The Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) slashed the repo rate today. RBI Governor Sanjay Malhotra said that the decision has been taken unanimously. This means that the current repo rate now is 6.25%. Global economic backdrop remains challenging, says Malhotra. He also says that "progress in global disinflation is stalling."

Moneycontrol collated a list of 11 rate-sensitive stocks from experts for the short term:

Ashish Kyal, CMT, Founder and CEO of Waves Strategy Advisors

Bajaj Finance | CMP: Rs 8,507.3

Bajaj Finance gave a breakout from the triangle formation on January 29 and has extended its gains ever since. Additionally, prices have consistently protected the prior day’s low, highlighting the strength of the ongoing trend. On the daily chart, prices have been continuously closing near the upper Bollinger Bands for the past 9 trading sessions, which is a positive sign. However, after the sharp rise, the RSI (Relative Strength Index) is trading near its overbought level, suggesting that prices may need to cool off before resuming their trend. Therefore, rather than chasing highs, one should use dips as a buying opportunity to ride the trend more effectively.

In summary, the current trend for Bajaj Finance is bullish, and buying on dips seems to be a prudent strategy for better risk-reward ratios, with target levels of Rs 8,850, followed by Rs 9,200. On the downside, Rs 8,100 is the nearest support to watch out for.

Strategy: Buy

Target: Rs 8,850, Rs 9,200

Stop-Loss: Rs 8,100

Ujjivan Small Finance Bank | CMP: Rs 38.65

Ujjivan Small Finance Bank had been moving in a rectangular range over the last few days, indicating accumulation in the stock. After breaking out of this range, the prices retested the neckline and saw a sharp bounce upwards in the previous trading session. On the daily chart, the stock is trading above the Ichimoku cloud, indicating that the short-term bias is bullish. In summary, the current trend for Ujjivan Small Finance Bank looks bullish. Use dips towards Rs 38-38.30 as a buying opportunity, aiming for a move towards Rs 41-42, as long as Rs 37 holds as support.

Strategy: Buy

Target: Rs 41, Rs 42

Stop-Loss: Rs 37

Ganesh Housing Corporation | CMP: Rs 1,480.05

Ganesh Housing Corporation has been moving within an upward sloping channel since October 2024, suggesting strength in the ongoing trend. The stock has closed above its prior day’s high since February 4, which maintains a bullish bias. Furthermore, prices took support from the Ichimoku cloud, which is near the support of the channel, and extended gains thereafter, suggesting growing bullishness.

Currently, prices are near their previous swing high of Rs 1,485. A decisive break above this level could intensify buying pressure. Additionally, the MACD (Moving Average Convergence Divergence) has given a bullish crossover and is trading above the zero line, indicating that the trending move is likely to continue. In summary, the current trend for Ganesh Housing Corporation is bullish. A break above Rs 1,485 could lift prices toward Rs 1,560, followed by Rs 1,630. On the downside, Rs 1,420 is the nearest support to watch.

Strategy: Buy

Target: Rs 1,560, Rs 1,630

Stop-Loss: Rs 1,420

Anshul Jain, Head of Research at Lakshmishree Investments

Maruti Suzuki India | CMP: Rs 13,074

Maruti Suzuki is forming a 131-day bullish Cup and Handle pattern, indicating strong upside potential. A breakout above Rs 13,130 could trigger a rally toward Rs 13,800, making it an attractive buying opportunity. Traders should maintain a stop-loss at Rs 12,900 to manage risk. If momentum sustains, the stock could witness strong bullish action, supported by technical confirmation.

Strategy: Buy

Target: Rs 13,800

Stop-Loss: Rs 12,900

IndusInd Bank | CMP: Rs 1,065.55

IndusInd Bank is showing strength after a breakout from a falling trendline, bouncing back and consolidating with an Inside bar pattern on Thursday. This setup suggests a potential breakout move. A buy above Rs 1,070 could trigger an immediate rally toward Rs 1,125, providing a solid trading opportunity. Traders should maintain a stop-loss below Rs 1,050 to manage risk. With momentum building, the stock is poised for a strong upside move.

Strategy: Buy

Target: Rs 1,125

Stop-Loss: Rs 1,050

ICICI Bank | CMP: Rs 1,272.4

ICICI Bank is consolidating after a flag breakout, forming two inside bars. The stock is on the verge of a breakout above Rs 1,278, with a strong bullish structure and rising volumes supporting an upside move. A breakout could push the stock toward Rs 1,330, offering significant gains. Traders should buy above Rs 1,278, maintaining a stop-loss below Rs 1,255 to manage risk.

Strategy: Buy

Target: Rs 1,330

Stop-Loss: Rs 1,255

Riyank Arora, Technical Research Analyst at Mehta Equities

State Bank of India | CMP: Rs 752.25

SBI has touched a major trendline support level at Rs 752, indicating signs of momentum and strength at lower levels. According to the daily chart, a strict stop-loss should be placed near Rs 735, and the stock is poised for an upside move towards Rs 785 and beyond. The RSI (14) is around 42, suggesting sideways momentum, but the good risk-reward ratio makes the stock attractive at current levels.

Strategy: Buy

Target: Rs 785

Stop-Loss: Rs 735

HDFC Bank | CMP: Rs 1,743.85

HDFC Bank has given a solid breakout above its anchor VWAP (volume weighted average price) resistance level of Rs 1,733 and successfully closed well above it. With increasing volumes and the stock holding its strength, it seems poised to head higher toward Rs 1,800. A strict stop-loss should be placed near Rs 1,715 to manage risk effectively.

