank, IndusInd Bank:

August 18, 2021 / 15:10 IST

Yash Gupta Equity Research Associate, Angel Broking:

Windlas Biotech got listed at a 4.5% discount to its issue price of Rs 460, despite the IPO getting a good response from investors and getting oversubscribed by more than 22 times. Currently, the stock is trading at Rs 392 which is down by 14.7% from its IPO price.

Earlier, we have seen some of the IPOs getting listed at discount to its IPO price like Macrotech Developers and after the listing, the stock has recovered and given good returns to investors. This was on the back of good fundamentals and recovery in the sector.

We suggest investors look at the fundamentals of the company before applying to an IPO, as we have seen that companies having good fundamentals give good returns on listing day or after the listing.

For the upcoming IPOs, we suggest investors be cautious as a lot of the upcoming IPOs are at aggressive valuations. We believe that a company having good fundamentals along with it being priced at reasonable valuations improves the chances of getting listing gains significantly.

August 18, 2021 / 15:01 IST

Market at 3 PM

Benchmark indices erased all the opening gains and trading near the day's low point with Nifty below 16,550.

The Sensex was down 191.38 points or 0.34% at 55,600.89, and the Nifty was down 53.10 points or 0.32% at 16,561.50. About 971 shares have advanced, 1979 shares declined, and 65 shares are unchanged.