After rallying over 14 percent in April, all eyes are on the month of May which is often linked with the age-old Wall Street saying ‘Sell in May and Go away’.

It is an investment strategy in which investors sell stock in May and re-enter markets in early November. It’s based on the belief that the market produces lower returns from May to October.

In terms of benchmark returns, bulls have managed to push the index in the green almost 60 percent of the time in May in the last 10 years, while there has been some selling from foreign investors as they remain net sellers 50 percent of the times in the same period.

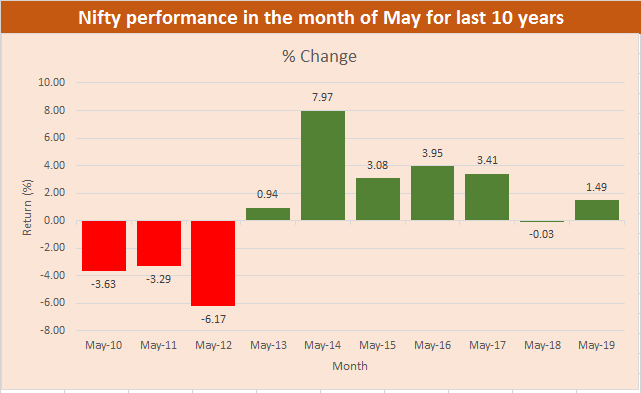

Nifty50 closed in the green in 6 out of the last 10 years, data from AceEquity showed.

The Nifty50 jumped nearly 8 percent in May 2014, followed by a 4 percent rally in May 2016 and a 3.4 percent gain in May 2017 — three of the biggest gains in May in the last 10 years.

On the other hand, Nifty fell four times in May in the last 10 years — in 2012 (over 6 percent), 2010 (3.6 percent), 2011 (3.2 percent), and 2018 (0.03 percent).

Most experts feel that the age-old saying might just come true for D-Street in 2020 because the 30 percent rally from the March lows was more of a relief rally, and investors will be better off booking profits at higher levels.

“At the current level, we have a cautious view in the market, unless the global health environment improves with a better treatment & vaccination in the future. We term this as a bear rally, the sustainability of which is difficult in the short-term given rising cascading economy effect,” Vinod Nair, Head of Research at Geojit Financial Services told Moneycontrol

“We are advising traders to capitalise on this rally and book gains in the near-term. Long-term investors can accumulate in the dip,” he said.

Investors’ wealth rose by nearly Rs 16 lakh crore in April. The average market capitalisation of the BSE-listed companies grew from Rs 113.48 lakh crore from March 31 to Rs 129.41 lakh crore recorded on April 30.

D-Street seems to be taking comfort in the fact that the United States Food and Drug Administration (USFDA) has granted emergency use authorisation (EUA) for the investigational antiviral remdesivir to treat COVID-19 patients.

Apart from the use of new drugs, investors are also pinning hopes on second stimulus package from the government to cushion the economic impact of COVID-19 on India.

But, a possible Trade War between the US and China could derail the market recovery. The US President Donald Trump said his administration was crafting retaliatory measures against China as punishment for the coronavirus outbreak, once again sparking tariff fears that rattled markets through much of the last two years, said a Reuters report.

“Domestic markets have been mirroring the directions from the US markets. Positives start, as the Indian market is taking cues from the international markets, driven by the success of the Gilead drug and expectations of stimulus and partial opening up of the economy in green,” Pankaj Bobade, Head- Fundamental Research, Axis Securities Limited told Moneycontrol.

“It is too early to talk about the market movements for the month of May. The political activities on the international platforms are heating up, which are likely to have an impact on international market movements,” he said.

FII Activity:

Foreign institutional investors (FIIs) pulled out more than Rs 65,000 crore from the cash segment of the Indian equity markets in March, as per provisional data, and little over Rs 5,000 crore in April.

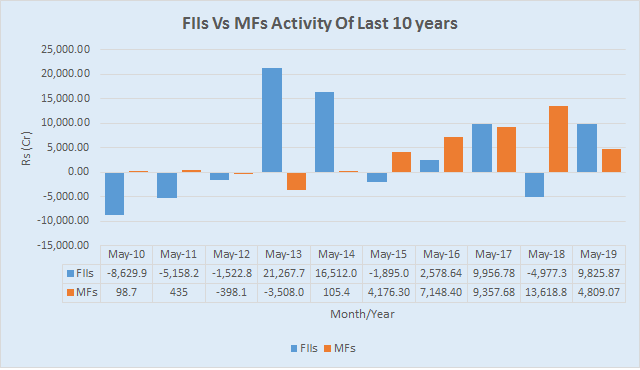

If we look at the historical data, they have net sellers about 50 percent of the time in the last 10 years in May. FIIs were net sellers of equities worth nearly Rs 21,000 crore in May 2013, followed by Rs 16,000 crore outflows in May 2014, and nearly Rs 10,000 crore selloff recorded in May 2019.

On the other hand, mutual funds were mostly net buyers in the last ten years in the month of May. They poured in more than Rs 13,000 crore in May 2018, followed by over Rs 9,000 crore buying in May 2017, and over Rs 7,000 crore in May 2016.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.