Strategy: Buy

Target: Rs 1,800

Stop-Loss: Rs 1,715

Vidnyan Sawant, HOD - Research at GEPL Capital

Kotak Mahindra Bank | CMP: Rs 1,916

Kotak Mahindra Bank has formed higher bottoms on the weekly scale, and for the past two weeks, it has sustained above its sloping trendline drawn from its multi-year high since 2021, indicating trend improvement. On the daily scale, after a strong bullish gap in January 2025, the stock is now consolidating near its key short-term average, the 12-DEMA. The RSI momentum indicator is at 60, reflecting bullish momentum.

Strategy: Buy

Target: Rs 2,127

Stop-Loss: Rs 1,801

City Union Bank | CMP: Rs 173.12

City Union Bank has continued to form higher bottoms on the weekly scale since April 2024, signaling a bullish trend. On the daily scale, a notable price pattern has emerged, where drawdowns during the uptrend have been short-lived, typically correcting by 13-20%, followed by price surges of approximately 20-30%. The RSI is at 53, signaling improving momentum.

Strategy: Buy

Target: Rs 203

Stop-Loss: Rs 162

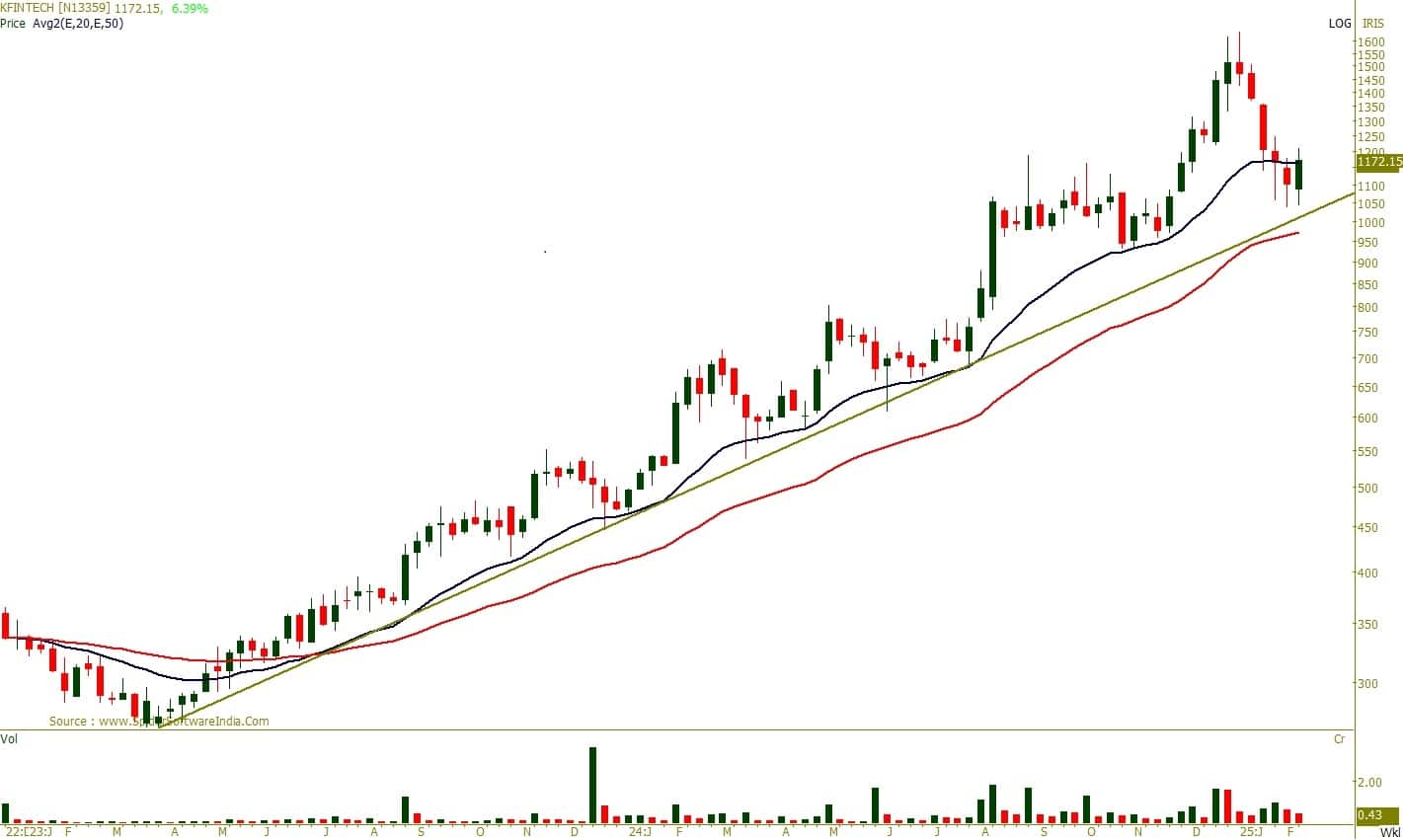

KFIN Technologies | CMP: Rs 1,170.3

KFIN Technologies has shown a strong upward movement since March 2023, consistently maintaining higher tops and higher bottoms. During this rising trend, drawdowns have been short-lived, ranging between 18-25%. Recently, the stock completed a 25% correction, suggesting it is poised for recovery and likely to resume its uptrend.

Strategy: Buy

Target: Rs 1,406

Stop-Loss: Rs 1,078

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!