Indian equity benchmarks Sensex and Nifty hit their 10 percent lower circuits in early trade on March 23.

Consequently, trading on Dalal Street was halted for 45 minutes.

Indian stock exchanges have been implementing index-based market-wide circuit breakers since July 2, 2001, based on the Securities and Exchange Board of India (SEBI) guidelines.

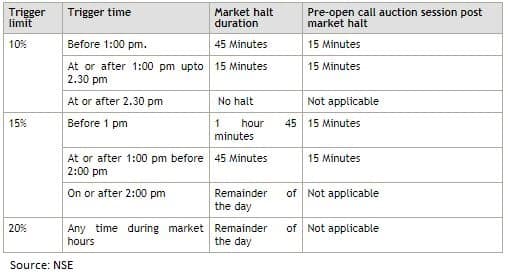

The circuit-breaker system applies at three stages of index movement, either way-- at 10%, 15%, and 20%. These breakers when triggered bring about a coordinated trading halt in all equity and equity derivative markets nationwide, the NSE has said in a note.

The circuit breakers are triggered by the movement of either the BSE Sensex or the Nifty, whichever is breached earlier, it said.

The market re-opens with a pre-open call auction session. The duration of the halt and the pre-open session are as below:

Tracking the volatility in the market which has so far eroded more than Rs 20 lakh cr in terms of market capitalisation on the BSE, Sebi introduced a certain measure to curb volatility.

In order to curb the extreme volatility witnessed in the stock market, SEBI has introduced measures such as revising the market-wide position limit to 50 percent which will reduce fresh short positions in individual stocks.

"Tightening rules on short selling can bring down the excessive volatility during times of crisis like this. Therefore, it is to be welcomed. However, there can be unintended consequences during panics,” Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services told Moneycontrol.

“The market is now oversold. The short-covering may lead to sharp volatility. Also, when liquidity is low, selling in the cash market can lead to a crash in prices,” he said.

Experts now say it is tough to say where the markets will stop.

"It's all about what kind of Nifty earnings hit one is expecting and what multiple are you ready to give these markets. In the current scenario, it looks like investors are not willing to give a multiple of more than 11-13 times and presuming overall earnings for FY21E will be down by 20 percent across the board, in which case the bottom is somewhere between 6,800 and 8,000 for the Nifty," said Vinay Pandit, Head - Institutional Equities, IndiaNivesh.

Pandit, however, added that these are excellent times for long-term value picks at cheap valuations.

"It's time to pick and choose but the focus should only be on quality businesses and companies which have stood the test of time. Any news of a cure or global recovery from the virus will send the index in a V-shaped recovery. Hence investors are advised not to time the bottom," he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.