A decade ago, the pharmaceuticals industry was on the path of becoming a disruptor for India, thanks to its strong export potential. The best days of the pharma sector in the early 2010s due to the boom in the US generics market had the Street filled with hopes of watching the sector come to the forefront not just in India's export segment but also within the stock market.

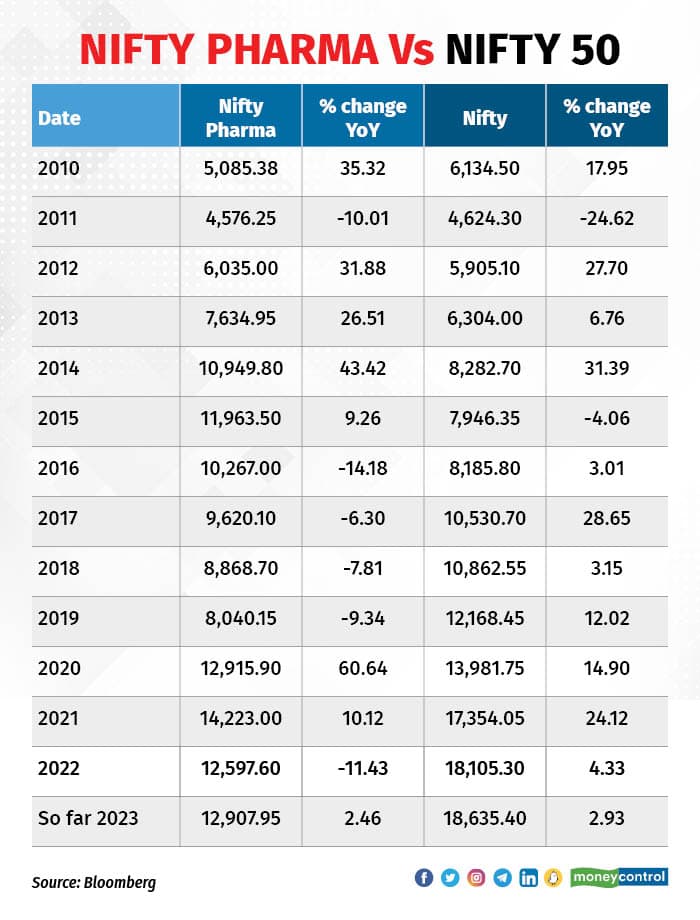

However, that never happened. Since delivering outperforming returns from 2010-2015, an era when pharma was the talk of the town, the sector has lost its upward momentum. Data from 2010 to 2023 so far shows the pharma index lagging, especially in the second half and barring the COVID boom. Excluding 2020, the pharma index has underperformed the Nifty 50 every year since 2015.

That begs the question: why has the Street fallen out of love with India's pharma sector, even as countries across the globe referred to the country as the 'Pharmacy of the World'. Let's take a deep dive to understand why the sector's growth faltered.

Started on the wrong footing

The fortunes for drugmakers turned largely after their foray into the US generics business. That market struggles with consistent price erosion, high competition and severe scrutiny from the US Food and Drug Administration.

Choosing to focus on the generics space instead of delving deeper into research and development (R&D) to develop niche products is considered one of the major missteps of the pharma sector. After the initial boost from US sales, which still comprises a major chunk of revenue for pharma players, intense competition, eroding pricing power and tightening regulatory norms began backfiring on the sector.

"Our leadership is limited to select APIs (active pharmaceutical ingredients) and generics. And in that too, we fell behind China in the last decade," said Sham Chandak, head of institutional broking at Elios Financial Services.

Sameer Kolhe, founder of Maypharm Life Sciences, and who has closely worked in the pharma sector for around two decades, believes that despite high demand and a strong export potential, several drugmakers focused on low-hanging fruits like US generics that were less risky and gave immediate returns. "Even though US generics grabbed higher sales, most domestic drugmakers were aiming to share the same pie," Kolhe said. "With time, US generics lost their sheen and since we did not touch base with the high-value product, and R&D, due to the lack of investments, the sector slipped into the shadows over the years."

Surya Patra, vice president, healthcare and specialty chemical research at PhillipCapital (India), seconded the view, pointing to the higher dependence on the US market as the reason behind the slump within the domestic pharma industry. "The glorious era of the US generics market is over and since most Indian companies have been overly dependent on them, they too have witnessed a downturn in the past years," Patra said.

Lax government policies

Kolhe also highlighted the near-absence of stringent regulations for manufacturing within the sector, adding that delays in approvals, necessary for drug filings in other markets, have been a constant drag on pharma companies.

As a result, Indian drugmakers have been on the radar of the US regulatory body and faced a barrage of observations from the FDA. The issue of lax government regulations for the sector again came to the fore when several instances of people dying due to Indian-manufactured medicines came to light.

Also Read: What are the implications of the govt's ban on 14 fixed-dose combination drugs?

However, the government has taken notice of the situation and is working towards improving manufacturing and quality control standards for drugmakers.

Pharma heavyweights dependent on US generics

The weightage of the pharma sector has also been stuck below 5 percent for years in a row now. Analysts blame the high dependence of large-cap pharma companies like Cipla, Sun Pharma and Dr Reddy's on the US generics market as the biggest reason why the sector lagged in weightage.

As the US generics market entered a phase of cyclical downturn in the second half of the 2010s, the earnings growth for these large-cap pharma companies also began moderating, restricting the scope of an increase in their weightage within the benchmark index.

Also Read: Why contract drug manufacturers meet FDA norms easily while others struggle

Regardless, in recent years, companies have also come to realise that grabbing a share in the already overcrowded US generics space will not support their long-term growth story. Hence, players within the sector have not just started focusing on entering into niche products, but also in new emerging markets.

Back to riches: is there a possibility?

After struggling to sustain themselves in the US generics segment, companies are now exploring new avenues for boosting growth. The domestic market, for one, presents a lucrative opportunity. The India pharma market is growing at a rapid pace and companies are now shifting their attention to being a part of the domestic growth story.

There have also been an increase in R&D spends and a pickup in acquisitions, both within India and outside. With the right measures in place, it is safe to say that there is a possibility of a revival.

Kolhe also emphasised that companies are now putting up facilities for manufacturing complex products, and collaborating on R&D. "The government is also supporting the industry through its production-linked incentive scheme, which means we will now be less dependent on China on a few areas," he added.

Also Read: Are pharma cos poised for a bull ride? Here's what analysts believe

Vineet Gala, founder of Xylem Investment Managers, also noted that several major drugmakers are in the phase of investing in building their specialty portfolios and he believes peak profits from these investments still lie ahead. "With the realisation of profitability, I believe pharma's weightage in the headline index should also increase over a period of time," he said.

"So, all this put together, I foresee a good increase in pharma exports as well as strong domestic market growth in next three to five years," Kolhe said.

In conclusion, the Street remains cautiously optimistic on pharma's turnaround in this decade, but overindulgence in the US generics space still remains a big 'no' when looking for investment opportunities in the sector.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.