The Finance Ministry has raised a red flag over weak private sector investment, warning that it could dampen economic momentum. In its June monthly review, the ministry said, “Slow credit growth and private investment appetite may restrict acceleration in economic momentum,” underscoring the urgent need for the private sector to step up.

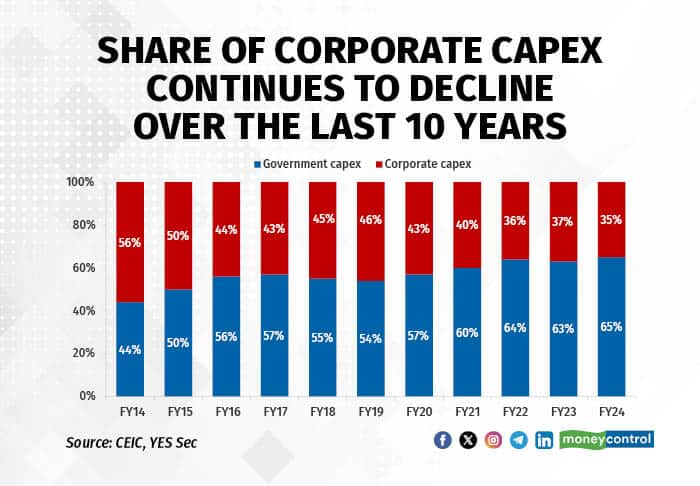

Despite India Inc. sitting on record-high profits, the willingness to invest hasn't kept pace with the ability. The result: private investment has lagged even as the government doubled down on capital expenditure post-Covid.

So what’s holding back private capex?

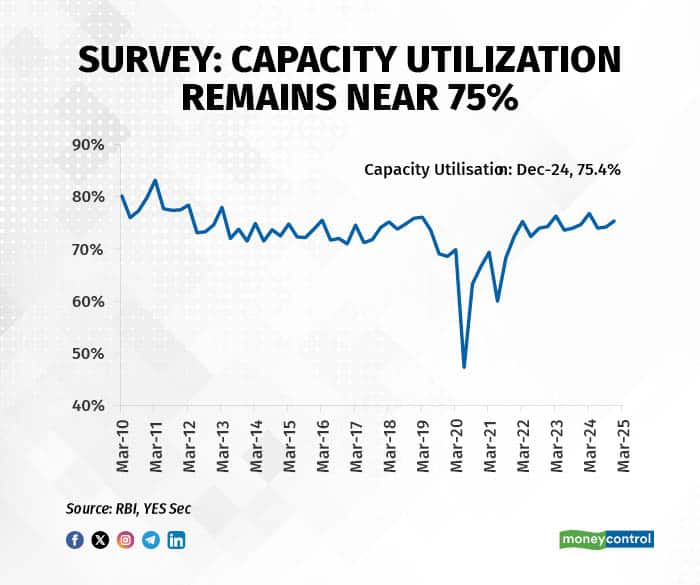

According to YES Securities, several factors are contributing to the continued sluggishness:

Further, a Ministry of Statistics and Programme Implementation (MoSPI) study also pointed to a “conservative approach and apprehension” among companies in planning fresh capital expenditure for FY26.

Public Push, Private Pullback

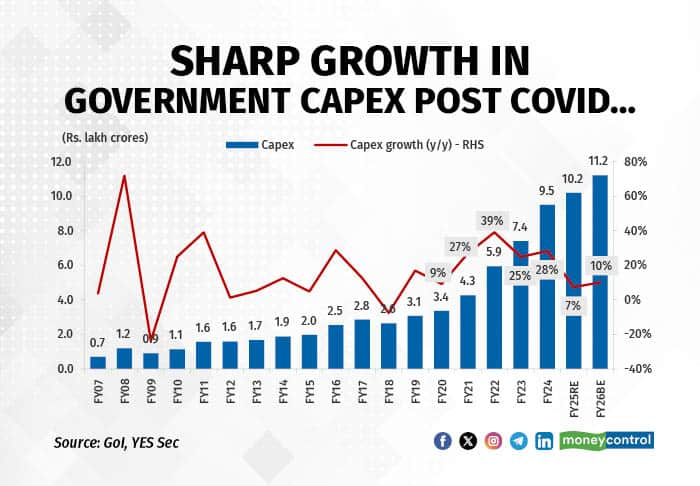

While private capex remains subdued, public capital expenditure surged from Rs 3.4 lakh crore in FY20 to Rs 10.2 lakh crore in FY25, which is a CAGR of 25 percent, driven largely by railways, roads, highways, and communications. Capex as a share of the government’s budget has stayed above 20 percent for three consecutive years.

However, general elections in 2024 led to a temporary slowdown in both Centre and state spending. Expectations were high for large private companies to step in, but the pickup has been tepid.

Pockets of Optimism

That said, some sectors are showing signs of life. Data centres and renewables are attracting fresh investments, and capacity expansions in cement and mining are being planned through 2028-30. However, oil & gas capex has remained mostly flat, despite utilisation rates topping the 100 percent mark.

CareEdge Ratings notes that in a cloudy global macro environment, private investment may stay subdued in the near term. Yet, public capex continues to hold steady, with completions staying above Rs 2 lakh crore for the second consecutive quarter.

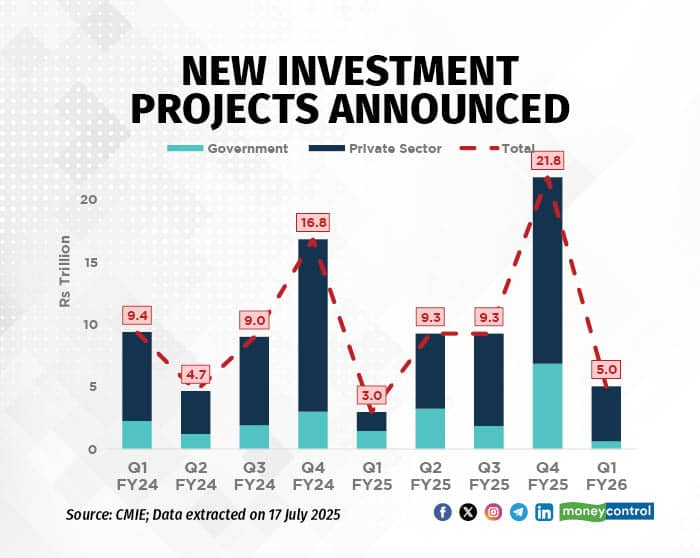

There’s also renewed hope in the announcements pipeline. Private players have ramped up fresh investment intents, particularly in electricity and manufacturing.

Metals (13 percent of announcements), chemicals (8 percent), and machinery (6 percent) are leading the pack.

Looking forward, policy moves could create a more supportive environment. A narrower fiscal deficit, which is targeted to fall from 5.6 percent in FY24 and 4.8 percent in FY25 to roughly around 4.4 percent in FY26 can help crowd in private investment by reducing government borrowing and lowering capital costs.

If the RBI follows up with another cut in the benchmark lending rate, cheaper credit could further nudge corporates into loosening their purse strings. Combined with easing inflation, improving consumption, and a favourable monsoon, conditions may finally align for India Inc. to restart its capex cycle.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.