Taking Stock: IT rout sinks market; Sensex down 520 points, Nifty below 17,750

The information technology index fell 4.7 percent and pharma index down 0.6 percent.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 83,216.28 | -94.73 | -0.11% |

| Nifty 50 | 25,492.30 | -17.40 | -0.07% |

| Nifty Bank | 57,876.80 | 322.55 | +0.56% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Shriram Finance | 816.35 | 23.85 | +3.01% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Bharti Airtel | 2,001.20 | -93.70 | -4.47% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10426.80 | 144.90 | +1.41% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Infra | 9393.60 | -95.20 | -1.00% |

Markets started the week on a subdued note and lost over half a percent, taking a breather after a recent surge. Pressure in the IT majors, especially Infosys, was weighing on the sentiment in early trades however resilience in banking and FMCG majors combined rebound in the energy pack helped the index to recoup some losses. Consequently, Nifty settled at 17,706.85; down by 0.68%. Meanwhile, the broader indices outperformed the benchmark and ended in the green.

We expect consolidation in the index after 3 weeks of successive rise, so participants should focus more on sector/stock selection. Besides, managing risk, especially in overnight positions, holds the key, citing an uptick in volatility during the earnings season. Participants should plan their positions accordingly.

Nifty remained under the bears' grip as the benchmark slipped following a hanging man pattern formation in the previous session. Besides, the recent rally found resistance around the 50% retracement level of the previous fall before closing with a bearish engulfing pattern.

Over the near term, the trend is likely to remain sideways, as after a rally of 900 points, buyers at 17000 would want to take some profits. On the lower end, support lies at 17550, below which the index may fall towards 17400. On the higher end, 17800 is likely to remain resistance for the Nifty.

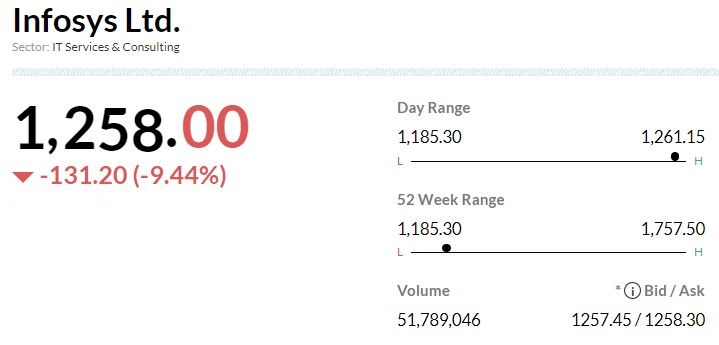

The much anticipated profit-taking came to the fore as technology stocks led the correction that saw the Sensex slump below the psychological 60,000 mark. The real damage was done by the frontline IT stocks with Infosys coming under severe hammering after its corporate earnings failed to meet street estimates.

Besides disappointing results, worries of weak IT spending by multinational giants on gloomy economic conditions and recessionary fears have weighed heavily on the sector over the past few months.

On the daily charts, the Nifty has formed a bar-reversal candlestick formation indicating time-based correction till the market is not crossing 17,870 levels. For the bulls, 17,800-17,870 would act as immediate resistance zones, while 17,600-17,500 would act as key support zones. Fresh buying momentum could be seen only above the levels of 17,870.

The market responded negatively to the weak start of the earnings season by IT bellwether and their cautious outlook. On the global front, the US 10-year bond yield rose as solid US job data raised concerns over further rate hikes by the Fed.

The earnings reports, primarily from the IT and banking sectors, will influence market trends in the coming days. We expect Nifty 50 earnings to grow by 10percentin Q4 FY23, driven by banking and finance, auto, telecom, and FMCG.

The Indian rupee started the week on a sour note after a long weekend amid a rebound in the dollar index and risk-off sentiments. However, the day trading range remained small in the absence of fresh cues.

There is a relief at factory gate inflation as the wholesale inflation reading came at 1.34percentbelow the 1.6 percentestimates and 3.85percentthe previous month.

Spot USDINR is hovering around 82 amid the central bank’s intervention and dollar buying from the importers.

Technically, the pair has support at 81.70 and resistance at 82.50.

The Nifty has finally closed negative today after nine consecutive positive trading sessions. On the daily charts we can observe that Nifty has faced resistance at 17,850 – 17.870 which coincides with the 50 percentfibonbacci retracement level (17,858) of the fall from 18,888 – 16,828.

