April 05, 2021 / 15:56 IST

Ajit Mishra, VP - Research, Religare Broking:

The week started on a negative note for the Indian markets mainly due to sharp surge in COVID-19 cases across the country. Despite, stable global cues, the Indian indices lost its ground and ended with losses of nearly 1.5% to end at 14,638 levels. The broader markets too were not spared as both BSE Midcap and Smallcap ended with losses of nearly 1% each. On the sector front, IT, healthcare and metals ended with healthy gains whereas banking, auto, and realty were the top losers.

The sharp surge in COVID-19 cases has dented investor sentiments and has increased fear of harsh restrictions which would impact economic activity. Going forward, government actions to curb the surge would be one of the important factors to watch out for investors. Further, the upcoming RBI monetary policy would be actively tracked by investors. We expect the RBI to maintain its dovish stance and leave key rates to be unchanged.

April 05, 2021 / 15:52 IST

Rohit Singre, Senior Technical Analyst at LKP Securities:

Strong cuts have been witnessed in today’s session as Nifty closed a day at 14638 with loss of one & half percent forming a bearish candle on the daily chart. The overall structure still looks of narrow consolidations as index rejected around 14900 zone third time on hourly charts and we saw good profit booking from the same levels, now if index managed to sustain below 14700 zone then we may see next move towards its previous swing low of 14300 zone and if it managed to hold above 14700 zone then some relief rally can be seen.

April 05, 2021 / 15:50 IST

S Ranganathan, Head of Research at LKP Securities:

Markets opened gap down following strict guidelines issued in Maharashtra amidst rising coronavirus cases with BFSI and rate sensitives taking a knock ahead of the monetary policy. However, technology, steel and pathology labs bucked the downtrend and posted handsome gains.

April 05, 2021 / 15:43 IST

Vinod Nair, Head of Research at Geojit Financial Services:

The market witnessed a huge sell-off today as India’s second wave of Covid-19 is getting bigger than anticipated and is expected to ruin the pace of economic recovery. High valuation added further concern due to a possible downgrade in Q1FY22 earnings. Barring IT, metal and telecom, all sectors remained in the red. A policy decision in the upcoming MPC announcement and Q4 earnings will define the market volatility in the coming days.

April 05, 2021 / 15:42 IST

Rupee Close:

Indian rupee ended 19 paise lower at 73.30 per dollar, amid selling saw in the domestic equity market on the back of worries over rising COVID-19 cases in India.

It opened lower at 73.44 per dollar against Wednesday's close of 73.11 and traded in the range of 73.28-73.46.

April 05, 2021 / 15:35 IST

Market Close

: Benchmark indices lost 1.5 percent on the back of concerns over rising COVID-19 cases in India with Nifty closing below 14,650 and Sensex below 50,000 level.

At close, the Sensex was down 870.51 points or 1.74% at 49,159.32, and the Nifty was down 229.60 points or 1.54% at 14,637.80. About 1063 shares have advanced, 1848 shares declined, and 180 shares are unchanged.

Bajaj Finance, IndusInd Bank, SBI, Eicher Motors and M&M were among major losers on the Nifty, while gainers were HCL Technologies, TCS, Britannia Industries, Wipro and Infosys.

On the sectoral front, Nifty PSU Bank index slipped 4 percent, Nifty Bank index shed over 3 percent and auto index declined more than 2 percent. However, IT index gained 2 percent.

April 05, 2021 / 15:19 IST

Ashis Biswas, Head of Technical Research at CapitalVia Global Research:

The market failed to show resilience to stay above the Nifty 50 Index level of 14,800. While it is subject to further price action evolution, the technical factors are aligned to support a short-term consolidation in the near future. The market is expected to attempt a breakout above the 14,900 mid of the month. Any corrective wave down should find support around 14,400.

As such, the traders are advised to refrain from building a fresh buying position until the market witnesses a correction to the 14,400 level or a breakout above 14,900. The volatility is observed to expand in today’s trading session indicating profit booking and distribution of stocks at a higher market level.

April 05, 2021 / 15:08 IST

Abhishek Bansal, Founder Chairman, Abans Group:

WTI Crude oil price is currently trading near $60.72, sharply lower from last month's high of $67.98. Crude oil prices were under pressure after OPEC+ at its monthly meeting decided to gradually reduce its production cuts.

WTI Crude oil future contract is likely to face stiff resistance near $62.90-64.30 while it may find immediate support base near 50 days EMA $59.40 and 100 days EMA at $55.30.

April 05, 2021 / 15:02 IST

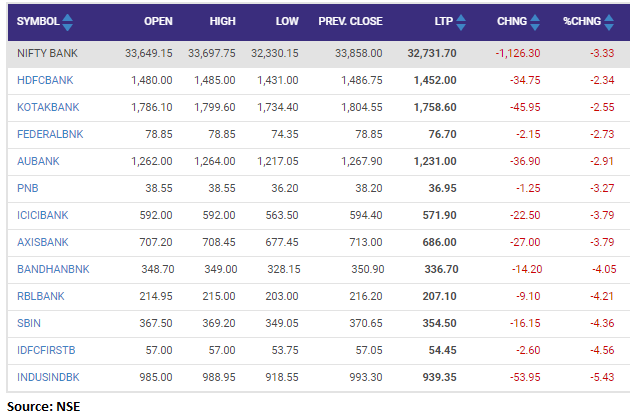

Nifty Bank index fell 3 percent dragged by the HDFC Bank, Kotak Mahindra Bank, Federal Bank:

April 05, 2021 / 14:53 IST

Anil Kumar Bhansali, Head- Treasury, Finrex Treasury Advisors:

The spike in corona cases and US jobs data comes better than expected taking dollar index higher and Asian currencies particular CNH down. A range of 73.20 to 73.60 is expected for the day as equities fall and there is s bout of risk off sentiment prevailing in the market. Exporters to sell near to 73.60 levels and importers to buy near 73.20 levels.

April 05, 2021 / 14:42 IST

Sharekhan on Blue Star

Blue Star has made consistent, rapid progress and outperformed the industry as well as its peers driven by strengthening distribution network, rising market share and improving product mix (higher proportion of inverter ACs). Over the next five years, Blue Star’s management has ambitious growth plan of increasing revenues at a 20% CAGR and profitability by 25% CAGR.

With rising return ratios, healthy cash flow, lean working capital cycle and a comfortable leverage position, Blue Star is placed favourably compared to listed brands in terms of its valuation vis-a-vis RoE and EPS growth prospects. We initiate coverage on Blue Star with a price target of Rs 1,200.

April 05, 2021 / 14:35 IST

Indian Oil Corp buys its first Johan Sverdrup crude cargoes: Report

State-run refiner Indian Oil Corporation (IOC) has bought 4 million barrels of Norway's Johan Sverdrup crude for the first time via a tender as it speeds up diversification of crude imports, two trade sources told Reuters on Monday.

IOC will take delivery of 2 million barrels each of the North Sea crude in May and June, one of the sources said. Further details on the trades were not yet clear. Read more