During the second half of the trading session the Nifty witnessed a recovery which helped it to close off its intraday lows (17,574). The daily momentum indicator still has a positive crossover which is a buy signal.

We believe that the uptrend is still intact, and this dip should be used as a buying opportunity. In terms of levels, 17,860 – 17,900 is the immediate hurdle one, while 17,560 – 17,500 shall act as a crucial support from short term perspective. On the upside we expect the Nifty to target level of 18,000.

Indian rupee closed 12 paise lower at 81.97 per dollar against Thursday's close of 81.85.

Indian benchmark indices ended lower on April 17 with Nifty around 17,700.

At close, the Sensex was down 520.25 points or 0.86 percentat 59,910.75, and the Nifty was down 121.20 points or 0.68percentat 17,706.80. About 1,747 shares advanced, 1.739 shares declined, and 180 shares were unchanged.

Infosys, Tech Mahindra, HCL Technologies, NTPC and Larsen and Toubro were among major losers on the Nifty, while gainers included Nestle India, Power Grid Corporation, SBI, Britannia Industries and

Coal India.

On the sectoral front, the information technology index fell 4.7 percent and pharma index down 0.6 percent, while PSU Bank index up 3 percent and oil & gas, realty, FMCG indices rose 1 percent each.

The BSE midcap index added 0.5 percent, while smallcap index up 0.15 percent.

Gold prices marginally gained on Monday, with spot gold prices at Comex were trading up by 0.06percentat $2,007 per ounce. Gold June future contract at MCX were trading up by 0.30percentat Rs 60,510 per 10 grams by noon session.

Comex spot gold prices hovered around physiological level $2,000.0 per ounce with positive bias after Friday’s fall. Gold prices witnessed sharp correction on Friday after US near-term inflation expectations jumped in early April by the most in nearly two years, according to the preliminary April reading from the University of Michigan. The inflation data fueled bets the Federal Reserve may carry on with aggressive monetary tightening and US dollar and yields rose in response, while traders cut long position and sell off witnessed in yellow metal post data. Today’s recovery in yellow metals due to bargain hunter active near support level.

We expect gold prices should consolidate in range and selling pressure will likely to see at higher level. For the week Comex spot gold having supports at $ 1,980/1,945 per ounce and resistance at $2,033/$2,050 per ounce. MCX Gold June future having support at Rs 59,680 per 10 gram and resistance at Rs 61,200 per 10 grams.

JPMorgan has downgraded Infosys to an ‘underweight’ rating and has cut its target price from Rs 1,500 to Rs 1,200 per share. Broking house feels that uninspiring commentary and ambitious guidance post sharp miss, triggering a reappraisal. As a result, it has cut revenue by 4-5 percent and margin by 70 bps, driving 8-9 percent EPS cuts over FY24/25.

JPMorgan also notes that the FY24 guidance of 4-7 percent CC revenue growth and 20-22 percent margin is below their consensus. The guidance bakes in an ambitious ask rate of 1.6-2.7 percent CQGR, which appears uncharacteristically H2FY24 heavy. The company is prone to subsequent downgrades.

Crude oil recorded fourth straight weekly gains to finish above $82 last week supported by the strong Chinese import data showing 22.5 percentannual jump in March to the highest monthly volumes in nearly three years, since June 2020.

On the other hand, in US Gasoline and diesel inventories have declined recently and Gasoline inventories are much lower than last year's level, ahead of the summer driving season may support gasoline cracks.

The market remains in backwardation as OPEC+ decision to cut voluntary production around 1.6mbpd from May is likely see to global balance falling into deficit of around 1 mbpd from June onwards. The overall outlook is bullish, positive Chinese economic numbers may further set oil prices for resistance of $85, while support stay around $79.

Indian Rupee depreciated on Monday on strong US Dollar and weak domestic equities. However, easing crude oil prices cushioned the downside. India’s WPI fell to a 29-month low at 1.34percentin March 2023 topping forecast of 1.87 percentand previous month’s reading of 3.85 percent, compared to IMF. Dollar rebounded from a one-year low on Friday on upbeat economic data from US and hawkish Fedspeak. Fed official Christopher Waller said that inflation remains too high.

We expect Indian Rupee to trade with a slight negative bias on strong Dollar and elevated crude oil prices. Weak domestic markets may also weigh on Rupee. However, sustained FII inflows and cooling inflation may support Rupee at lower levels. Traders may remain cautious ahead of Empire State Manufacturing Index data from US. USDINR spot price is expected to trade in a range of Rs 81.50 to Rs 82.50 in the near term.